Trump's Tariff Relief Signals Boost European Stock Markets; LVMH Decline

Table of Contents

Trump's Tariff Relief Measures and their Impact

Trump's administration implemented several significant tariff relief measures, primarily focused on easing trade tensions with European nations. These changes involved the reduction or complete removal of tariffs on various goods imported from Europe. The rationale behind these actions was multifaceted, encompassing ongoing trade negotiations, political maneuvering, and a strategic attempt to stimulate economic growth.

- Specific tariff reductions: Notable reductions targeted automobiles, agricultural products, and certain luxury goods. The exact percentages varied depending on the specific product category.

- Impact on specific industries: The automobile sector witnessed a significant boost, while the luxury goods industry showed a mixed response, with some companies benefiting and others, like LVMH, experiencing setbacks.

- Timeline of tariff changes: The announcements were made in phases, with the initial wave of relief triggering immediate market reactions. Subsequent adjustments further influenced the overall impact.

European Stock Market Response to Tariff Relief

The news of Trump's tariff relief was met with a wave of optimism in European markets. Major stock market indices experienced significant gains, reflecting a surge in investor confidence.

- Percentage increase in major European stock market indices: The DAX (Germany) saw a [Insert Percentage]% increase, the CAC 40 (France) rose by [Insert Percentage]%, and the FTSE 100 (UK) gained [Insert Percentage]%. These figures represent a significant short-term boost.

- Analysis of investor sentiment and confidence: Investor sentiment shifted dramatically, with a noticeable increase in confidence driven by reduced uncertainty regarding future trade relations.

- Sectors that showed the most significant gains: The automotive and industrial sectors were among the biggest beneficiaries, directly correlating with the tariff relief measures.

LVMH's Contrasting Performance and Potential Reasons

Despite the overall positive trend in European stock markets, LVMH, the world's leading luxury goods conglomerate, registered an unexpected decline in its stock price.

- Percentage drop in LVMH's stock price: LVMH experienced a [Insert Percentage]% drop in its share price, a stark contrast to the broader market trend.

- Potential factors contributing to the decline: Several factors might have contributed to this decline, including specific company performance, market speculation related to future growth, and potential concerns about the overall luxury goods market's vulnerability to economic shifts. A direct impact from Trump's tariff relief seems less likely given the broader context.

- Comparison of LVMH's performance to other luxury goods companies: A comparative analysis against other luxury goods companies could reveal whether this was an industry-specific issue or a factor unique to LVMH.

Expert Analysis and Future Outlook

Financial analysts and economists offer diverse perspectives on the long-term effects of Trump's tariff relief.

- Quotes from experts on the short-term and long-term impacts: [Insert quotes from experts emphasizing both the positive short-term gains and the potential for long-term uncertainty].

- Predictions for future stock market performance: Forecasts vary, with some analysts predicting sustained growth while others caution about potential future volatility.

- Analysis of potential risks and uncertainties: Concerns remain about the potential for unforeseen economic shifts and the possibility of future trade disputes impacting the positive effects of Trump's tariff relief.

Conclusion

Trump's Tariff Relief has undeniably had a significant impact on global markets, with European stock markets enjoying a short-term boost. However, the contrasting performance of LVMH underscores the complexities of predicting market behavior. While the initial response to the tariff reductions was largely positive, experts caution against overconfidence, highlighting the need for a nuanced understanding of the ongoing dynamics of international trade and their impact on individual companies and broader market trends. Stay informed about the ongoing effects of Trump's tariff relief and its impact on global financial markets. Subscribe to our newsletter for the latest updates!

Featured Posts

-

Investing In The Amundi Dow Jones Industrial Average Ucits Etf A Nav Perspective

May 25, 2025

Investing In The Amundi Dow Jones Industrial Average Ucits Etf A Nav Perspective

May 25, 2025 -

Intimacy Growth And The Making Of Her In Deep An Interview With Matt Maltese

May 25, 2025

Intimacy Growth And The Making Of Her In Deep An Interview With Matt Maltese

May 25, 2025 -

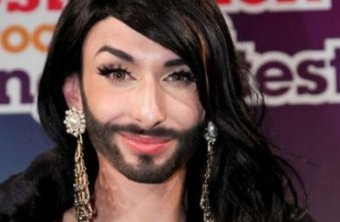

Evroviziya Kde E Sega Konchita Vurst I Kak Izglezhda

May 25, 2025

Evroviziya Kde E Sega Konchita Vurst I Kak Izglezhda

May 25, 2025 -

Euro Boven 1 08 Analyse Van De Stijgende Kapitaalmarktrentes

May 25, 2025

Euro Boven 1 08 Analyse Van De Stijgende Kapitaalmarktrentes

May 25, 2025 -

Former French Premier Challenges Macrons Governing Decisions

May 25, 2025

Former French Premier Challenges Macrons Governing Decisions

May 25, 2025

Latest Posts

-

Analysis Of Sean Penns Stance On Dylan Farrows Accusations Against Woody Allen

May 25, 2025

Analysis Of Sean Penns Stance On Dylan Farrows Accusations Against Woody Allen

May 25, 2025 -

The Sean Penn Woody Allen Dylan Farrow Controversy A Deeper Look

May 25, 2025

The Sean Penn Woody Allen Dylan Farrow Controversy A Deeper Look

May 25, 2025 -

Woody Allen Sexual Assault Allegations Sean Penns Doubts

May 25, 2025

Woody Allen Sexual Assault Allegations Sean Penns Doubts

May 25, 2025 -

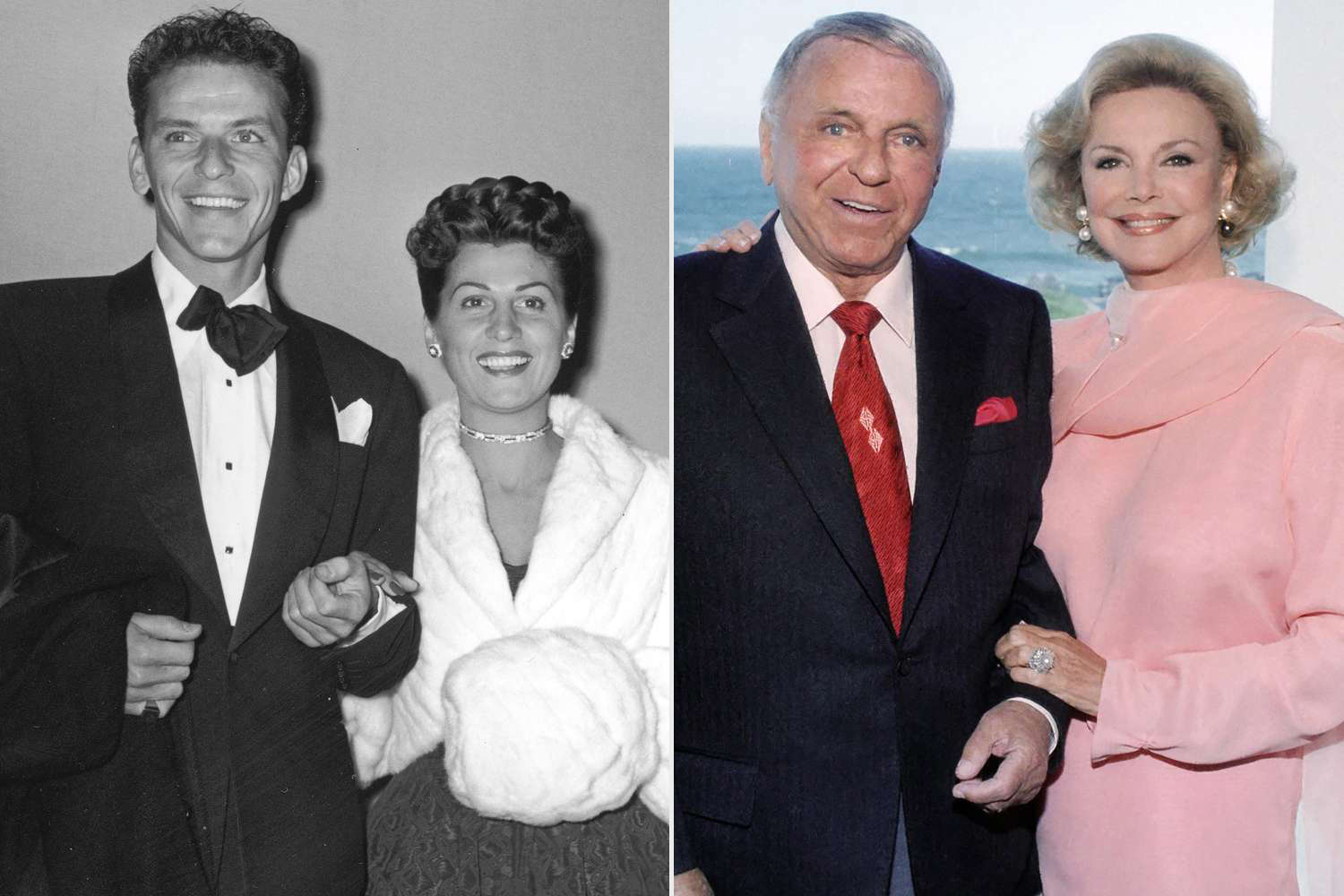

Understanding Frank Sinatras Four Marriages Wives Love And Legacy

May 25, 2025

Understanding Frank Sinatras Four Marriages Wives Love And Legacy

May 25, 2025 -

Sean Penns Response To Dylan Farrows Sexual Assault Claims Against Woody Allen

May 25, 2025

Sean Penns Response To Dylan Farrows Sexual Assault Claims Against Woody Allen

May 25, 2025