Toronto Company's Bid For Hudson's Bay: Expected Challenges

Table of Contents

A Toronto-based company's potential acquisition of Hudson's Bay Company (HBC) is creating considerable excitement, but the path to a successful takeover is paved with significant challenges. This article delves into the key hurdles facing this ambitious bid, analyzing the potential obstacles and their implications for both companies involved in this high-stakes Toronto Company Hudson's Bay bid.

<h2>Regulatory Hurdles and Antitrust Concerns</h2>

Acquisitions of this scale inevitably attract intense scrutiny from regulatory bodies, particularly the Competition Bureau of Canada. The potential for anti-competitive practices within the Canadian retail market must be carefully considered. A successful Toronto Company Hudson's Bay bid hinges on navigating these regulatory complexities.

- Thorough review by the Competition Bureau is inevitable. The Bureau will meticulously examine the potential impact on market competition, consumer prices, and the overall retail landscape. This process can be lengthy and demanding.

- Potential divestiture of assets may be required to satisfy regulatory concerns. To alleviate antitrust worries, the acquiring Toronto company might be required to sell off certain HBC assets, potentially impacting the overall deal structure and profitability.

- Lengthy approval process could delay or even derail the bid. The regulatory review process can span several months, even years, creating uncertainty and potentially influencing the overall feasibility of the Toronto Company Hudson's Bay acquisition.

- Public opinion and political pressure can influence regulatory decisions. Public perception and political considerations can significantly affect the regulatory outcome, adding another layer of complexity to the bidding process.

<h2>Financing the Acquisition</h2>

Securing sufficient funding for such a substantial acquisition presents a formidable challenge. The Toronto company requires a robust and well-defined financial strategy to make this Toronto Company Hudson's Bay bid a reality.

- Need to secure significant debt financing or equity investment. Raising the necessary capital will likely involve a combination of debt financing from banks and financial institutions, and equity investment from private investors or other stakeholders.

- Market conditions and investor confidence will play a crucial role. Prevailing market conditions and investor sentiment toward both the acquiring company and HBC will significantly impact the availability and cost of financing.

- Potential impact on the company's credit rating. Taking on substantial debt to finance the acquisition could negatively affect the Toronto company's credit rating, potentially increasing future borrowing costs.

- Balancing debt levels with future investment needs. The acquiring company must carefully balance the debt incurred from the acquisition with its ongoing operational needs and future investment plans, ensuring financial sustainability post-acquisition.

<h3>Valuation Disputes and Negotiation Challenges</h3>

Reaching a mutually agreeable purchase price is a potential major stumbling block in this Toronto Company Hudson's Bay bid. Disparities in valuation between the buyer and seller can easily lead to deal collapse.

- Differences in assessing HBC's current and future value. Buyer and seller may have differing opinions on HBC's intrinsic worth, leading to protracted negotiations. This difference is especially pronounced considering HBC's substantial real estate holdings.

- Negotiating favorable terms and conditions. Beyond the purchase price, negotiating favorable terms and conditions regarding the transfer of assets, liabilities, and operational control is critical.

- Potential for protracted and complex negotiations. The complexity of the transaction and the potential for disagreements can lead to lengthy and involved negotiations.

- Impact of market fluctuations on the agreed-upon valuation. Market fluctuations during the negotiation period can significantly influence the perceived value of HBC, potentially impacting the final agreed-upon price.

<h2>Integrating Two Distinct Business Models</h2>

Successfully merging two organizations with unique operational structures, cultures, and strategies is an extremely complex undertaking. The Toronto company's success in this Toronto Company Hudson's Bay bid will hinge on a comprehensive integration plan.

- Challenges in integrating different IT systems and supply chains. Harmonizing different IT systems, supply chains, and logistics processes can be incredibly challenging and time-consuming.

- Potential for employee disruptions and resistance to change. Mergers often lead to employee redundancies and restructuring, which can cause disruptions and resistance from the workforce.

- Cultural clashes and difficulties in unifying the workforce. Different corporate cultures can create friction and hinder the smooth integration of the two organizations.

- Need for a clear post-merger integration plan. A well-defined and executed integration plan is crucial for minimizing disruptions and maximizing the combined entity's value.

<h2>Impact on Hudson's Bay's Real Estate Portfolio</h2>

HBC's extensive real estate portfolio adds another layer of complexity to this Toronto Company Hudson's Bay bid. The acquiring company must develop a strategic approach to manage these assets effectively.

- Determining the value and future use of HBC's properties. The acquiring company must carefully assess the value and potential uses of HBC's real estate assets, considering options such as continued operation, redevelopment, or sale.

- Potential for property sales or redevelopment. Depending on the strategic goals, the acquiring company might decide to sell off some properties or undertake redevelopment projects.

- Navigating zoning regulations and local government approvals. Any significant changes to HBC's properties will necessitate navigating local zoning regulations and obtaining the necessary approvals from government authorities.

- Managing potential tenant relationships and lease agreements. The acquiring company must manage existing tenant relationships and lease agreements, ensuring a smooth transition and minimizing potential disruptions.

<h2>Conclusion</h2>

The Toronto company's bid for Hudson's Bay presents a multitude of substantial challenges, ranging from regulatory hurdles and securing adequate financing to integrating diverse business models and strategically managing a vast real estate portfolio. Successfully navigating these obstacles demands meticulous planning, robust financial backing, and a clearly defined, comprehensive integration strategy. The outcome of this Toronto Company Hudson's Bay bid will significantly impact both companies and the Canadian retail landscape. Stay informed on the latest news regarding this complex and potentially transformative acquisition. Keep following for more updates on this Toronto Company Hudson's Bay bid.

Featured Posts

-

Smart Ring Technology Detecting Infidelity Or Just Privacy Concerns

May 03, 2025

Smart Ring Technology Detecting Infidelity Or Just Privacy Concerns

May 03, 2025 -

Fortnite Update 34 30 Release Date Downtime And Sabrina Carpenter Patch Notes

May 03, 2025

Fortnite Update 34 30 Release Date Downtime And Sabrina Carpenter Patch Notes

May 03, 2025 -

Trump Et Macron Au Vatican Les Coulisses D Une Rencontre

May 03, 2025

Trump Et Macron Au Vatican Les Coulisses D Une Rencontre

May 03, 2025 -

Improving Mental Healthcare Addressing Systemic Issues And Funding Gaps

May 03, 2025

Improving Mental Healthcare Addressing Systemic Issues And Funding Gaps

May 03, 2025 -

Le Mariage Macron Regards Sur L Intimite Apres Des Annees

May 03, 2025

Le Mariage Macron Regards Sur L Intimite Apres Des Annees

May 03, 2025

Latest Posts

-

Makron Ubedil S Sh A Usilit Davlenie Na Rossiyu Po Ukraine

May 04, 2025

Makron Ubedil S Sh A Usilit Davlenie Na Rossiyu Po Ukraine

May 04, 2025 -

Pm Modis France Visit Ai Summit Co Chairmanship And Ceo Forum Address

May 04, 2025

Pm Modis France Visit Ai Summit Co Chairmanship And Ceo Forum Address

May 04, 2025 -

Image Rare Emmanuel Macron Profondement Touche Par Le Recit Des Victimes Israeliennes

May 04, 2025

Image Rare Emmanuel Macron Profondement Touche Par Le Recit Des Victimes Israeliennes

May 04, 2025 -

La Rencontre Emouvante D Emmanuel Macron Avec Des Victimes De L Armee Israelienne

May 04, 2025

La Rencontre Emouvante D Emmanuel Macron Avec Des Victimes De L Armee Israelienne

May 04, 2025 -

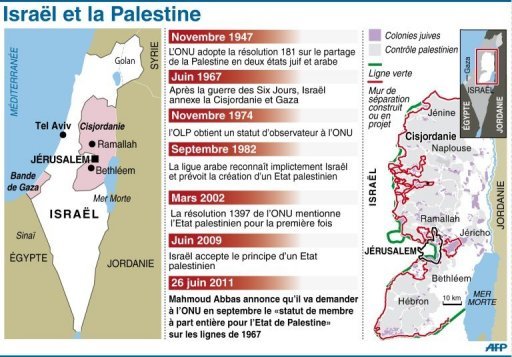

Positions Divergentes Sur L Etat Palestinien Macron Et Netanyahu S Opposent

May 04, 2025

Positions Divergentes Sur L Etat Palestinien Macron Et Netanyahu S Opposent

May 04, 2025