Trump's Economic Policies And The Difficulties For The Incoming Fed Chair

Table of Contents

The Legacy of Trump's Tax Cuts

The Tax Cuts and Jobs Act of 2017, a cornerstone of Trump's economic agenda, significantly lowered corporate and individual income tax rates. While proponents argued it would stimulate economic growth through increased investment and job creation, critics pointed to its potential to exacerbate the national debt and worsen income inequality. The Act's impact is a complex issue with both short-term benefits and long-term concerns.

- Increased national debt: The tax cuts led to a substantial increase in the national debt, as revenue fell short of projections. This increased fiscal burden places constraints on future government spending and necessitates difficult choices regarding budget priorities.

- Impact on income inequality: Critics argue the tax cuts disproportionately benefited high-income earners, widening the gap between the rich and the poor. This has fueled social and political tensions and poses a challenge to economic stability.

- Effects on corporate investment and job creation: While some corporations did increase investment and hiring following the tax cuts, the effects were not uniformly positive across all sectors. Some companies used the extra cash for stock buybacks rather than expansion, limiting the overall job creation impact.

- Potential for future tax increases: The increased national debt resulting from the tax cuts necessitates difficult decisions regarding future fiscal policy. This could lead to future tax increases to address the mounting debt, potentially dampening economic growth. Understanding the fiscal policy implications of Trump's tax cuts is therefore crucial.

Keywords: Tax Cuts and Jobs Act, national debt, fiscal policy, economic stimulus, income inequality

Trade Wars and Global Uncertainty

Trump's protectionist trade policies, characterized by the imposition of tariffs and initiation of trade disputes with numerous countries, significantly impacted the global economic landscape. These "trade wars" created considerable uncertainty for businesses and investors, affecting supply chains and international relations.

- Impact on specific industries: Industries like agriculture and manufacturing were particularly vulnerable to retaliatory tariffs imposed by other nations. This led to reduced exports, job losses in certain sectors, and increased prices for consumers.

- Uncertainty for businesses and investors: The unpredictability of Trump's trade policies created a climate of uncertainty that discouraged investment and hindered long-term planning by businesses. This volatility impacted economic growth and market confidence.

- Geopolitical consequences: Trump's trade policies strained relationships with key allies, undermining international cooperation and the stability of global trade agreements. The role of the WTO and existing international trade mechanisms was significantly challenged.

- Inflationary Pressures: Tariffs directly increase the price of imported goods, contributing to inflationary pressures within the US economy. This adds to the complexity of the economic challenges facing the incoming Fed Chair.

Keywords: Trade wars, tariffs, protectionism, global trade, inflation, supply chain, WTO

Regulatory Rollbacks and Their Economic Effects

The Trump administration pursued a significant deregulation agenda across various sectors, aiming to reduce the burden on businesses and stimulate economic growth. However, this approach also carries inherent risks, potentially compromising environmental protection and financial stability.

- Impact on specific sectors: Deregulation efforts affected sectors such as finance, energy, and environmental protection. The loosening of financial regulations, for example, raised concerns about potential increased market volatility and systemic risk.

- Potential for increased market volatility: Reduced regulatory oversight can increase market volatility, making the economy more susceptible to shocks and crises. This necessitates careful monitoring and potential intervention by the Federal Reserve.

- Long-term consequences for economic stability: The long-term effects of deregulation remain uncertain, with potential risks to economic stability outweighing the short-term benefits in some cases. Careful evaluation of these consequences is essential.

- Regulatory capture concerns: A key risk associated with deregulation is the potential for regulatory capture, where agencies become unduly influenced by the industries they are supposed to regulate.

Keywords: Deregulation, financial regulation, environmental regulation, market volatility, economic stability, regulatory capture

The Challenge of Inflation Control

The incoming Fed Chair faces the difficult task of managing inflation in the context of Trump's policies. The combination of increased national debt, potential for higher inflation due to trade wars and deregulation, creates the potential for stagflation - a period of slow economic growth combined with high inflation. This necessitates a delicate balancing act between stimulating economic activity and curbing inflation.

Managing Expectations and Maintaining Independence

Maintaining the Federal Reserve's independence from political pressure is crucial for its effectiveness. The incoming chair must navigate the complexities of communicating transparently with the public and markets while avoiding the appearance of political influence.

- The risk of political interference: The Fed's independence is vital for maintaining confidence in its ability to make objective decisions based on economic data, rather than political considerations.

- Importance of transparent monetary policy: Clear communication of the Fed's policy objectives and strategies is essential to managing market expectations and maintaining stability.

- Maintaining credibility and market confidence: The Fed's credibility hinges on its ability to demonstrate its commitment to price stability and full employment, independent of political pressures.

Keywords: Federal Reserve independence, monetary policy, inflation targeting, market confidence, transparency

Conclusion

The incoming Fed Chair inherits an extraordinarily complex economic landscape profoundly shaped by Trump's economic policies. The interconnectedness of the issues—tax cuts, trade wars, deregulation, and inflation—demands skillful navigation and careful consideration of potential long-term consequences. The unprecedented nature of the challenge requires not only expertise in monetary policy but also a keen understanding of the political and geopolitical context. Understanding the lasting impact of Trump's economic policies is crucial for anyone interested in the future of the US economy. Further research into the nuances of Trump's economic policies and their consequences is essential for informed discussion and policymaking.

Featured Posts

-

Experience A Dutch Street Party At Millcreek Commons King Day Festivities

Apr 26, 2025

Experience A Dutch Street Party At Millcreek Commons King Day Festivities

Apr 26, 2025 -

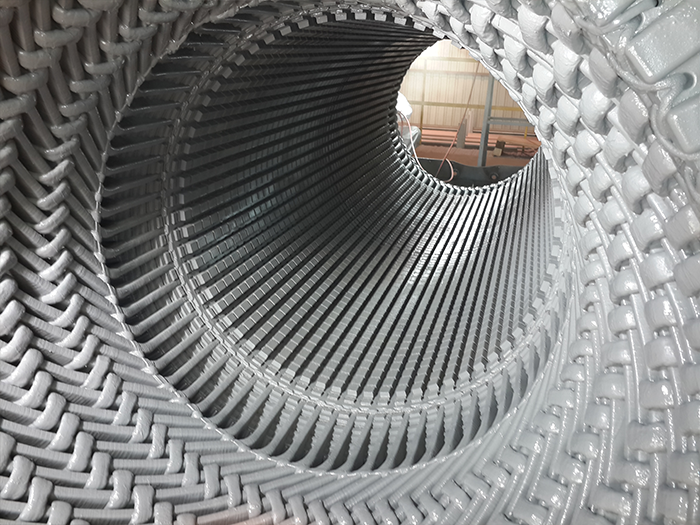

Situatia Critica De La Santierul Naval Mangalia Interventie Solicitata De Sindicat

Apr 26, 2025

Situatia Critica De La Santierul Naval Mangalia Interventie Solicitata De Sindicat

Apr 26, 2025 -

Analyzing The Disinflationary Effects Of Trump Tariffs An Ecb Viewpoint Holzmann

Apr 26, 2025

Analyzing The Disinflationary Effects Of Trump Tariffs An Ecb Viewpoint Holzmann

Apr 26, 2025 -

Shedeur Sanders Nfl Draft Stock An Espn Analysts Expanded Analysis

Apr 26, 2025

Shedeur Sanders Nfl Draft Stock An Espn Analysts Expanded Analysis

Apr 26, 2025 -

Turkey To Get New Tug Damen And Icdas Collaboration

Apr 26, 2025

Turkey To Get New Tug Damen And Icdas Collaboration

Apr 26, 2025