Uber Stock: A Recession-Resistant Investment?

Table of Contents

Uber's Diversified Revenue Streams: A Buffer Against Recession

Uber's financial stability isn't solely reliant on its flagship ride-sharing service. Its diversified revenue streams offer a potential buffer against recessionary pressures. Let's break down the key components:

-

Uber Rides: While the core ride-sharing business is sensitive to economic conditions – discretionary spending on rides tends to decrease during recessions – Uber's vast network and brand recognition provide a solid base. However, a decline in non-essential travel could impact revenue.

-

Uber Eats: Uber Eats, however, presents a compelling argument for recession-resistance. Food delivery demand often increases during economic downturns. People may cut back on restaurant dining but still desire convenient food options, boosting Uber Eats' revenue and potentially mitigating losses from reduced ride-sharing usage. This increased demand for food delivery during lockdowns and periods of economic uncertainty is a significant factor.

-

Uber Freight: Uber Freight, focusing on logistics and trucking, offers further diversification. This segment is less susceptible to immediate economic shocks than ride-sharing, as essential goods transportation remains vital even during recessions. This diversification of revenue streams is a key factor in analyzing the resilience of Uber stock.

-

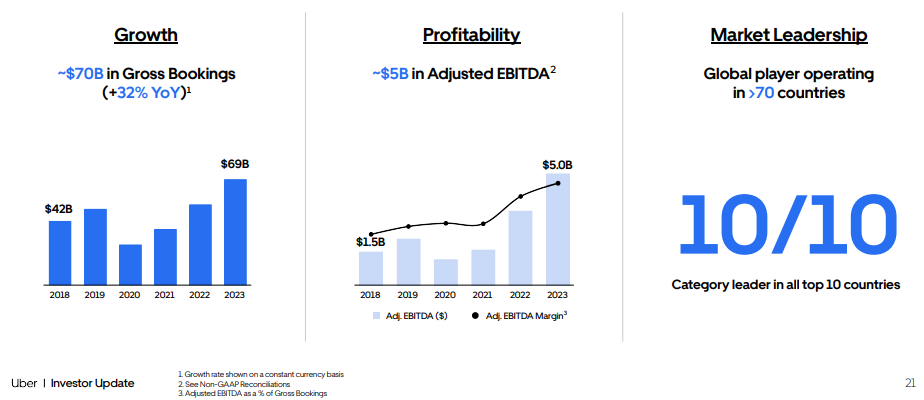

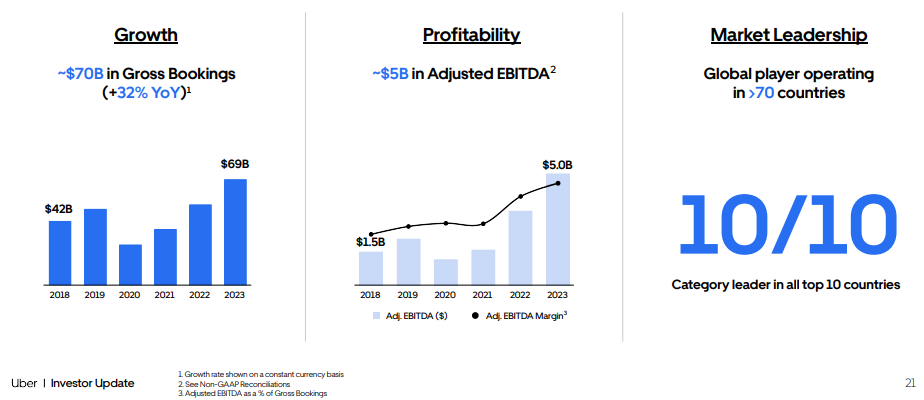

Historical Performance: Analyzing Uber's financial reports during previous economic slowdowns will reveal how these different revenue streams performed relative to each other. This historical data is crucial to assess the company's resilience and the validity of its recession-resistant claims.

Demand Elasticity and Essential Services Argument

The elasticity of demand for ride-sharing and food delivery is crucial. Are these services considered necessities or luxuries?

-

Inelastic Demand Aspects: Some argue that ride-sharing services, particularly for essential workers or medical appointments, exhibit inelastic demand. Even during a recession, people need transportation for essential purposes, making demand relatively stable. Similarly, food delivery, while potentially a luxury in some cases, serves a vital role for those unable or unwilling to cook.

-

Pricing Strategies: Uber's pricing strategies will play a vital role. During a recession, offering targeted promotions and discounts could attract price-sensitive consumers and maintain demand, although this may impact profitability. This adjustment in consumer behavior must be considered during recessionary periods.

-

Essential Services Factor: The 'essential services' argument centers on the fact that some Uber services cater to crucial needs. Transportation for essential workers in healthcare, emergency services, and logistics sectors remain vital, regardless of the economic climate. This contributes to the argument of Uber stock as a potentially recession-resistant investment.

Risks and Challenges Facing Uber Stock During a Recession

Despite its diversified model, Uber faces significant challenges during economic downturns:

-

Intense Competition: The ride-sharing and food delivery markets are highly competitive. Recessions can exacerbate competition as companies fight for market share, potentially squeezing profit margins for Uber.

-

Rising Costs: Inflation significantly impacts Uber's profitability. Increased fuel prices, driver wages, and operational expenses reduce profit margins, particularly during periods of reduced demand.

-

Regulatory Hurdles: Regulatory changes impacting driver classification, minimum wages, and other operational aspects pose a considerable threat. These regulatory hurdles can significantly alter operational costs and profitability, especially during economic uncertainty.

-

Debt Management: Uber's debt levels need careful consideration. Managing financial obligations during a recession can be challenging, potentially impacting the company's ability to invest in growth or weather economic storms.

Comparing Uber to Other Recession-Resistant Stocks

To determine if Uber stock truly qualifies as recession-resistant, it's essential to compare its performance and resilience during previous economic downturns against other commonly cited recession-resistant stocks. For example, consumer staples companies, utility companies, and some healthcare sectors often demonstrate better resilience during economic downturns. Analyzing these comparative performances helps investors assess the relative risks and rewards associated with Uber stock as part of a diversified portfolio. This sector comparison helps determine if Uber stock is a truly suitable recession-proof stock.

Conclusion

This article explored whether Uber stock qualifies as a recession-resistant investment. While Uber's diversified revenue streams (Uber Eats, Uber Freight, and Uber rides) and the essential nature of some of its services offer some degree of protection against economic downturns, potential risks remain, including competition, inflation, and regulatory challenges. The ultimate decision on whether to invest in Uber stock depends on your individual risk tolerance and investment strategy. The performance of the UBER share price during the next economic downturn is uncertain, hence the need for careful consideration.

Call to Action: Before making any investment decisions concerning Uber stock, conduct thorough research and consider consulting a financial advisor. Remember to carefully weigh the potential benefits and risks of Uber stock as part of a diversified investment portfolio. Learn more about how to assess the recession-resistant qualities of other stocks and build a robust investment strategy for navigating economic uncertainty.

Featured Posts

-

Ufc 313 Controversy Fighter Admits Defeat Following Robbery Accusations

May 19, 2025

Ufc 313 Controversy Fighter Admits Defeat Following Robbery Accusations

May 19, 2025 -

School Employee Among Fsu Shooting Victims Family Connection To Cia Revealed

May 19, 2025

School Employee Among Fsu Shooting Victims Family Connection To Cia Revealed

May 19, 2025 -

The Morales Knockout Ufc Fighters React To Vegas 106 Headliner

May 19, 2025

The Morales Knockout Ufc Fighters React To Vegas 106 Headliner

May 19, 2025 -

Dyr Sydt Allwyzt Ystdyf Qdas Alqyamt Tghtyt Alwkalt Alwtnyt Llielam

May 19, 2025

Dyr Sydt Allwyzt Ystdyf Qdas Alqyamt Tghtyt Alwkalt Alwtnyt Llielam

May 19, 2025 -

The Eus Tightening Grip A Growing Exodus Of Europeans

May 19, 2025

The Eus Tightening Grip A Growing Exodus Of Europeans

May 19, 2025

Latest Posts

-

Minervois Wine A Guide To Sun Drenched Vineyards And Value Wines

May 19, 2025

Minervois Wine A Guide To Sun Drenched Vineyards And Value Wines

May 19, 2025 -

Sun Kissed Minervois Wines Uncovering Exceptional Quality At Affordable Prices

May 19, 2025

Sun Kissed Minervois Wines Uncovering Exceptional Quality At Affordable Prices

May 19, 2025 -

Celebrating Vermonts 2025 Presidential Scholars

May 19, 2025

Celebrating Vermonts 2025 Presidential Scholars

May 19, 2025 -

Vermont Agency Of Education 2025 Presidential Scholars Revealed

May 19, 2025

Vermont Agency Of Education 2025 Presidential Scholars Revealed

May 19, 2025 -

Justice For Stolen Dreams A Restaurant Owners Plea For Accountability

May 19, 2025

Justice For Stolen Dreams A Restaurant Owners Plea For Accountability

May 19, 2025