Uber Calls Off Foodpanda Taiwan Purchase Amid Regulatory Delays

Table of Contents

Regulatory Delays as the Primary Culprit

The primary reason behind Uber's abandonment of the Foodpanda Taiwan acquisition boils down to protracted and insurmountable regulatory delays. While the specifics remain somewhat opaque, it's clear that Taiwanese regulatory bodies presented significant hurdles. These likely included a combination of factors, potentially encompassing antitrust concerns related to market dominance, licensing issues concerning food handling and delivery permits, and stringent data privacy regulations.

The regulatory process, which was expected to conclude within a reasonable timeframe, stretched far beyond anticipated deadlines. The lack of timely approvals ultimately forced Uber to withdraw its bid, demonstrating the high stakes involved in navigating international regulatory landscapes.

- Specific regulations that caused delays: The exact regulations remain undisclosed, but potential areas of concern include antitrust laws preventing monopolies in the food delivery sector and data protection regulations concerning customer information.

- Timeline of regulatory review: While precise dates aren't publicly available, the extended review period likely spanned several months, exceeding Uber's tolerance for uncertainty.

- Statements from involved government agencies: Official statements from Taiwanese regulatory agencies regarding the reasons for the delay are limited, adding to the mystery surrounding the failed acquisition.

- Impact of these delays on Uber’s financial projections: The prolonged uncertainty significantly impacted Uber's financial planning and projections, contributing to the decision to abandon the deal. The potential costs associated with continued delays likely outweighed the expected benefits of acquiring Foodpanda Taiwan.

Financial Implications for Uber and Foodpanda

The cancellation of the Uber-Foodpanda Taiwan deal carries significant financial repercussions for both companies. Uber faces the loss of a potential foothold in a rapidly growing market, representing a setback to its Asian expansion strategy. This includes not only the direct financial cost of the failed acquisition but also the opportunity cost of investing resources elsewhere. Foodpanda, on the other hand, loses a potential infusion of capital and the backing of a global tech giant, hindering its growth trajectory.

- Estimated financial losses for Uber: Precise figures remain confidential, but the costs associated with due diligence, legal fees, and lost opportunities are substantial.

- Impact on Foodpanda's market position in Taiwan: The lack of Uber's resources may weaken Foodpanda's competitive edge against other food delivery platforms in Taiwan.

- Stock market reaction (if applicable): The news likely impacted Uber's stock price, reflecting investor concern over the company's expansion strategy and the challenges of navigating international regulatory environments.

- Repercussions for Uber's expansion plans in Asia: This incident serves as a cautionary tale, highlighting the risks associated with international acquisitions and the importance of thorough due diligence, including regulatory risk assessment.

Impact on the Taiwanese Food Delivery Market

The failed acquisition will undoubtedly reshape the competitive dynamics of the Taiwanese food delivery market. The absence of Uber's resources and influence could allow existing players, such as local competitors, to consolidate their market share and potentially lead to increased competition. Consumers may experience fluctuations in pricing and service offerings as companies react to this shift in the market landscape.

- Major competitors in the Taiwanese market: Other major players will likely benefit from the decreased competitive pressure, potentially leading to increased market share and influence.

- Potential increase/decrease in prices for consumers: The competitive landscape could lead to price adjustments, potentially impacting affordability for consumers.

- Impact on restaurant partnerships: Existing partnerships between Foodpanda and restaurants may remain unchanged, but new opportunities for other players to expand their partnerships may emerge.

- Future market consolidation possibilities: The failed acquisition could accelerate market consolidation, with stronger players potentially acquiring smaller competitors.

Future Strategies for Uber and Foodpanda in Taiwan

Following the failed acquisition, both Uber and Foodpanda must re-evaluate their strategies in Taiwan. Uber might explore alternative methods of entering the Taiwanese food delivery market, potentially through partnerships or the development of its own platform. Foodpanda will need to focus on organic growth and strengthening its market position without Uber's resources.

- Uber's potential new strategies in Taiwan: Alternative expansion strategies could involve forging strategic alliances, developing innovative delivery solutions, or focusing on other areas within the Taiwanese market.

- Foodpanda's likely response to the failed acquisition: Foodpanda will likely intensify its marketing efforts, enhance its service offerings, and build stronger relationships with restaurants.

- Possibility of future mergers or acquisitions in the sector: The market dynamics may increase the likelihood of future mergers and acquisitions, potentially leading to further consolidation.

- Long-term outlook for the Taiwanese food delivery market: The market is expected to remain dynamic, with ongoing competition and innovation shaping its future trajectory.

Conclusion: The Fallout of Uber's Failed Foodpanda Taiwan Bid

The cancellation of Uber's bid to acquire Foodpanda Taiwan serves as a stark reminder of the challenges inherent in navigating complex regulatory landscapes during international mergers and acquisitions. Regulatory delays proved to be the insurmountable hurdle, resulting in significant financial implications for both companies and altering the competitive dynamics of the Taiwanese food delivery market. The long-term impact on both Uber's Asian strategy and the overall structure of the Taiwanese market remains to be seen. Stay tuned for further updates on the evolving landscape of the Taiwanese food delivery market, particularly regarding Uber's future moves in the region.

Featured Posts

-

The Morales Knockout Ufc Fighters React To Vegas 106 Headliner

May 19, 2025

The Morales Knockout Ufc Fighters React To Vegas 106 Headliner

May 19, 2025 -

Political Fallout From Proposed Migrant Deportation To Remote Island

May 19, 2025

Political Fallout From Proposed Migrant Deportation To Remote Island

May 19, 2025 -

What Macron Can Teach Merz About The Far Right

May 19, 2025

What Macron Can Teach Merz About The Far Right

May 19, 2025 -

Uber One Arrives In Kenya Get More For Less With Membership Benefits

May 19, 2025

Uber One Arrives In Kenya Get More For Less With Membership Benefits

May 19, 2025 -

Orlando Magic Vs Dallas Mavericks Game Preview Odds And How To Watch March 27th

May 19, 2025

Orlando Magic Vs Dallas Mavericks Game Preview Odds And How To Watch March 27th

May 19, 2025

Latest Posts

-

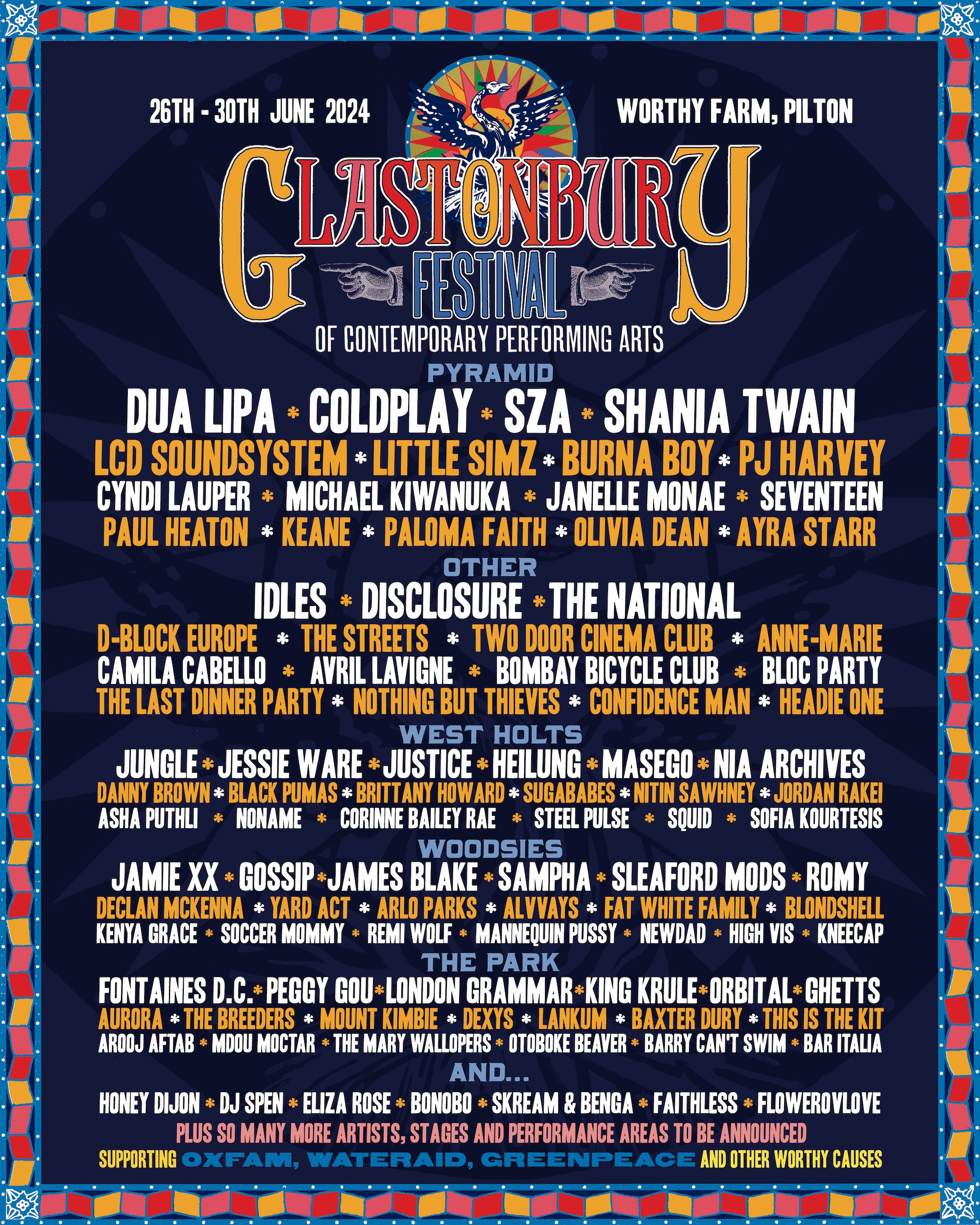

Nos Alive 2025 Complete Guide To Headliners Lineup And Tickets

May 19, 2025

Nos Alive 2025 Complete Guide To Headliners Lineup And Tickets

May 19, 2025 -

Eurovision 2025 United Kingdoms Performance And Final Ranking 19th

May 19, 2025

Eurovision 2025 United Kingdoms Performance And Final Ranking 19th

May 19, 2025 -

Primarias 2025 18 Recursos De Nulidad Presentados Ante El Cne

May 19, 2025

Primarias 2025 18 Recursos De Nulidad Presentados Ante El Cne

May 19, 2025 -

Nos Alive 2025 Headliners Lineup Tickets And Dates

May 19, 2025

Nos Alive 2025 Headliners Lineup Tickets And Dates

May 19, 2025 -

El Cne Y Las Elecciones Primarias De 2025 Un Analisis Del Proceso

May 19, 2025

El Cne Y Las Elecciones Primarias De 2025 Un Analisis Del Proceso

May 19, 2025