Uber Stock Recession Resistance: Analyst Insights

Table of Contents

Uber's Diversified Revenue Streams: A Key to Recession Resistance

Uber's success doesn't solely depend on its ride-sharing services. Its diversified revenue streams contribute significantly to its potential for recession resistance. Let's examine the key components:

Ride-Sharing's Resilience:

Even during economic downturns, people still need transportation. While discretionary travel might decrease, essential commutes and travel remain relatively consistent. This provides a base level of revenue for Uber. Several factors contribute to ride-sharing's resilience:

- Dynamic Pricing: Uber's pricing model adjusts to demand, helping maintain profitability even during periods of lower ridership.

- Cost Optimization: Uber consistently focuses on cost-cutting measures and operational efficiency, crucial for navigating economic slowdowns.

- Data-Driven Approach: Uber utilizes data analytics to optimize pricing, driver allocation, and service availability, maximizing efficiency and revenue.

The Strength of Uber Eats:

The food delivery sector has proven remarkably resilient, even during economic hardship. People tend to reduce restaurant dining but often maintain or increase food delivery orders. Uber Eats benefits from this trend:

- Expanding Services: Uber Eats' growth potential extends beyond restaurant deliveries, encompassing grocery delivery and other ancillary services. This diversification further mitigates risk.

- Strategic Partnerships: Collaborations with restaurants and grocery chains expand reach and enhance customer loyalty.

- Delivery Optimization: Uber continuously works on optimizing delivery routes and minimizing delivery times, improving efficiency and customer satisfaction.

Freight and Other Emerging Businesses:

Uber isn't solely focused on ride-sharing and food delivery. Its foray into freight and other emerging businesses diversifies its revenue sources even further, reducing reliance on potentially more volatile sectors.

- Diversification Strategy: Expanding into less volatile sectors like freight reduces overall risk and strengthens resilience.

- Financial Performance Analysis: The financial performance of these emerging businesses is crucial in evaluating Uber's overall recession resistance.

- Strategic Acquisitions and Partnerships: Strategic moves to acquire or partner with companies in complementary sectors enhance its market position and resilience.

Analyst Predictions and Stock Performance:

Analyzing analyst predictions and Uber's historical stock performance provides valuable insights into its potential for recession resistance.

Examining Analyst Ratings:

Major financial analysts offer a range of opinions on Uber stock, expressed through buy, hold, and sell recommendations. Analyzing these ratings provides a broader picture:

- Buy, Hold, Sell Recommendations: A summary of analyst ratings offers a consensus view on the stock's future performance.

- Price Targets: Analyst price targets provide insights into potential future stock price movements.

- Analyst Biases: It's important to consider potential biases and conflicts of interest when evaluating analyst opinions.

- Sector Comparisons: Comparing Uber's performance and analyst ratings to similar companies in the transportation and technology sectors provides valuable context.

Historical Stock Performance During Previous Recessions:

Examining Uber's performance during past economic downturns is crucial in assessing its potential resilience:

- Past Recession Performance: Analyzing how Uber performed during previous recessions helps predict its behavior in future downturns.

- Resilience Factors: Understanding the factors that contributed to Uber's resilience (or vulnerability) during past recessions is vital.

- Tech Stock Comparisons: Comparing Uber's performance to other tech stocks during the same periods provides a valuable benchmark.

- Identifying Patterns: Identifying patterns and lessons learned from past performance can inform future investment strategies.

Risks and Considerations:

While Uber demonstrates potential for recession resistance, several risks and considerations must be factored in:

Regulatory Hurdles and Competition:

The ride-sharing and food delivery industries face significant regulatory challenges and intense competition:

- Competitive Landscape: Analyzing the competitive landscape helps assess Uber's ability to maintain market share and profitability.

- Regulatory Challenges: Ongoing regulatory changes and potential lawsuits can significantly impact profitability.

- Adaptability to Regulations: Uber's ability to adapt to evolving regulations is crucial for its long-term success.

- Competitive Threats: New entrants and existing competitors constantly pose a threat to Uber's market dominance.

Macroeconomic Factors and Inflation:

Macroeconomic factors, particularly inflation, significantly impact Uber's performance:

- Inflationary Pressures: Rising inflation affects operating costs and consumer spending, potentially impacting demand.

- Economic Scenario Analysis: Conducting sensitivity analyses to assess Uber's performance under various economic scenarios is crucial.

- Interest Rate Impact: Rising interest rates can impact Uber's valuation and make investments less attractive.

- Geopolitical Risks: Geopolitical events and uncertainties can create unpredictable market volatility.

Conclusion:

This article explored whether Uber stock exhibits recession resistance, examining its diversified revenue streams, analyst predictions, and inherent risks. While Uber's diversified business model – encompassing ride-sharing, Uber Eats, and other ventures – offers a degree of protection against economic downturns, investors should carefully weigh the potential risks alongside its strengths. The analysis suggests that Uber stock may offer some resilience, but thorough due diligence and consideration of macroeconomic factors remain crucial. Before investing in Uber stock or any other investment, conduct thorough research and consider consulting with a financial advisor. Make informed decisions regarding your Uber stock investment strategy, and remember that past performance does not guarantee future results. Understanding the nuances of recession-proof stocks and carefully evaluating the potential for Uber stock to be a safe haven is paramount for any investor.

Featured Posts

-

Actor Miles Caton Eyes Spider Man Role In Mcu

May 18, 2025

Actor Miles Caton Eyes Spider Man Role In Mcu

May 18, 2025 -

Uber Pet New Cities Added Delhi And Mumbai

May 18, 2025

Uber Pet New Cities Added Delhi And Mumbai

May 18, 2025 -

Spring Breakout Rosters 2025 Unveiling The Teams

May 18, 2025

Spring Breakout Rosters 2025 Unveiling The Teams

May 18, 2025 -

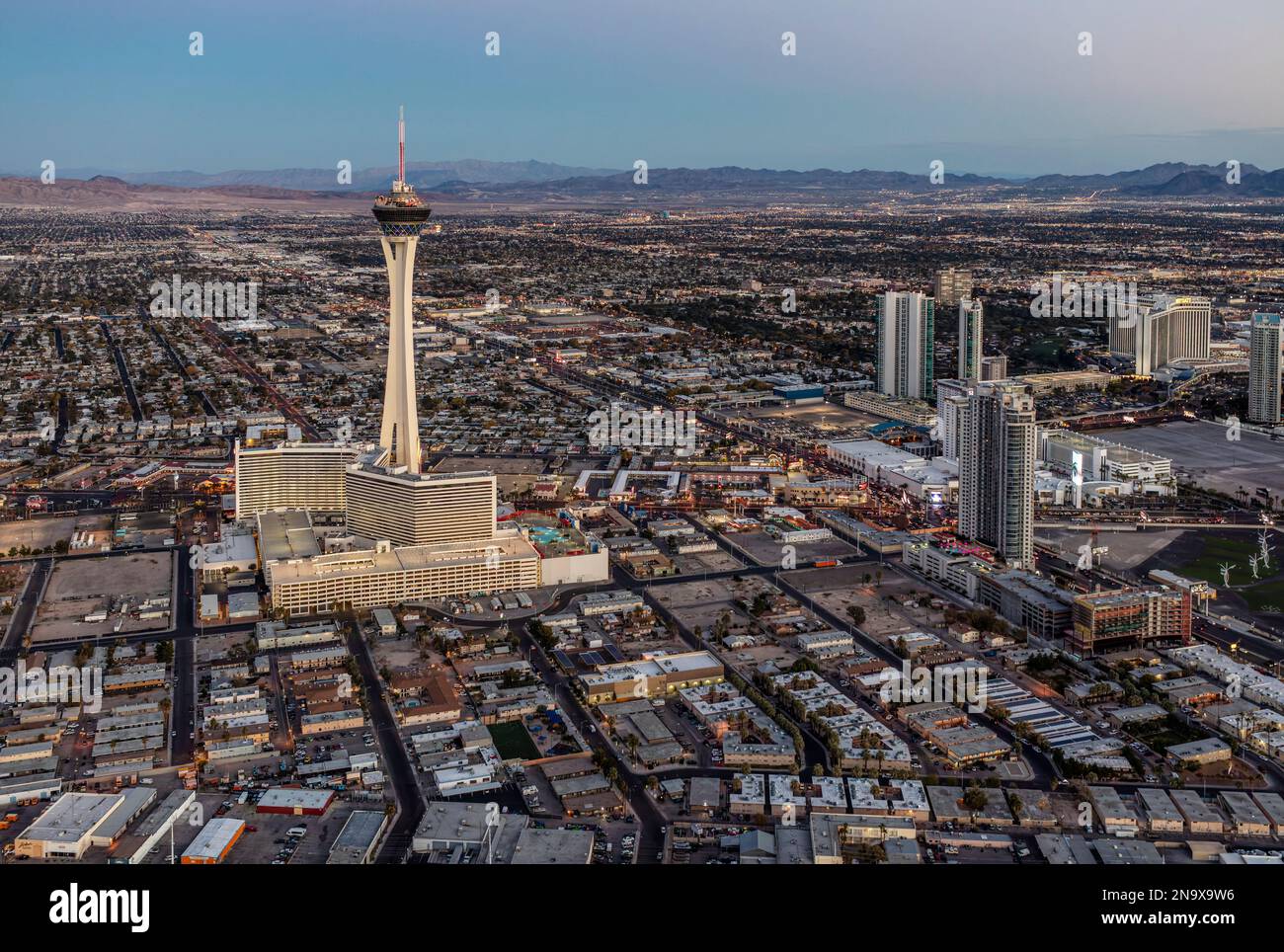

From Vegas World To The Strat A History Of Casino Growth

May 18, 2025

From Vegas World To The Strat A History Of Casino Growth

May 18, 2025 -

April 9th Lotto Winning Numbers Revealed

May 18, 2025

April 9th Lotto Winning Numbers Revealed

May 18, 2025

Latest Posts

-

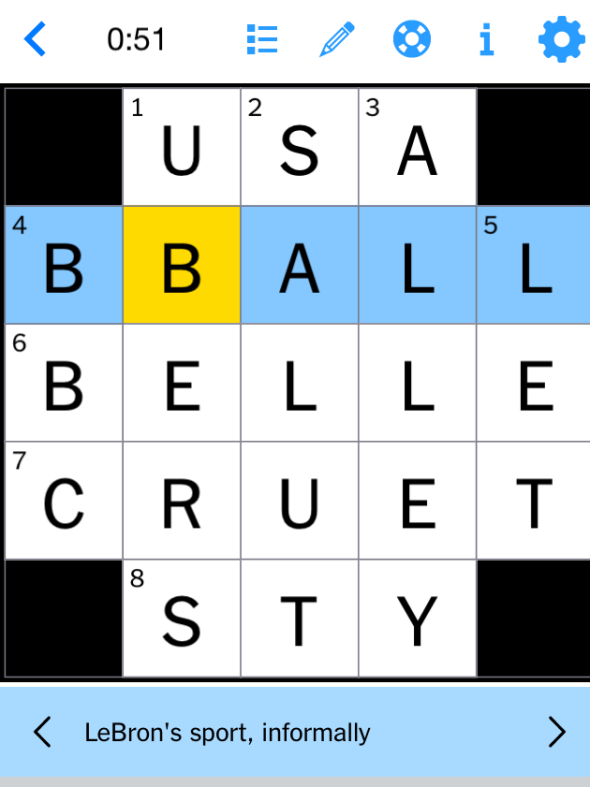

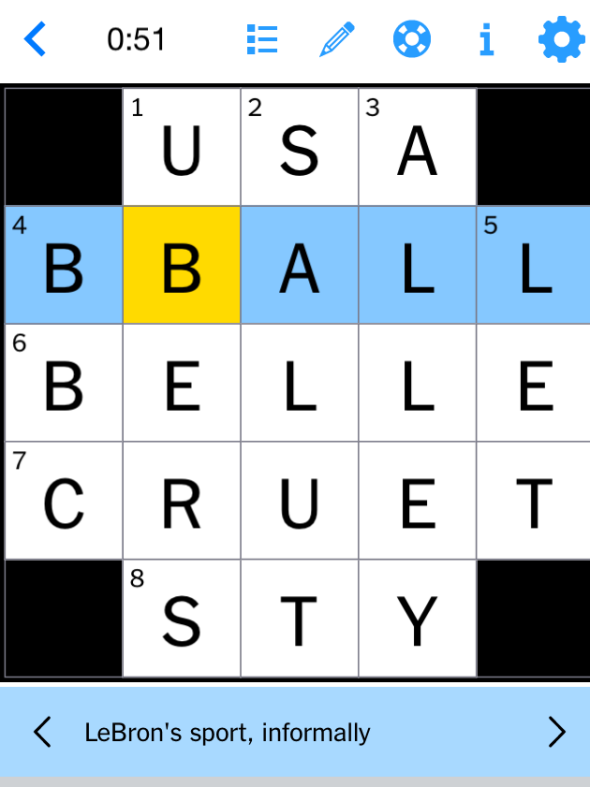

Nyt Mini Crossword Puzzle Solutions March 26 2025

May 19, 2025

Nyt Mini Crossword Puzzle Solutions March 26 2025

May 19, 2025 -

Uber Pet Service Now Available In Delhi And Mumbai

May 19, 2025

Uber Pet Service Now Available In Delhi And Mumbai

May 19, 2025 -

Todays Nyt Mini Crossword Answers March 26 2025

May 19, 2025

Todays Nyt Mini Crossword Answers March 26 2025

May 19, 2025 -

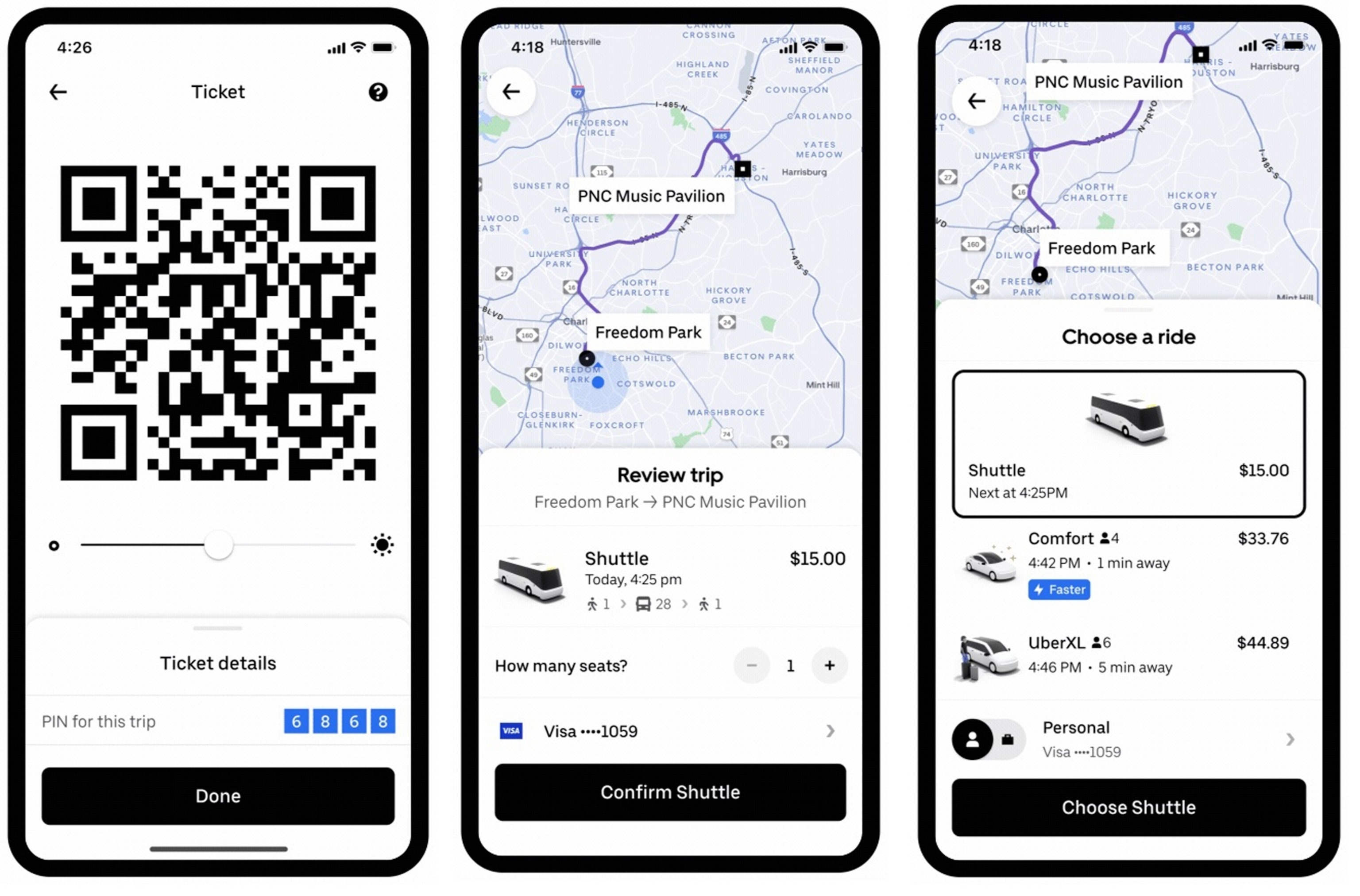

Convenient And Affordable 5 Uber Shuttle Service From United Center

May 19, 2025

Convenient And Affordable 5 Uber Shuttle Service From United Center

May 19, 2025 -

Solve The Nyt Mini Crossword Answers For March 26 2025

May 19, 2025

Solve The Nyt Mini Crossword Answers For March 26 2025

May 19, 2025