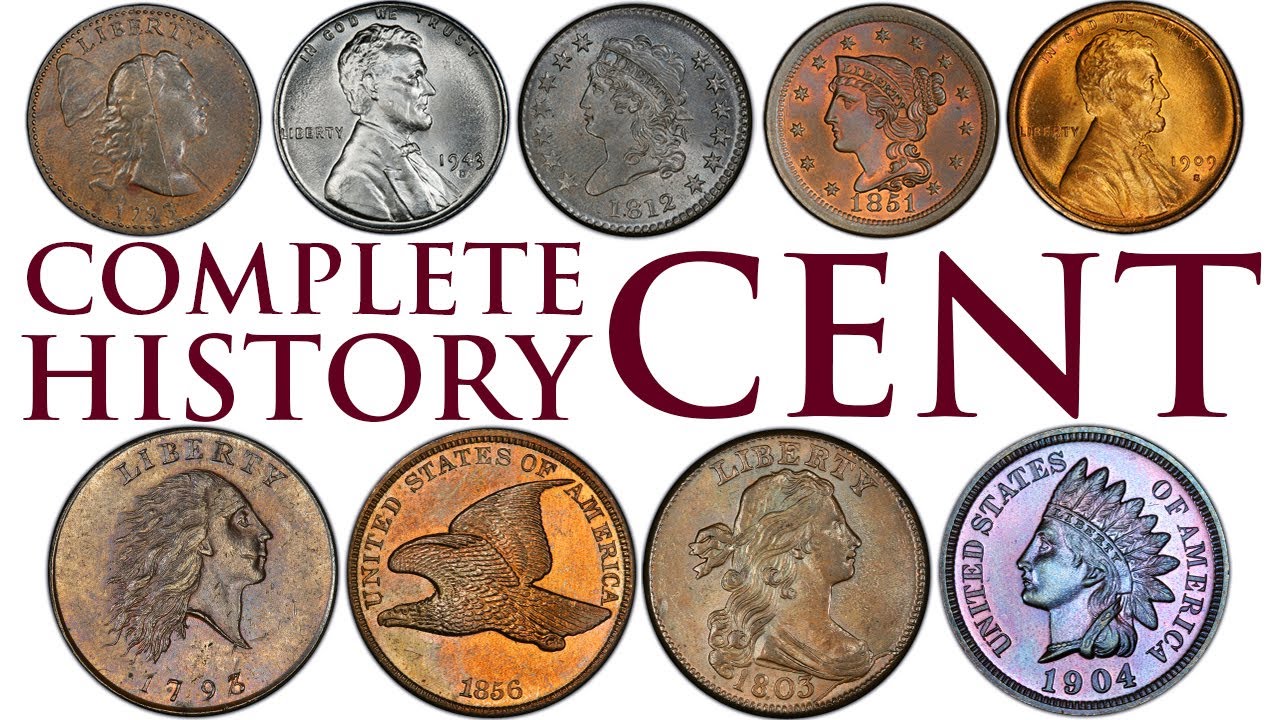

U.S. Penny Phase-Out: Circulation To End By Early 2026

Table of Contents

The High Cost of Producing Pennies

The primary driver behind the push for a U.S. penny phase-out is the simple fact that it costs more to produce a penny than its worth. This financial inefficiency has been a persistent argument for years, and recent economic analyses only strengthen the case.

Production Costs Exceed Face Value

The cost of minting a penny significantly surpasses its one-cent value. This is due to several factors:

- Breakdown of penny production costs: The cost of raw materials, primarily zinc and copper, fluctuates with commodity prices. Labor costs for minting, packaging, and transportation also add to the expense. Estimates suggest that the cost to produce a single penny can exceed two cents.

- Comparison of production costs to penny's face value: The discrepancy between production cost and face value results in a substantial financial loss for the U.S. Mint each year. This loss accumulates to millions, even billions, of dollars over time, representing a significant drain on taxpayer money.

- Mention the environmental impact of penny production: The mining and processing of metals required for penny production have considerable environmental consequences. Energy consumption associated with these processes adds to the overall carbon footprint, contributing to broader environmental concerns.

The Inefficiency of Penny Circulation

Beyond production costs, the sheer volume and handling of pennies create further inefficiencies:

- Statistics on the volume of pennies produced and circulated annually: Billions of pennies are produced and circulated annually, placing a strain on the logistics of the U.S. monetary system.

- The cost of transporting and storing pennies for banks and businesses: Banks and businesses incur significant expenses in handling, transporting, and storing vast quantities of pennies. This includes the costs of armored trucks, secure storage facilities, and personnel dedicated to penny management.

- The inconvenience of handling large quantities of pennies for consumers: Consumers also experience the inconvenience of dealing with large amounts of pennies. This often leads to pennies being discarded, contributing to the overall inefficiency of the system.

Alternatives to the Penny

If the penny is phased out, several alternatives exist to ensure smooth transactions:

Rounding Up or Down

The most common suggestion is rounding transactions to the nearest nickel. This would eliminate the need for pennies altogether.

- Pros and cons of rounding up/down: While rounding simplifies transactions, concerns exist about potential cumulative impacts on consumers and businesses, particularly regarding rounding up. Studies would be needed to determine the effects of rounding on inflation.

- Examples of countries that have successfully eliminated low-denomination coins: Canada and Australia successfully eliminated their low-denomination coins, providing valuable case studies for the U.S. Their experiences highlight both successes and challenges in implementing such changes.

- Potential impact on inflation: A well-designed rounding system could minimize the impact on inflation, but careful planning and monitoring would be crucial.

Digital Payment Transition

The increasing use of digital payment methods offers another avenue for reducing reliance on physical currency, including pennies.

- Growth of digital payment methods (mobile payments, online banking): The rapid growth of digital wallets, mobile payments, and online banking is transforming how people conduct transactions, reducing the need for physical cash.

- The role of technology in minimizing the use of cash: Technological advancements further facilitate cashless transactions, potentially accelerating the phase-out of low-value coins.

- Potential challenges in transitioning to a cashless society: While a cashless society offers many advantages, concerns remain about accessibility and equity for individuals who may not have equal access to digital payment technologies.

Public Opinion and Political Considerations

The success of a U.S. penny phase-out hinges significantly on public opinion and political maneuvering.

Public Sentiment Towards Penny Elimination

Public sentiment regarding penny elimination is mixed.

- Results of public opinion polls on penny elimination: Public opinion polls show a diverse range of views, with some supporting the phase-out to save money and resources, while others cling to the sentimental value of the penny.

- Arguments for and against keeping the penny: Arguments for keeping the penny often center on tradition and nostalgia. Arguments for elimination focus on cost savings and efficiency.

- The role of nostalgia and sentimental value in the debate: The penny's place in American history and culture adds emotional weight to the debate, making purely economic arguments insufficient.

Political and Economic Implications

Political factors significantly influence the feasibility of a U.S. penny phase-out.

- Potential impact on inflation: Careful economic modeling is needed to assess and mitigate any potential inflationary effects from a penny phase-out.

- The role of lobbying groups in influencing the debate: Various lobbying groups, including those representing the minting industry and consumer advocacy groups, play a significant role in shaping the political landscape of the debate.

- The potential for political gridlock and delays in implementing a phase-out: Given the complexity of the issue and diverse stakeholder interests, political gridlock could delay or even prevent the implementation of a penny phase-out.

Conclusion

The potential phase-out of the U.S. penny by early 2026 presents a complex issue with significant economic, environmental, and social implications. While the high cost of production and the increasing shift towards digital payments make a strong case for elimination, public opinion and political realities will ultimately determine the fate of this iconic coin. The debate surrounding the U.S. penny phase-out highlights the need for a comprehensive solution that balances financial efficiency with the concerns of consumers and businesses. Stay informed about the latest developments on this topic and prepare for a possible future without the penny in your pocket. Continue to follow news and updates on the potential U.S. penny phase-out to stay ahead of the curve.

Featured Posts

-

Efektivne Gospodaryuvannya Kerivnitstvo Tov Z Odnim Uchasnikom

May 23, 2025

Efektivne Gospodaryuvannya Kerivnitstvo Tov Z Odnim Uchasnikom

May 23, 2025 -

Cat Deeleys Last Minute Dress Disaster On This Morning

May 23, 2025

Cat Deeleys Last Minute Dress Disaster On This Morning

May 23, 2025 -

Unveiled A Major Disagreement Within The Who

May 23, 2025

Unveiled A Major Disagreement Within The Who

May 23, 2025 -

Dylan Dreyers Family Celebrates A Joyful Update

May 23, 2025

Dylan Dreyers Family Celebrates A Joyful Update

May 23, 2025 -

El Coe Eleva A 9 El Numero De Provincias En Alerta Amarilla

May 23, 2025

El Coe Eleva A 9 El Numero De Provincias En Alerta Amarilla

May 23, 2025

Latest Posts

-

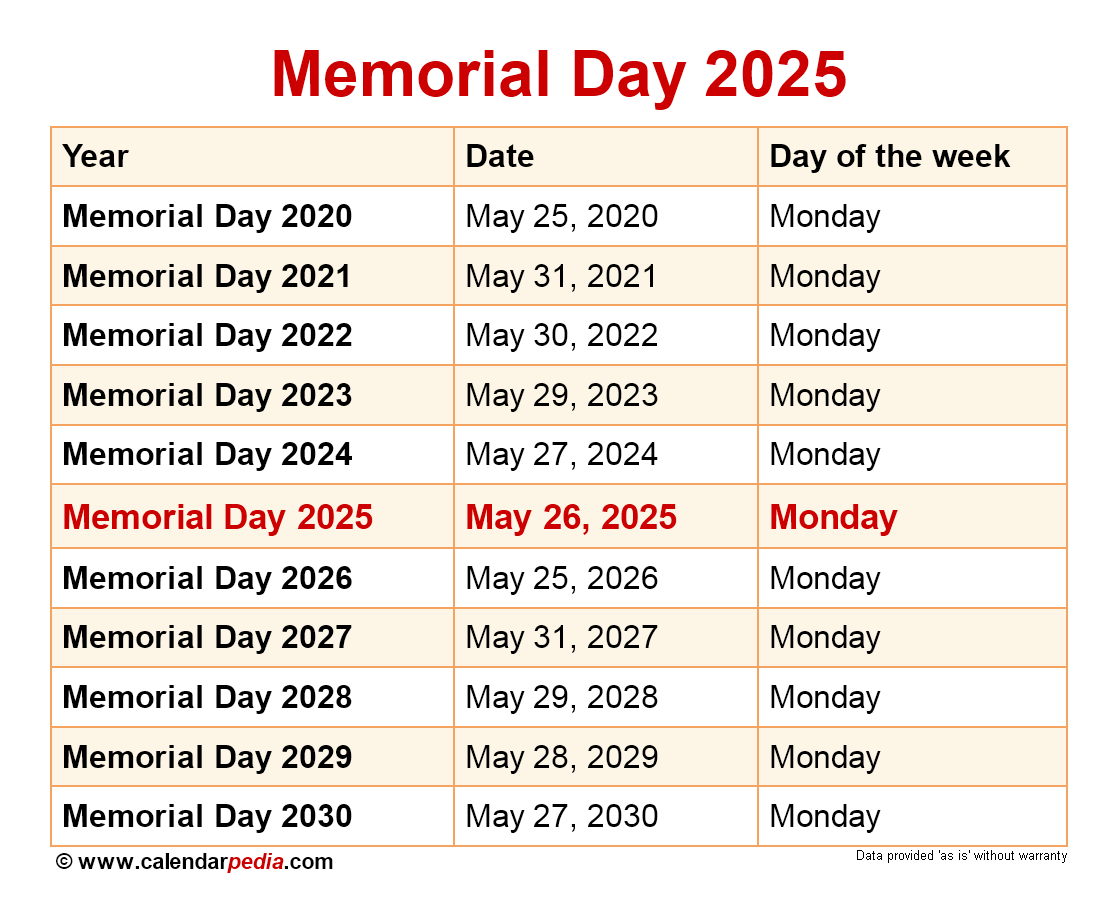

Memorial Day 2025 Date History And Three Day Weekend Plans

May 23, 2025

Memorial Day 2025 Date History And Three Day Weekend Plans

May 23, 2025 -

Stitchpossible Weekend Box Office Analyzing The Potential For A 2025 Record

May 23, 2025

Stitchpossible Weekend Box Office Analyzing The Potential For A 2025 Record

May 23, 2025 -

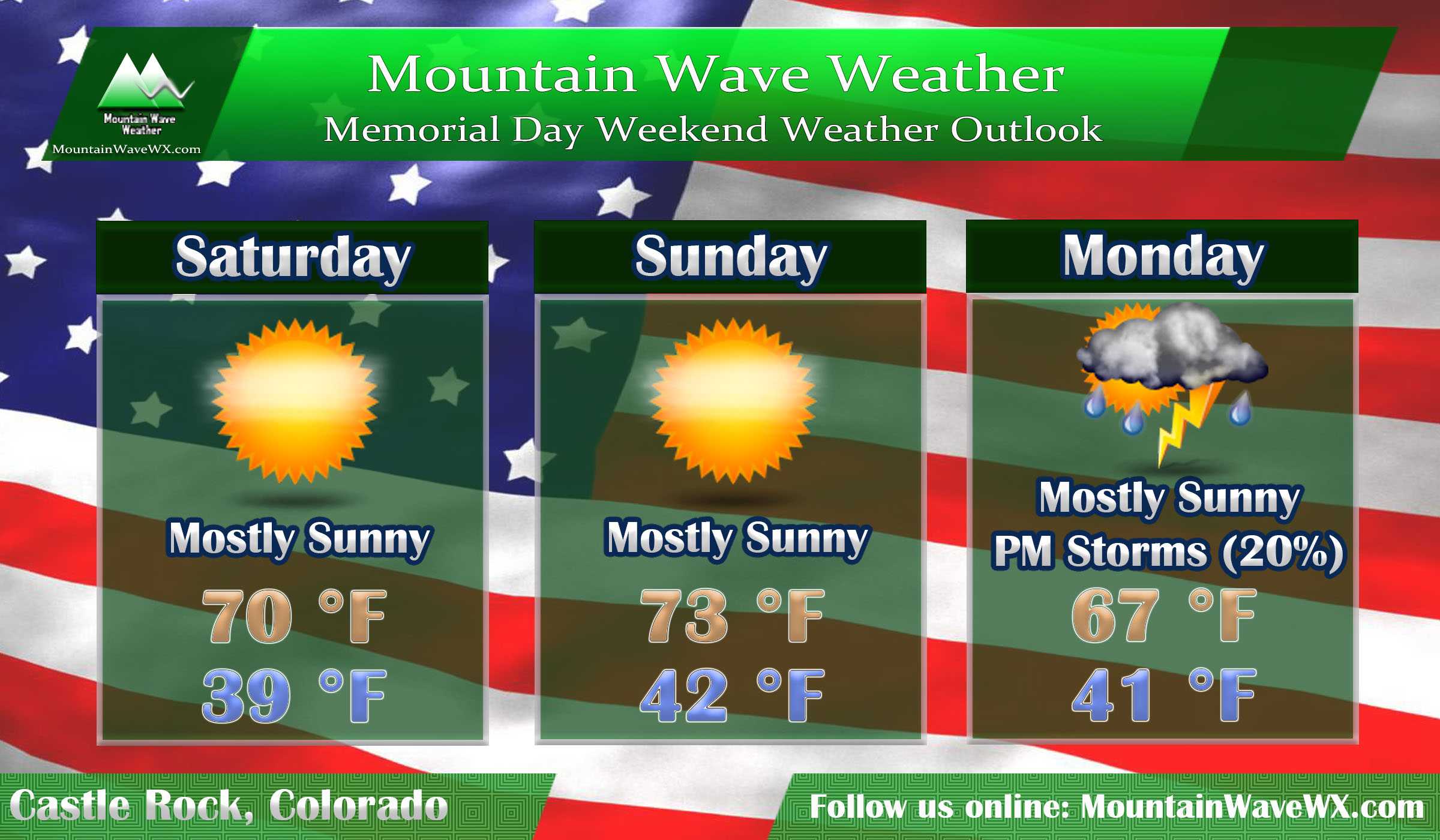

Nyc Memorial Day Weekend Weather Will It Rain

May 23, 2025

Nyc Memorial Day Weekend Weather Will It Rain

May 23, 2025 -

Memorial Day Weekend Nyc Forecast Rain Chances

May 23, 2025

Memorial Day Weekend Nyc Forecast Rain Chances

May 23, 2025 -

Stitchpossibles Weekend Debut Predicting A Record Breaking 2025 Clash

May 23, 2025

Stitchpossibles Weekend Debut Predicting A Record Breaking 2025 Clash

May 23, 2025