Tongling Metals Forecasts Copper Market Impact Of US Tariffs

Table of Contents

Tongling Metals' Market Position and Forecasting Capabilities

Tongling Metals' Role in Global Copper Production

Tongling Nonferrous Metals Group Co., Ltd. (Tongling Metals) is a significant global producer of copper, boasting substantial smelting and refining capacity. Their extensive operations contribute significantly to global copper supply, giving them a unique perspective on market dynamics. Precise figures on their market share vary depending on the year and reporting agencies, but their consistent presence among the top global producers grants their forecasts significant weight. This substantial production capacity directly influences their ability to predict market trends accurately.

Tongling Metals' Forecasting Methodology

Tongling Metals' forecasting methodology likely incorporates a multifaceted approach, combining econometric modeling with extensive market research and analysis. Their predictions aren’t solely based on historical data; instead, they probably incorporate a range of factors including:

- Macroeconomic indicators: Global GDP growth, inflation rates, and interest rates are considered influential variables.

- Geopolitical factors: International trade policies, political instability in copper-producing regions, and shifts in global alliances affect supply and demand.

- Industry-specific data: Analysis of construction activity, electronics manufacturing trends, and automotive production helps predict future copper demand.

- Supply chain analysis: Assessment of mining output, transportation costs, and refining capacity helps predict copper supply.

Their unique insights likely stem from direct involvement in the copper supply chain, allowing them to incorporate real-time data and industry intelligence.

Credibility and Track Record

Assessing the credibility of any forecast is crucial. Tongling Metals' track record, while not publicly available in detail, benefits from their long-standing presence and expertise within the copper industry. Their consistent participation in industry forums and their reputation as a reliable supplier contributes to the credibility of their forecasts. Future research could focus on comparing their past predictions with actual market outcomes to gauge their accuracy more thoroughly.

Specific Predictions Regarding US Tariffs and Copper Prices

Impact of Tariffs on Copper Demand

Tongling Metals' forecasts likely indicate a dampening effect of US tariffs on copper demand, particularly within the US. Higher import costs due to tariffs make copper more expensive for US manufacturers, potentially leading to:

- Reduced consumption: Industries may reduce their copper usage, opting for alternative materials or postponing projects.

- Shift in sourcing: US companies may seek copper from other countries to bypass the tariffs, reshaping global supply chains.

- Impact on specific sectors: Construction, electronics, and automotive industries, being major consumers of copper, are likely to be disproportionately affected.

The extent of this impact depends on the elasticity of demand for copper and the availability of substitutes.

Impact of Tariffs on Copper Supply

US tariffs could also indirectly influence copper supply. While the US may experience increased domestic production to capitalize on the reduced competition from imported copper, the impact is likely to be complex:

- Supply chain disruptions: Tariffs might disrupt established supply chains, leading to delays and increased transportation costs.

- Investment in domestic production: Higher prices could incentivize investment in US copper mining and refining, but this increase is unlikely to offset import reductions immediately.

- Global supply adjustments: Producers in other countries might adjust their export strategies, potentially leading to price fluctuations elsewhere.

Predicted Price Fluctuations

Tongling Metals' specific price predictions regarding copper, in response to the tariffs, are not publicly detailed in this context. However, their forecasts likely anticipate short-term price volatility due to market uncertainty. The long-term effects are harder to predict, potentially influenced by the strength of global demand, and any adjustments in copper supply chains. The predictions would likely involve scenarios incorporating different tariff levels and economic growth rates.

Wider Market Implications of Tongling Metals' Forecast

Impact on other Metals Markets

Changes in the copper market, as predicted by Tongling Metals, will likely have ripple effects on related metal markets. For example, increased demand for aluminum as a substitute for copper in certain applications could impact aluminum prices. Similarly, zinc, used in some of the same applications, might experience price adjustments depending on the extent of substitution.

Geopolitical Implications

Tongling Metals’ forecast likely considers geopolitical implications. Trade disputes and shifting global alliances arising from tariff policies have the potential to destabilize markets and create uncertainty for businesses worldwide, which in turn impacts the stability and investment in copper mining and processing operations.

Investment Strategies Based on Tongling Metals' Forecast

Tongling Metals' predictions could inform various investment strategies, including hedging strategies to mitigate price volatility, or diversification strategies involving investments in related metals or industries. Long-term investors might consider the predicted price fluctuations while short-term investors may focus on leveraging short-term volatility for profit. The specific recommendations depend on individual risk tolerance and investment goals.

Conclusion: Understanding the Tongling Metals Copper Market Forecast and Next Steps

Tongling Metals' forecasts highlight the complex interplay between US tariffs, copper prices, and wider market dynamics. Their predictions suggest potential short-term volatility and longer-term adjustments within the copper market and related metal sectors. Understanding these forecasts is crucial for investors, businesses, and policymakers alike. To stay abreast of developments and gain further insights into the impact of US tariffs on the copper market, we encourage you to follow Tongling Metals' future publications and analyses. By staying informed about "Tongling Metals Forecasts Copper Market Impact of US Tariffs," you can make informed decisions and navigate the complexities of the global copper market.

Featured Posts

-

Hudsons Bay Closures Where Will Brands Find New Retail Space

Apr 23, 2025

Hudsons Bay Closures Where Will Brands Find New Retail Space

Apr 23, 2025 -

Usa Russie L Augmentation Des Depenses De Defense Selon John Plassard Usa Today

Apr 23, 2025

Usa Russie L Augmentation Des Depenses De Defense Selon John Plassard Usa Today

Apr 23, 2025 -

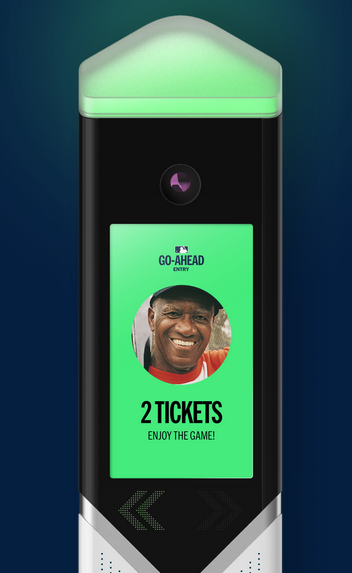

Target Fields Go Ahead Entry Facial Recognition Speeds Up Lines

Apr 23, 2025

Target Fields Go Ahead Entry Facial Recognition Speeds Up Lines

Apr 23, 2025 -

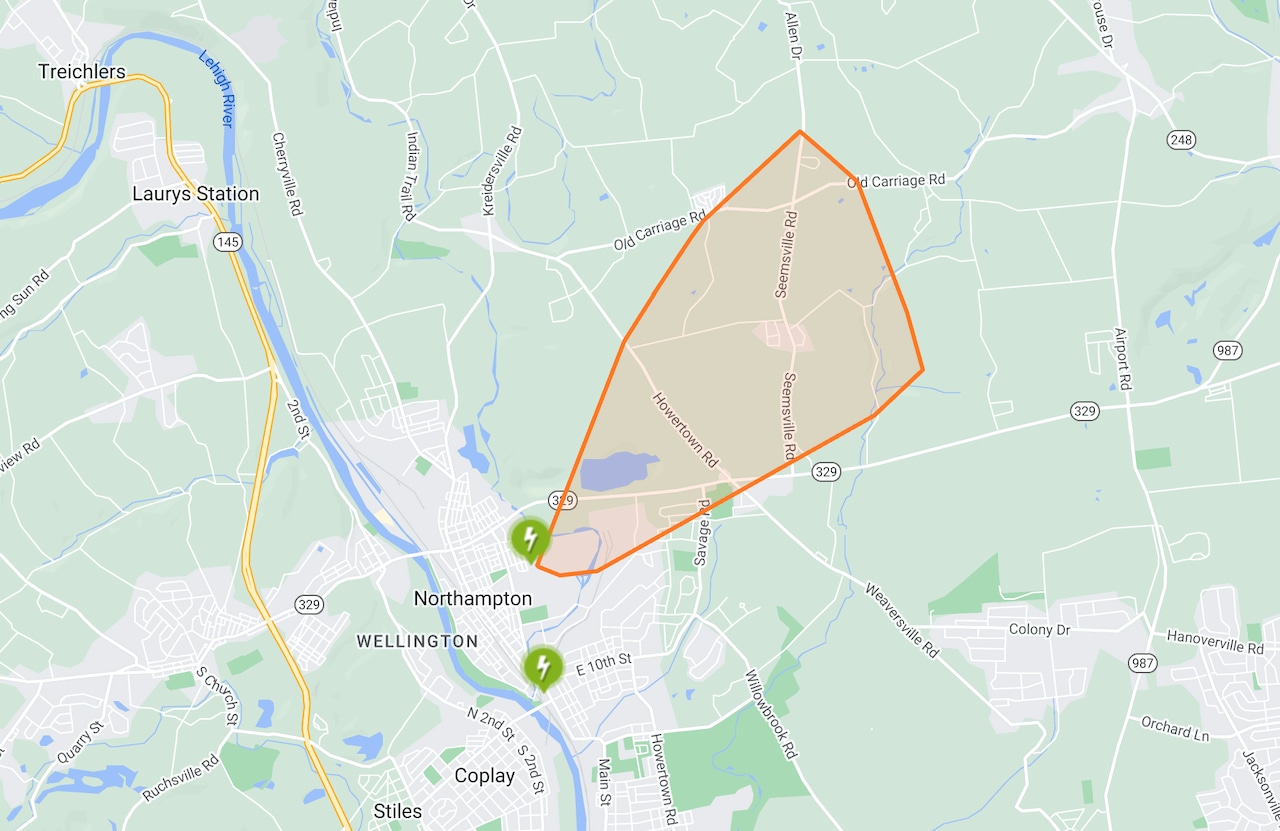

Lehigh Valley Faces Widespread Power Outages Due To Strong Winds

Apr 23, 2025

Lehigh Valley Faces Widespread Power Outages Due To Strong Winds

Apr 23, 2025 -

Power Outages Hit Lehigh Valley Amid High Winds Photo Gallery

Apr 23, 2025

Power Outages Hit Lehigh Valley Amid High Winds Photo Gallery

Apr 23, 2025