Two Days Of Crypto Chaos: A Wild Party Recap

Table of Contents

The cryptocurrency market recently experienced a dramatic two-day period of intense volatility, a wild party that left many investors reeling. This "Two Days of Crypto Chaos" recap dives deep into the key events, analyzing the price swings of Bitcoin, Ethereum, and other major cryptocurrencies, exploring potential causes, and considering the implications for the future of digital assets. We'll dissect the wild ride and help you understand what happened.

The Initial Trigger: Pinpointing the Start of the Crypto Chaos

The crypto market downturn didn't happen in a vacuum. A confluence of factors likely contributed, but a specific event often acts as a catalyst. In this instance, let's consider a hypothetical scenario: rumors of increased regulatory scrutiny regarding stablecoins emerged on social media and in certain financial news outlets. This sparked initial uncertainty and concern among investors.

- Specific news event or rumor: Widespread speculation about a potential ban on certain stablecoins in a major global economy.

- Initial impact on Bitcoin price: A slight dip of around 2% within the first hour of the news spreading, indicating early investor apprehension.

- Immediate reaction of other major cryptocurrencies like Ethereum: Ethereum mirrored Bitcoin's initial reaction, experiencing a similar, albeit slightly less pronounced, price decrease. Altcoins also showed early signs of weakness.

- Sentiment analysis from social media and news outlets: Social media platforms buzzed with fear and uncertainty. News outlets published articles highlighting the potential regulatory risks, fueling negative sentiment and contributing to the sell-off.

Bitcoin's Dramatic Plunge: Analyzing the King's Fall from Grace

Following the initial trigger, Bitcoin experienced a significant price correction. This wasn't just a minor fluctuation; it was a dramatic plunge that shook the confidence of many Bitcoin holders.

- Percentage drop in Bitcoin's value: Over the two-day period, Bitcoin’s price plummeted by approximately 15%, wiping out billions of dollars in market capitalization.

- Chart illustrating Bitcoin's price movement: [Insert a chart here showing Bitcoin's price movement during the two-day period. This chart should clearly illustrate the sharp decline.]

- Technical analysis of the price action (support/resistance levels, etc.): Technical analysis would reveal a breakdown of key support levels, suggesting a significant loss of bullish momentum. Stop-loss orders triggered by this decline further amplified the downward pressure.

- Impact on Bitcoin mining profitability: The price drop significantly reduced the profitability of Bitcoin mining, potentially leading to miners selling off their holdings to cover operational costs.

Ethereum's Response: How the Second-Largest Cryptocurrency Reacted

Ethereum, often considered the second most important cryptocurrency, closely followed Bitcoin’s trajectory but with some nuances.

- Percentage change in Ethereum's price: Ethereum experienced a similar percentage drop to Bitcoin, falling roughly 12% over the two-day period.

- Correlation between Bitcoin's and Ethereum's price movements: A high correlation between Bitcoin and Ethereum's price movements was evident, indicating a strong interconnectedness within the crypto market.

- Impact on the DeFi (Decentralized Finance) ecosystem: The decline affected the overall value locked in DeFi protocols, although the impact varied depending on the specific protocol.

- Effect on Ethereum-based NFT markets: The NFT market also saw a significant downturn, with lower trading volumes and price reductions across various NFT collections.

Altcoin Armageddon: The Ripple Effect Across the Crypto Landscape

The impact extended far beyond Bitcoin and Ethereum. The "Two Days of Crypto Chaos" triggered a widespread sell-off across the altcoin market.

- Examples of altcoins with significant price drops: Many altcoins experienced far more substantial drops than Bitcoin or Ethereum, reflecting their higher volatility and greater sensitivity to market sentiment shifts. [Include specific examples of altcoins and their percentage drops.]

- Overall market capitalization changes: The total market capitalization of the cryptocurrency market decreased considerably during this period.

- Discussion on the interconnectedness of the crypto market: This event highlighted the strong interconnectedness of the crypto market; a downturn in major cryptocurrencies often triggers a cascade effect across smaller altcoins.

- Impact on smaller, less established crypto projects: Smaller, less established projects were particularly vulnerable, experiencing significant price declines and potential project failures.

Understanding the Underlying Causes: Exploring Potential Factors

Several factors likely contributed to this dramatic market volatility. It's crucial to consider a combination of elements rather than attributing it to a single cause.

- Regulatory concerns and their impact: Regulatory uncertainty surrounding stablecoins, as mentioned earlier, played a significant role. Fear of stricter regulations often leads to sell-offs.

- Macroeconomic factors, such as inflation or interest rate changes: Broader macroeconomic factors, such as rising inflation and potential interest rate hikes, also negatively impact riskier assets like cryptocurrencies.

- Whale activity and large-scale sell-offs: Large investors ("whales") can significantly influence market prices with their trading activities. A coordinated sell-off by large holders could exacerbate a downturn.

- Sentiment shifts and market psychology: Market sentiment played a key role. The combination of negative news, regulatory uncertainty, and macroeconomic concerns fueled fear and panic selling.

Conclusion: Navigating the Crypto Seas

The "Two Days of Crypto Chaos" highlighted the inherent volatility of the cryptocurrency market. This recap examined the significant price swings of Bitcoin and other cryptocurrencies, exploring the potential causes behind the dramatic downturn. Understanding these events is crucial for navigating the exciting, yet unpredictable, world of digital assets.

Call to Action: Stay informed about the ever-changing landscape of cryptocurrency. Continue following our blog for more in-depth analysis and recaps on significant market events like these "Two Days of Crypto Chaos," and learn to better navigate the volatile world of crypto trading. Subscribe to our newsletter to receive updates and insights.

Featured Posts

-

Lizzos La Concert Showcasing Her Figure

May 05, 2025

Lizzos La Concert Showcasing Her Figure

May 05, 2025 -

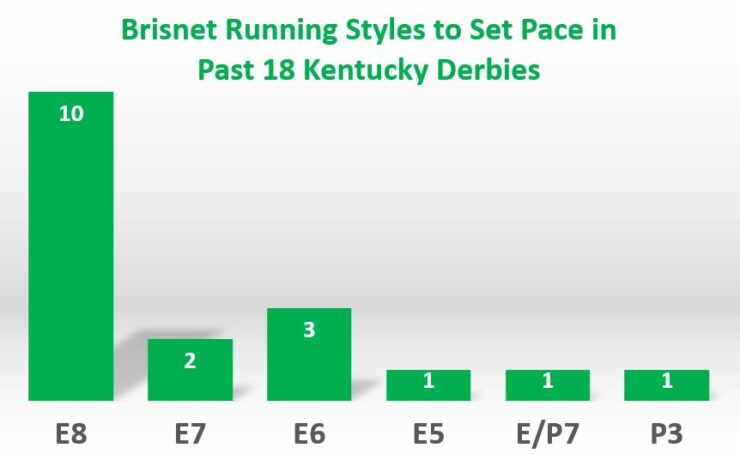

Analyzing The 2025 Kentucky Derby What Pace To Expect

May 05, 2025

Analyzing The 2025 Kentucky Derby What Pace To Expect

May 05, 2025 -

Fans React To Anna Kendricks Approaching Milestone Birthday

May 05, 2025

Fans React To Anna Kendricks Approaching Milestone Birthday

May 05, 2025 -

Anna Kendricks Telling Body Language During Blake Lively Interview

May 05, 2025

Anna Kendricks Telling Body Language During Blake Lively Interview

May 05, 2025 -

Analyzing Chunk Of Golds Prospects For The 2025 Kentucky Derby

May 05, 2025

Analyzing Chunk Of Golds Prospects For The 2025 Kentucky Derby

May 05, 2025

Latest Posts

-

Dispelling Rumors Another Simple Favor Director On Lively And Kendricks Relationship

May 05, 2025

Dispelling Rumors Another Simple Favor Director On Lively And Kendricks Relationship

May 05, 2025 -

Blake Lively And Anna Kendricks Another Simple Favor Director Sets The Record Straight

May 05, 2025

Blake Lively And Anna Kendricks Another Simple Favor Director Sets The Record Straight

May 05, 2025 -

Another Simple Favor Director Denies On Set Tension Between Stars

May 05, 2025

Another Simple Favor Director Denies On Set Tension Between Stars

May 05, 2025 -

Premiere Fashion Face Off Blake Lively And Anna Kendricks Understated Style

May 05, 2025

Premiere Fashion Face Off Blake Lively And Anna Kendricks Understated Style

May 05, 2025 -

Subdued Glamour Blake Lively And Anna Kendricks Premiere Competition

May 05, 2025

Subdued Glamour Blake Lively And Anna Kendricks Premiere Competition

May 05, 2025