Uber Stock Performance And The Future Of Robotaxis

Table of Contents

Uber's Current Stock Performance and Market Valuation

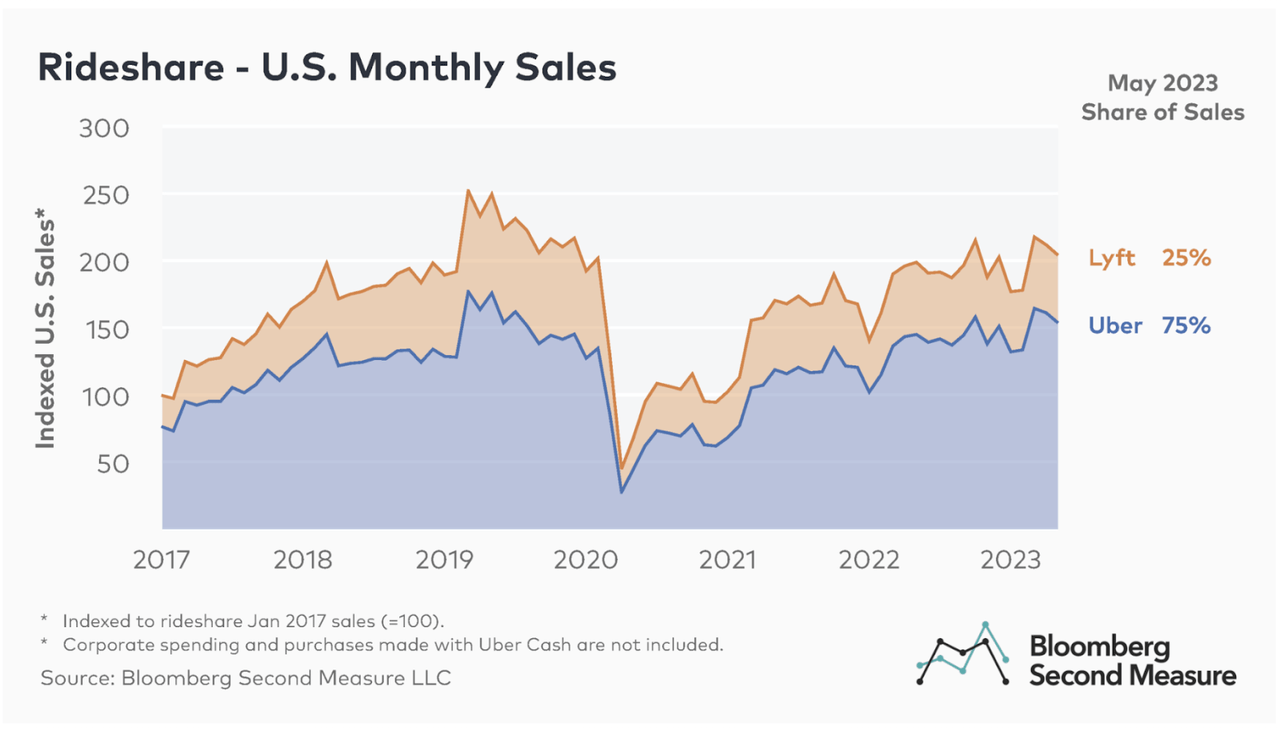

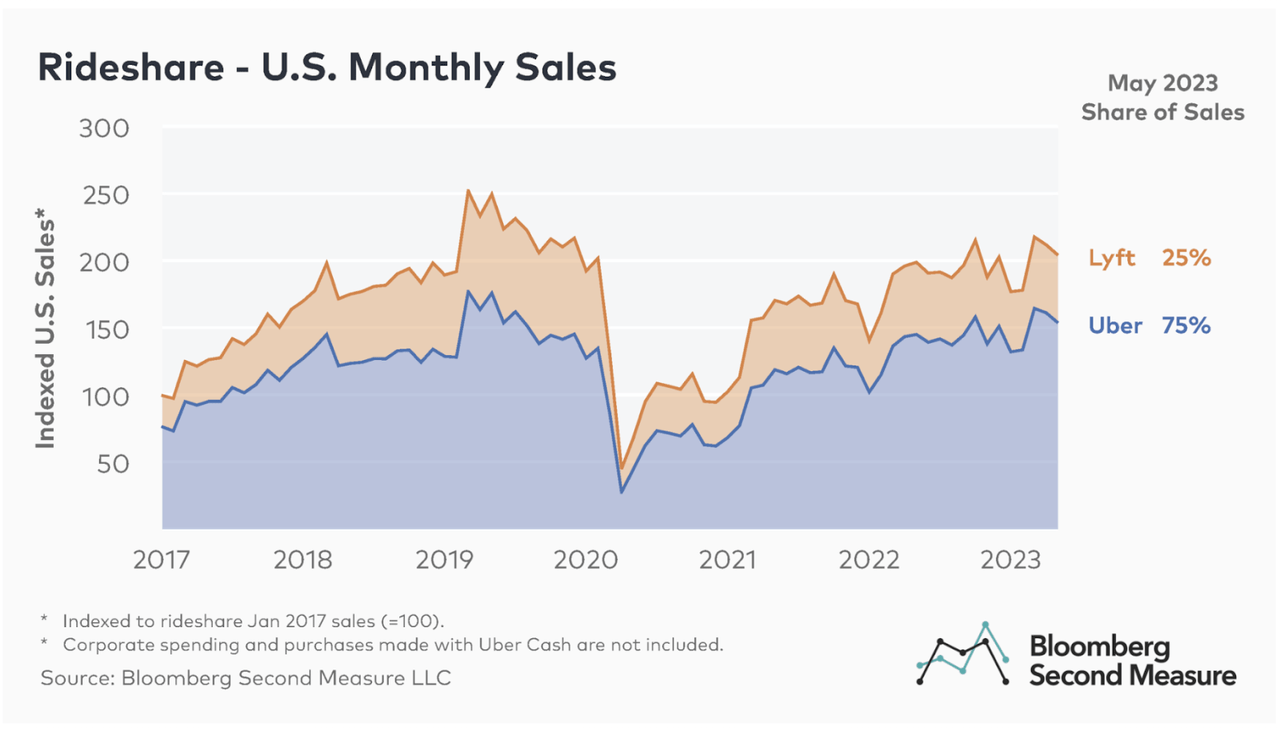

Uber's stock price has experienced significant fluctuations in recent years. While initially promising, the company has faced challenges in achieving consistent profitability, battling intense competition, and navigating regulatory hurdles. Factors influencing Uber's stock price include: fluctuating ride demand, increasing operating costs, and the ongoing battle for market share against competitors like Lyft and regional players. Analyzing Uber's stock performance requires a look at key metrics beyond just the share price. This includes considering its market capitalization, price-to-earnings ratio (P/E), and revenue growth.

- Specific price points and dates of significant changes: For example, note any significant spikes or dips correlated with specific news events, such as regulatory changes or announcements regarding robotaxi progress. (Include specific examples with dates and prices if possible, referencing credible financial news sources).

- Comparison to competitor stock performance (e.g., Lyft, Waymo): A comparative analysis highlighting Uber's performance relative to its main competitors provides valuable context. (Include a chart or table visualizing this comparison, if possible).

- Analyst ratings and predictions: Incorporate data from reputable financial analysts regarding their ratings and future predictions for Uber's stock. (Cite sources appropriately).

Uber's Investments in Autonomous Vehicle Technology

Uber's commitment to autonomous vehicle technology is substantial, representing a significant long-term investment aimed at revolutionizing its business model. This commitment is evident through: strategic partnerships with self-driving companies, significant acquisitions of autonomous vehicle technology firms, and substantial investment in its own in-house R&D efforts. The successful deployment of robotaxis could dramatically impact Uber's profitability and market share, potentially lowering operating costs and expanding its service offerings. However, challenges remain.

- Key partnerships with self-driving technology companies: List and briefly describe key partnerships, highlighting their strategic importance to Uber's autonomous vehicle strategy.

- Timeline for expected robotaxi rollout in key markets: Discuss Uber's projected timeline for the launch of robotaxi services, specifying target markets.

- Investment amounts and projected return on investment: Include information on the financial investment Uber has made in this area and the projected return on investment (ROI), if available. This requires careful analysis of publicly available financial reports.

The Impact of Robotaxis on Uber's Business Model

The introduction of robotaxis has the potential to significantly disrupt Uber's existing business model, offering both opportunities and challenges. The primary benefit lies in the potential for drastically reduced labor costs, as autonomous vehicles eliminate the need for human drivers. This could translate to lower fares for riders and increased profit margins for Uber. However, the transition will undoubtedly present obstacles.

- Projected cost savings from reduced driver expenses: Quantify the potential cost savings if feasible, using estimates based on current driver compensation and projected operating costs for autonomous vehicles.

- Potential increase in ridership due to lower fares: Discuss the potential increase in demand due to lower fares resulting from automation.

- New market opportunities and expansion plans: Analyze the potential for expansion into new service areas and the creation of new revenue streams, such as autonomous delivery services or subscription models. For example, Uber Eats could leverage autonomous delivery for greater efficiency and reach.

Regulatory Landscape and Future Outlook for Robotaxis

The regulatory landscape for autonomous vehicles is complex and varies significantly across different jurisdictions. Regulations concerning safety testing, liability, and data privacy pose significant hurdles for Uber's robotaxi plans. These regulatory challenges will significantly impact the timeline and feasibility of widespread robotaxi deployment. The future regulatory environment will be a key determinant of Uber's success in this area.

- Key regulatory hurdles in different regions: Identify and discuss major regulatory hurdles in key markets where Uber plans to deploy robotaxis.

- Potential changes in legislation impacting autonomous vehicle deployment: Analyze potential future legislative changes and their impact on the industry.

- Expert opinions and predictions about the future regulatory landscape: Incorporate expert opinions on the future regulatory outlook for autonomous vehicles.

Conclusion: Investing in the Future of Uber and Robotaxis

Uber's stock performance is inextricably linked to the success of its robotaxi initiative. While the technology holds immense potential to revolutionize transportation and increase profitability, regulatory hurdles and technological challenges remain. The successful deployment of robotaxis could lead to significant cost reductions, increased market share, and the creation of new revenue streams. However, investors need to carefully consider the risks associated with this ambitious undertaking. Further research into "Uber stock performance" and the "future of robotaxis," including analysis of financial reports and industry expert opinions, is crucial for anyone considering investing in this dynamic sector. Understanding the interplay between Uber's stock performance and the progress of its robotaxi program is key to making informed investment decisions.

Featured Posts

-

Flamengo Vs Liga De Quito Analisis Previo A La Fecha 3 De Libertadores

May 08, 2025

Flamengo Vs Liga De Quito Analisis Previo A La Fecha 3 De Libertadores

May 08, 2025 -

Bitcoin Madenciliginin Sonu Mu Yaklasiyor

May 08, 2025

Bitcoin Madenciliginin Sonu Mu Yaklasiyor

May 08, 2025 -

Daily Lotto Results Friday April 18th 2025

May 08, 2025

Daily Lotto Results Friday April 18th 2025

May 08, 2025 -

Daily Lotto Draw Results Thursday 17th April 2025

May 08, 2025

Daily Lotto Draw Results Thursday 17th April 2025

May 08, 2025 -

Star Wars New Tv Show To Reveal The Origin Of A Rogue One Hero

May 08, 2025

Star Wars New Tv Show To Reveal The Origin Of A Rogue One Hero

May 08, 2025