Trump Renews Assault On Jerome Powell: Urges Termination Of Fed Chair

Table of Contents

Brief Background: Trump's criticism of Powell isn't new. He has consistently attacked the Fed Chair, particularly during his presidency, primarily due to Powell's interest rate hikes, which Trump viewed as hindering economic growth. These criticisms have ranged from public tweets to direct verbal assaults, creating considerable uncertainty in the financial markets.

This article will focus on the latest escalation of this conflict, examining Trump's specific statements, the motivations behind his renewed attacks, and the potential repercussions for the US economy and the Federal Reserve's independence.

Trump's Latest Criticism and its Rationale

Specific Statements and Actions:

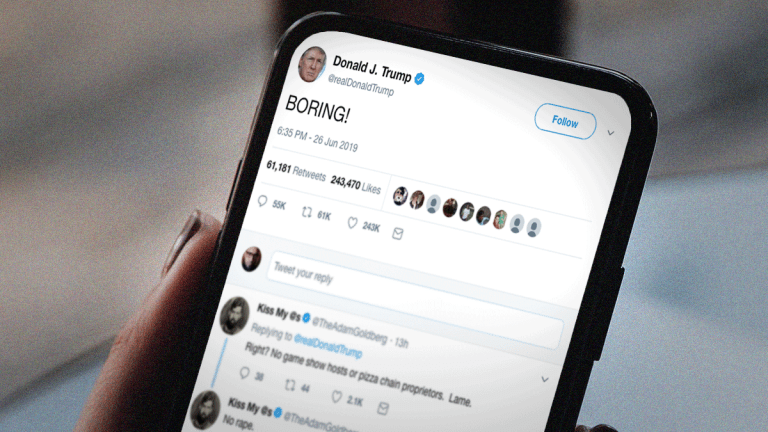

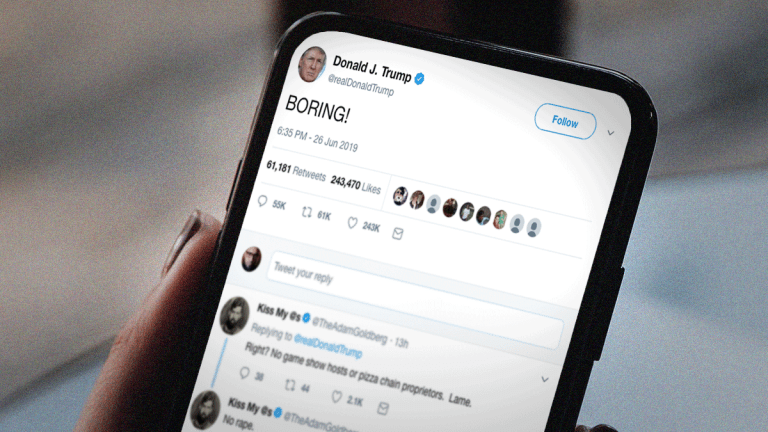

Trump's recent assault on Powell includes renewed calls for his dismissal, echoing previous criticisms of Powell's monetary policies. While specific statements vary across different platforms, the core message remains consistent: Powell's actions are detrimental to the American economy. These attacks often appear on social media and through interviews, further amplifying their impact. For example, [insert a link to a relevant news source quoting Trump directly]. This rhetoric paints Powell as incompetent and directly responsible for any economic slowdown. The keywords "Powell Termination," "Fed Chair," and "Trump's criticism" frequently appear in his pronouncements.

Underlying Reasons for the Attack:

Trump's motivations are multifaceted. His criticisms stem largely from Powell's interest rate hikes aimed at curbing inflation. Trump believes these hikes stifle economic growth and harm his political standing. The keywords "Interest Rate Hikes," "Inflation," "Economic Growth," and "Political Strategy" are central to understanding his actions. His attacks might also be a calculated political strategy, attempting to shift blame for any economic downturn away from himself and onto the independent Federal Reserve.

- Specific examples: Trump has repeatedly claimed that Powell's policies are "ruining the economy."

- News sources: [insert links to multiple news sources reporting on Trump's statements]

- Expert opinions: [insert links to or quotes from economic analysts commenting on Trump's motives]

Potential Consequences of Trump's Actions

Impact on the Federal Reserve's Independence:

Trump's continued attacks undermine the Federal Reserve's crucial independence. A central bank's autonomy is essential for making unbiased monetary policy decisions based on economic data, not political pressure. Keywords such as "Central Bank Independence," "Monetary Policy," and "Political Interference" highlight the severity of the situation. Openly criticizing the Fed Chair erodes public trust and weakens the institution's ability to effectively manage the economy.

Economic Market Reactions:

Trump's renewed assault has already created ripples in the financial markets. Increased uncertainty can lead to market volatility, impacting investor confidence and potentially slowing economic growth. Keywords like "Market Volatility," "Investor Confidence," and "Economic Uncertainty" are crucial here. The stock market's reaction to such pronouncements often reflects the perceived risk to economic stability.

Legal and Constitutional Considerations:

The process for removing a Fed Chair is complex and subject to legal and constitutional constraints. While a president can appoint and potentially influence the Fed, outright dismissal without justifiable cause could face legal challenges and raise constitutional questions. Keywords such as "Presidential Power," "Federal Reserve Act," and "Constitutional Limits" are critical to understanding this facet.

- Potential economic scenarios: Continued political pressure could lead to decreased investment, higher inflation, or even recession.

- Expert opinions: [insert links to or quotes from legal scholars and economists on the potential long-term effects].

- Historical precedents: [cite historical examples of political interference in the Fed and their outcomes].

Public Opinion and Reactions

Public Sentiment Towards Powell and Trump:

Public opinion polls reveal a polarized landscape. Some support Powell's actions to control inflation, even if it means slower economic growth. Others side with Trump, blaming Powell for economic hardships. Keywords such as "Public Opinion," "Approval Ratings," and "Political Polarization" aptly describe the situation. This division underscores the political sensitivity of economic policy decisions.

Media Coverage and Analysis:

Media coverage has been extensive, with various news outlets offering a range of analyses. Some commentators criticize Trump's attacks as harmful and destabilizing, while others offer a more nuanced perspective. Keywords such as "Media Coverage," "Expert Opinion," and "News Analysis" are pertinent. This diverse coverage highlights the significance of the event and its wide-ranging impact.

- Public opinion data: [cite relevant polls and surveys on public sentiment].

- Relevant articles and opinions: [insert links to various media articles and opinion pieces].

- Significant public figures' comments: [mention prominent figures who have commented on the situation].

Conclusion

Trump's renewed assault on Jerome Powell, fueled by disagreements over monetary policy and potentially driven by political strategy, presents significant risks to the Federal Reserve's independence and the stability of the US economy. The potential consequences, ranging from market volatility to erosion of public trust in the central bank, are substantial. The keywords "Trump's attacks on Powell," "Fed Chair," and "Economic Instability" encapsulate the gravity of the situation. The Federal Reserve's independence is paramount for effective economic management; political interference jeopardizes this vital element.

Stay updated on the developing story of Trump's assault on Jerome Powell and the future of the Federal Reserve. The ongoing conflict has far-reaching implications, affecting not only the economy but also the delicate balance of power between the executive branch and independent institutions.

Featured Posts

-

Exec Office365 Breach Nets Millions For Hacker Fbi Says

Apr 23, 2025

Exec Office365 Breach Nets Millions For Hacker Fbi Says

Apr 23, 2025 -

Blockchain Analytics Leader Chainalysis Integrates Ai Through Alterya Purchase

Apr 23, 2025

Blockchain Analytics Leader Chainalysis Integrates Ai Through Alterya Purchase

Apr 23, 2025 -

Erzurum Valiligi Aciklamasi 24 Subat Pazartesi Okullar Tatil Mi Kar Tatili Bilgisi

Apr 23, 2025

Erzurum Valiligi Aciklamasi 24 Subat Pazartesi Okullar Tatil Mi Kar Tatili Bilgisi

Apr 23, 2025 -

Adeyemi Praesentiert Sich Stylish In Dortmund

Apr 23, 2025

Adeyemi Praesentiert Sich Stylish In Dortmund

Apr 23, 2025 -

Lab Owners Guilty Plea Faking Covid 19 Test Results During Pandemic

Apr 23, 2025

Lab Owners Guilty Plea Faking Covid 19 Test Results During Pandemic

Apr 23, 2025