Trump's Trade Threats Send Gold Prices Climbing

Table of Contents

Safe Haven Demand Fuels Gold's Ascent

Gold has long been recognized as a safe haven asset, a go-to investment during times of economic and geopolitical uncertainty. When investors feel anxious about the future, they often flock to gold, viewing it as a stable store of value that can withstand market volatility. Trump's trade threats have injected a significant dose of uncertainty into the global economy, triggering this very response. His unpredictable trade policies – characterized by tariffs, trade wars, and shifting alliances – have created a climate of fear and apprehension.

- Increased market volatility: The unpredictable nature of Trump's trade actions leads to increased market volatility, causing investors to seek shelter in less volatile assets like gold.

- Gold's historical performance: Throughout history, gold has demonstrated its resilience during periods of geopolitical instability and economic downturn, consistently holding or increasing its value.

- Examples of previous instances: Past trade wars, such as the Smoot-Hawley Tariff Act of 1930, have historically led to a surge in gold prices, providing a historical precedent for the current situation. The increased uncertainty mirrors the anxieties seen in prior periods of protectionist trade policy.

The Impact of the US Dollar on Gold Prices

The US dollar and gold prices share an inverse relationship: when the dollar weakens, gold prices typically rise, and vice versa. Trump's trade policies have the potential to weaken the dollar. The imposition of tariffs can negatively impact the US economy, potentially leading to slower growth and reduced investor confidence in the US currency.

- Trade wars and the US economy: Trade wars often result in higher prices for consumers, reduced economic growth, and potential job losses, all of which contribute to a weaker dollar.

- Increased gold demand: A weaker dollar makes gold more affordable for investors holding other currencies, thereby boosting demand and driving up the price.

- Currency fluctuations and gold pricing: The direct relationship between currency fluctuations and gold pricing makes gold a compelling investment option during periods of trade uncertainty and currency volatility created by Trump's trade threats.

Investor Sentiment and Speculative Trading

Investor sentiment plays a crucial role in gold price fluctuations. Fear and uncertainty, amplified by media coverage of escalating trade tensions, significantly impact investor decisions. Speculative trading further exacerbates these effects. As fear increases, so does the demand for safe-haven assets, and large investors like hedge funds often increase their gold holdings.

- Media influence on investor anxiety: Constant news coverage of trade disputes creates a climate of anxiety, pushing investors towards safe havens like gold.

- Hedge fund activity: Large institutional investors, anticipating further market volatility from Trump's trade threats, often increase their gold holdings, pushing prices upwards.

- Futures and options markets: The futures and options markets related to gold provide further avenues for speculation, amplifying price movements based on perceived risks related to Trump’s trade threats.

Alternative Investments and Their Performance

Compared to traditional assets like stocks and bonds, gold often performs differently during periods of trade uncertainty. While stocks and bonds can experience significant drops during such times, gold tends to hold its value or even increase.

- Historical performance comparison: Analyzing past trade disputes reveals that gold has often outperformed stocks and bonds during periods of high uncertainty.

- Portfolio diversification: Including gold in a diversified investment portfolio can help mitigate risk and improve overall performance during periods of economic and geopolitical stress driven by Trump's trade threats.

- Outperformance during trade wars: Gold's inherent characteristics—its scarcity, its role as a store of value, and its lack of correlation to other asset classes—contribute to its outperformance in times of trade war.

Conclusion: Navigating the Market with Trump's Trade Threats

Trump's trade threats have undeniably contributed to the recent surge in gold prices. The uncertainty generated by these policies has fueled safe haven demand, weakened the US dollar, and amplified investor anxiety. Gold's resilience and its historical performance during times of economic turmoil make it a compelling investment option for those seeking to navigate the complexities of this volatile market. To effectively mitigate risks associated with Trump's trade threats and ongoing market volatility, consider diversifying your portfolio with gold investments. For more in-depth information on gold investment strategies, explore additional resources or consult a qualified financial advisor. Understanding the impact of Trump's trade threats on the market is crucial for making informed investment decisions.

Featured Posts

-

Zheng Qinwens Breakthrough Italian Open Semifinal Spot After Sabalenka Win

May 25, 2025

Zheng Qinwens Breakthrough Italian Open Semifinal Spot After Sabalenka Win

May 25, 2025 -

How Demna Gvasalia Will Transform Gucci

May 25, 2025

How Demna Gvasalia Will Transform Gucci

May 25, 2025 -

Uefa Nin Real Madrid Sorusturmasi Doert Yildizin Gelecegi Tehlikede

May 25, 2025

Uefa Nin Real Madrid Sorusturmasi Doert Yildizin Gelecegi Tehlikede

May 25, 2025 -

Frankfurt Stock Exchange Dax Climbs Nears Record High At Opening

May 25, 2025

Frankfurt Stock Exchange Dax Climbs Nears Record High At Opening

May 25, 2025 -

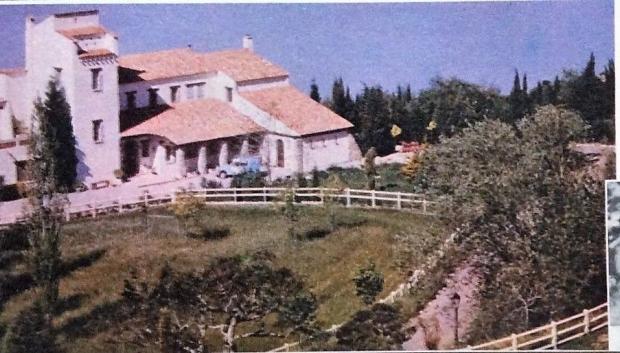

Roc Agel La Finca De La Familia Grimaldi En Monaco

May 25, 2025

Roc Agel La Finca De La Familia Grimaldi En Monaco

May 25, 2025

Latest Posts

-

Inspiracion Otonal Charlene De Monaco Y El Arte De Vestir Lino

May 25, 2025

Inspiracion Otonal Charlene De Monaco Y El Arte De Vestir Lino

May 25, 2025 -

Los Mejores Looks Del Baile De La Rosa 2025 Carolina De Monaco Y Alexandra De Hannover

May 25, 2025

Los Mejores Looks Del Baile De La Rosa 2025 Carolina De Monaco Y Alexandra De Hannover

May 25, 2025 -

Descubriendo Roc Agel La Historia Detras De La Finca Grimaldi

May 25, 2025

Descubriendo Roc Agel La Historia Detras De La Finca Grimaldi

May 25, 2025 -

La Reina Charlene De Monaco Como Llevar Lino En Otono

May 25, 2025

La Reina Charlene De Monaco Como Llevar Lino En Otono

May 25, 2025 -

La Propiedad De Roc Agel Un Retiro Discreto Para Charlene

May 25, 2025

La Propiedad De Roc Agel Un Retiro Discreto Para Charlene

May 25, 2025