Trump Tax Plan Details Released By House Republicans

Table of Contents

Individual Income Tax Changes under the Trump Tax Plan

The Trump Tax Plan proposed significant alterations to the individual income tax system. Key changes impacting individual taxpayers included adjustments to tax brackets, the standard deduction, and the child tax credit. Understanding these changes is crucial for assessing the plan's personal impact.

-

Proposed Changes to Individual Income Tax Brackets: The plan aimed to simplify the tax brackets, potentially reducing the number of brackets and altering the tax rates applied to each income level. While specific rates varied depending on the version of the plan, the general goal was to lower overall rates for many taxpayers. For example, some proposals suggested a reduction from seven brackets to three or four.

-

Impact on the Standard Deduction: The Trump Tax Plan generally proposed increasing the standard deduction, potentially offering greater tax relief to lower and middle-income taxpayers. This increase aimed to offset the impact of other tax changes and simplify tax filing for many individuals.

-

Modifications to the Child Tax Credit: The plan included modifications to the Child Tax Credit, potentially increasing the credit amount or expanding eligibility. This change sought to provide greater financial support to families with children.

-

Elimination or Modification of Specific Deductions: A controversial aspect of the Trump Tax Plan was the potential elimination or modification of certain deductions, such as the deduction for state and local taxes (SALT). The elimination of these deductions often sparked considerable debate, as they significantly impacted taxpayers in high-tax states.

-

Analysis of the Overall Impact on Different Income Levels: The overall impact of the Trump Tax Plan on different income levels varied. While some proposed cuts benefited higher-income earners more substantially, others argued that the increase in the standard deduction and modifications to the child tax credit offered significant benefits to lower and middle-income families. Detailed analysis of this aspect requires considering various factors and specific plan details.

Corporate Tax Rate Reductions in the Republican Tax Plan

A central element of the Trump Tax Plan was a substantial reduction in the corporate tax rate. This aimed to stimulate business investment, boost economic growth, and enhance U.S. competitiveness in the global marketplace.

-

Proposed Reduction in the Corporate Tax Rate: The plan proposed a significant reduction in the corporate tax rate from 35% to a significantly lower percentage (specific percentages varied based on the proposed legislation). This decrease was intended to make the U.S. a more attractive location for businesses and encourage domestic investment.

-

Potential Impact on Business Investment and Economic Growth: Proponents argued that lower corporate tax rates would incentivize businesses to invest more in their operations, creating jobs and driving economic growth. This anticipated increase in investment was a core argument for supporting the tax plan.

-

Discussion of the Repatriation of Foreign Earnings: The plan also addressed the issue of repatriating foreign earnings, encouraging U.S.-based companies to bring their profits earned overseas back to the United States. The proposed tax incentives for repatriation aimed to boost domestic investment and economic activity.

-

Analysis of the Potential Effects on Corporate Profits and Shareholder Returns: The anticipated effect on corporate profits and shareholder returns was a subject of much discussion. While lower tax rates could lead to higher profits, the overall impact was dependent on a multitude of economic factors, making definitive predictions challenging.

Potential Economic Consequences of the Trump Tax Plan

The Trump Tax Plan's potential economic consequences were a significant focus of debate. Analyzing the plan's fiscal implications, potential impact on inflation and interest rates, and long-term effects was critical to understanding its overall worth.

-

Projected Impact on the National Debt and Budget Deficit: A primary concern surrounding the tax plan was its potential impact on the national debt and the budget deficit. Significant tax cuts without corresponding spending cuts were expected to increase the deficit, raising concerns about long-term economic stability.

-

Potential Effects on Inflation and Interest Rates: The tax cuts could potentially stimulate demand, leading to increased inflation and potentially higher interest rates. The extent of these effects depended on a number of factors, including the overall state of the economy.

-

Analysis of the Plan's Potential to Stimulate Economic Growth or Exacerbate Income Inequality: Proponents argued the plan would stimulate economic growth, while critics worried it would exacerbate income inequality, disproportionately benefiting high-income individuals and corporations. This debate highlighted differing perspectives on the plan's distributive effects.

-

Discussion of Potential Long-Term Consequences: The long-term consequences of the Trump Tax Plan remained a subject of ongoing discussion and analysis. Forecasting the long-term impact necessitated intricate economic modeling and considerable uncertainty.

Criticisms and Concerns Regarding the Trump Tax Plan

The Trump Tax Plan faced significant criticism from various sources. These criticisms encompassed concerns about its potential economic impacts, distributional effects, and overall design.

-

Arguments Against the Proposed Tax Cuts: Opponents argued that the tax cuts were too large, lacked sufficient targeting to benefit low and middle-income families, and would primarily benefit the wealthy. They highlighted the potential for increased income inequality as a significant downside.

-

Potential Negative Impacts on Specific Demographics or Sectors: Critics raised concerns about the potential negative impacts on specific demographics, such as low-income individuals and families, and sectors, such as state and local governments, due to potential cuts to deductions.

-

Counterarguments to the Claims Made by Proponents of the Tax Plan: Opponents challenged the claims made by proponents, arguing that the tax cuts would not necessarily lead to the promised levels of economic growth and job creation. They highlighted alternative approaches to tax reform.

-

Mention of Alternative Proposals or Approaches to Tax Reform: Critics proposed alternative approaches to tax reform that they felt would be more equitable and effective in achieving desired economic outcomes, such as focusing on closing tax loopholes rather than enacting broad-based tax cuts.

Conclusion

The House Republicans' Trump Tax Plan represented a significant attempt at comprehensive tax reform. It proposed substantial changes to both individual and corporate taxation, promising to boost economic growth by lowering tax rates and simplifying the tax code. However, concerns remain regarding its potential to exacerbate income inequality and increase the national debt. The plan's long-term impact on the U.S. economy remains a subject of ongoing debate and analysis.

Call to Action: Stay informed about the ongoing debate surrounding the Trump Tax Plan and its potential implications for you. Continue researching the specifics of the Trump Tax Plan to understand how it might affect your personal finances and business operations. Learn more about the Trump Tax Plan details and its potential impact on the U.S. economy to make informed decisions.

Featured Posts

-

Nhl Suspends Minority Owner For Online Abuse Of Opposing Fan

May 16, 2025

Nhl Suspends Minority Owner For Online Abuse Of Opposing Fan

May 16, 2025 -

Mdah Ne Tam Krwz Ke Jwte Pr Pawn Rkha Adakar Ka Rdeml Jan Kr Hyran Rh Jayyn Ge

May 16, 2025

Mdah Ne Tam Krwz Ke Jwte Pr Pawn Rkha Adakar Ka Rdeml Jan Kr Hyran Rh Jayyn Ge

May 16, 2025 -

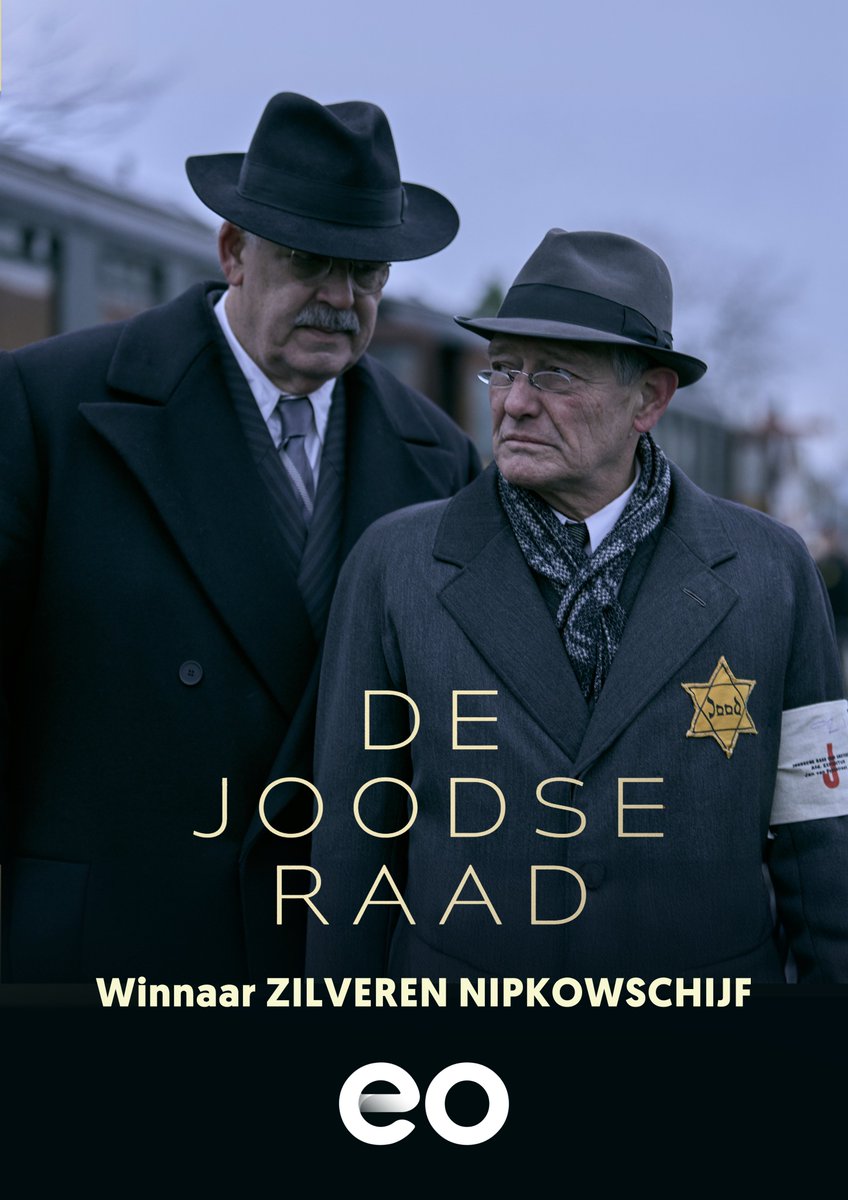

De Ere Zilveren Nipkowschijf Voor Jiskefet Een Mijlpaal In De Nederlandse Televisiegeschiedenis

May 16, 2025

De Ere Zilveren Nipkowschijf Voor Jiskefet Een Mijlpaal In De Nederlandse Televisiegeschiedenis

May 16, 2025 -

Jalen Brunson Ankle Roll Knicks Suffer Overtime Setback

May 16, 2025

Jalen Brunson Ankle Roll Knicks Suffer Overtime Setback

May 16, 2025 -

May 8th Mlb Dfs Top Sleeper Picks And One Batter To Bench

May 16, 2025

May 8th Mlb Dfs Top Sleeper Picks And One Batter To Bench

May 16, 2025