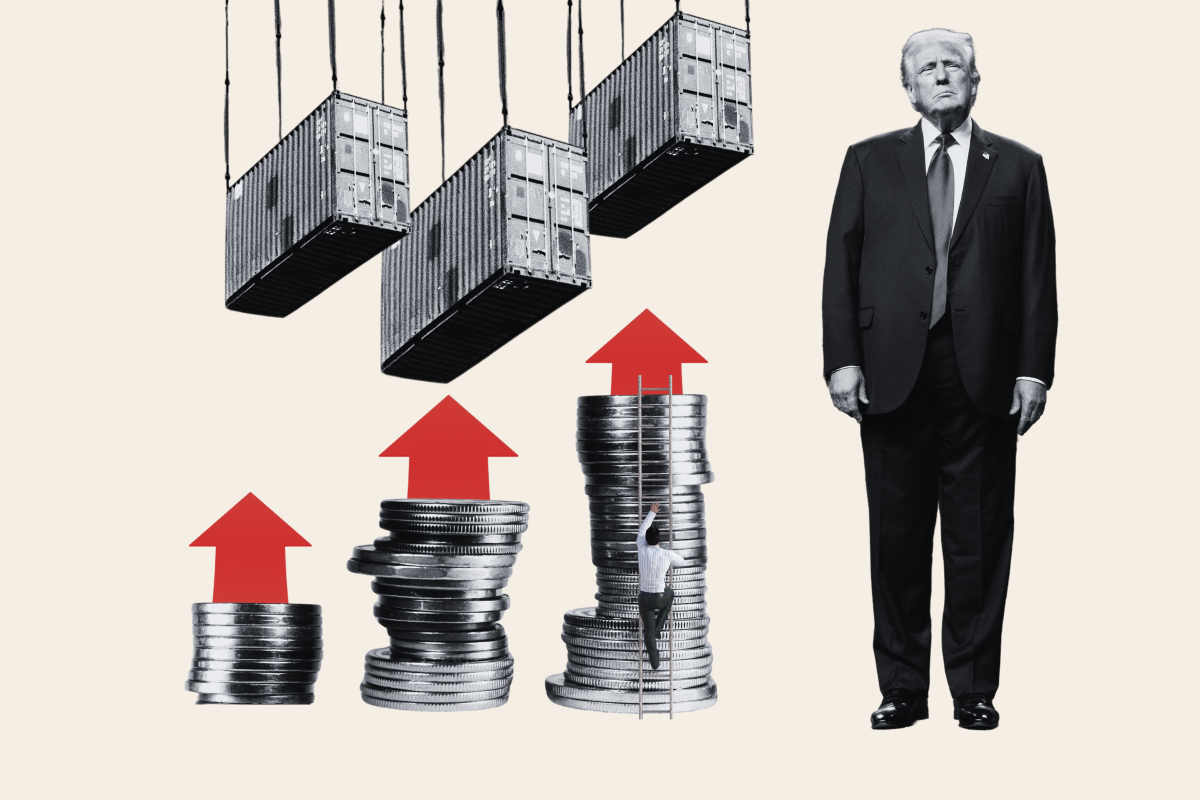

Trump's Tariff Announcement: A 10% Baseline Unless...

Table of Contents

The 10% Tariff Baseline: What it Means for Businesses

The 10% tariff, announced as a starting point, represents a significant increase in import costs for numerous businesses. This isn't just a minor adjustment; it has the potential to dramatically reshape the business landscape. The impact of a 10% tariff on import costs can be substantial, depending on the industry and reliance on imported goods.

- Increased costs for imported goods: Businesses relying on imported raw materials, components, or finished products will face a direct increase in their input costs. This translates to higher production costs and potentially reduced profit margins.

- Potential price increases for consumers: To maintain profitability, businesses may pass these increased costs onto consumers, resulting in higher prices for goods and services. This can lead to decreased consumer spending and potentially slower economic growth.

- Supply chain disruptions and delays: The imposition of tariffs can disrupt established supply chains, leading to delays in receiving goods and increased logistical complexities. This can significantly impact production schedules and potentially harm businesses' ability to meet customer demands.

- Reduced competitiveness for US businesses reliant on imports: Businesses using imported components in their production may find themselves at a competitive disadvantage against businesses that source materials domestically. This may lead to decreased market share and potential job losses.

- Potential for job losses in import-dependent industries: Industries heavily reliant on imported goods may be forced to reduce production or even lay off workers due to increased costs and reduced competitiveness. This could have a significant impact on employment rates in affected sectors.

The "Unless..." Clause: Conditions that Could Alter the Tariff Rate

The announcement of a 10% baseline tariff wasn't presented as a fixed figure. The "unless..." clause highlights the inherent uncertainty and the potential for significant shifts in the tariff rate. Several factors could influence the final tariff applied:

- Successful trade negotiations with specific countries leading to lower tariffs: The administration may negotiate bilateral agreements with certain countries, potentially resulting in lower tariffs or even tariff exemptions for specific goods. The success of these negotiations will largely dictate the final tariff rates.

- Geopolitical events impacting tariff decisions: Unforeseen geopolitical events – from international conflicts to shifts in global alliances – could influence the administration's approach to trade policy and, consequently, the applied tariff rates.

- Retaliatory tariffs imposed by other countries: Other countries might retaliate against US tariffs by imposing their own tariffs on American exports, escalating the trade conflict and further impacting businesses on both sides.

- Exemptions granted to specific industries or products: Certain industries or specific products might be granted exemptions from the tariffs based on lobbying efforts, national security concerns, or other considerations. These exemptions can significantly impact specific sectors.

- The role of lobbying and political pressure: Intense lobbying efforts from various industries and interest groups can significantly influence the final tariff decisions, potentially leading to changes in the baseline rate or exemptions for specific products.

Economic Consequences and Predictions: Winners and Losers

The economic consequences of these tariffs are complex and far-reaching. The impact on inflation, GDP growth, and the job market will vary across different sectors.

- Potential for increased inflation: The higher import costs associated with the tariffs will likely translate to higher consumer prices for a range of goods and services, potentially contributing to increased inflation.

- Impact on consumer spending: Higher prices could lead to reduced consumer spending, impacting economic growth and possibly leading to a slowdown in economic activity.

- Effects on GDP growth: The combined impact of increased prices, reduced consumer spending, and potential supply chain disruptions could significantly affect GDP growth, potentially leading to a slower-than-expected economic expansion.

- Winners and losers among different industries: Some industries, particularly those producing goods that compete with imports, may benefit from increased protection. However, other industries heavily reliant on imports may face significant hardship. The net impact will depend on the specific industry and its reliance on global trade.

- Changes in the US trade deficit: The tariffs are intended to reduce the US trade deficit, but the outcome is uncertain. Retaliatory tariffs and decreased consumer spending could offset any potential positive effects on the trade balance.

Long-Term Implications for the Global Economy

Trump's tariff announcement has significant implications for the global economy, extending beyond the immediate effects on US businesses. The potential for a protracted trade war, characterized by retaliatory tariffs and escalating tensions, poses a substantial threat to global economic stability. Increased protectionism could lead to a fragmentation of global supply chains and hinder international cooperation on key economic issues. The resulting economic uncertainty could negatively impact investment, trade, and overall global growth.

Conclusion

Trump's tariff announcement, with its 10% baseline tariff, introduces considerable uncertainty into the global trade landscape. The final tariff rates will depend on a complex interplay of trade negotiations, geopolitical factors, and political pressure. Understanding the potential consequences—from increased inflation to supply chain disruptions—is crucial for businesses and consumers alike. Staying updated on future changes to Trump's tariffs and their potential impact on specific industries is critical for strategic planning and risk mitigation. Monitor news sources and government announcements closely to stay informed about evolving trade policy and its impact on your business.

Featured Posts

-

Analyzing Apples Role In Googles Continued Market Share

May 11, 2025

Analyzing Apples Role In Googles Continued Market Share

May 11, 2025 -

Vpechatliva Kreatsi A Kim Kardashi An Vo Tselosno Nova Svetlina

May 11, 2025

Vpechatliva Kreatsi A Kim Kardashi An Vo Tselosno Nova Svetlina

May 11, 2025 -

The Conor Mc Gregor Fox News Connection News And Analysis

May 11, 2025

The Conor Mc Gregor Fox News Connection News And Analysis

May 11, 2025 -

Cleveland Cavaliers Vs New York Knicks Predictions Odds And Betting Picks February 21

May 11, 2025

Cleveland Cavaliers Vs New York Knicks Predictions Odds And Betting Picks February 21

May 11, 2025 -

Analyzing The Jessica Simpson And Jeremy Renner Relationship Rumors

May 11, 2025

Analyzing The Jessica Simpson And Jeremy Renner Relationship Rumors

May 11, 2025