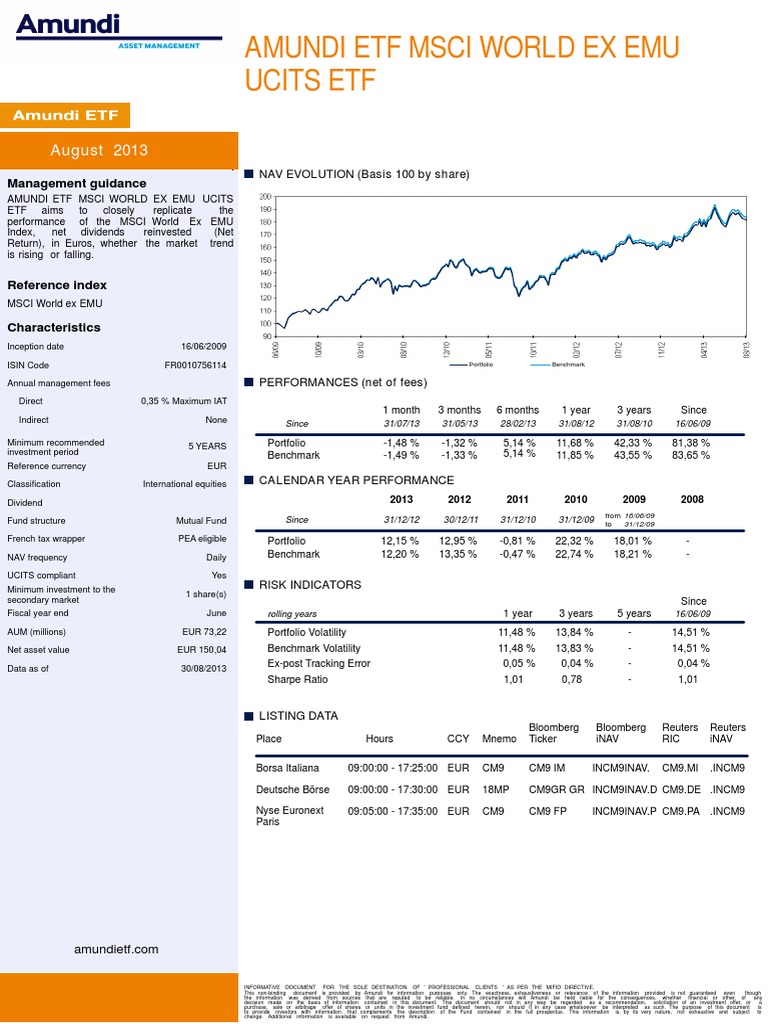

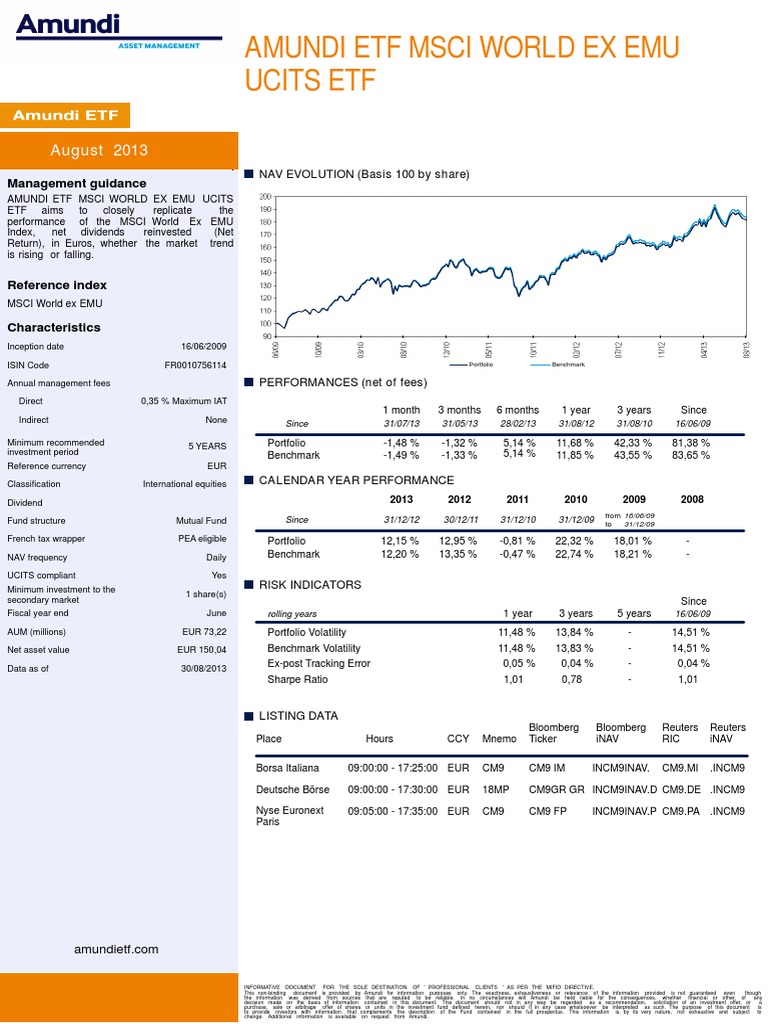

Tracking Amundi MSCI World II UCITS ETF USD Hedged Dist Net Asset Value

Table of Contents

Understanding the Amundi MSCI World II UCITS ETF USD Hedged Dist

The Amundi MSCI World II UCITS ETF USD Hedged Dist is an exchange-traded fund that tracks the MSCI World Index, providing broad exposure to a large selection of developed market equities globally. This makes it suitable for investors with a relatively high risk tolerance seeking long-term growth and international diversification within their investment portfolios.

- Suitable for: Investors seeking broad global market exposure, long-term growth, and relative diversification. It's generally considered suitable for those comfortable with moderate to higher levels of market volatility.

- Underlying Index: The MSCI World Index, a widely recognized benchmark representing large and mid-cap equities from developed countries worldwide. This provides significant diversification across various sectors and geographies.

- USD Hedged: The "USD Hedged" aspect means the fund aims to minimize currency risk for investors holding USD. This helps reduce the impact of fluctuations between the Euro (the base currency of the ETF) and the US dollar on the investment's value.

- Dist (Distribution): The "Dist" signifies that the ETF distributes dividends to shareholders periodically. These dividends are typically reinvested automatically unless specified otherwise by the investor.

Methods for Tracking Net Asset Value (NAV)

Regularly monitoring the Amundi MSCI World II UCITS ETF USD Hedged Dist NAV is vital. Here are several reliable methods:

Using Online Brokerage Platforms

Most online brokerage accounts display the NAV of your held ETFs, either in real-time or with a slight delay. The frequency and accuracy of updates vary depending on the platform and data provider.

- Examples: Interactive Brokers, Fidelity, Schwab, TD Ameritrade, and many others offer real-time or near real-time quotes. Check your brokerage account's specific features and data refresh rates.

- Reliability: Choose a reputable and established brokerage platform known for accurate and timely data. Compare different platforms and their data quality before settling on one.

Checking the Amundi Website

Amundi, the fund manager, typically publishes the official NAV of its ETFs on its website. This is a reliable source, though it might not offer real-time updates.

- Frequency: The NAV is generally updated daily, often at the close of market hours.

- Potential Discrepancies: There might be slight differences between the NAV displayed on the Amundi website and the NAV shown on your brokerage platform due to timing differences and data processing.

Utilizing Financial News Websites and Data Providers

Reputable financial news sources and data providers also publish ETF NAV data.

- Examples: Bloomberg, Yahoo Finance, Google Finance, and others offer ETF data, including NAV information.

- Data Delays: Be aware that data from these sources may be delayed compared to real-time brokerage data. Discrepancies might exist across different platforms.

Factors Affecting the Amundi MSCI World II UCITS ETF USD Hedged Dist NAV

Several factors can significantly impact the Amundi MSCI World II UCITS ETF USD Hedged Dist NAV:

Market Fluctuations

Global market movements are a primary driver of NAV changes. Positive market performance generally leads to NAV increases, while negative performance leads to decreases. This is directly related to the performance of the underlying MSCI World Index.

Currency Exchange Rates

Even with USD hedging, minor fluctuations in the USD/EUR exchange rate can still affect the NAV. While hedging mitigates the majority of the currency risk, it's not a perfect solution.

Dividend Distributions

When the ETF distributes dividends, the NAV will typically decrease by the amount of the distribution on the ex-dividend date. This is because the fund's assets are reduced by the payout to shareholders.

Expense Ratio

The ETF's expense ratio, a yearly fee charged to cover operating costs, gradually impacts the NAV over time. It's a small, ongoing deduction that slightly erodes the fund's value.

Conclusion

Tracking the Amundi MSCI World II UCITS ETF USD Hedged Dist Net Asset Value effectively involves utilizing multiple reliable sources. Whether you use your online brokerage platform, the Amundi website, or reputable financial news sources, understanding the various methods and potential discrepancies is crucial for making informed investment decisions. Remember to consider the impact of market fluctuations, currency exchange rates, dividend distributions, and expense ratios when analyzing NAV changes. Don't leave your investment performance in the dark! Stay informed about your investments by diligently tracking the Amundi MSCI World II UCITS ETF USD Hedged Dist Net Asset Value using the methods outlined above.

Featured Posts

-

Porsche Classic Art Week 2025 Di Indonesia Perayaan Budaya Dan Otomotif

May 25, 2025

Porsche Classic Art Week 2025 Di Indonesia Perayaan Budaya Dan Otomotif

May 25, 2025 -

Novo Ferrari 296 Speciale Motor Hibrido De 880 Cv Apresentado

May 25, 2025

Novo Ferrari 296 Speciale Motor Hibrido De 880 Cv Apresentado

May 25, 2025 -

Planning Your Memorial Day Trip Flight Dates To Consider In 2025

May 25, 2025

Planning Your Memorial Day Trip Flight Dates To Consider In 2025

May 25, 2025 -

Ferrari Owners Checklist Key Gear And Accessories

May 25, 2025

Ferrari Owners Checklist Key Gear And Accessories

May 25, 2025 -

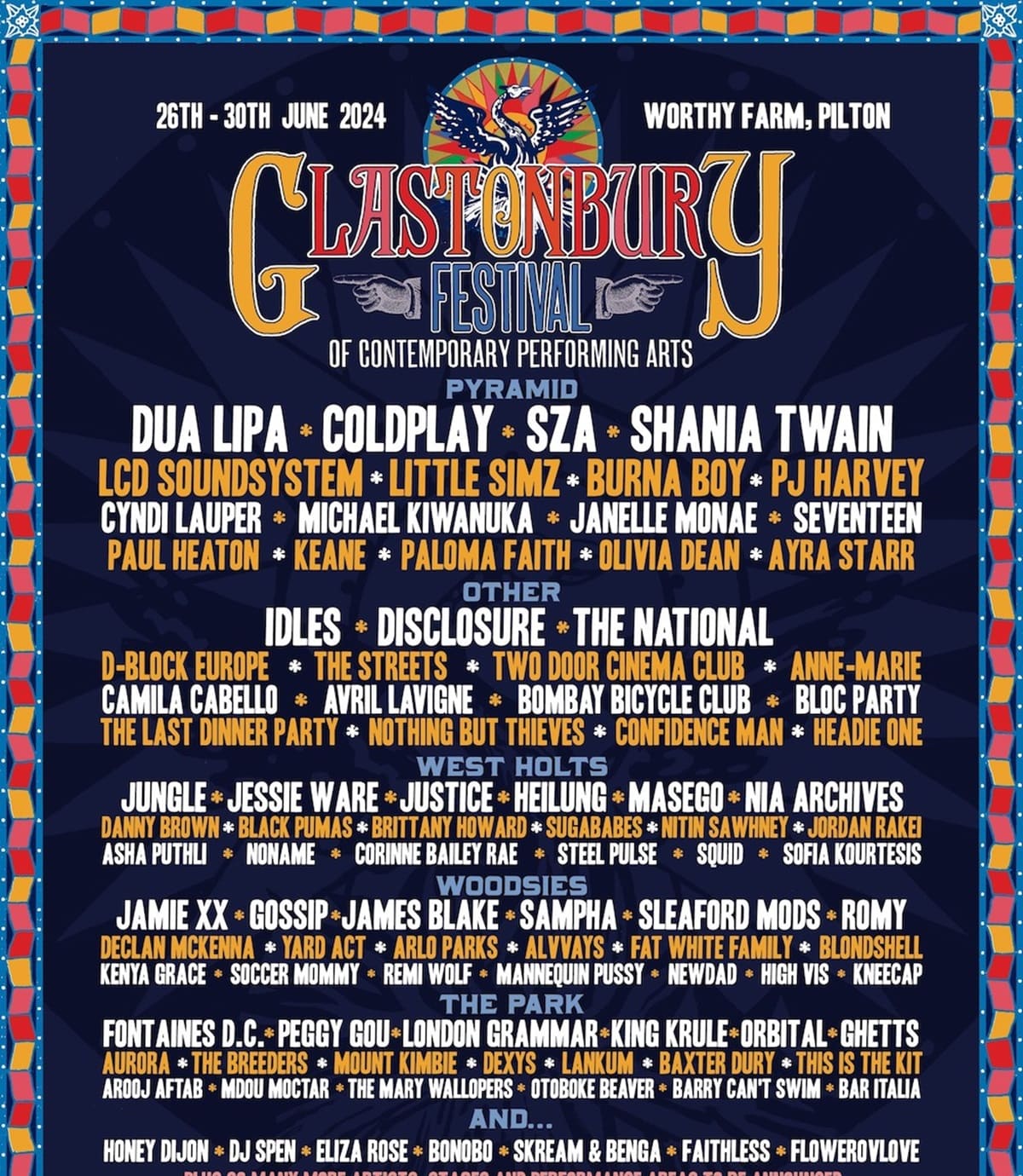

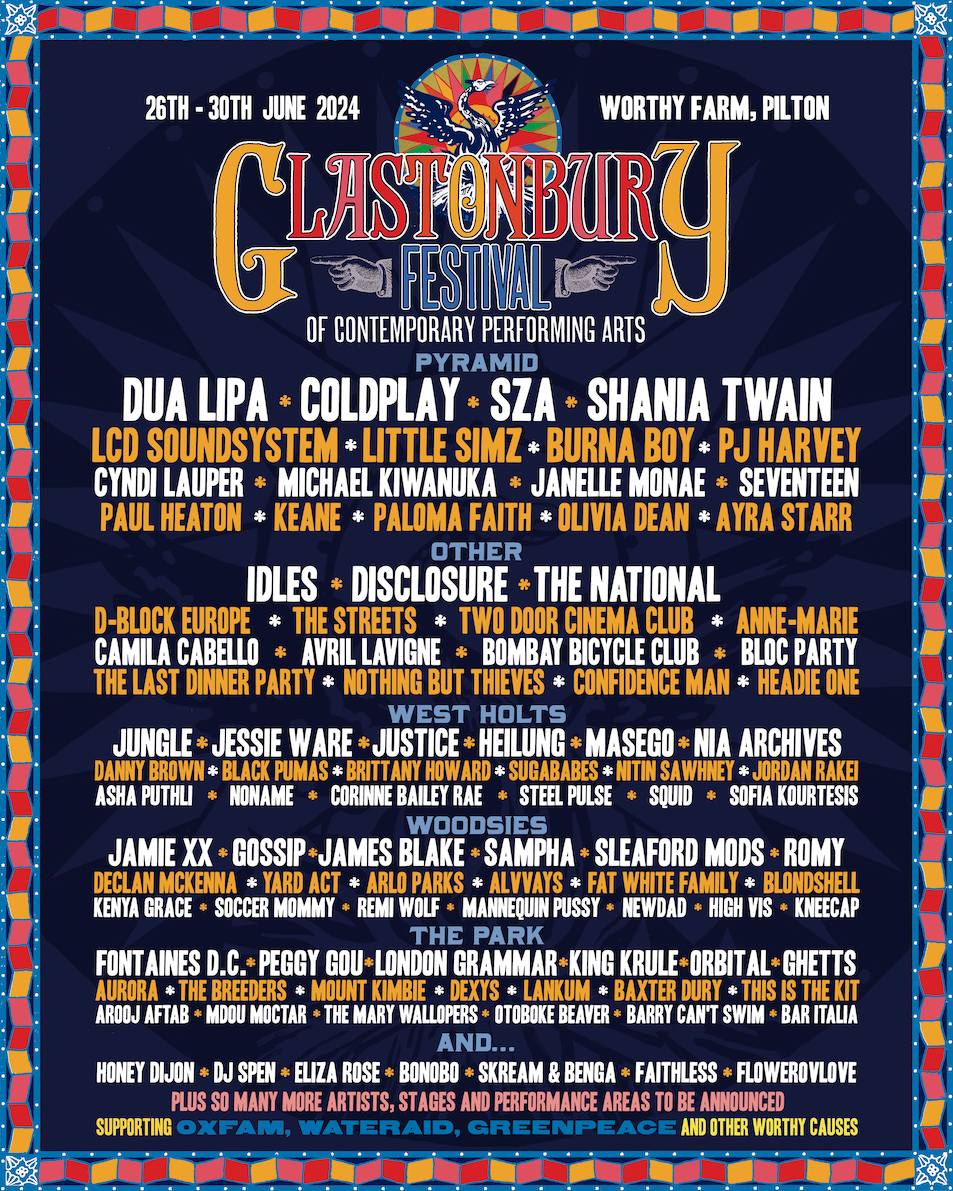

The Glastonbury 2025 Lineup A Deep Dive Featuring Charli Xcx Neil Young And Other Highlights

May 25, 2025

The Glastonbury 2025 Lineup A Deep Dive Featuring Charli Xcx Neil Young And Other Highlights

May 25, 2025

Latest Posts

-

Get Your Bbc Radio 1 Big Weekend Tickets The Ultimate Guide

May 25, 2025

Get Your Bbc Radio 1 Big Weekend Tickets The Ultimate Guide

May 25, 2025 -

Securing Your Bbc Radio 1 Big Weekend Tickets Tips And Strategies

May 25, 2025

Securing Your Bbc Radio 1 Big Weekend Tickets Tips And Strategies

May 25, 2025 -

Bbc Radio 1 Big Weekend A Ticket Buyers Guide

May 25, 2025

Bbc Radio 1 Big Weekend A Ticket Buyers Guide

May 25, 2025 -

Glastonbury Festival 2025 Complete Lineup And Ticket Purchase Guide Following Leak

May 25, 2025

Glastonbury Festival 2025 Complete Lineup And Ticket Purchase Guide Following Leak

May 25, 2025 -

Glastonbury 2025 Full Lineup Revealed Following Leak Get Your Tickets Now

May 25, 2025

Glastonbury 2025 Full Lineup Revealed Following Leak Get Your Tickets Now

May 25, 2025