Uber Stock And Recession: A Deeper Dive Into Analyst Predictions

Table of Contents

Analyst Sentiment on Uber Stock During a Recession

The analyst community is divided on the future performance of Uber stock (UBER) during a potential recession. Some offer bearish predictions, while others maintain a more bullish outlook. Understanding these differing viewpoints is crucial for investors.

Bearish Predictions and Their Rationale

Several analysts predict a negative impact on Uber stock due to decreased consumer spending during a recession. Their rationale centers around the discretionary nature of Uber's services.

- Reduced discretionary spending on rides: As consumers tighten their belts, they may opt for cheaper alternatives to ride-sharing, such as public transportation or carpooling. This could lead to a decline in ride volume and revenue for Uber.

- Lower food delivery orders: Similarly, demand for food delivery services, another key revenue stream for Uber Eats, might decrease as consumers reduce their spending on restaurant meals and opt for home-cooked food.

- Impact on advertising revenue: Uber's advertising revenue could also suffer as businesses reduce their marketing budgets in response to economic uncertainty.

- Potential for layoffs and cost-cutting measures by Uber: To mitigate losses, Uber might implement cost-cutting measures, including potential layoffs, which could negatively impact investor confidence.

For example, Analyst X from Investment Firm Y recently issued a report predicting a drop in Uber's stock price to $15 per share, citing concerns about reduced consumer spending and increased competition. Another report from Analyst Z forecasts a decline in revenue due to decreased ride demand. These predictions highlight potential risks and challenges for Uber during a recessionary period.

Bullish Predictions and Supporting Arguments

Conversely, some analysts believe Uber stock might demonstrate resilience or even benefit in certain aspects during a recession. Their arguments focus on Uber's adaptability and diversified revenue streams.

- Uber's potential for cost-cutting and efficiency gains: Uber has a proven track record of implementing cost-cutting measures, and a recession could provide further impetus for efficiency improvements.

- Increased demand for affordable transportation: During a recession, consumers may seek more affordable transportation options, potentially increasing the demand for Uber's services.

- Potential increase in delivery service usage: Consumers might increase their reliance on food delivery services as dining out becomes less affordable.

- Diversified revenue streams: Uber's diversification beyond ride-sharing, encompassing food delivery (Uber Eats), freight transportation (Uber Freight), and other services, could help cushion the impact of a recession on any single segment.

Analyst A from Investment Firm B, for instance, argues that Uber's cost-cutting measures and diversified revenue streams will mitigate the negative impact of a recession. Their report suggests that Uber's stock price could remain relatively stable, even demonstrating modest growth. This bullish outlook emphasizes the potential adaptability and resilience of the Uber business model.

Factors Influencing Uber Stock Price Volatility

Numerous factors, both macroeconomic and company-specific, influence Uber stock price volatility. Understanding these factors is essential for informed investment decisions.

Macroeconomic Conditions and Their Impact

Macroeconomic conditions significantly impact Uber's performance. These include:

- Impact of inflation on fuel prices and operating costs: Rising fuel prices directly impact Uber's operating costs, potentially squeezing profit margins and impacting stock prices.

- Effect of interest rate hikes on borrowing costs: Increased interest rates make borrowing more expensive, potentially hindering Uber's expansion plans and affecting its overall financial health.

- Correlation between GDP growth and Uber's revenue: Uber's revenue is closely tied to overall economic growth. A decline in GDP growth typically translates to reduced consumer spending and lower demand for Uber's services.

Company-Specific Factors

Internal factors also play a crucial role in Uber stock price fluctuations:

- Impact of driver compensation and retention: Attracting and retaining drivers is crucial for Uber's operations. Changes in driver compensation strategies can significantly impact its profitability and stock price.

- Success of new initiatives (e.g., freight, autonomous vehicles): The success or failure of Uber's expansion into new areas, such as freight transportation and autonomous vehicles, directly influences its future growth prospects and stock valuation.

- Effectiveness of cost-cutting measures: The efficiency and effectiveness of Uber's cost-cutting initiatives are critical to its ability to weather economic downturns.

- Competitive landscape: Uber operates in a competitive market. The actions of its rivals, such as Lyft and other ride-sharing and food delivery companies, can significantly impact its market share and stock price.

Investing Strategies During Uncertainty

Navigating the uncertainty surrounding Uber stock during a potential recession requires a thoughtful investment strategy.

Risk Mitigation Techniques for Uber Stock Investors

Investors can employ several strategies to mitigate risk:

- Building a diversified investment portfolio: Diversification across different asset classes reduces reliance on any single investment, limiting potential losses.

- Spreading investments across different asset classes: Don't put all your eggs in one basket. Invest in stocks, bonds, real estate, and other asset classes to reduce risk.

- Gradually investing rather than lump-sum investing: Dollar-cost averaging mitigates the risk of investing a large sum at a market peak.

- Setting stop-loss orders to limit potential losses: Stop-loss orders automatically sell your stock when it reaches a predetermined price, preventing significant losses.

Opportunities and Potential Upside

Despite the recessionary risks, long-term investors might identify opportunities:

- Potential for long-term growth in ride-sharing and food delivery: The long-term growth potential of these sectors remains substantial.

- Opportunities from technological advancements: Uber's investments in technology, such as autonomous vehicles, could yield significant returns in the long term.

- Potential acquisition targets: A recession could create opportunities for Uber to acquire smaller, struggling competitors at attractive valuations.

- Valuation discrepancies: A market downturn might create valuation discrepancies, presenting buying opportunities for long-term investors.

Conclusion

Analyst predictions on Uber stock during a potential recession are mixed, with both bullish and bearish viewpoints presented. Understanding these differing perspectives, along with the influence of macroeconomic and company-specific factors, is crucial for informed investment decisions. While a recession presents challenges, Uber's adaptability and diversified revenue streams offer potential resilience. Conduct thorough research and consult with a financial advisor before making any decisions regarding your Uber stock investments. Stay informed about the latest news and analyst predictions on Uber stock to navigate this period of market uncertainty effectively. Consider diversifying your portfolio to mitigate risks associated with Uber stock price volatility. Remember that investing in the stock market always carries risk, so only invest what you can afford to lose.

Featured Posts

-

Blue Origins Launch Abort Vehicle Subsystem Problem Delays Mission

May 18, 2025

Blue Origins Launch Abort Vehicle Subsystem Problem Delays Mission

May 18, 2025 -

Radio 94 5 Maneskins Damiano Davids Electrifying Jimmy Kimmel Live Performance

May 18, 2025

Radio 94 5 Maneskins Damiano Davids Electrifying Jimmy Kimmel Live Performance

May 18, 2025 -

Megethi Rekor Stin Eyropaiki Naytilia Mia Analytiki Matia

May 18, 2025

Megethi Rekor Stin Eyropaiki Naytilia Mia Analytiki Matia

May 18, 2025 -

Huge New City Pickle Pickleball Center Opening In Nyc 60 000 Square Feet

May 18, 2025

Huge New City Pickle Pickleball Center Opening In Nyc 60 000 Square Feet

May 18, 2025 -

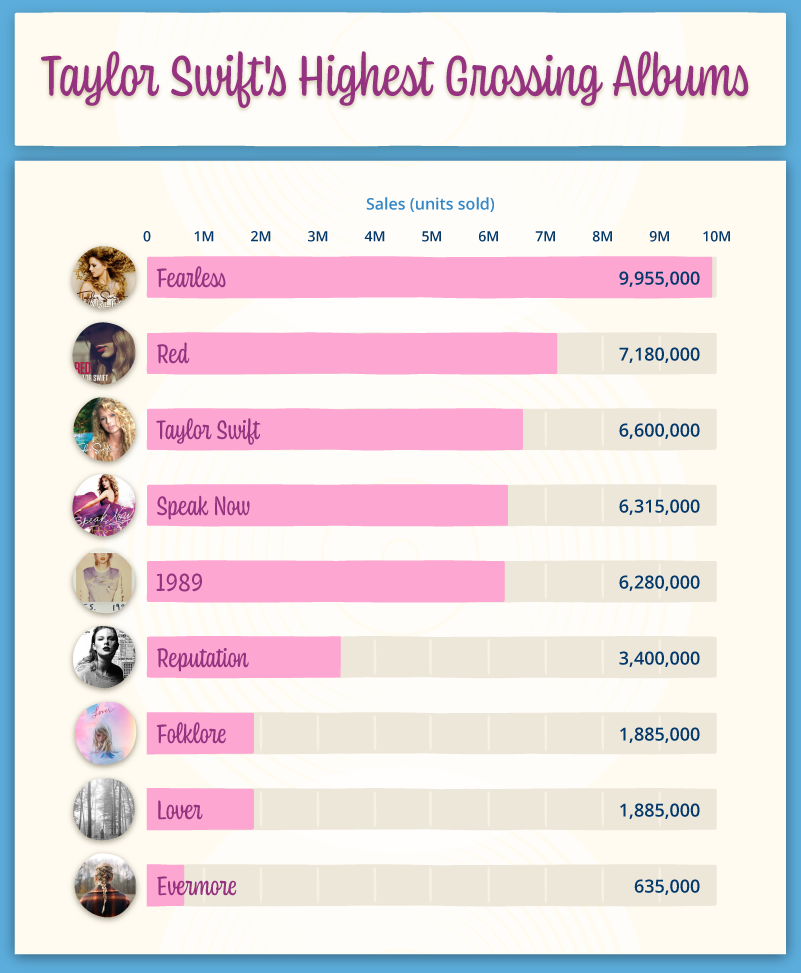

Ranking Taylor Swifts Albums A Critical Review Of All 11

May 18, 2025

Ranking Taylor Swifts Albums A Critical Review Of All 11

May 18, 2025

Latest Posts

-

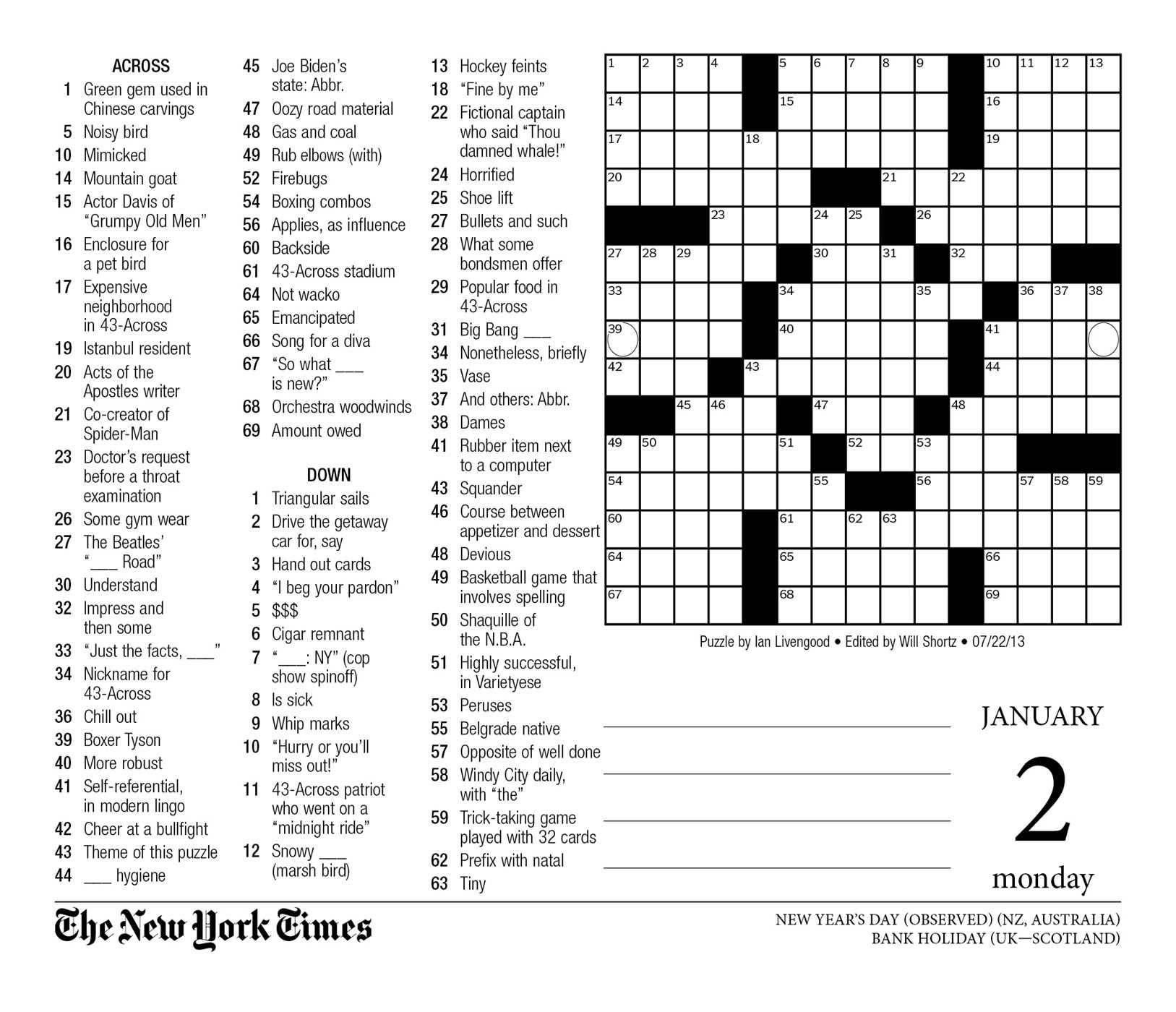

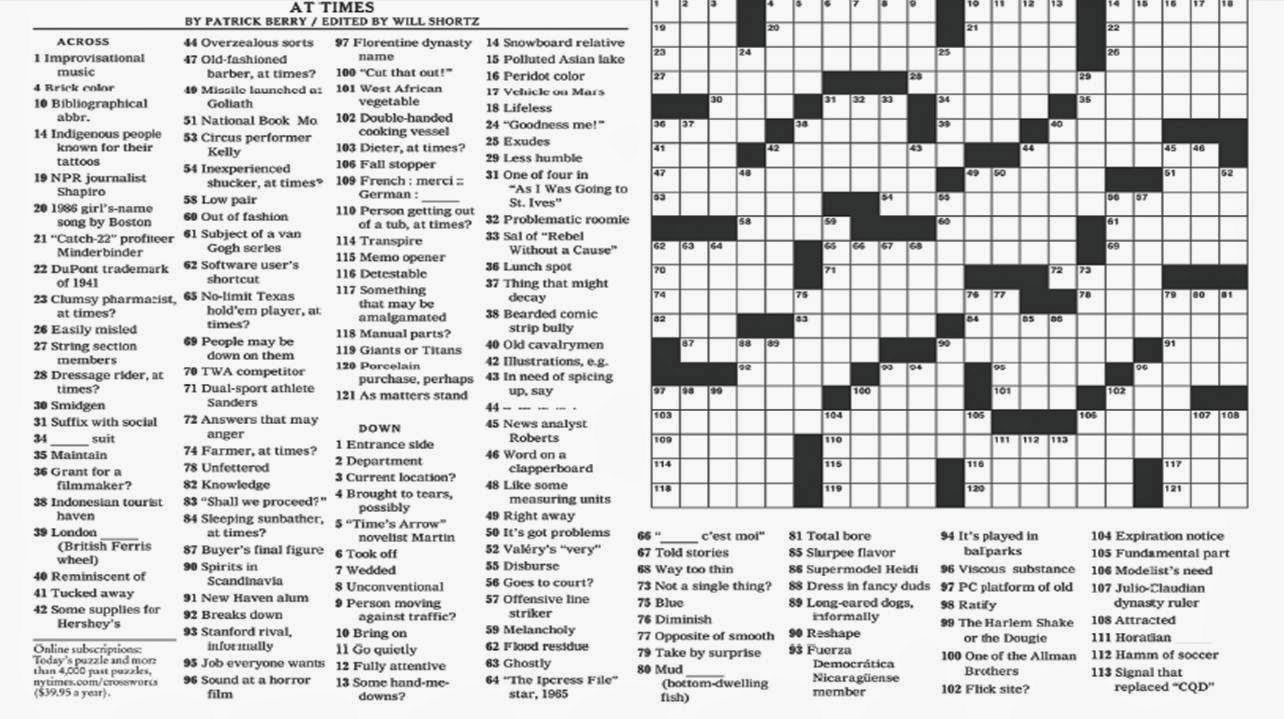

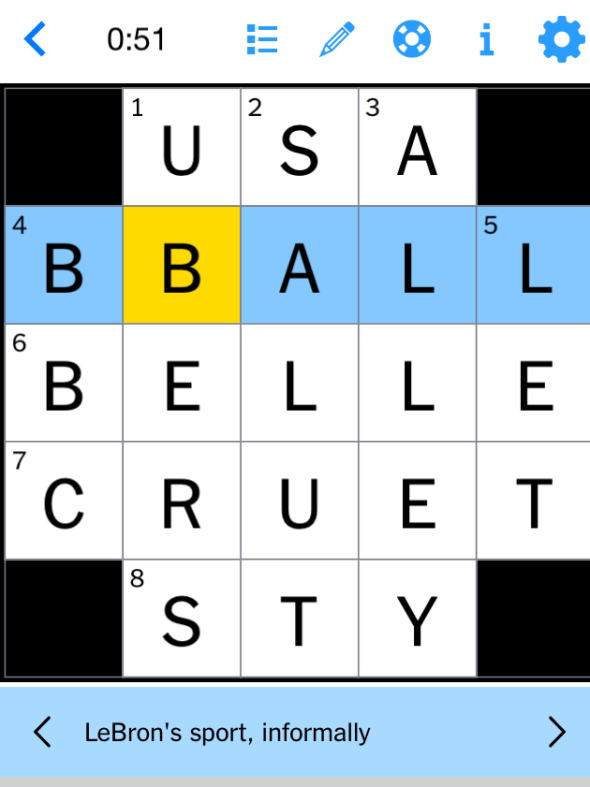

Solve The Nyt Mini Crossword Hints And Answers For April 8 2025

May 19, 2025

Solve The Nyt Mini Crossword Hints And Answers For April 8 2025

May 19, 2025 -

Nyt Mini Crossword Answers Sunday May 11 Complete Clue Guide

May 19, 2025

Nyt Mini Crossword Answers Sunday May 11 Complete Clue Guide

May 19, 2025 -

Nyt Mini Crossword Solutions April 8 2025 Tuesday

May 19, 2025

Nyt Mini Crossword Solutions April 8 2025 Tuesday

May 19, 2025 -

Nyt Mini Crossword March 5 2025 Solutions And Clues

May 19, 2025

Nyt Mini Crossword March 5 2025 Solutions And Clues

May 19, 2025 -

Nyt Mini Crossword Today Hints And Answers For March 5 2025

May 19, 2025

Nyt Mini Crossword Today Hints And Answers For March 5 2025

May 19, 2025