U.S. Dollar's Bleak Outlook: Worst Start Since Nixon?

Table of Contents

Unprecedented Inflation and Interest Rate Hikes

The U.S. dollar's decline is intrinsically linked to the current inflationary environment. High inflation erodes the purchasing power of a currency, making it less attractive to investors and potentially leading to currency devaluation.

The Inflationary Spiral

The U.S. is grappling with its highest inflation rate in decades. This inflationary spiral is fueled by several factors, including supply chain disruptions, increased energy prices, and robust consumer demand.

- CPI Data: The Consumer Price Index (CPI) has consistently shown alarming increases, far exceeding the Federal Reserve's target rate.

- Impact on Consumer Spending: High inflation reduces real disposable income, impacting consumer spending and overall economic growth.

- Federal Reserve Response: The Federal Reserve (the Fed) has responded aggressively to combat inflation, but its actions have introduced new uncertainties.

Aggressive Fed Rate Hikes

To curb inflation, the Fed has implemented a series of aggressive interest rate hikes. This policy aims to cool down the economy by making borrowing more expensive, thus reducing spending and investment.

- Frequency of Rate Hikes: The Fed has raised interest rates at an unprecedented pace, impacting various sectors of the economy.

- Impact on Borrowing Costs: Higher interest rates increase the cost of borrowing for businesses and consumers, potentially slowing economic activity.

- Potential for Recession: The aggressive rate hikes increase the risk of a recession, a scenario that could further weaken the dollar. The effectiveness of these rate hikes in taming inflation without triggering a recession remains to be seen, directly impacting the dollar's outlook.

Strengthening Global Competitors

The U.S. dollar's dominance is also being challenged by the strengthening of its global competitors. This shift in global economic power dynamics adds to the downward pressure on the dollar.

The Euro's Rise

The euro has recently appreciated significantly against the dollar, reflecting the robust performance of the Eurozone economy in certain sectors and increased investor confidence.

- Eurozone Economic Performance: The Eurozone, despite facing its own challenges, has shown relative resilience compared to the U.S. in some key areas.

- Energy Crisis: While the energy crisis impacts Europe, its response and relative economic strength compared to other regions influence the euro's value.

- ECB Monetary Policy: The European Central Bank's (ECB) monetary policy, while also tightening, has differed from the Fed's approach, influencing the relative strength of the euro against the dollar.

Emerging Market Currencies

Emerging market currencies are exhibiting mixed performances against the dollar. Some are strengthening, while others are weakening, highlighting the complexity of the global economic landscape and the interplay of various factors.

- Examples of Specific Emerging Market Currencies: The Chinese Yuan, for instance, has shown periods of strength, partly driven by China's economic growth and its role in global trade.

- Factors Influencing Their Performance: These currencies' performance is influenced by factors such as commodity prices, domestic economic policies, and global investor sentiment. This dynamic significantly impacts global trade and the dollar's role as the primary reserve currency.

Geopolitical Instability and Uncertainty

Geopolitical instability adds another layer of complexity to the U.S. dollar's outlook. Uncertainty surrounding global events significantly influences investor confidence and capital flows, impacting currency values.

The War in Ukraine

The ongoing war in Ukraine has created significant ripple effects across the globe, profoundly impacting the global economy and the dollar's value.

- Energy Prices: The war has led to a surge in energy prices, contributing to inflation globally and impacting currency values.

- Supply Chain Disruptions: The conflict has disrupted global supply chains, further fueling inflationary pressures and economic uncertainty.

- Sanctions: The sanctions imposed on Russia have also created volatility in financial markets and added to the uncertainty surrounding the global economy.

Global Recession Fears

Growing concerns about a global recession are further weighing on the dollar. A global recession would likely lead to decreased demand for the dollar and further weaken its value.

- Economic Indicators: Various economic indicators point toward a potential global slowdown or recession, fueling anxieties in financial markets.

- Predictions from Financial Institutions: Many prominent financial institutions are predicting a recession, either globally or in specific regions, adding to the pessimistic outlook.

- Flight to Safety Phenomenon: During times of economic uncertainty, investors often move their assets into "safe haven" currencies like the dollar. However, the current situation is complex and this traditional pattern might not be consistently observed, possibly further weakening the dollar.

Conclusion

The U.S. dollar's current weak outlook is a confluence of factors: high and persistent inflation, aggressive interest rate hikes by the Fed, the strengthening of global competitors like the euro, and significant geopolitical uncertainty fueled by the war in Ukraine and global recession fears. The situation bears resemblance to the post-Nixon shock period, a time of significant currency volatility. Monitor the U.S. dollar outlook closely; understand the risks of a weak U.S. dollar and its potential impact on your investments and financial planning. Stay informed about the U.S. dollar crisis and its potential developments by following reputable financial news sources and economic analyses to make informed decisions. The future of the U.S. dollar remains uncertain, requiring vigilant monitoring and strategic adaptation.

Featured Posts

-

Iran Nuclear Deal Latest Round Of Talks Ends Inconclusively

Apr 28, 2025

Iran Nuclear Deal Latest Round Of Talks Ends Inconclusively

Apr 28, 2025 -

E Bay Faces Legal Challenge Section 230 And The Sale Of Banned Chemicals

Apr 28, 2025

E Bay Faces Legal Challenge Section 230 And The Sale Of Banned Chemicals

Apr 28, 2025 -

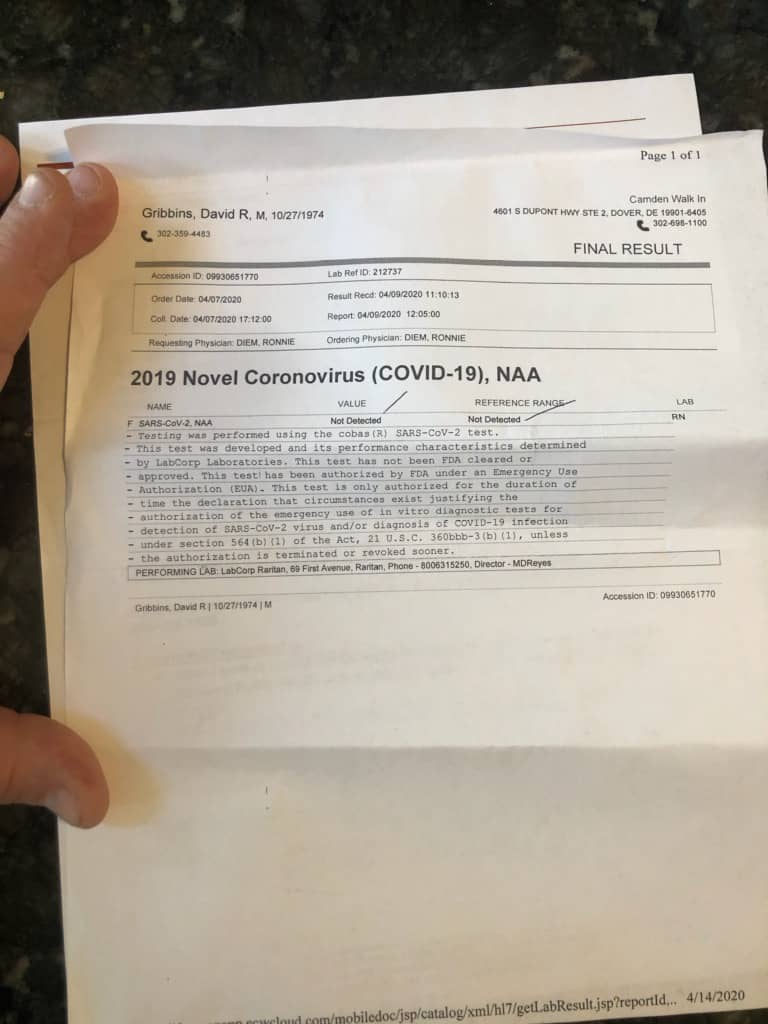

Fake Covid Test Results Lab Owners Guilty Plea

Apr 28, 2025

Fake Covid Test Results Lab Owners Guilty Plea

Apr 28, 2025 -

Addressing Americas Growing Truck Size Problem

Apr 28, 2025

Addressing Americas Growing Truck Size Problem

Apr 28, 2025 -

Metro Vancouver Housing Market Rent Increase Slowdown But Costs Still Climbing

Apr 28, 2025

Metro Vancouver Housing Market Rent Increase Slowdown But Costs Still Climbing

Apr 28, 2025

Latest Posts

-

Red Sox Roster Update Outfielders Return Impacts Lineup Casas Moves Down

Apr 28, 2025

Red Sox Roster Update Outfielders Return Impacts Lineup Casas Moves Down

Apr 28, 2025 -

Boston Red Sox Adjust Lineup Casas Lowered Outfielder Back In Action

Apr 28, 2025

Boston Red Sox Adjust Lineup Casas Lowered Outfielder Back In Action

Apr 28, 2025 -

Red Sox Lineup Changes Triston Casas Slide And Outfield Return

Apr 28, 2025

Red Sox Lineup Changes Triston Casas Slide And Outfield Return

Apr 28, 2025 -

Red Sox Lineup Shakeup Casas Demoted Struggling Outfielder Returns

Apr 28, 2025

Red Sox Lineup Shakeup Casas Demoted Struggling Outfielder Returns

Apr 28, 2025 -

Red Sox Outfielder Breakout Could This Player Be The Next Jarren Duran

Apr 28, 2025

Red Sox Outfielder Breakout Could This Player Be The Next Jarren Duran

Apr 28, 2025