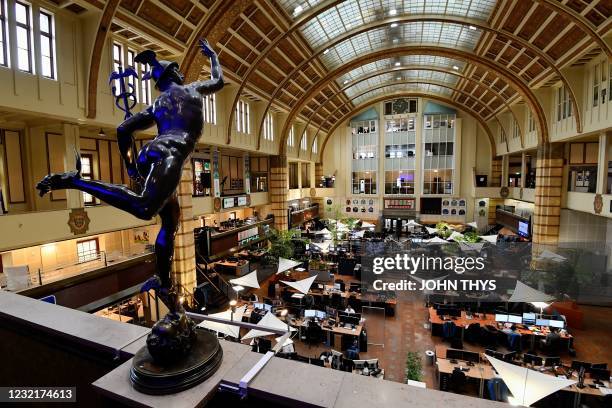

Trump's Tariff Relief: 8% Stock Market Surge On Euronext Amsterdam

Table of Contents

Understanding the Tariff Relief Announcement

The Trump administration's announcement of tariff relief involved a significant reduction and, in some cases, complete removal of tariffs on specific goods imported into the United States. While the exact details were complex, the key takeaway was a substantial easing of trade restrictions, particularly affecting sectors previously impacted by the trade war.

- Specific tariffs removed or reduced: The announcement specifically targeted tariffs on certain agricultural products (like soybeans and dairy), some manufactured goods, and certain technology components. Exact percentages varied depending on the product and its country of origin.

- Targeted industries impacted: The technology sector, agriculture, and manufacturing industries were among the primary beneficiaries of this relief. Companies involved in these sectors saw significant boosts to their bottom lines due to reduced import costs and increased competitiveness.

- Geographic regions affected: While the benefits were global to some extent, European nations, particularly those with strong trade ties to the US, saw the most immediate impact. This included a considerable positive impact on businesses operating within the Euronext Amsterdam exchange.

Euronext Amsterdam's Response: An 8% Surge Deconstructed

The Euronext Amsterdam exchange reacted dramatically to the news, experiencing an unprecedented 8% surge in its overall index. This rapid increase wasn't uniform across all sectors, with some experiencing more significant gains than others.

- Key performance indicators (KPIs) showing the market surge: The overall index increase of 8% was accompanied by substantial increases in trading volume, indicating a significant shift in investor behavior. Specific sector indices showed even larger percentage gains.

- Comparison to other European stock exchanges' responses: While other European markets experienced positive movement, Euronext Amsterdam's 8% surge was considerably larger than those seen in other exchanges such as the London Stock Exchange or the Frankfurt Stock Exchange. This suggests a stronger connection between the specific sectors listed on Euronext Amsterdam and the targeted tariff relief.

- Sector-specific analysis of gains: Sectors heavily reliant on US trade, particularly technology and agriculture-related companies, showed the largest gains. This indicates a direct correlation between the tariff relief and the market’s response.

Investor Sentiment and Market Confidence

The tariff relief announcement dramatically altered investor sentiment. The initial uncertainty and pessimism surrounding the trade war gave way to optimism and a renewed confidence in the market.

- Analysis of investor behavior before and after the announcement: Before the announcement, cautious investor behavior was evident, with reduced investment in high-risk sectors. After the announcement, a sharp increase in buying activity, particularly in sectors directly impacted by the tariff relief, was observed.

- Expert opinions and market commentary: Financial analysts widely interpreted the surge as a vote of confidence in the potential for de-escalation of trade tensions. Many predicted further positive market movement contingent upon the continued implementation of the tariff relief measures.

- Impact on future investment strategies: The event significantly influenced future investment strategies, with investors showing increased interest in sectors expected to benefit from continued trade liberalization.

Long-Term Implications and Potential Risks

While the 8% surge is impressive, the long-term implications of Trump's tariff relief on Euronext Amsterdam and the broader European economy remain uncertain.

- Sustainability of the market surge: The sustainability of this surge depends on several factors, including the continued implementation of the tariff relief measures and the overall global economic outlook. Any reversal of these policies could lead to market correction.

- Potential for future trade disputes: The risk of future trade disputes remains a significant concern. Any new trade friction could easily reverse the positive impact of the current relief.

- Geopolitical considerations influencing the market: Geopolitical events and broader international relations will continue to significantly impact market performance. Political stability and international cooperation are critical factors for sustained economic growth.

Comparing the Euronext Amsterdam Surge to Global Markets

While Euronext Amsterdam showed a dramatic response, other global markets also reacted positively to Trump's tariff relief, albeit less dramatically.

- Specific examples of other market responses: Wall Street experienced a modest increase, while Shanghai and other Asian markets showed mixed reactions, highlighting the varying degrees of exposure to US trade across different economies.

- Comparative analysis of market volatility: Euronext Amsterdam displayed higher volatility compared to some other major indices, showcasing its heightened sensitivity to US trade policy changes.

- Discussion of global economic interconnectedness: This event underscores the increasing interconnectedness of the global economy. Trade policy changes in one region have a ripple effect across the world, affecting various markets in different ways.

Conclusion

Trump's tariff relief announcement triggered a significant and unexpected 8% surge in the Euronext Amsterdam stock market. This surge reflects a powerful shift in investor sentiment and confidence, driven by the reduction of trade barriers. While promising, the long-term implications remain uncertain, contingent upon various factors, including the sustainability of the relief measures, potential future trade disputes, and broader geopolitical factors. The event highlights the profound impact of trade policy on market volatility and the interconnected nature of the global economy. To stay abreast of the evolving impact of Trump's tariff relief policies, continue monitoring market developments and consult reputable financial news sources. Remember to consult a financial advisor before making any investment decisions based on Trump's tariff relief news or any market fluctuations.

Featured Posts

-

8 Stock Market Surge On Euronext Amsterdam Trumps Tariff Impact

May 24, 2025

8 Stock Market Surge On Euronext Amsterdam Trumps Tariff Impact

May 24, 2025 -

Nyt Mini Crossword Answers For April 18 2025 Your Complete Guide

May 24, 2025

Nyt Mini Crossword Answers For April 18 2025 Your Complete Guide

May 24, 2025 -

Znaete Li Vy Vse Roli Olega Basilashvili

May 24, 2025

Znaete Li Vy Vse Roli Olega Basilashvili

May 24, 2025 -

Amundi Msci World Catholic Principles Ucits Etf Acc Net Asset Value Nav Explained

May 24, 2025

Amundi Msci World Catholic Principles Ucits Etf Acc Net Asset Value Nav Explained

May 24, 2025 -

Aubrey Wursts Stellar Performance Powers Maryland Softball Past Delaware 11 1

May 24, 2025

Aubrey Wursts Stellar Performance Powers Maryland Softball Past Delaware 11 1

May 24, 2025

Latest Posts

-

Voice Assistant Creation Revolutionized Open Ais 2024 Developer Showcase

May 24, 2025

Voice Assistant Creation Revolutionized Open Ais 2024 Developer Showcase

May 24, 2025 -

Open Ai Unveils New Tools For Voice Assistant Development At 2024 Event

May 24, 2025

Open Ai Unveils New Tools For Voice Assistant Development At 2024 Event

May 24, 2025 -

Three Years Of Breaches Cost T Mobile 16 Million In Fines

May 24, 2025

Three Years Of Breaches Cost T Mobile 16 Million In Fines

May 24, 2025 -

16 Million Penalty T Mobiles Extensive Data Breach Settlement

May 24, 2025

16 Million Penalty T Mobiles Extensive Data Breach Settlement

May 24, 2025 -

The State Of Museum Programs Post Trump Administration Cuts

May 24, 2025

The State Of Museum Programs Post Trump Administration Cuts

May 24, 2025