Today's Stock Market: Navigating Trump's Trade Policies And UK Brexit Deal

Table of Contents

Trump's Trade Policies and their Impact on Global Markets

Trump's trade policies, characterized by aggressive tariffs and renegotiated trade agreements, have significantly impacted global markets. The resulting uncertainty has created volatility and challenges for investors worldwide.

The Tariff Wars

The Trump administration's imposition of tariffs on various countries, most notably China, Mexico, and Canada, ignited a series of "trade wars." These tariffs significantly impacted specific sectors:

- Agriculture: American farmers faced retaliatory tariffs, impacting exports of soybeans, corn, and other agricultural products. This led to decreased farm income and market instability.

- Manufacturing: Tariffs on imported steel and aluminum raised production costs for manufacturers, impacting competitiveness and profitability. Many companies experienced increased prices and decreased demand.

- Technology: The tech sector faced tariffs on components and finished goods, leading to higher prices for consumers and increased uncertainty for businesses involved in global supply chains.

The market reacted to these tariff announcements with significant volatility. For example:

- The announcement of tariffs on Chinese goods often resulted in immediate drops in the stock prices of companies heavily reliant on Chinese markets or manufacturing.

- Investor confidence was eroded by the unpredictability of the trade policy shifts, resulting in increased market fluctuations.

Trade Deal Uncertainties

The unpredictable nature of Trump's trade policies created significant uncertainty for businesses and investors. While renegotiated deals, such as the USMCA (United States-Mexico-Canada Agreement), aimed to replace NAFTA, the constant threat of new tariffs and trade restrictions hampered long-term investment planning.

- Businesses struggled to forecast future costs and profits, leading to hesitancy in making large capital investments.

- International organizations like the World Trade Organization (WTO) played a crucial role in mediating trade disputes, but their influence was often challenged by the unilateral nature of US trade actions.

- The constant threat of trade wars created a climate of fear and uncertainty among investors, leading to decreased investment in certain sectors and geographic regions.

The UK Brexit Deal and its Ripple Effects on the Stock Market

The UK's withdrawal from the European Union (Brexit) created significant uncertainty and volatility in the stock market, both immediately and in the long term.

Brexit's Initial Impact

The Brexit referendum in 2016 and the subsequent negotiations led to immediate market reactions:

- The pound sterling experienced a sharp decline against other major currencies, impacting UK-based companies' profitability and competitiveness.

- Foreign investment in the UK plummeted as businesses hesitated to invest in a country facing considerable economic and political uncertainty.

- Sectors heavily reliant on EU trade, such as finance and tourism, were particularly affected by the initial uncertainty surrounding the Brexit deal.

Long-Term Implications of Brexit

The long-term implications of Brexit continue to unfold, affecting the UK and the global economy:

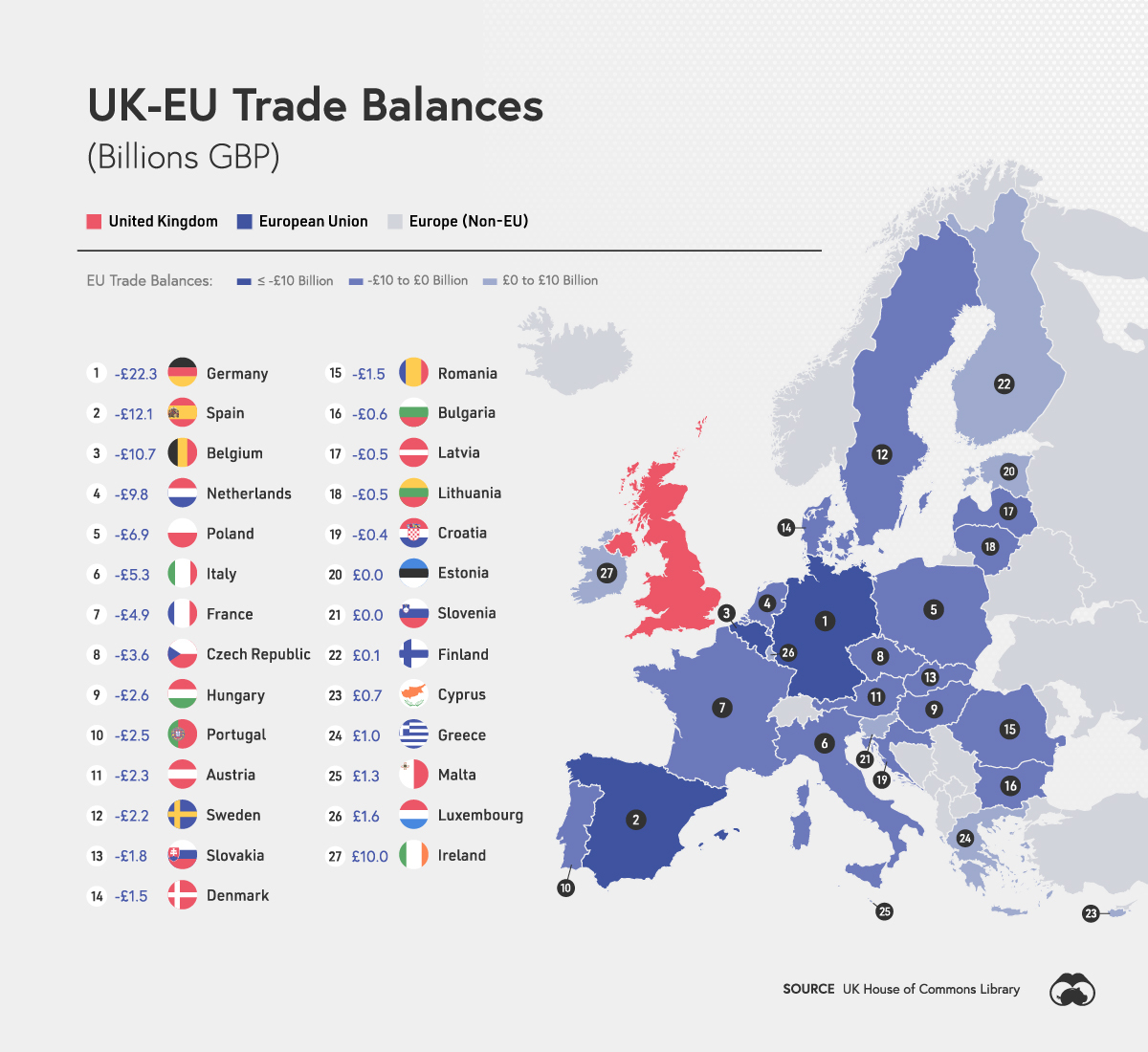

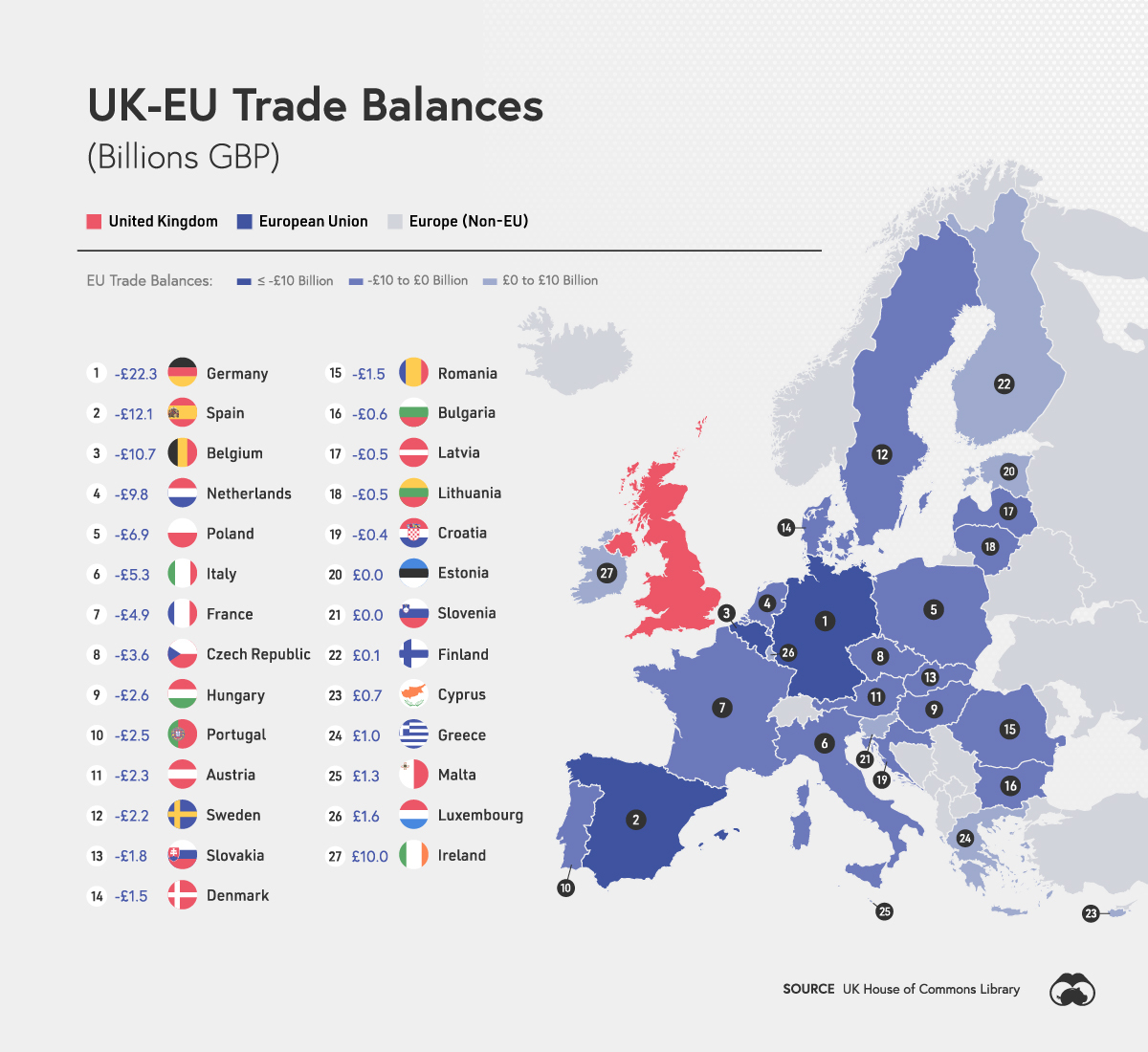

- New trade relationships between the UK and the EU created new barriers to trade, impacting supply chains and cross-border investments.

- The future economic growth of the UK remains uncertain, with some analysts predicting a period of slower growth or even recession.

- The complexities of navigating new trade agreements and regulatory frameworks impacted the global supply chain, causing disruptions and increased costs for businesses.

Conclusion

Trump's trade policies and the UK Brexit deal have significantly impacted today's stock market, creating considerable volatility and uncertainty. Understanding these geopolitical factors is crucial for successful stock market navigation. The unpredictable nature of these events highlights the importance of careful risk assessment and diversification.

Navigating today's stock market requires a keen understanding of global events like Trump's trade policies and the UK Brexit deal. Stay informed about global economic and political developments and consult with a financial advisor to make informed decisions about your investments. Don't let the volatility of today's market deter you; with careful planning and expert advice, you can effectively manage your investments and achieve your financial goals.

Featured Posts

-

Controversial Shane Lowry Video A Look At The American Fan Reaction

May 11, 2025

Controversial Shane Lowry Video A Look At The American Fan Reaction

May 11, 2025 -

Predicting Ufc 315 Early Fight Card Analysis And Outcome Forecasts

May 11, 2025

Predicting Ufc 315 Early Fight Card Analysis And Outcome Forecasts

May 11, 2025 -

Hvem Vinder Dansk Melodi Grand Prix 2025

May 11, 2025

Hvem Vinder Dansk Melodi Grand Prix 2025

May 11, 2025 -

Streaming Success Henry Cavills Night Hunter Action Thriller

May 11, 2025

Streaming Success Henry Cavills Night Hunter Action Thriller

May 11, 2025 -

Confirmed Crazy Rich Asians Series Coming Soon Directed By Jon M Chu

May 11, 2025

Confirmed Crazy Rich Asians Series Coming Soon Directed By Jon M Chu

May 11, 2025