Tracking The Net Asset Value (NAV) Of Amundi MSCI World II UCITS ETF Dist

Table of Contents

Understanding the Amundi MSCI World II UCITS ETF Dist and its NAV Calculation

The Amundi MSCI World II UCITS ETF Dist is a UCITS-compliant ETF that tracks the MSCI World Index, providing exposure to a broad range of large and mid-cap companies across developed markets globally. Understanding its Net Asset Value (NAV) is paramount to assessing its performance. The NAV represents the net value of the ETF's assets minus its liabilities, divided by the number of outstanding shares. This figure reflects the intrinsic value of each share.

Several factors influence the daily NAV calculation:

- Market Value of Holdings: The primary driver is the fluctuating market value of the underlying assets (the companies within the MSCI World Index). A rise in the market value of these holdings increases the ETF's NAV, and vice-versa.

- Expenses: The ETF's operating expenses, including management fees, reduce the NAV. These are typically deducted daily.

- Dividends: Dividend payouts from the underlying companies are initially included in the NAV calculation. However, once distributed to shareholders, the NAV is adjusted accordingly.

The NAV is typically calculated daily at the market close, providing a snapshot of the ETF's value at that specific point in time. It's important to note the difference between NAV and the market price. The market price is the price at which the ETF is traded on the exchange and can fluctuate throughout the trading day, sometimes diverging slightly from the NAV due to supply and demand.

- Underlying assets: The Amundi MSCI World II UCITS ETF Dist holds a portfolio mirroring the composition of the MSCI World Index, including a wide range of global equities.

- Factors affecting NAV: Market fluctuations, dividend payouts, expense ratio, and currency exchange rates all play a role.

- Calculation frequency: The NAV is typically calculated and published daily, usually at the end of the trading day.

Where to Find the Amundi MSCI World II UCITS ETF Dist NAV

Accessing the accurate NAV for the Amundi MSCI World II UCITS ETF Dist is straightforward thanks to multiple reliable sources:

- Amundi's Official Website: Amundi, the ETF issuer, usually provides detailed information on its website, including historical NAV data. Look for a section dedicated to ETF factsheets or performance data.

- Financial News Websites: Major financial news providers such as Bloomberg, Yahoo Finance, and Google Finance usually list ETF NAVs. You can typically search using the ETF's ticker symbol.

- Brokerage Platforms: If you hold the Amundi MSCI World II UCITS ETF Dist through a brokerage account, the platform will likely display the NAV alongside the current market price. Check your account statements or portfolio overview.

- ETF Data Providers: Specialized financial data providers offer comprehensive ETF data, including NAVs, often via subscription services.

It's crucial to note that minor discrepancies might exist between different sources due to timing differences in data updates. However, significant variations should prompt further investigation to ensure data accuracy.

- Amundi Website: Check the dedicated investor relations section or the ETF's factsheet page.

- Financial News: Search using the ETF's ticker symbol (e.g., "AMUNDI MSCI WORLD II NAV").

- Brokerage Platforms: Consult your brokerage platform's help section for instructions on locating ETF data.

Utilizing NAV Data for Effective Investment Decisions

Tracking the NAV of the Amundi MSCI World II UCITS ETF Dist allows for effective investment management:

-

Performance Monitoring: By comparing the NAV over time, you can monitor the ETF's performance, identifying periods of growth or decline.

-

Benchmarking: Comparing the ETF's NAV against the MSCI World Index benchmark allows you to evaluate how well the ETF is tracking its target index.

-

Buy/Sell Signals: Analyzing NAV trends can help identify potential buying or selling opportunities. However, this should be done cautiously and alongside other fundamental and technical analyses. It's crucial to remember that past performance is not indicative of future results.

-

Total Return Calculation: Remember to include dividend reinvestment when calculating total return. The NAV alone doesn’t capture the full picture of your investment's growth.

-

Performance tracking: Create a chart or spreadsheet to visualize NAV changes over time.

-

Benchmarking: Regularly compare the ETF's NAV against the MSCI World Index to assess tracking accuracy.

-

Buy/Sell signals: Use caution; NAV trends alone should not be the sole basis for trading decisions.

-

Dividend reinvestment: Account for reinvested dividends to get a complete picture of your total return.

Tools and Resources for NAV Tracking

Several tools simplify NAV tracking:

- Spreadsheet Software: Excel or Google Sheets can be used to manually record and analyze NAV data obtained from the sources mentioned above.

- Financial Data Platforms/APIs: Many financial data platforms and APIs offer automated data feeds, allowing for real-time NAV tracking and integration with other investment management tools. These often come with subscription fees.

Choosing the right method depends on your technical skills and investment needs. Manual tracking provides good control but requires more time, while automated solutions offer convenience but come with a cost.

Conclusion

Tracking the Net Asset Value (NAV) of your Amundi MSCI World II UCITS ETF Dist investments is essential for informed decision-making. By utilizing reliable sources like Amundi's website, financial news platforms, and brokerage accounts, and understanding the factors influencing the NAV, you can effectively monitor your portfolio's performance and identify potential opportunities. Start tracking the Net Asset Value (NAV) of your Amundi MSCI World II UCITS ETF Dist investments today to make informed decisions and optimize your portfolio performance. Regularly monitoring your Amundi MSCI World II UCITS ETF Dist NAV is key to successful global market investing.

Featured Posts

-

Escape To The Country Choosing The Right Location For You

May 24, 2025

Escape To The Country Choosing The Right Location For You

May 24, 2025 -

Amundi Dow Jones Industrial Average Ucits Etf Nav A Comprehensive Guide

May 24, 2025

Amundi Dow Jones Industrial Average Ucits Etf Nav A Comprehensive Guide

May 24, 2025 -

Esc 2025 Conchita Wurst And Jjs Eurovision Village Performance

May 24, 2025

Esc 2025 Conchita Wurst And Jjs Eurovision Village Performance

May 24, 2025 -

Will A Us Market Upswing Counteract The Daxs Positive Momentum

May 24, 2025

Will A Us Market Upswing Counteract The Daxs Positive Momentum

May 24, 2025 -

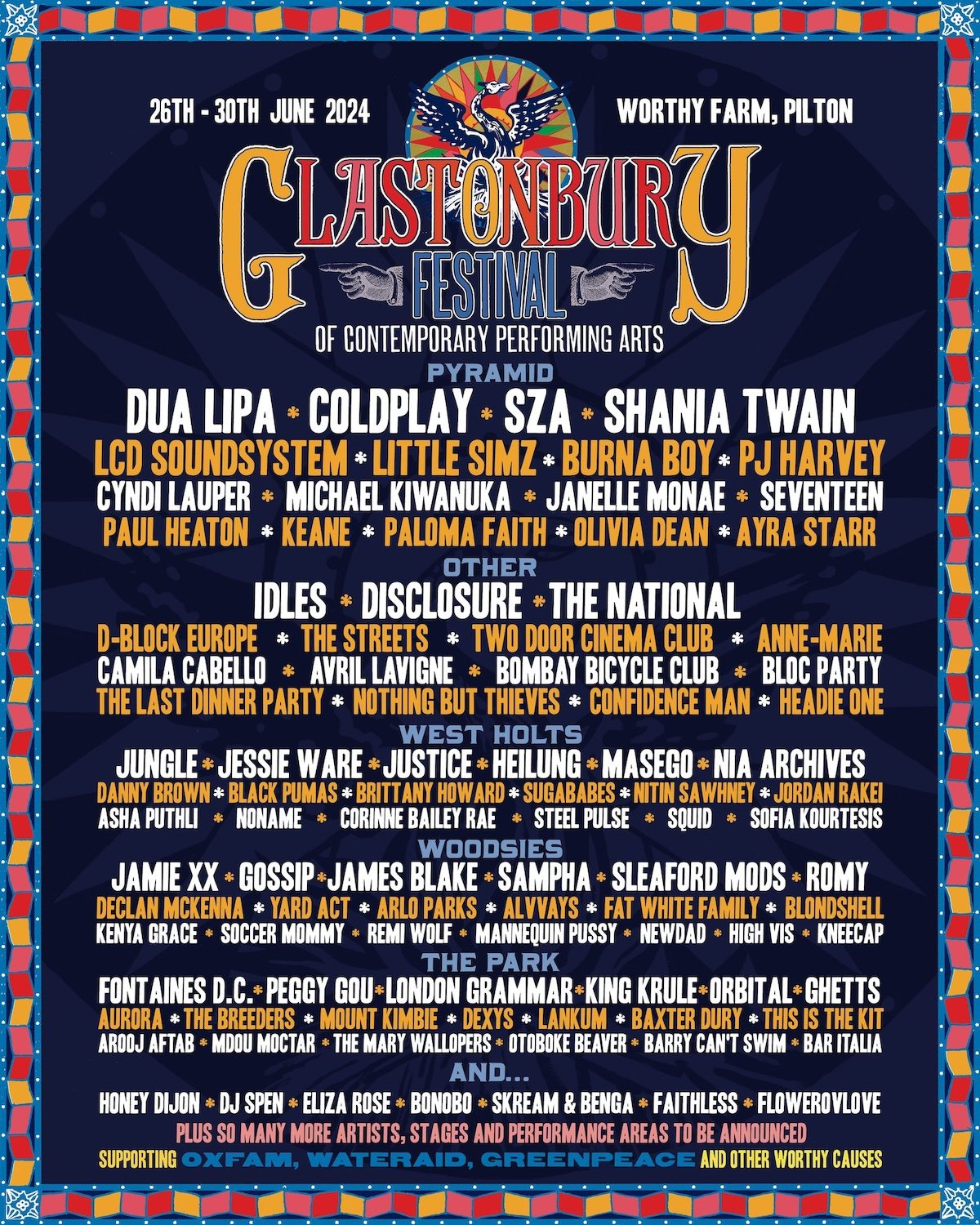

Glastonbury 2024 Unannounced Us Band Performance Confirmed

May 24, 2025

Glastonbury 2024 Unannounced Us Band Performance Confirmed

May 24, 2025

Latest Posts

-

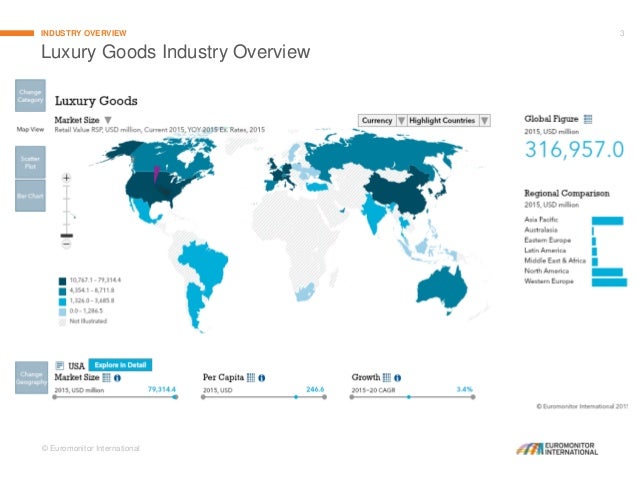

Economic Slowdown Hits Paris Luxury Goods Sector Takes A Toll

May 24, 2025

Economic Slowdown Hits Paris Luxury Goods Sector Takes A Toll

May 24, 2025 -

Financial Strain In Paris The Luxury Sector Slump

May 24, 2025

Financial Strain In Paris The Luxury Sector Slump

May 24, 2025 -

Departure Of Guccis Chief Industrial And Supply Chain Officer Massimo Vian

May 24, 2025

Departure Of Guccis Chief Industrial And Supply Chain Officer Massimo Vian

May 24, 2025 -

Pariss Red Alert Impact Of Luxury Goods Market Decline

May 24, 2025

Pariss Red Alert Impact Of Luxury Goods Market Decline

May 24, 2025 -

Gucci Supply Chain Shakeup Departure Of Chief Industrial Officer Massimo Vian

May 24, 2025

Gucci Supply Chain Shakeup Departure Of Chief Industrial Officer Massimo Vian

May 24, 2025