Trade Wars And Gold: Why Bullion Prices Are Surging

Table of Contents

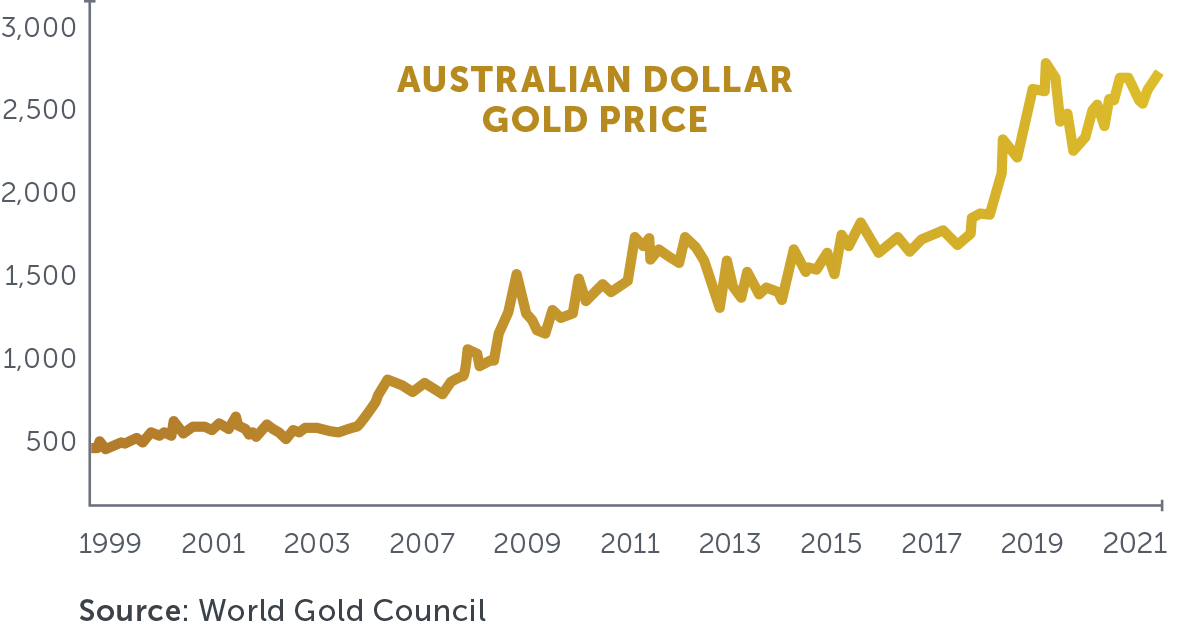

Gold prices have hit record highs in recent months, a surge that many analysts attribute to escalating global trade tensions. The relationship between trade wars and gold is undeniable; as uncertainty in the global marketplace increases, investors flock to the precious metal as a safe haven. This article explores the complex interplay between trade wars and gold, examining why bullion prices are soaring and what it means for investors. We'll delve into the reasons why gold is considered a safe haven asset in times of economic and geopolitical turmoil, such as during trade wars.

H2: Safe Haven Asset

Gold has historically served as a reliable safe-haven asset, a haven for investors seeking refuge from market volatility. During periods of economic uncertainty, geopolitical instability, or escalating trade conflicts like the ones we see today, investors often shift their assets towards gold, driving up demand and consequently, prices. This is because gold’s value remains relatively stable even when other assets, like stocks and bonds, experience significant drops.

H3: Diversification and Portfolio Protection

Diversifying your investment portfolio with gold is a crucial strategy for mitigating risk.

- Example: A portfolio heavily weighted in stocks might experience substantial losses during a market downturn triggered by trade wars. Including gold can act as a buffer, softening the blow.

- Benefits: Gold offers negative correlation with stocks, meaning its price often moves in the opposite direction. This helps balance portfolio performance during market fluctuations.

- Risk Reduction: A diversified portfolio including gold demonstrably reduces overall portfolio risk, protecting investors from substantial losses during periods of economic uncertainty fueled by trade disputes.

H3: Inflation Hedge

Gold is also considered a hedge against inflation. Trade wars often lead to inflationary pressures as tariffs increase the cost of imported goods.

- Inflation and Gold: Historically, gold prices have risen during inflationary periods as investors seek to protect their purchasing power.

- Historical Examples: Throughout history, periods of high inflation have seen a corresponding increase in gold's value. The 1970s, for instance, witnessed both high inflation and soaring gold prices.

- Trade Wars and Inflation: Trade wars contribute to inflation by disrupting supply chains and increasing production costs. This makes gold an increasingly attractive investment.

H2: Currency Devaluation and Trade Wars

Trade wars significantly impact currency values, creating volatility that influences gold prices.

H3: Weakening US Dollar

Trade disputes can weaken the US dollar, which is inversely correlated with gold prices.

- Current Status: The US dollar's strength fluctuates depending on global economic conditions and trade negotiations.

- Tariffs and Exchange Rates: Imposition of tariffs often leads to retaliatory measures, impacting currency exchange rates and creating further uncertainty.

- Historical Impact: Historically, a weakening dollar has been a catalyst for higher gold prices, as it becomes cheaper for investors holding other currencies to purchase gold.

H3: Global Economic Slowdown

Trade wars can trigger a global economic slowdown, further bolstering gold's appeal as a safe haven.

- Indicators of Slowdown: Reduced global trade volumes, decreased consumer spending, and declining industrial production are all warning signs.

- Supply Chain Disruptions: Trade conflicts disrupt global supply chains, increasing production costs and reducing economic activity.

H2: Increased Investment Demand

The uncertainty caused by trade wars has fueled increased demand for gold from both individual and institutional investors.

H3: Central Bank Purchases

Central banks worldwide are significantly increasing their gold reserves.

- Recent Data: Reports show a steady increase in central bank gold purchases in recent years.

- Reasons for Accumulation: Central banks view gold as a reliable store of value and a hedge against geopolitical risks.

- Impact on Prices: Increased central bank demand directly contributes to upward pressure on gold prices.

H3: ETF Flows

Gold-backed exchange-traded funds (ETFs) have seen substantial inflows, reflecting investor sentiment.

- ETF Inflows: Data shows a net inflow of investment into gold ETFs during periods of trade war uncertainty.

- Investor Confidence: High ETF inflows signal investor confidence in gold as a safe haven asset.

- Accessibility: ETFs make gold investment more accessible to a broader range of investors.

Conclusion:

In summary, the surge in gold bullion prices is strongly linked to escalating trade wars. The resulting economic uncertainty increases demand for gold as a safe haven asset, while currency fluctuations and inflationary pressures further contribute to its price appreciation. Increased investment demand from both individual investors and central banks reinforces this trend. To protect your portfolio with gold and hedge against trade war risks, consider adding gold to your investment strategy. Learn more about investing in gold during trade wars and diversify your portfolio effectively. [Link to relevant resource]

Featured Posts

-

Le Labo Du 8 Une Exposition Photographique De Pierre Terrasson

Apr 26, 2025

Le Labo Du 8 Une Exposition Photographique De Pierre Terrasson

Apr 26, 2025 -

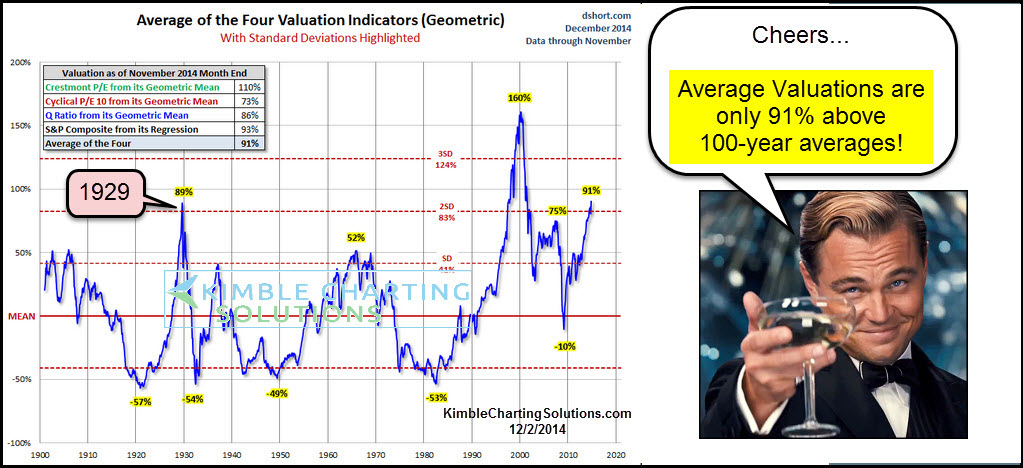

Understanding Stock Market Valuations Bof As Perspective For Investors

Apr 26, 2025

Understanding Stock Market Valuations Bof As Perspective For Investors

Apr 26, 2025 -

Exclusive Polygraph Threats And Internal Conflict Shake Up The Pentagon

Apr 26, 2025

Exclusive Polygraph Threats And Internal Conflict Shake Up The Pentagon

Apr 26, 2025 -

New Restrictions On Federal Disaster Assistance Under Trump Administration

Apr 26, 2025

New Restrictions On Federal Disaster Assistance Under Trump Administration

Apr 26, 2025 -

I Heart Radio Music Awards 2025 Benson Boones Bold Fashion Choice

Apr 26, 2025

I Heart Radio Music Awards 2025 Benson Boones Bold Fashion Choice

Apr 26, 2025