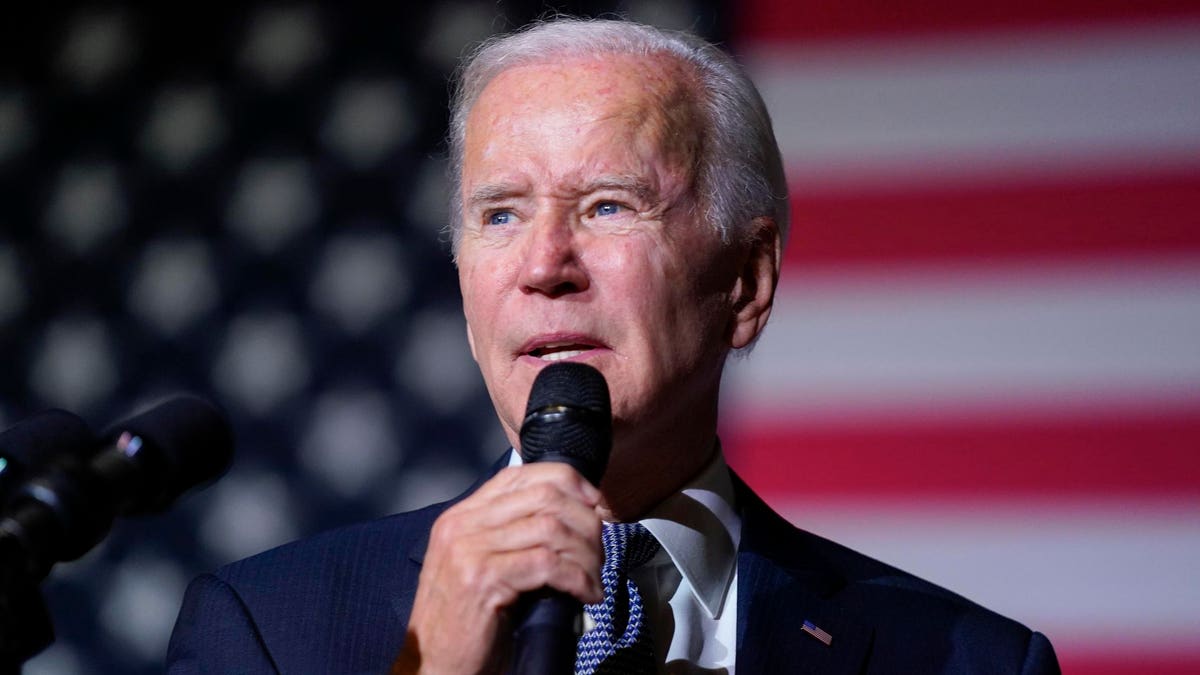

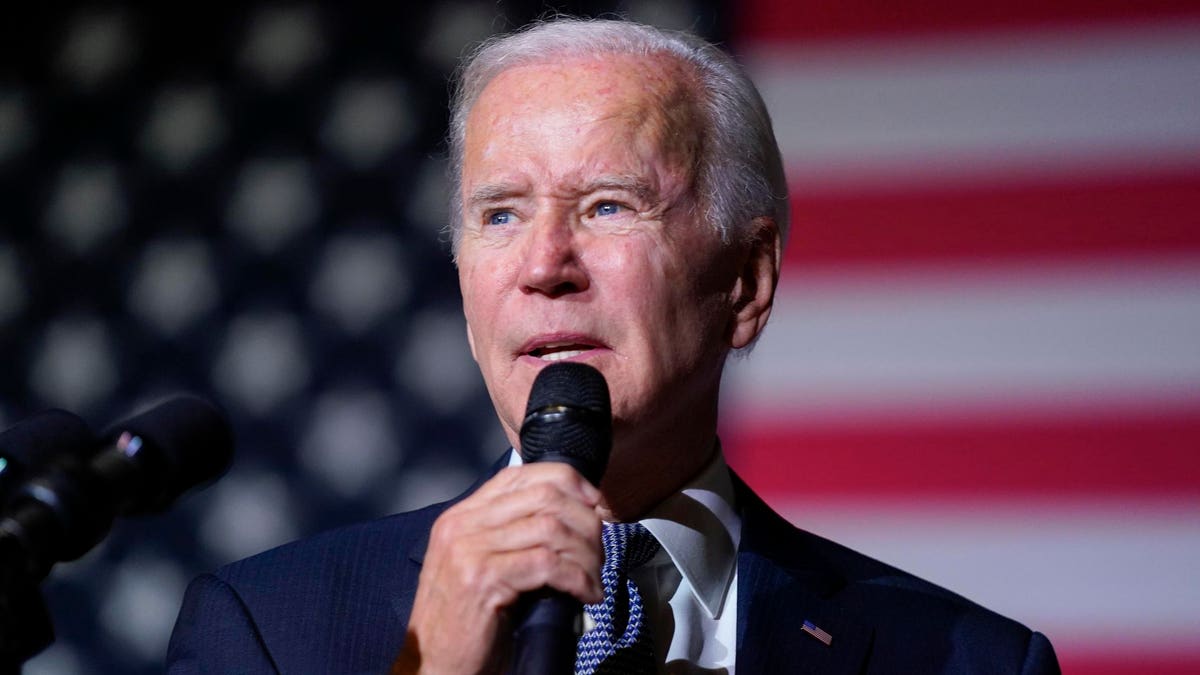

Trump's Student Loan Privatization Plan: What It Means For Borrowers

Table of Contents

Key Proposals within Trump's Student Loan Plan

Trump's proposed student loan privatization plan centered on shifting away from the current federal system toward a more market-based approach. This involved a significant reduction in the federal government's role in student loan disbursement and a greater reliance on private lenders. The core tenets of this plan included introducing "market-based solutions" and encouraging "increased competition" among private lenders to potentially offer more favorable terms to borrowers. However, the details remained somewhat vague, leaving much open to interpretation.

- Shifting Responsibility: The plan proposed shifting the responsibility of disbursing student loans from the federal government to private lenders. This meant a significant change in the way students access funding for higher education.

- Interest Rates and Repayment Terms: The potential impact on interest rates and repayment terms was a major point of concern. Private lenders are profit-driven, and there were worries that this could translate to less favorable terms for borrowers.

- Income-Driven Repayment and Forgiveness: The plan's impact on existing income-driven repayment (IDR) plans and loan forgiveness programs was unclear. Many feared these crucial safety nets for struggling borrowers might be significantly altered or eliminated.

- Private Sector Innovation: Proponents argued that private sector involvement would bring innovation and efficiency to student loan management, leading to better technologies and streamlined processes for borrowers.

Potential Benefits of Privatizing Student Loans

Advocates of Trump's student loan privatization plan argued that it could lead to several benefits, primarily centered on efficiency, innovation, and cost reduction. The core idea was that competition among private lenders would drive down costs and improve borrower experiences.

- Increased Competition: The introduction of multiple private lenders was expected to foster competition, potentially resulting in lower interest rates and more flexible repayment options for borrowers.

- Technological Innovation: Private companies were expected to bring innovative technologies and improved services to the student loan process, making it easier and more efficient for borrowers to manage their debt.

- Repayment Flexibility: The hope was that privatization would lead to greater flexibility in repayment plans, offering borrowers more tailored solutions to suit their individual financial circumstances.

- Reduced Government Spending: Some argued that reducing the government's role in student loan management would decrease federal spending, freeing up resources for other priorities.

Potential Drawbacks and Risks of Privatization

Despite the potential benefits, significant drawbacks and risks were associated with Trump's student loan privatization plan. The most pressing concerns revolved around increased costs for borrowers, predatory lending practices, and reduced access to education for vulnerable populations.

- Higher Interest Rates: A major concern was that private lenders, driven by profit, might charge higher interest rates compared to the federally subsidized rates currently available.

- Predatory Lending: There was significant apprehension about the potential for predatory lending practices, particularly targeting vulnerable borrowers who may lack the financial literacy to navigate complex loan agreements.

- Reduced Access: Many feared that a privatized system would reduce access to student loans for low-income students and those from underrepresented groups, exacerbating existing inequalities in higher education.

- Lack of Borrower Protections: The absence of strong government oversight and borrower protections in a privatized system raised concerns about potential exploitation and unfair practices.

Comparison to Existing Federal Student Loan Programs

Comparing Trump's proposed privatized system to the existing federal student loan system reveals significant differences in accessibility, affordability, and borrower protections.

- Loan Forgiveness: Federal student loan forgiveness programs, like Public Service Loan Forgiveness (PSLF), were a significant point of difference. The privatization plan lacked clarity regarding the future of these programs.

- Interest Rates and Repayment Options: Federal loans generally offered lower interest rates and a wider range of repayment options compared to what private lenders might offer.

- Government Oversight: The federal government provides significant oversight and borrower protections under the current system, something largely absent in a privatized model.

The Impact on Specific Borrower Groups

The impact of Trump's student loan privatization plan would vary across different borrower groups. Graduate students, often burdened with larger loan amounts, could face significantly higher interest rates and repayment burdens under a privatized system. Similarly, low-income students could experience reduced access to loans altogether, further hindering their ability to pursue higher education.

Conclusion

Trump's student loan privatization plan presented a complex and controversial approach to student loan debt. While proponents argued it would increase efficiency and lower costs through market competition, opponents raised valid concerns about increased interest rates, predatory lending, and reduced access to education for vulnerable populations. The plan's potential impact on income-driven repayment plans and loan forgiveness programs also raised significant questions about borrower protections. Understanding the intricacies of Trump's student loan privatization plan is crucial for all borrowers. Stay informed about the ongoing developments and advocate for policies that protect your interests and ensure access to affordable higher education. Further research on Trump's student loan privatization plan is essential to make informed decisions about your educational financing.

Featured Posts

-

Analyzing Trumps Presidency The Significance Of His May 15 2025 Middle East Trip

May 17, 2025

Analyzing Trumps Presidency The Significance Of His May 15 2025 Middle East Trip

May 17, 2025 -

Ftc To Appeal Activision Blizzard Acquisition A Deep Dive

May 17, 2025

Ftc To Appeal Activision Blizzard Acquisition A Deep Dive

May 17, 2025 -

Heavy Rare Earths Production Lynas Global Leadership

May 17, 2025

Heavy Rare Earths Production Lynas Global Leadership

May 17, 2025 -

The Eminem Factor Assessing The Likelihood Of A Wnba Return To Detroit

May 17, 2025

The Eminem Factor Assessing The Likelihood Of A Wnba Return To Detroit

May 17, 2025 -

Anunoby Anota 27 En La Victoria De Knicks 105 91 Sobre Sixers

May 17, 2025

Anunoby Anota 27 En La Victoria De Knicks 105 91 Sobre Sixers

May 17, 2025

Latest Posts

-

Ultraviolette Tesseract Electric Scooter Launched At R1 2 Lakh 261km Range 20 1 Bhp

May 17, 2025

Ultraviolette Tesseract Electric Scooter Launched At R1 2 Lakh 261km Range 20 1 Bhp

May 17, 2025 -

A Detroit Wnba Revival Is Eminem The Answer

May 17, 2025

A Detroit Wnba Revival Is Eminem The Answer

May 17, 2025 -

Analyzing Eminems Potential Impact On A Detroit Wnba Franchise

May 17, 2025

Analyzing Eminems Potential Impact On A Detroit Wnba Franchise

May 17, 2025 -

The Eminem Factor Assessing The Likelihood Of A Wnba Return To Detroit

May 17, 2025

The Eminem Factor Assessing The Likelihood Of A Wnba Return To Detroit

May 17, 2025 -

Eminem Key To Reviving Detroits Wnba Franchise

May 17, 2025

Eminem Key To Reviving Detroits Wnba Franchise

May 17, 2025