Today's Market: Dow Futures, Gold Prices, And Key Economic Indicators

Table of Contents

Dow Futures: A Glimpse into the Future

Dow futures contracts predict the direction of the Dow Jones Industrial Average. Analyzing these futures can offer insights into investor sentiment and potential market movements. Understanding how to interpret these predictions is crucial for navigating today's market effectively.

-

Factors influencing Dow futures: Economic data releases (like employment figures and inflation reports), geopolitical events (such as international conflicts or policy changes), and corporate earnings reports all significantly influence Dow futures. Positive news generally leads to higher futures prices, while negative news can cause them to fall. Analyzing these factors is key to predicting market trends.

-

Interpreting Dow futures charts: Charts display the price movements of Dow futures over time. Identifying trends (uptrends, downtrends, sideways trends), support and resistance levels (price points where the market finds it difficult to break through), and potential breakouts (sharp movements beyond support or resistance) are crucial for effective trading. Technical analysis tools, such as moving averages and relative strength index (RSI), can enhance chart interpretation.

-

Risks associated with Dow futures trading: Dow futures trading involves significant risk. Volatility in the market can lead to substantial losses. Leverage, the use of borrowed money to amplify potential profits (and losses), magnifies this risk. It’s vital to understand these risks before engaging in futures trading.

-

Strategies for trading Dow futures: Traders employ various strategies. Hedging involves using futures contracts to offset potential losses in other investments. Speculation involves taking a position based on a prediction of future price movements. Arbitrage involves exploiting price differences between different markets or instruments.

Gold Prices: A Safe Haven in Uncertain Times

Gold is often considered a safe-haven asset; its price tends to rise during times of economic uncertainty or geopolitical instability. Understanding its price movements is crucial for portfolio diversification and risk management within the context of today's market.

-

Factors influencing gold prices: Several factors impact gold prices. Interest rate hikes typically push gold prices down, as higher rates make non-interest-bearing assets (like gold) less attractive. Conversely, inflation often drives gold prices up, as it erodes the purchasing power of fiat currencies. Currency fluctuations and geopolitical risks also play significant roles. A weakening dollar, for example, often strengthens gold's value.

-

Analyzing gold price charts: Similar to Dow futures, analyzing gold price charts helps identify trends, support and resistance levels, and potential breakouts. Technical analysis tools can be applied to gold price charts to assist in making informed investment decisions.

-

Different ways to invest in gold: Investors can access gold through various avenues. Physical gold (bars and coins) offers tangible ownership but involves storage and security concerns. Gold ETFs (exchange-traded funds) provide exposure to gold prices without the complexities of physical ownership. Gold mining stocks offer another route, albeit with higher risk and volatility.

-

Risks associated with gold investments: While considered a safe haven, gold investments aren't risk-free. Gold prices can be volatile, and gold itself doesn't generate income (no dividends or interest).

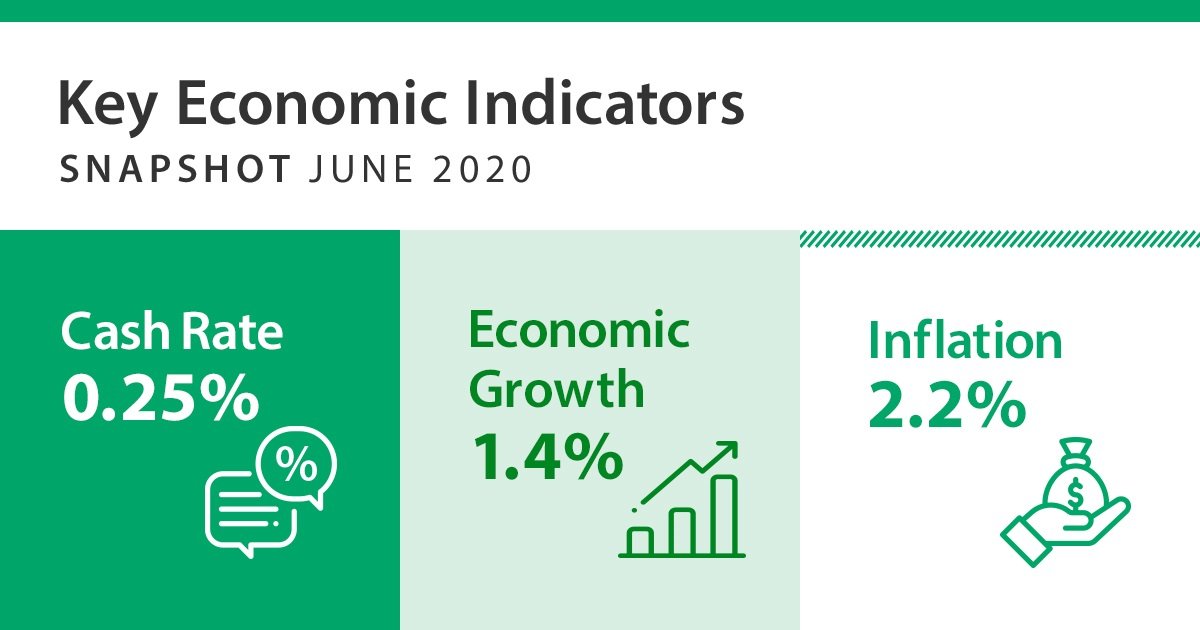

Key Economic Indicators: Deciphering the Data

Several key economic indicators provide valuable insights into the overall health of the economy, thus influencing today's market performance. Understanding these indicators is critical for making informed investment choices.

-

Major economic indicators: Inflation rate (measured by CPI - Consumer Price Index and PPI - Producer Price Index), unemployment rate, GDP (Gross Domestic Product) growth, and the consumer confidence index are among the most significant indicators. Each offers a different perspective on the economic landscape.

-

Interpreting economic data: Understanding the context of each indicator and their interrelationships is crucial. For example, high inflation might lead to interest rate hikes, which can impact stock market performance. A strong GDP growth usually signifies a healthy economy, but it can also lead to inflationary pressures.

-

Impact of economic indicators on market movements: The release of economic data can significantly affect market movements. Stronger-than-expected data might boost stock prices and increase bond yields, while weaker-than-expected data might have the opposite effect. Currency exchange rates are also influenced by economic data releases.

-

Sources for reliable economic data: Reliable economic data can be found from sources like government agencies (e.g., the Bureau of Labor Statistics in the US), central banks (e.g., the Federal Reserve), reputable financial institutions, and credible news outlets. It's important to rely on trustworthy sources to avoid misinformation.

Conclusion

Understanding Today's Market requires a holistic approach, considering the interplay between Dow futures, gold prices, and key economic indicators. By carefully analyzing these factors, investors can make more informed decisions and potentially navigate market volatility more effectively. Staying informed about these elements and regularly reviewing market analyses is crucial for successful investment strategies. Continue monitoring today's market and its fluctuations to adapt your investment strategies accordingly. Learn more about effective strategies for navigating today's market by exploring our comprehensive market analysis resources (link to resources if applicable).

Featured Posts

-

Yankees Smash Team Record With 9 Home Runs Aaron Judge Leads The Charge

Apr 23, 2025

Yankees Smash Team Record With 9 Home Runs Aaron Judge Leads The Charge

Apr 23, 2025 -

La Fires Fuel Landlord Price Gouging Claims A Selling Sunset Stars Perspective

Apr 23, 2025

La Fires Fuel Landlord Price Gouging Claims A Selling Sunset Stars Perspective

Apr 23, 2025 -

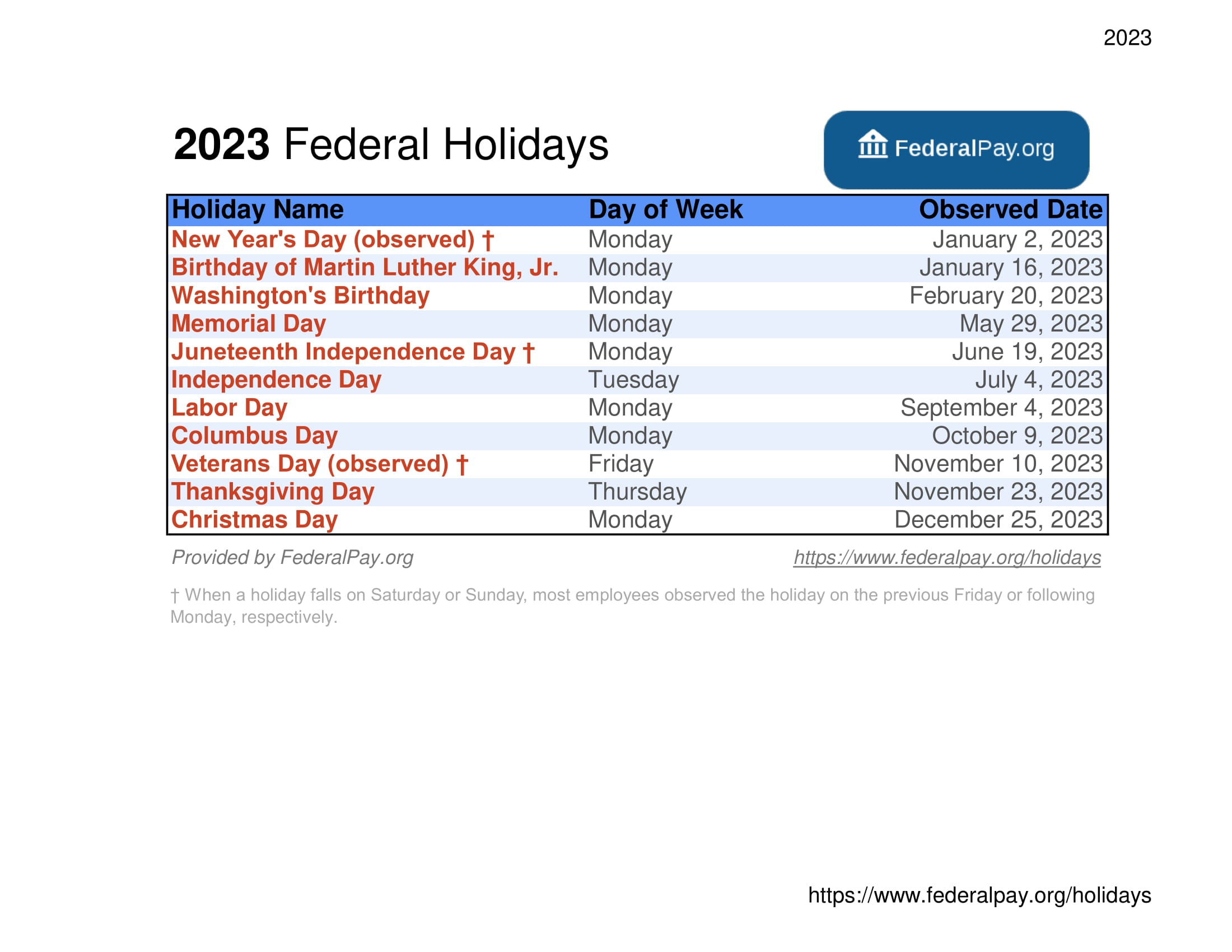

Federal And Non Federal Holidays In The Us 2025 Calendar

Apr 23, 2025

Federal And Non Federal Holidays In The Us 2025 Calendar

Apr 23, 2025 -

Resume De La Bfm Bourse Du 17 Fevrier 15h 16h

Apr 23, 2025

Resume De La Bfm Bourse Du 17 Fevrier 15h 16h

Apr 23, 2025 -

Neuer Bvb Star Adeyemi Mit Elegantem Stil

Apr 23, 2025

Neuer Bvb Star Adeyemi Mit Elegantem Stil

Apr 23, 2025