Uber Stock: A Comprehensive Investment Analysis

Table of Contents

Uber's Financial Performance and Growth Trajectory

Analyzing Uber's financial health is crucial for any potential investor. Examining key metrics provides insights into its past performance and potential for future growth. Let's look at some key aspects of Uber financials:

-

Revenue Growth: Uber has demonstrated significant revenue growth over the past few years, driven primarily by its ride-sharing and food delivery services. However, the rate of growth may fluctuate depending on economic conditions and competitive pressures. Analyzing historical Uber revenue trends is vital for understanding the company's trajectory.

-

Profitability and Earnings Per Share (EPS): While Uber has shown revenue growth, achieving consistent profitability has been a challenge. Analyzing Uber profitability margins, both gross and net, and their evolution over time, is critical. Similarly, examining the Uber EPS and its trends provides valuable insights into the company's earnings performance and its implications for investors.

-

Key Financial Ratios: A deeper dive into key financial ratios, such as the Price-to-Earnings (P/E) ratio, debt-to-equity ratio, and free cash flow, offers a more nuanced understanding of Uber's financial strength and stability. A high P/E ratio might suggest the market anticipates significant future growth, while a high debt-to-equity ratio might indicate higher financial risk. Analyzing Uber's free cash flow is crucial for assessing its ability to generate cash and fund future investments.

-

Sustainability of Growth: The sustainability of Uber's growth is a major concern. Market saturation in certain regions, increased competition, and regulatory changes could all impact its future performance. Careful consideration of these factors is necessary when evaluating the long-term viability of investing in Uber stock.

Market Position and Competitive Landscape

Uber operates in a fiercely competitive market. Understanding its market share and competitive positioning is paramount for assessing its future potential.

-

Global Market Share: Uber holds a significant market share in the global ride-sharing and food delivery markets, but this share varies considerably by region. Its global presence and regional dominance are key strengths, but maintaining this position requires continuous innovation and adaptation.

-

Competitive Analysis: Key competitors such as Lyft, DoorDash, and Didi (in specific regions) pose significant challenges. Analyzing their strengths and weaknesses, pricing strategies, and technological capabilities provides a clearer picture of the ride-sharing market and food delivery competition.

-

Technological Advantages: Uber’s technological advantages, including its sophisticated ride-matching algorithms and robust delivery platforms, are critical differentiators. Continuous innovation and investment in technology are vital for maintaining a competitive edge.

-

Brand Loyalty and Customer Satisfaction: Building and maintaining strong brand loyalty and high customer satisfaction are essential for long-term success. Analyzing customer reviews and satisfaction scores can offer insights into Uber’s competitive positioning.

Future Growth Opportunities and Risks

Assessing Uber's potential for future growth and the associated risks is critical for making informed investment decisions.

-

Growth Avenues: Uber's growth potential lies in various areas, including expansion into new markets, particularly in developing economies. The potential for growth in autonomous vehicles, freight services, and strategic partnerships also holds significant promise. Uber innovation in these areas will be key to its future success. However, this potential also requires significant capital investment and may face significant regulatory hurdles.

-

Regulatory Hurdles: Government regulations significantly impact Uber's operations. Changes in regulations, licensing requirements, and labor laws pose significant risks and could affect its profitability and expansion plans. An in-depth Uber risk assessment should include a detailed analysis of potential regulatory impacts.

-

Economic Downturns: Economic downturns can significantly reduce consumer spending on ride-sharing and food delivery services, directly impacting Uber's revenue and profitability. Understanding the cyclical nature of the industry is crucial.

-

Technological Disruption: The ride-sharing and food delivery industries are constantly evolving. New entrants with innovative technologies or business models could disrupt Uber's market dominance, leading to decreased market share and profitability.

Valuation and Investment Strategy

Determining a fair value for Uber stock is crucial for making informed investment decisions.

-

Valuation Methodologies: Several valuation methodologies can be applied, including discounted cash flow (DCF) analysis and comparable company analysis. Each approach offers unique perspectives and should be considered to determine a robust Uber stock valuation.

-

Fair Value Estimation: By comparing the estimated fair value to the current Uber stock price, investors can assess whether the stock is undervalued or overvalued. A sensitivity analysis of valuation estimates to key assumptions should be conducted to understand the range of potential outcomes.

-

Investment Strategies: Depending on an investor's risk tolerance and investment horizon, several strategies are possible. Long-term investors might hold the stock for years, expecting appreciation over time. Short-term investors might employ trading strategies based on market fluctuations. A comprehensive Uber investment strategy should align with individual goals.

-

Entry and Exit Strategies: Defining clear entry and exit points based on price targets, financial performance, or market conditions is crucial for managing risk and maximizing returns.

Conclusion

Investing in Uber stock presents a unique opportunity, but thorough analysis of its financial performance, market position, future prospects, and inherent risks is crucial. While promising growth avenues exist, potential challenges need careful consideration. This comprehensive analysis should assist you in making an informed decision. Remember to conduct your own due diligence before investing in any stock, including Uber stock. Consider your risk tolerance and long-term investment goals when determining if Uber stock is the right fit for your portfolio. Are you ready to assess your investment strategy regarding Uber stock?

Featured Posts

-

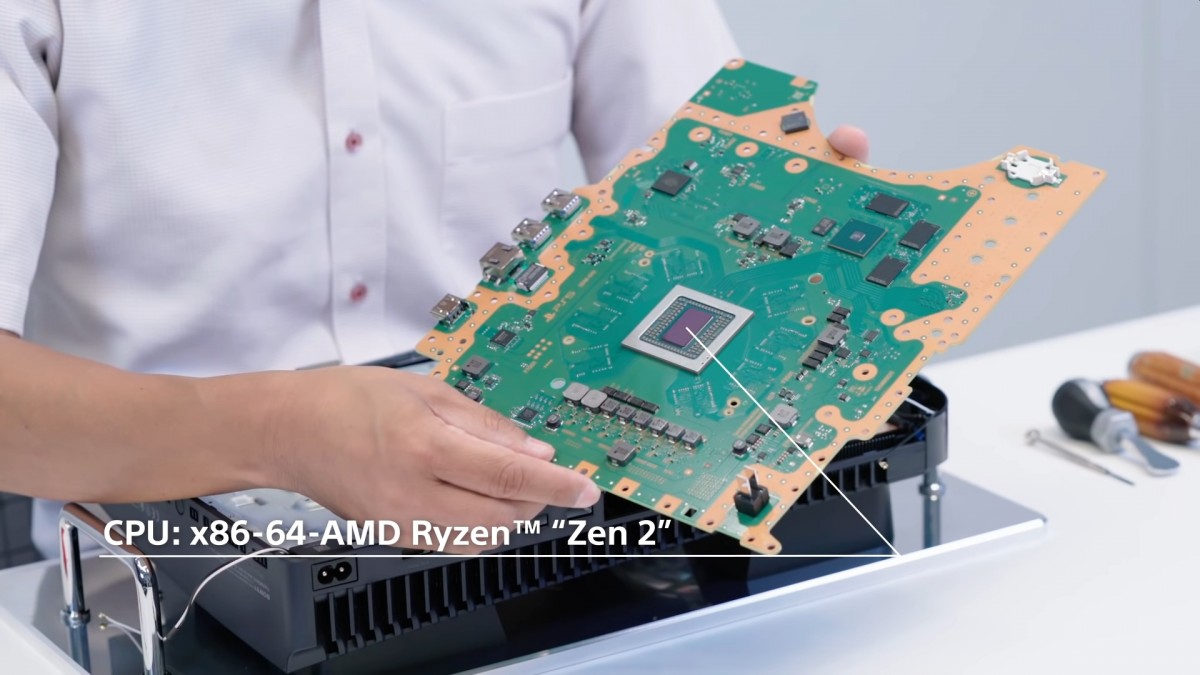

Inside The Ps 5 Pro A Detailed Teardown And Analysis Of Its Liquid Metal Cooling

May 08, 2025

Inside The Ps 5 Pro A Detailed Teardown And Analysis Of Its Liquid Metal Cooling

May 08, 2025 -

Dwp Announces Universal Credit Refunds Impact Of 5 Billion Cuts On April And May Payments

May 08, 2025

Dwp Announces Universal Credit Refunds Impact Of 5 Billion Cuts On April And May Payments

May 08, 2025 -

Kripto Para Platformlari Icin Yeni Kurallar Sermaye Ve Guevenlik Odakli Duezenleme

May 08, 2025

Kripto Para Platformlari Icin Yeni Kurallar Sermaye Ve Guevenlik Odakli Duezenleme

May 08, 2025 -

Andor Season 2 Diego Luna Promises A Game Changing Star Wars Experience

May 08, 2025

Andor Season 2 Diego Luna Promises A Game Changing Star Wars Experience

May 08, 2025 -

Psl Matches In Lahore Impact On School Schedules

May 08, 2025

Psl Matches In Lahore Impact On School Schedules

May 08, 2025