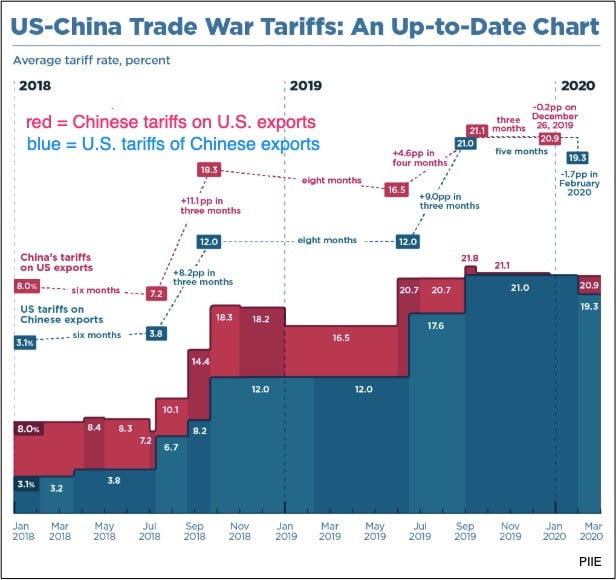

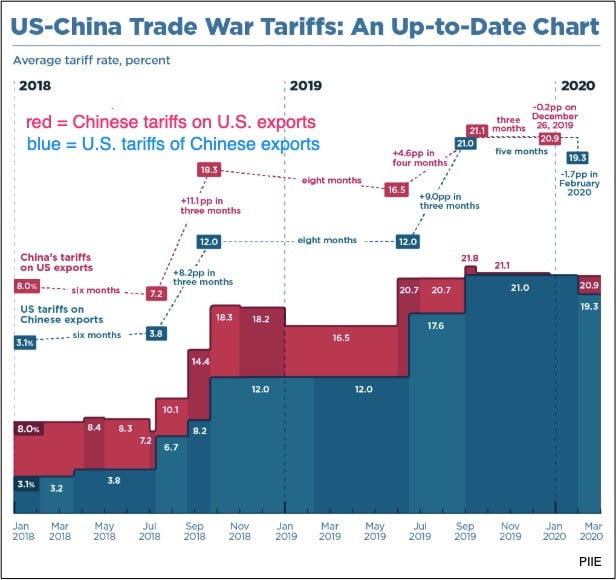

U.S.-China Tariff Rollback: Impact On The American Economy

Table of Contents

Impact on Consumer Prices

A U.S.-China tariff rollback could significantly alter consumer prices in the United States.

Reduced Inflation

- Lower import costs translate to lower prices for consumers. The most immediate impact of a tariff reduction would be a decrease in the price of imported goods from China. This translates directly to lower prices on shelves for consumers.

- Increased purchasing power for American households. Lower prices effectively increase the purchasing power of American households, allowing them to buy more with the same amount of money.

- Potential reduction in the Consumer Price Index (CPI). A significant decrease in import prices could lead to a noticeable drop in the Consumer Price Index, a key measure of inflation. This would provide much-needed relief to consumers struggling with rising costs.

Shifting Consumer Spending

Lower prices on Chinese imports might not just mean lower costs; it could also lead to shifts in consumer spending patterns.

- Increased disposable income leading to increased spending on services and other goods. With more disposable income, consumers may be more likely to spend money on services like entertainment, travel, and dining out, boosting those sectors of the economy.

- Potential growth in related sectors like hospitality and entertainment. As consumer spending shifts, industries that benefit from increased disposable income could see significant growth.

- Reduced strain on household budgets. The overall impact on household budgets could be substantial, easing financial pressure on many families.

Effects on American Businesses

The impact of a U.S.-China tariff rollback on American businesses would be multifaceted, with both opportunities and challenges.

Increased Profit Margins

For businesses importing goods from China, a tariff reduction would directly translate into increased profit margins.

- Lower input costs leading to higher profit margins. Reduced tariffs mean lower costs for raw materials and finished goods, directly improving profitability.

- Increased competitiveness for American businesses. With lower input costs, American businesses could become more competitive in both domestic and international markets.

- Potential for business expansion and job creation. Increased profitability could lead to business expansion, investment in new technologies, and the creation of new jobs.

Supply Chain Restructuring

The rollback could also necessitate a significant restructuring of supply chains for many businesses.

- Potential for reshoring and near-shoring initiatives. Companies may reconsider their reliance on Chinese manufacturing and explore bringing production back to the U.S. (reshoring) or to nearby countries (near-shoring).

- Investment in domestic manufacturing and infrastructure. Reshoring initiatives could require significant investment in domestic manufacturing facilities and infrastructure.

- Challenges associated with adjusting existing supply chains. This process would be complex and potentially disruptive in the short term, requiring careful planning and execution.

Impact on Specific Sectors

Certain sectors of the American economy would experience a more pronounced impact from a U.S.-China tariff rollback than others.

Agriculture

The agricultural sector, heavily impacted by previous tariffs, stands to gain significantly.

- Increased demand for American agricultural products. Reduced tariffs could lead to a surge in demand for American agricultural products, particularly soybeans and pork, in the Chinese market.

- Boost in farm incomes and rural economies. This increased demand would translate into higher farm incomes and a boost for rural economies dependent on agricultural exports.

- Potential for increased trade agreements with China. A successful tariff rollback could pave the way for further trade agreements between the two countries.

Technology

The tech sector, facing significant restrictions, could also see substantial changes.

- Easier access to components and technology. Reduced tariffs could facilitate access to Chinese technology and components crucial for innovation and production.

- Increased collaboration between U.S. and Chinese tech firms. This could lead to more collaborations and partnerships, fostering innovation and competitiveness.

- Potential acceleration of technological innovation. Improved access to technology and components could accelerate the pace of technological innovation in the U.S.

Geopolitical Implications

The effects of a U.S.-China tariff rollback extend far beyond economic considerations, influencing the geopolitical landscape.

Improved U.S.-China Relations

A rollback could signal a thawing of trade tensions and improved diplomatic relations between the two countries.

- Positive signals for international trade and global stability. This could have positive ripple effects on international trade and global economic stability.

- Potential for future trade agreements and collaboration. Improved relations could lay the groundwork for more comprehensive trade agreements and collaborations in various fields.

- Reduced uncertainty for businesses operating in both markets. This reduction in uncertainty would be welcomed by businesses operating in both the U.S. and Chinese markets.

Long-Term Economic Uncertainty

However, despite potential benefits, long-term economic uncertainty persists.

- Ongoing potential for future trade disputes. The possibility of future trade disputes remains, requiring businesses to adopt flexible and resilient strategies.

- Need for strategic planning and diversification by businesses. Businesses need to strategically plan for various scenarios and diversify their supply chains to mitigate future risks.

- Importance of monitoring geopolitical developments. Continuous monitoring of geopolitical developments is crucial for businesses and policymakers to make informed decisions.

Conclusion

A U.S.-China tariff rollback presents a complex picture with potential benefits and challenges for the American economy. While reduced inflation and increased profit margins are likely positive outcomes, businesses will need to adapt to potential supply chain disruptions. The impact on specific sectors will vary, with agriculture and technology potentially seeing significant boosts. The geopolitical implications are far-reaching, highlighting the need for careful consideration and strategic planning. Understanding the potential ramifications of a U.S.-China tariff rollback is crucial for businesses and policymakers alike. Stay informed about the latest developments regarding the U.S.-China tariff rollback and its effects on various sectors to make informed decisions for your business. Monitoring the progress and impact of any U.S.-China tariff rollbacks is vital for navigating this evolving economic landscape.

Featured Posts

-

Megan Thee Stallion Seeks Contempt Finding Against Tory Lanez For Deposition Misconduct

May 13, 2025

Megan Thee Stallion Seeks Contempt Finding Against Tory Lanez For Deposition Misconduct

May 13, 2025 -

The Appeal Of Murderbot Why This Goofy Sci Fi Series Resonates

May 13, 2025

The Appeal Of Murderbot Why This Goofy Sci Fi Series Resonates

May 13, 2025 -

Update Tory Lanezs Condition Following Prison Stabbing

May 13, 2025

Update Tory Lanezs Condition Following Prison Stabbing

May 13, 2025 -

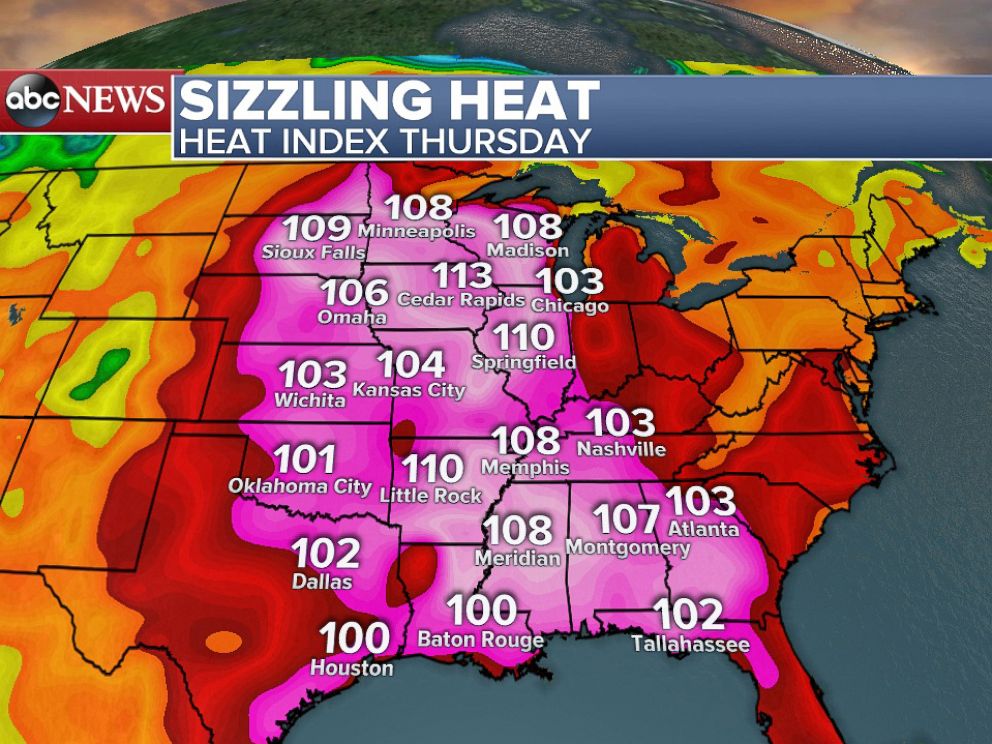

Mini Heat Wave Forecast Southern California Weekend Heat

May 13, 2025

Mini Heat Wave Forecast Southern California Weekend Heat

May 13, 2025 -

Charlotte Hornets Host Free Nba Draft Lottery Party

May 13, 2025

Charlotte Hornets Host Free Nba Draft Lottery Party

May 13, 2025