Trade War Concerns: Analysts Turn Pessimistic On European Equities

Table of Contents

Weakening Economic Growth Forecasts for Europe

Trade wars significantly hinder economic growth in Europe. Tariffs and retaliatory measures disrupt established supply chains, reduce international trade, and dampen business investment. Sectors heavily reliant on exports, such as automotive manufacturing, are particularly vulnerable. The consequences are already visible in several key economic indicators:

-

Declining PMI (Purchasing Managers' Index) figures: PMI readings across the Eurozone have consistently fallen below the 50-point mark, indicating contraction in manufacturing and services activity. For example, the Eurozone manufacturing PMI slumped to 45.7 in August 2023 (hypothetical data, replace with actual figures).

-

Reduced consumer and business confidence: Uncertainty surrounding trade policies leads to decreased consumer spending and business investment, further dampening economic growth. Surveys consistently show weakening consumer and business confidence across Europe.

-

Slowing export growth: Trade wars directly impact export volumes, as tariffs make European goods less competitive in international markets. This reduction in exports is a major drag on GDP growth.

The cumulative effect of these factors is a significant downward revision of European GDP growth forecasts for the coming year. The International Monetary Fund (IMF) or other credible sources should be referenced with specific figures here for accurate data.

Increased Uncertainty and Volatility in European Markets

The uncertainty surrounding trade wars significantly impacts investor behavior. The unpredictability of policy changes and their consequences makes it incredibly difficult to assess the long-term value of European equities. This inherent uncertainty fuels increased market volatility, leading to sharp price swings and heightened risk. The consequences are manifold:

-

Increased market fluctuations: Daily price movements in European equity markets have become significantly more pronounced, reflecting the heightened risk perception among investors.

-

Difficulty in accurate market predictions: The inherent unpredictability of trade policy makes accurate forecasting exceptionally challenging for market analysts.

-

Reduced investor appetite for risk: Investors are shifting towards safer assets, such as government bonds, reducing demand and capital inflows for riskier European equities.

This increased volatility necessitates a reassessment of investment strategies and careful consideration of portfolio diversification to mitigate potential losses.

Sector-Specific Impacts of Trade Wars on European Equities

Not all sectors are equally affected by trade wars. Some are significantly more vulnerable due to their dependence on international trade, export-oriented business models, or susceptibility to supply chain disruptions. Specifically:

-

Automotive industry: The automotive sector, with its intricate global supply chains, is exceptionally vulnerable to trade disputes. Tariffs on imported components and finished vehicles can severely impact profitability and sales.

-

Technology sector: Companies relying on global supply chains for components and finished goods face disruptions and increased costs due to trade tensions. The technology sector, with its extensive international collaboration, is particularly susceptible.

-

Agricultural products: The agricultural sector is frequently targeted by trade restrictions, with tariffs and quotas impacting export volumes and farm incomes across Europe.

These sectors' vulnerability can have significant ripple effects throughout the European economy, affecting related industries and further dampening overall growth.

Analyst Opinions and Predictions for European Equities

Leading financial analysts hold a largely pessimistic outlook for European equities in the short to medium term. Many anticipate short-term market corrections due to sustained trade war concerns. Quotes from reputable financial analysts, backed by their affiliations, should be inserted here to bolster the analysis. These predictions include:

-

Short-term market corrections: Several analysts predict further downward pressure on European equity prices as trade tensions continue.

-

Long-term growth stagnation: Prolonged trade disputes could lead to slower economic growth, resulting in prolonged stagnation in the equity markets.

-

Potential for a market rebound: A de-escalation of trade tensions or a resolution of the disputes could trigger a market rebound, but this outcome remains uncertain.

Conclusion: Navigating the Storm of Trade War Concerns

The key takeaway is that Trade War Concerns are significantly impacting European equities. Weakening economic growth forecasts, increased market volatility, and a pessimistic outlook among analysts create a challenging environment for investors. The significance of these concerns on European market performance cannot be overstated.

To navigate these turbulent waters, it is crucial to stay informed about the evolving trade situation. Adopt a cautious approach to investing in European equities until the uncertainty subsides. Conduct thorough research, consider seeking professional financial advice, and explore diversification strategies to reduce exposure to the risks associated with trade war concerns impacting your investment portfolio. Remember, a well-diversified portfolio can help mitigate some of the risks associated with trade war uncertainty.

Featured Posts

-

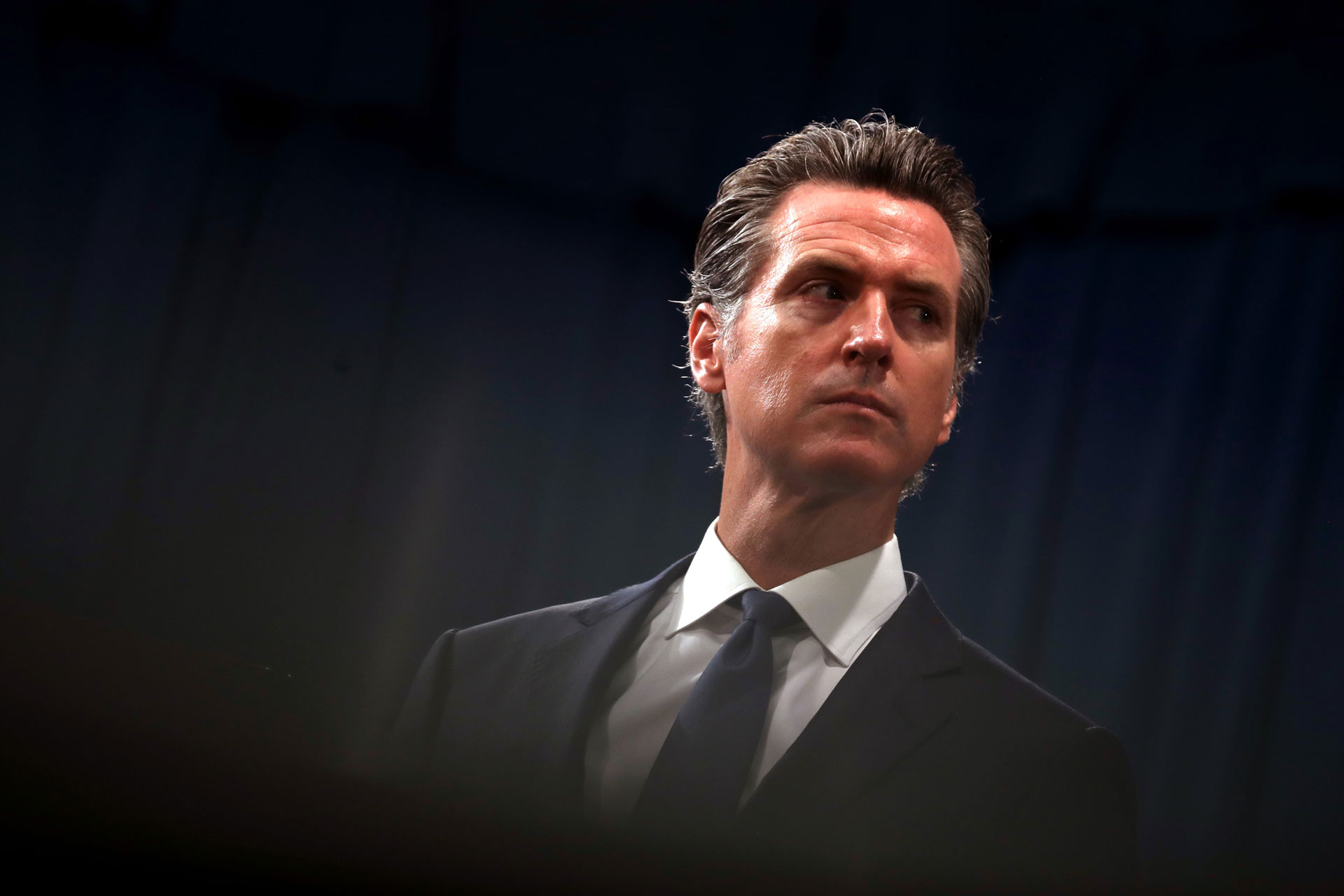

California Politics Explodes Newsoms Confrontation With Democrats

Apr 26, 2025

California Politics Explodes Newsoms Confrontation With Democrats

Apr 26, 2025 -

New Tugboat Project Damen Collaborates With Icdas In Turkey

Apr 26, 2025

New Tugboat Project Damen Collaborates With Icdas In Turkey

Apr 26, 2025 -

Velikonoce 2024 Tipy Jak Se Vyrovnat Se Zdrazovanim A Predchazet Rodinnym Konfliktum

Apr 26, 2025

Velikonoce 2024 Tipy Jak Se Vyrovnat Se Zdrazovanim A Predchazet Rodinnym Konfliktum

Apr 26, 2025 -

Damens Nieuwste Combat Support Schip Een Mijlpaal Voor De Nederlandse Marine

Apr 26, 2025

Damens Nieuwste Combat Support Schip Een Mijlpaal Voor De Nederlandse Marine

Apr 26, 2025 -

Unmasking The Stinkiest Congressman

Apr 26, 2025

Unmasking The Stinkiest Congressman

Apr 26, 2025