Trump: Congressional Stock Trading Ban – A Time Magazine Interview

Table of Contents

Trump's Stance on a Congressional Stock Trading Ban

Analyzing Trump's specific comments from the Time Magazine interview regarding a congressional stock trading ban is crucial to understanding the current political climate. Did he unequivocally support or oppose it? What reasoning did he offer? Understanding his perspective provides valuable context for the broader debate.

- Direct quotes from the interview regarding stock trading and congressional ethics: [Insert direct quotes here, properly cited. If no direct quotes are available, state this and explain how his position can be inferred from the context of the interview]. Careful analysis of these quotes is needed to determine the nuances of his position.

- Analysis of Trump's historical positions on financial regulation and transparency: Examining his past statements and actions regarding financial disclosure and regulation helps establish consistency (or lack thereof) in his approach to this issue. This includes considering his administration's policies and his public statements on related topics.

- Comparison of Trump's stance with other prominent political figures: Comparing Trump's viewpoint with those of other leading Republicans and Democrats illuminates the partisan divides within the debate. This comparison should highlight areas of agreement and disagreement.

Arguments For a Congressional Stock Trading Ban

The call for a congressional stock trading ban stems from serious concerns about conflicts of interest and the potential for insider trading. This section explores the compelling arguments supporting this restriction.

- Examples of alleged instances of insider trading or conflicts of interest involving members of Congress: Highlighting specific, well-documented cases serves to underscore the need for reform. Include links to credible sources detailing these instances.

- The impact of public perception on trust in government: A significant argument for the ban centers on public perception. Erosion of public trust in government due to perceived conflicts of interest can have significant consequences for democratic legitimacy. Research on public opinion regarding congressional ethics can support this point.

- Discussion of similar bans in other countries or at the state level: Examining successful implementations of stock trading bans in other jurisdictions offers valuable insights and potential models for the U.S. Consider the experiences of countries with stricter regulations on lawmaker finances.

Arguments Against a Congressional Stock Trading Ban

While the arguments for a ban are strong, counterarguments also deserve consideration. This section explores the potential drawbacks and unintended consequences of such a measure.

- Concerns about limiting the financial freedom of elected officials: Opponents argue that a ban infringes upon the financial freedom of elected officials, potentially discouraging qualified individuals from seeking public office. This argument needs careful consideration, balancing individual liberty with the public interest.

- Potential for unintended consequences, such as limiting investment opportunities for lawmakers: Limiting investment options might disproportionately impact lawmakers from certain socioeconomic backgrounds. This concern requires careful consideration and analysis of the potential effects.

- Arguments that stricter financial disclosure requirements are a sufficient solution: Proponents of increased transparency argue that stricter disclosure rules, rather than an outright ban, could sufficiently address concerns about conflicts of interest. A comparison of the efficacy of these two approaches is necessary.

The Current State of the Congressional Stock Trading Debate

Understanding the current legislative landscape is essential to assessing the likelihood of a congressional stock trading ban. This section reviews the ongoing efforts to address this issue.

- Summary of key proposed legislation: Detail the main features of current bills aimed at restricting or regulating congressional stock trading. Include links to the proposed legislation for further research.

- Analysis of the political hurdles and challenges to enacting a ban: The political realities of passing such legislation, including potential partisan gridlock, need to be considered. Highlight the political obstacles and the potential for compromise.

- Potential compromises and alternative solutions: Exploring potential compromises and alternative solutions, such as enhanced financial disclosure requirements, helps to create a more nuanced understanding of the debate.

The Role of Transparency and Financial Disclosure

Even without a complete ban on stock trading, enhanced transparency and improved financial disclosure requirements for members of Congress are paramount. Strengthening these mechanisms can significantly mitigate concerns about conflicts of interest, even in the absence of a full ban. This includes exploring mechanisms for quicker and more accessible disclosure of financial holdings and transactions.

Conclusion

The Time Magazine interview with Donald Trump offers a crucial glimpse into the ongoing debate surrounding a congressional stock trading ban. While Trump's specific position requires further clarification, the interview underscores the deep divisions and complex considerations surrounding this critical issue. Arguments for increased ethics and transparency clash with concerns about individual liberty and potential unintended consequences. The ongoing legislative efforts demonstrate the urgency of finding a solution to restore public trust and confidence in government. Strengthening financial disclosure is a key component of this effort.

Call to Action: Stay informed about the developments in the debate surrounding the congressional stock trading ban. Understanding the various perspectives and ongoing legislative efforts is crucial to shaping a future where Congress operates with integrity and transparency. Learn more about the proposed legislation and how you can participate in shaping ethical reform. Continue following the evolving discussion on the congressional stock trading ban and advocate for increased transparency and accountability in government.

Featured Posts

-

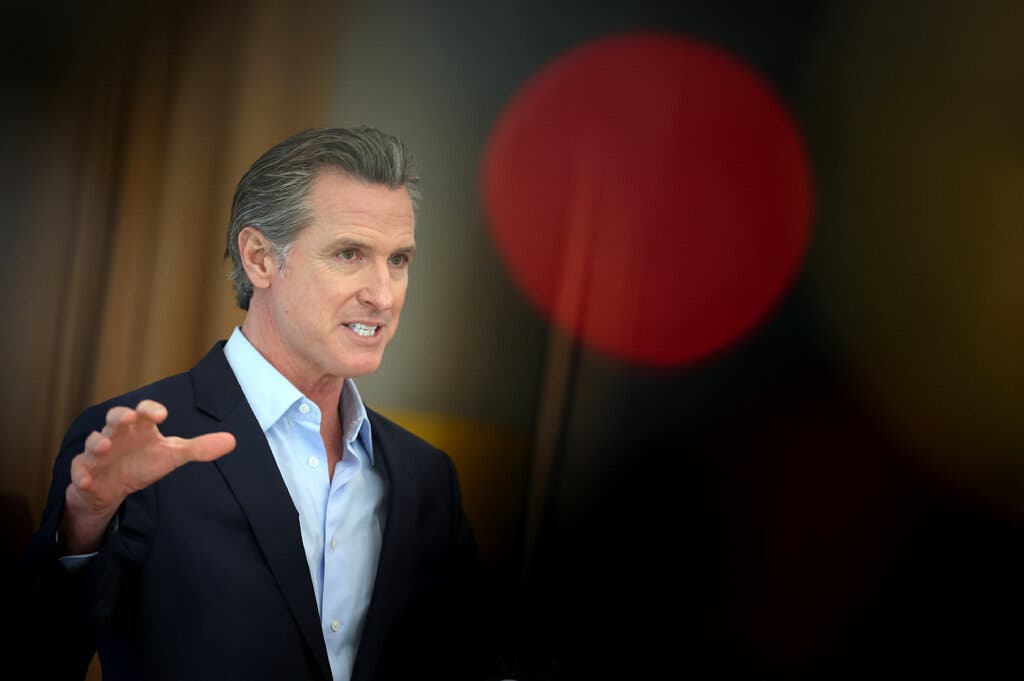

Dave Portnoys Criticism Of California Governor Newsom

Apr 26, 2025

Dave Portnoys Criticism Of California Governor Newsom

Apr 26, 2025 -

The Feeling Netflix Premiere Chelsea Handlers New Stand Up Special

Apr 26, 2025

The Feeling Netflix Premiere Chelsea Handlers New Stand Up Special

Apr 26, 2025 -

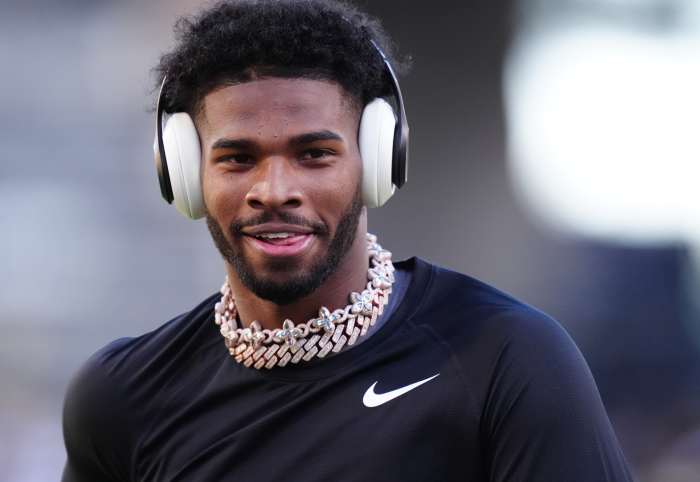

Analyzing The Shedeur Sanders New York Giants Fit

Apr 26, 2025

Analyzing The Shedeur Sanders New York Giants Fit

Apr 26, 2025 -

Is Benson Boone Copying Harry Styles A Detailed Look At The Comparisons

Apr 26, 2025

Is Benson Boone Copying Harry Styles A Detailed Look At The Comparisons

Apr 26, 2025 -

Exclusive Pentagon Leaks Polygraph Tests And The Fallout For Pete Hegseth

Apr 26, 2025

Exclusive Pentagon Leaks Polygraph Tests And The Fallout For Pete Hegseth

Apr 26, 2025