Trump's Shift In Tone Triggers Gold Price Increase

Table of Contents

Safe Haven Demand: Why Investors Turn to Gold During Uncertainty

Gold has long been considered a safe haven asset, meaning its value tends to increase during times of economic or political instability. When uncertainty rises, investors often seek refuge in assets perceived as less risky. This "flight to safety" phenomenon drives up demand for gold. Several factors contribute to this:

- Increased geopolitical risk perception: Unpredictable political events, such as unexpected policy shifts or escalating international tensions, heighten risk aversion among investors.

- Market volatility and uncertainty: Trump's pronouncements, known for their unpredictability, create market volatility, leading investors to seek the stability of gold.

- Decline in investor confidence in other asset classes: When stock markets or bond yields become volatile, investors often diversify their portfolios by shifting towards gold as a more stable investment.

- Inflationary pressures: Gold is often seen as a hedge against inflation. Concerns about rising inflation can boost gold demand.

Trump's often unpredictable statements and policy pronouncements contribute significantly to this uncertainty. His communication style, characterized by abrupt changes in tone and sometimes controversial remarks, can trigger immediate market reactions, fueling a demand for safe haven assets like gold. Historical data demonstrates a clear correlation between periods of significant political upheaval and increased gold prices. For example, during the 2008 financial crisis, gold prices soared as investors sought safety.

Analyzing Trump's Rhetorical Shifts and Their Market Impact

To understand the recent gold price increase, it's crucial to analyze specific instances of Trump's communication that influenced market sentiment. His shifts in tone, often conveyed through tweets, speeches, or interviews, have directly impacted investor confidence and, consequently, gold prices.

- Specific examples: For instance, [insert specific date and example of a tweet or statement that caused market fluctuation]. This statement [explain the impact and market reaction]. Similarly, [insert another specific date and example]. This resulted in [explain the resulting market movement].

- Media influence: The media's interpretation and amplification of Trump's statements further impact investor sentiment. Negative media coverage, particularly concerning geopolitical risks, often exacerbates the "flight to safety" effect.

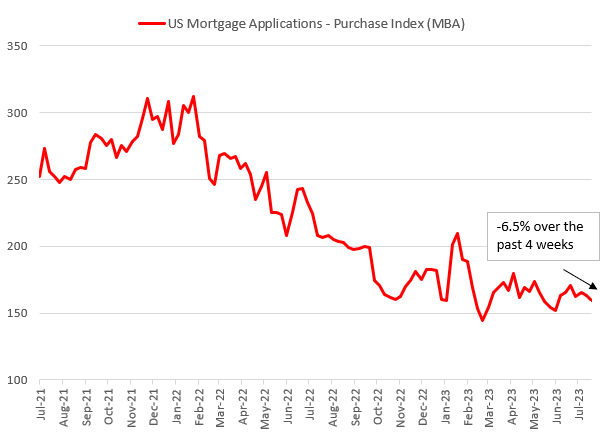

The psychology behind investor behavior is crucial here. Investors react not just to the factual content of Trump's communications but also to the perceived implications and potential consequences. Ambiguity or uncertainty in his messaging fuels speculation and volatility, driving investors towards the perceived safety of gold. [Include a chart or graph illustrating gold price movements correlated to specific Trump statements/tweets].

The Role of the US Dollar in Gold Price Fluctuations

The price of gold and the US dollar have an inverse relationship. A weakening US dollar generally strengthens the price of gold, and vice-versa.

- Weakening dollar: When the US dollar weakens, gold becomes more affordable for holders of other currencies, increasing demand and driving up its price.

- Trump's policies: Trump's economic policies and statements can directly affect the dollar's strength. For example, [insert example of a policy or statement that impacted the dollar and consequently gold].

- Past instances: History shows numerous instances where this correlation is evident. [Insert an example of a past event].

Trump's actions, whether they are policy decisions or public statements, can create uncertainty about the US dollar's future value. This uncertainty, in turn, can lead investors to seek the safe haven of gold, further driving up its price. [Include a chart showing the inverse relationship between USD and gold price over a relevant period, highlighting periods of Trump's pronouncements].

Other Contributing Factors to Gold Price Increases

While Trump's rhetoric plays a significant role, it's important to acknowledge other factors that can influence gold prices, such as:

- Global economic growth

- Interest rates

- Central bank policies

However, in the specific instances discussed above, the volatility introduced by Trump's communication style appears to be the dominant factor driving the increase in gold prices above and beyond these other economic influences. Current events like [mention any relevant current events] also play a minor supporting role, but the impact of Trump's changing rhetoric remains paramount.

Conclusion: Understanding the Impact of Trump's Rhetoric on Gold Investments

In conclusion, the recent surge in gold prices is largely attributable to Trump's shifting communication style and the resulting uncertainty it created in the markets. This underscores the critical role of political rhetoric in influencing investor sentiment and shaping the price of safe haven assets like gold. The unpredictable nature of his pronouncements fuels a "flight to safety," driving investors towards gold as a perceived stable investment during periods of political uncertainty.

To effectively manage your investment portfolio, it's crucial to stay informed about political developments and their potential impact on gold prices. Further research into "Trump's impact on gold prices" or "investing in gold during political uncertainty" can provide valuable insights. [Include a link to a reliable gold price tracking site or investment advice resource]. Understanding how Trump's shifts in tone trigger gold price increases is key to making informed investment decisions.

Featured Posts

-

Rays Plan In Dope Thief Episode 4 Deciphering The Ending After Michelles Warning

Apr 25, 2025

Rays Plan In Dope Thief Episode 4 Deciphering The Ending After Michelles Warning

Apr 25, 2025 -

Viyna V Ukrayini Yak Zminilasya Pozitsiya Trampa

Apr 25, 2025

Viyna V Ukrayini Yak Zminilasya Pozitsiya Trampa

Apr 25, 2025 -

Israel Eurovision Boycott Directors Dismissal

Apr 25, 2025

Israel Eurovision Boycott Directors Dismissal

Apr 25, 2025 -

The Trump Administrations Visa Crackdown And Its Impact On Student Op Eds

Apr 25, 2025

The Trump Administrations Visa Crackdown And Its Impact On Student Op Eds

Apr 25, 2025 -

John Spytek Of The Raiders At Boise State Pro Day Scouting Ashton Jeanty

Apr 25, 2025

John Spytek Of The Raiders At Boise State Pro Day Scouting Ashton Jeanty

Apr 25, 2025

Latest Posts

-

The Ethics Of Betting On The Los Angeles Wildfires And Similar Events

Apr 26, 2025

The Ethics Of Betting On The Los Angeles Wildfires And Similar Events

Apr 26, 2025 -

Are We Normalizing Disaster Betting The Los Angeles Wildfires Example

Apr 26, 2025

Are We Normalizing Disaster Betting The Los Angeles Wildfires Example

Apr 26, 2025 -

The China Factor Analyzing The Difficulties Faced By Premium Car Brands

Apr 26, 2025

The China Factor Analyzing The Difficulties Faced By Premium Car Brands

Apr 26, 2025 -

Gambling On Catastrophe The Los Angeles Wildfires And The Future Of Disaster Betting

Apr 26, 2025

Gambling On Catastrophe The Los Angeles Wildfires And The Future Of Disaster Betting

Apr 26, 2025 -

Navigating The Chinese Market The Struggles Of Bmw Porsche And Other Auto Brands

Apr 26, 2025

Navigating The Chinese Market The Struggles Of Bmw Porsche And Other Auto Brands

Apr 26, 2025