Tribal Loans For Bad Credit: Guaranteed Approval? Finding The Right Lender

Table of Contents

Understanding Tribal Loans

What are Tribal Loans?

Tribal loans are short-term loans offered by lenders associated with Native American tribes. These lenders operate on tribal land, often utilizing a legal framework distinct from state regulations. This means they may have different lending practices and regulations compared to traditional banks or credit unions. They are frequently marketed as a solution for individuals with bad credit who struggle to secure loans through traditional channels. Understanding the nuances of tribal lenders and short-term loans is crucial before considering this option.

Regulations and Legal Aspects

The regulatory landscape surrounding tribal lending is complex and often contentious. While some tribal lenders operate ethically, the industry has seen its share of predatory lending practices. Tribal lending regulations vary significantly and may not provide the same level of consumer protection as state-regulated lenders. High-interest rates are common, and borrowers need to carefully consider the interest rates and total cost of borrowing before committing.

- The legal jurisdiction governing tribal loans can be challenging to navigate, often involving both tribal and federal laws.

- Consumer protection laws may differ substantially from those protecting borrowers in state-regulated lending environments.

- Always read the fine print meticulously. Understand all fees, charges, and repayment terms to avoid unexpected financial burdens.

Finding Reputable Tribal Lenders

Research and Due Diligence

Finding a legitimate and reputable tribal lender requires thorough research and due diligence. The tribal lending market unfortunately includes fraudulent operators, making careful investigation essential. Use online search engines, but be critical of information found. Compare multiple online lenders and make sure they are operating legally.

Checking Licensing and Accreditation

Verifying the legitimacy of a tribal lender involves checking for relevant licenses and accreditations within the tribal jurisdiction. Look for transparent information about the lender's operations, contact details, and physical address. Avoid lenders who lack transparency or are vague about their operations.

- Utilize online resources such as the Better Business Bureau (BBB) to research lenders’ reputations and check for complaints.

- Read online reviews carefully, considering both positive and negative feedback to get a balanced perspective.

- Always verify the lender's contact information and physical address to ensure legitimacy and avoid potential scams.

The Reality of "Guaranteed Approval"

Debunking the Myth

The claim of "guaranteed approval" for tribal loans is largely a myth. While some tribal lenders may have more lenient approval criteria than traditional banks, approval is never guaranteed. Your creditworthiness remains a critical factor. Understanding the loan approval process is vital to avoiding disappointment.

Factors Affecting Loan Approval

Several factors influence loan approval, including your credit score, income, debt-to-income ratio, and employment history. Lenders assess your overall creditworthiness and financial stability to determine your risk profile. Even with bad credit, providing accurate information significantly increases your chances of approval.

- Accuracy is crucial: Provide truthful and complete information in your loan application.

- Financial responsibility matters: Demonstrating responsible financial behavior improves your chances.

- Credit score is only one factor: Lenders assess risk based on multiple financial factors.

Alternatives to Tribal Loans

Exploring Other Options

If you have bad credit, several alternatives to tribal loans exist. Consider these options carefully:

- Credit Unions: Often offer more favorable terms than traditional banks, particularly for members.

- Peer-to-Peer Lending Platforms: Connect borrowers directly with individual investors, sometimes providing more flexible options.

- Credit Counseling Services: Can help you improve your credit score and manage your debt effectively.

Choosing the Best Option

Compare loan offers meticulously. Analyze interest rates, fees, repayment terms, and the overall cost of borrowing before making a decision. Utilize loan comparison tools to make informed choices and avoid falling victim to predatory lending practices.

- Weigh the pros and cons of each alternative loan option carefully.

- Calculate the total cost of borrowing, including interest and fees, for each option.

- Seek professional financial advice to determine the most suitable option for your specific circumstances.

Conclusion

Securing tribal loans for bad credit requires careful consideration. While they can provide a solution for those facing financial difficulties, it's crucial to thoroughly research potential lenders, understand the complexities of tribal lending regulations, and be wary of misleading claims of "guaranteed approval." Explore all available options, compare lenders diligently, and prioritize responsible borrowing practices. To find the right tribal lender for your needs, conduct extensive research and prioritize reputable institutions. Remember, securing responsible tribal loans is possible with careful planning and due diligence.

Featured Posts

-

Leeds United Close To Signing 31 Cap England International

May 28, 2025

Leeds United Close To Signing 31 Cap England International

May 28, 2025 -

Another Win For Angels Four In A Row

May 28, 2025

Another Win For Angels Four In A Row

May 28, 2025 -

Champions League Derby Real Madrid Beats Atletico

May 28, 2025

Champions League Derby Real Madrid Beats Atletico

May 28, 2025 -

Predicting The 2025 Mlb Starting Left Fielders A Power Ranking

May 28, 2025

Predicting The 2025 Mlb Starting Left Fielders A Power Ranking

May 28, 2025 -

One Piece A Look At Pirates Who Served Multiple Crews

May 28, 2025

One Piece A Look At Pirates Who Served Multiple Crews

May 28, 2025

Latest Posts

-

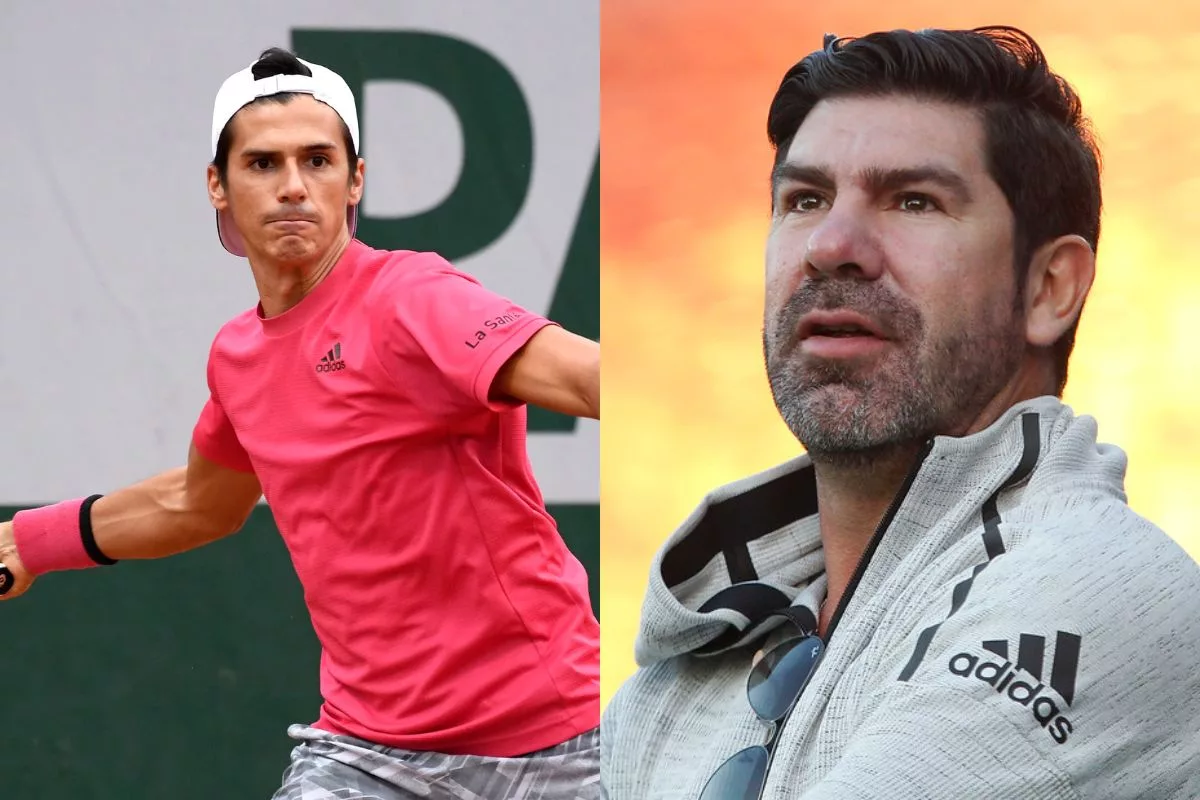

Un Tenista Argentino Revela Su Admiracion Por El Dios Del Tenis Marcelo Rios

May 30, 2025

Un Tenista Argentino Revela Su Admiracion Por El Dios Del Tenis Marcelo Rios

May 30, 2025 -

Marcelo Rios La Opinion De Un Tenista Argentino Que Lo Odiaba

May 30, 2025

Marcelo Rios La Opinion De Un Tenista Argentino Que Lo Odiaba

May 30, 2025 -

Confesion De Un Tenista Argentino Marcelo Rios Una Leyenda

May 30, 2025

Confesion De Un Tenista Argentino Marcelo Rios Una Leyenda

May 30, 2025 -

El Chino Rios Un Dios Del Tenis Segun Un Tenista Argentino

May 30, 2025

El Chino Rios Un Dios Del Tenis Segun Un Tenista Argentino

May 30, 2025 -

Odiado Tenista Argentino Su Impactante Confesion Sobre Marcelo Rios

May 30, 2025

Odiado Tenista Argentino Su Impactante Confesion Sobre Marcelo Rios

May 30, 2025