U.S. Dollar's First 100 Days Under Scrutiny: A Comparison To The Nixon Era

Table of Contents

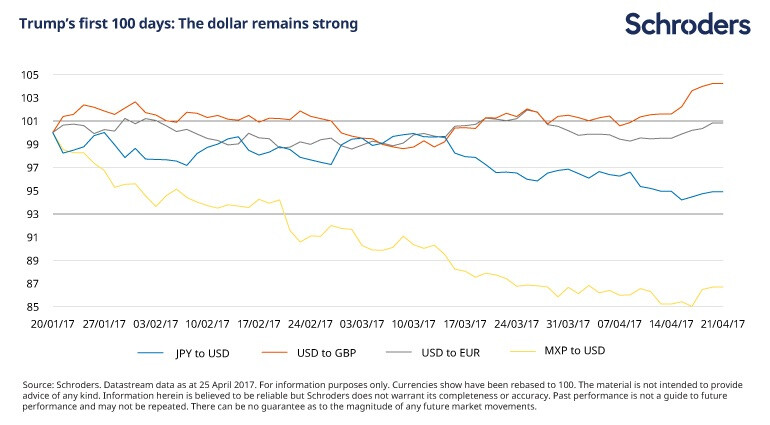

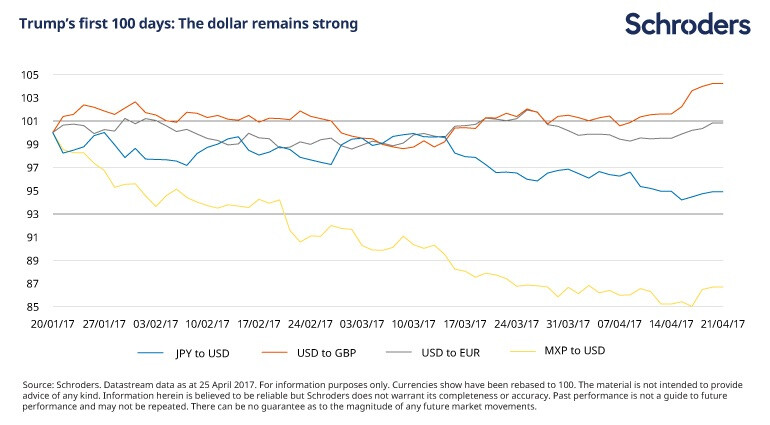

Current Economic Landscape and the U.S. Dollar's Performance

Inflationary Pressures and Interest Rate Hikes

Current inflation rates remain stubbornly high, forcing the Federal Reserve to implement aggressive interest rate hikes. This policy, aimed at curbing inflation, has had a mixed impact on the dollar's value.

- Inflation Rate (Example): [Insert current inflation rate data]. This high inflation erodes purchasing power and creates uncertainty in the market.

- Interest Rate Changes (Example): The Federal Reserve has raised interest rates by [Insert data on interest rate hikes] in an attempt to cool the economy.

- Impact on Dollar's Value: While higher interest rates generally attract foreign investment, increasing demand for the dollar, the persistent inflation has offset some of this positive effect. This has led to a fluctuating dollar value.

- Impact on Global Markets: This policy creates ripple effects across global markets. Higher interest rates can slow global economic growth and impact investor confidence, creating uncertainty in international trade.

Geopolitical Factors and Their Influence

Geopolitical events significantly influence the dollar's stability. The ongoing war in Ukraine, strained US-China relations, and energy crises have all contributed to global uncertainty.

- War in Ukraine: The conflict has disrupted supply chains, increased energy prices, and fueled inflation, negatively impacting the dollar's value.

- US-China Relations: Tensions between the U.S. and China create uncertainty in global trade and investment flows, adding volatility to the dollar.

- Energy Crisis: Global energy shortages and price volatility further contribute to inflationary pressures and economic instability, impacting the dollar's stability.

- Safe Haven Currency: Despite these challenges, the dollar often acts as a safe haven currency during times of global uncertainty. Investors tend to flock to the dollar, viewing it as a relatively stable asset compared to other currencies, although this is currently being challenged.

The Dollar's Role in International Trade and Finance

The dollar's dominance in international trade and finance remains significant, yet it faces increasing challenges.

- International Transactions: The vast majority of international transactions are conducted in U.S. dollars, highlighting its importance in global commerce.

- Central Bank Reserves: Many central banks hold substantial dollar reserves, reflecting the currency's role as a global reserve currency.

- Challenges to Dominance: However, the rise of alternative currencies, such as the Euro and the Chinese Yuan, presents a long-term challenge to the dollar's hegemony. The increasing use of cryptocurrencies also poses a threat to the dollar's future.

The Nixon Shock and its Long-Term Consequences

Nixon's Decision to End Gold Convertibility

In August 1971, President Nixon ended the Bretton Woods system, severing the direct link between the U.S. dollar and gold. This decision marked a pivotal moment in global monetary history.

- Bretton Woods System: This system established a fixed exchange rate regime, with the U.S. dollar pegged to gold and other currencies pegged to the dollar.

- Reasons for Collapse: The system collapsed due to increasing U.S. trade deficits and the growing cost of maintaining the dollar's gold convertibility.

- Consequences of Abandoning Gold Standard: The abandonment of the gold standard led to a period of significant exchange rate volatility and increased inflation globally.

The Rise of Fiat Currency and its Implications

The Nixon shock ushered in the era of fiat currencies—currencies not backed by a physical commodity like gold. This shift had profound implications.

- Monetary Policy: Fiat currencies allow central banks greater flexibility in managing monetary policy, but this flexibility also introduces the risk of inflation.

- Exchange Rate Fluctuations: Exchange rates become more volatile under a fiat currency system, creating uncertainty in international trade and investment.

- Stability vs. Volatility: The stability offered by a gold-backed currency is traded for increased monetary policy flexibility, however this comes with the potential risk of increased volatility.

Long-Term Effects on the U.S. Dollar and Global Economy

The Nixon shock left a lasting impact on the global economy.

- Increased Inflation: The abandonment of the gold standard contributed to a period of high inflation in the 1970s.

- Exchange Rate Volatility: Exchange rates became significantly more volatile, creating uncertainty for businesses and investors.

- New Global Financial Institutions: The need for a new international monetary system led to the creation of new global financial institutions, such as the Special Drawing Right (SDR).

Comparing and Contrasting the Two Eras

Similarities in Economic Conditions

Several parallels exist between the economic conditions of the Nixon era and the present day.

- High Inflation: Both periods witnessed high inflation rates, eroding purchasing power and causing economic uncertainty.

- Geopolitical Tensions: Both eras were marked by significant geopolitical tensions that impacted global markets and the dollar's value.

- Role of the U.S. Dollar: In both instances, the U.S. dollar's role as a global reserve currency has been challenged.

Differences in Global Economic Structure

Despite the similarities, key differences exist between the global economic landscape of the 1970s and today.

- Globalization: The global economy is significantly more interconnected today than it was in the 1970s, leading to greater interdependence and faster transmission of economic shocks.

- Rise of Emerging Economies: The emergence of powerful emerging economies, such as China and India, has altered the global economic landscape significantly.

- New Financial Technologies: The development of new financial technologies, such as electronic trading and cryptocurrencies, has changed how global finance operates.

Policy Responses and Their Effectiveness

The policy responses to the economic challenges of the Nixon era and the current situation differ significantly.

- Nixon Administration's Policies: Nixon implemented wage and price controls, which had limited long-term success.

- Current Policy Measures: The current Federal Reserve is using interest rate hikes and quantitative tightening to combat inflation. The effectiveness of these measures remains to be seen.

- Comparative Effectiveness: A comparative analysis of the effectiveness of different policies across these periods will offer insight into optimal strategies for economic stabilization.

Conclusion: The Future of the U.S. Dollar – Lessons from History

The analysis reveals striking similarities between the economic challenges facing the U.S. dollar today and those experienced during the Nixon era. High inflation, geopolitical tensions, and questions surrounding the dollar's global dominance are common threads. However, the global economic landscape has evolved significantly since the 1970s, making direct comparisons difficult. The effectiveness of current policy responses remains to be seen. The future trajectory of the U.S. dollar depends on several factors, including the success of efforts to curb inflation, the evolution of geopolitical events, and the resilience of the dollar's role in international trade and finance. Learning from the past, especially the lessons of the Nixon shock and the subsequent shift to a fiat currency system, is crucial in navigating the current uncertainties. Stay updated on the latest developments affecting the U.S. dollar's value and learn more about the historical context that shapes its future.

Featured Posts

-

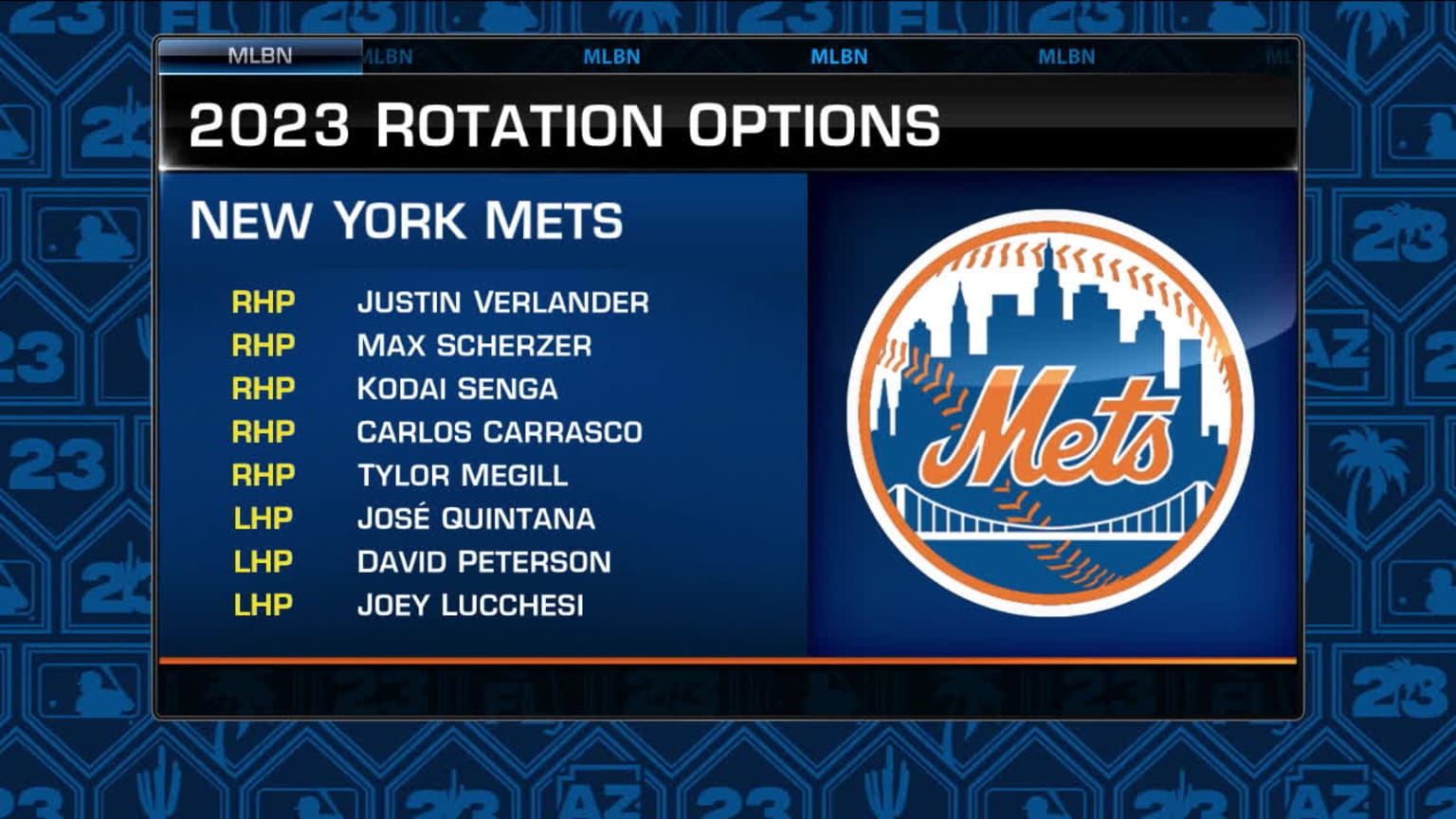

Is Pitchers Name Ready For A Mets Starting Rotation Role

Apr 29, 2025

Is Pitchers Name Ready For A Mets Starting Rotation Role

Apr 29, 2025 -

Lionel Messis Inter Miami Mls Schedule Live Streaming Options And Betting Odds

Apr 29, 2025

Lionel Messis Inter Miami Mls Schedule Live Streaming Options And Betting Odds

Apr 29, 2025 -

Pitchers Name S Case For A Mets Starting Rotation Spot

Apr 29, 2025

Pitchers Name S Case For A Mets Starting Rotation Spot

Apr 29, 2025 -

Reagan Airport Accident Shocking Details On Female Pilots Conduct Before Collision

Apr 29, 2025

Reagan Airport Accident Shocking Details On Female Pilots Conduct Before Collision

Apr 29, 2025 -

Trumps Potential Pardon Of Pete Rose A Look At The Mlb Ban And Its Implications

Apr 29, 2025

Trumps Potential Pardon Of Pete Rose A Look At The Mlb Ban And Its Implications

Apr 29, 2025

Latest Posts

-

Finding Capital Summertime Ball 2025 Tickets Tips For Success

Apr 29, 2025

Finding Capital Summertime Ball 2025 Tickets Tips For Success

Apr 29, 2025 -

Capital Summertime Ball 2025 Tickets A Practical Guide To Purchase

Apr 29, 2025

Capital Summertime Ball 2025 Tickets A Practical Guide To Purchase

Apr 29, 2025 -

How To Score Capital Summertime Ball 2025 Tickets

Apr 29, 2025

How To Score Capital Summertime Ball 2025 Tickets

Apr 29, 2025 -

Securing Your Capital Summertime Ball 2025 Tickets Tips And Tricks

Apr 29, 2025

Securing Your Capital Summertime Ball 2025 Tickets Tips And Tricks

Apr 29, 2025 -

Capital Summertime Ball 2025 Securing Your Place At The Show

Apr 29, 2025

Capital Summertime Ball 2025 Securing Your Place At The Show

Apr 29, 2025