Trump Tax Bill Passes House: Understanding The New Tax Law

Table of Contents

Individual Income Tax Changes under the Trump Tax Bill

The Trump Tax Bill brought substantial changes to individual income taxes. Understanding these alterations is crucial for effective tax planning. Key changes include modifications to individual income tax brackets, the standard deduction, itemized deductions, and the Child Tax Credit.

-

New Individual Income Tax Brackets and Rates: The Tax Cuts and Jobs Act reduced the number of individual income tax brackets and lowered the rates for most taxpayers. This resulted in a more simplified tax system, but the impact varied significantly depending on income level. Specific rates and bracket thresholds should be verified with official IRS documentation, as these can change over time.

-

Increased Standard Deduction Amounts: The standard deduction was significantly increased for single, married, and head-of-household filers. This change meant that many taxpayers found themselves itemizing fewer deductions, simplifying their tax preparation. The increased standard deduction made it easier for many to comply with tax requirements.

-

Changes to Itemized Deductions: The bill introduced limitations on several itemized deductions, most notably capping the deduction for state and local taxes (SALT). This change particularly impacted taxpayers in high-tax states, potentially increasing their overall tax liability. Understanding these limitations is crucial for accurate tax preparation.

-

Enhanced Child Tax Credit: The Child Tax Credit was also enhanced, with increased amounts and expanded eligibility requirements. This provided more tax relief to families with children. Careful consideration should be given to the specifics of the expanded credit when filing taxes.

Corporate Tax Rate Reduction: A Key Provision of the Trump Tax Bill

One of the most significant changes introduced by the Trump Tax Bill was the reduction in the corporate tax rate. This provision aimed to boost business investment and job creation.

-

Lowered Corporate Tax Rate: The corporate tax rate was slashed from 35% to 21%, a dramatic reduction that significantly impacted corporate profitability.

-

Impact on Corporate Profits and Investment: This reduction was intended to increase corporate profits, encouraging businesses to invest more in expansion and job creation. The actual impact is a subject of ongoing economic analysis.

-

Effects on Jobs and Economic Growth: Proponents argued that the lower tax rate would stimulate economic growth and lead to job creation. Critics, however, questioned the extent to which these benefits would materialize and whether the tax cuts would disproportionately benefit large corporations.

-

Potential Criticisms and Unforeseen Consequences: The corporate tax cut faced criticism for potentially exacerbating income inequality and increasing the national debt. Further analysis is needed to fully assess the long-term consequences of this significant tax reform.

Impact on Specific Taxpayers: Who Benefits Most from the Trump Tax Bill?

The Trump Tax Bill's impact varied considerably depending on income level and other factors. While some groups saw significant tax relief, others experienced less substantial changes, or even saw their taxes increase.

-

Analysis of Tax Benefits for Different Income Levels: Generally, high-income earners benefited more substantially from the tax cuts than lower-income taxpayers. However, the increased standard deduction provided some tax relief for middle- and lower-income individuals.

-

Impact on High-Income Earners, Middle-Class Families, and Low-Income Taxpayers: High-income earners benefited most significantly from the lower tax rates and various deductions. Middle-class families benefited from the increased standard deduction and child tax credit. The impact on low-income taxpayers was less pronounced.

-

Addressing Concerns about Increased National Debt: The substantial tax cuts raised concerns about their impact on the national debt. The long-term fiscal consequences of the Tax Cuts and Jobs Act remain a subject of debate.

Understanding the Implications for Long-Term Financial Planning

The Trump Tax Bill necessitates a reassessment of long-term financial planning strategies. The changes introduced require careful consideration for investment choices, retirement planning, and overall tax optimization.

-

Adapting Investment Strategies to the New Tax Law: Investors need to adjust their investment strategies to align with the new tax landscape. Understanding the impact on capital gains and other investment income is crucial.

-

Long-Term Implications for Retirement Planning: Retirement planning strategies need to be adapted to consider the changes in tax rates and deductions.

-

The Importance of Professional Financial Advice: Consulting with a financial advisor or tax professional is highly recommended to navigate the complexities of the new tax law and develop a sound long-term financial plan.

Conclusion

The Trump Tax Bill, encompassing significant changes to both individual and corporate taxes, represents a major overhaul of the US tax code. Understanding its intricacies—including modifications to tax rates, deductions, and credits—is vital for both individuals and businesses. The 2017 Tax Law changes, and their ramifications, will undoubtedly shape financial decisions for years to come. Stay informed about the details of the Trump Tax Bill and its impact on your personal finances. Consult with a tax professional to ensure you're taking full advantage of the new tax law and developing a sound tax strategy. Learn more about the Trump Tax Bill and its lasting effects on the US economy by exploring reputable financial news sources and official government websites.

Featured Posts

-

Amundi Msci World Ii Ucits Etf Dist A Comprehensive Guide To Net Asset Value

May 24, 2025

Amundi Msci World Ii Ucits Etf Dist A Comprehensive Guide To Net Asset Value

May 24, 2025 -

Boe Rate Cut Probabilities Decline Following Lower Uk Inflation

May 24, 2025

Boe Rate Cut Probabilities Decline Following Lower Uk Inflation

May 24, 2025 -

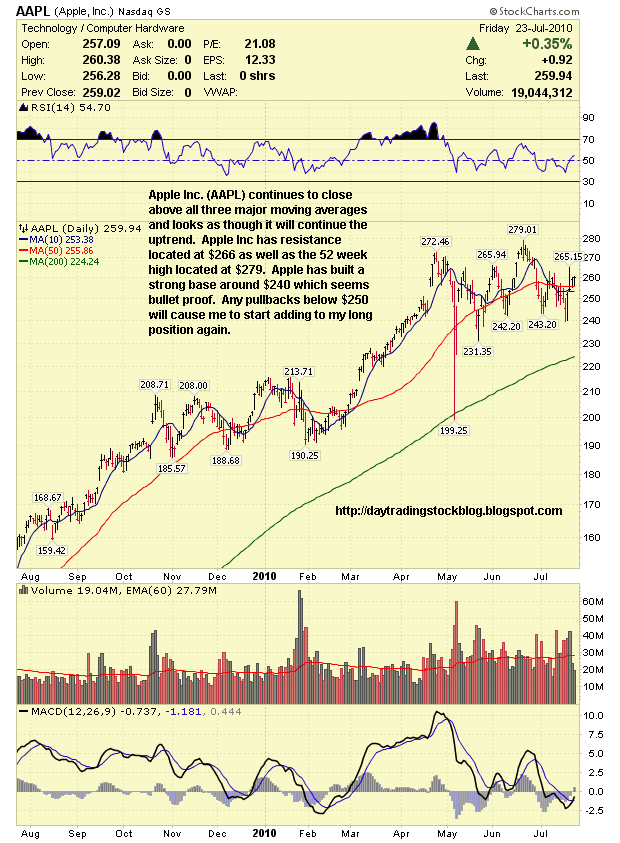

Aapl Stock Analysis Of Upcoming Price Levels

May 24, 2025

Aapl Stock Analysis Of Upcoming Price Levels

May 24, 2025 -

Viral Tik Tok A Former Parishioners Story Of Pope Leo

May 24, 2025

Viral Tik Tok A Former Parishioners Story Of Pope Leo

May 24, 2025 -

Outrage As Ferrari Targets Lewis Hamiltons Unfair Comments

May 24, 2025

Outrage As Ferrari Targets Lewis Hamiltons Unfair Comments

May 24, 2025

Latest Posts

-

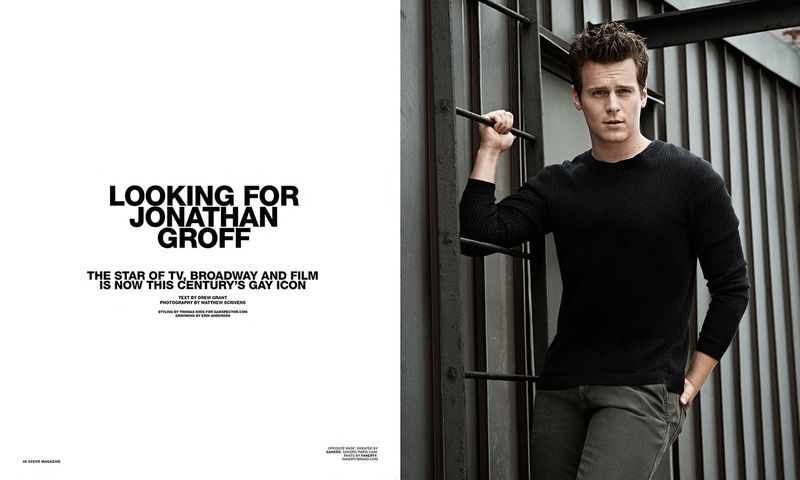

Jonathan Groff Discusses His Asexuality In New Instinct Magazine Interview

May 24, 2025

Jonathan Groff Discusses His Asexuality In New Instinct Magazine Interview

May 24, 2025 -

Jonathan Groffs Asexual Past An Instinct Magazine Interview

May 24, 2025

Jonathan Groffs Asexual Past An Instinct Magazine Interview

May 24, 2025 -

Broadway Buzz Jonathan Groffs Just In Time And The Raw Energy Of Bobby Darin

May 24, 2025

Broadway Buzz Jonathan Groffs Just In Time And The Raw Energy Of Bobby Darin

May 24, 2025 -

Just In Time Musical Review Groffs Performance And The 60s Vibe

May 24, 2025

Just In Time Musical Review Groffs Performance And The 60s Vibe

May 24, 2025 -

Jonathan Groffs Just In Time Performance Bobby Darin Primal Instincts And Broadway Buzz

May 24, 2025

Jonathan Groffs Just In Time Performance Bobby Darin Primal Instincts And Broadway Buzz

May 24, 2025