Uber Stock Surge: Understanding April's Double-Digit Rally

Table of Contents

Strong First-Quarter Earnings Beat Expectations

Uber's Q1 2024 earnings report played a pivotal role in the April Uber stock surge. The results significantly exceeded analyst predictions, boosting investor confidence and driving up the Uber stock price.

Revenue Growth Exceeded Forecasts

Uber's Q1 2024 revenue growth was a major catalyst for the stock's rally. The company demonstrated impressive performance across its key segments:

- Strong growth in the ride-sharing segment: Increased ridership, particularly in key markets, fueled substantial revenue growth in this core segment of Uber's business. This indicates a strong recovery in travel and a continued reliance on Uber's ride-hailing services.

- Increased adoption of Uber Eats: The food delivery segment also contributed significantly to overall revenue growth. Expanding partnerships with restaurants and increased marketing efforts likely contributed to this positive trend.

- Improved profitability margins: Uber demonstrated significant improvements in its operating margins, showcasing a greater efficiency in managing costs and maximizing revenue. This is crucial for long-term investor confidence.

- Successful cost-cutting measures: Strategic cost-cutting initiatives, implemented in previous quarters, yielded positive results, improving profitability and demonstrating the company's commitment to financial responsibility.

Improved Profitability and Guidance

Beyond revenue growth, Uber's Q1 report showcased a marked improvement in profitability, surpassing even the most optimistic analyst projections. This positive trend extends to the company's future guidance:

- Increased efficiency in operations: Operational improvements, driven by technological advancements and streamlined processes, directly contributed to enhanced profitability.

- Strategic investments paying off: Previous investments in technology and infrastructure are now delivering significant returns, solidifying Uber's position as a leader in the ride-sharing and delivery sectors.

- Positive future guidance: Uber's confident outlook for future earnings further bolstered investor sentiment, suggesting sustained growth and profitability in the coming quarters. This positive outlook is a key factor in the continued strength of the Uber stock price.

Positive Market Sentiment and Sector Trends

The April Uber stock surge wasn't solely due to internal factors. Broader market trends and positive sentiment within the ride-sharing sector also played a significant role.

Broader Market Recovery

The overall positive trend in the stock market contributed to the improved performance of Uber stock. A general sense of optimism among investors spilled over into the tech sector, benefiting companies like Uber:

- Decreased market volatility: Reduced uncertainty in the broader market made investors more willing to invest in growth stocks like Uber.

- Increased investor confidence in the tech sector: Positive sentiment towards the tech sector as a whole created a favorable environment for Uber's stock price to rise.

- Positive economic indicators: Favorable economic data, such as employment figures and consumer spending, contributed to the overall market optimism, positively impacting Uber's stock performance.

Ride-Sharing Sector Growth

The ride-sharing sector itself is experiencing a period of strong growth, and Uber is well-positioned to benefit from this trend:

- Increased demand for ride-sharing services: Post-pandemic recovery and increased travel have led to higher demand for ride-sharing, benefitting companies like Uber.

- Expansion into new markets: Uber's continued expansion into new geographical markets provides additional growth opportunities.

- Innovation and technological advancements in ride-sharing: Continuous innovation and technological advancements within the ride-sharing industry, including improved app functionality and safety features, enhance Uber's competitive edge.

Strategic Initiatives and Future Outlook

Beyond the immediate results, Uber's strategic initiatives and long-term growth potential also underpinned the April Uber stock surge.

Focus on Efficiency and Profitability

Uber's sustained focus on operational efficiency and profitability is a key factor driving investor confidence:

- Investments in technology to optimize operations: Ongoing investments in technology enhance operational efficiency, reducing costs and improving profitability.

- Strategic partnerships to expand market reach: Strategic partnerships with other companies broaden Uber's reach and access to new customer segments.

- Emphasis on sustainable business practices: Increased focus on environmental and social responsibility attracts environmentally conscious investors.

Long-Term Growth Potential

Investors are increasingly drawn to Uber's long-term growth potential in emerging areas:

- Investments in autonomous vehicle technology: Uber's continued investment in autonomous vehicle technology positions the company for future growth and potential disruption of the transportation industry.

- Expansion of delivery services beyond food: Expanding into new delivery segments beyond food, like groceries and other goods, opens up significant opportunities for revenue growth.

- Potential for future market disruption: Uber's innovative spirit and disruptive business model create the potential for significant future market growth and influence.

Conclusion

The April double-digit rally in Uber stock resulted from a confluence of factors: exceeding first-quarter earnings expectations, positive market sentiment, and promising long-term growth prospects. The strong revenue growth, improved profitability, and strategic initiatives all contributed to increased investor confidence, fueling the significant rise in the Uber stock price. Understanding these factors provides valuable insights for investors considering their position in the Uber stock market. If you’re interested in learning more about the potential of Uber stock and how its performance continues to shape the ride-sharing and delivery sectors, continue researching the Uber stock surge and its implications for your investment portfolio. Remember to always conduct thorough research and consult with a financial advisor before making any investment decisions.

Featured Posts

-

Rozriv Kanye Vesta Ta B Yanki Tsenzori Scho Stalosya

May 18, 2025

Rozriv Kanye Vesta Ta B Yanki Tsenzori Scho Stalosya

May 18, 2025 -

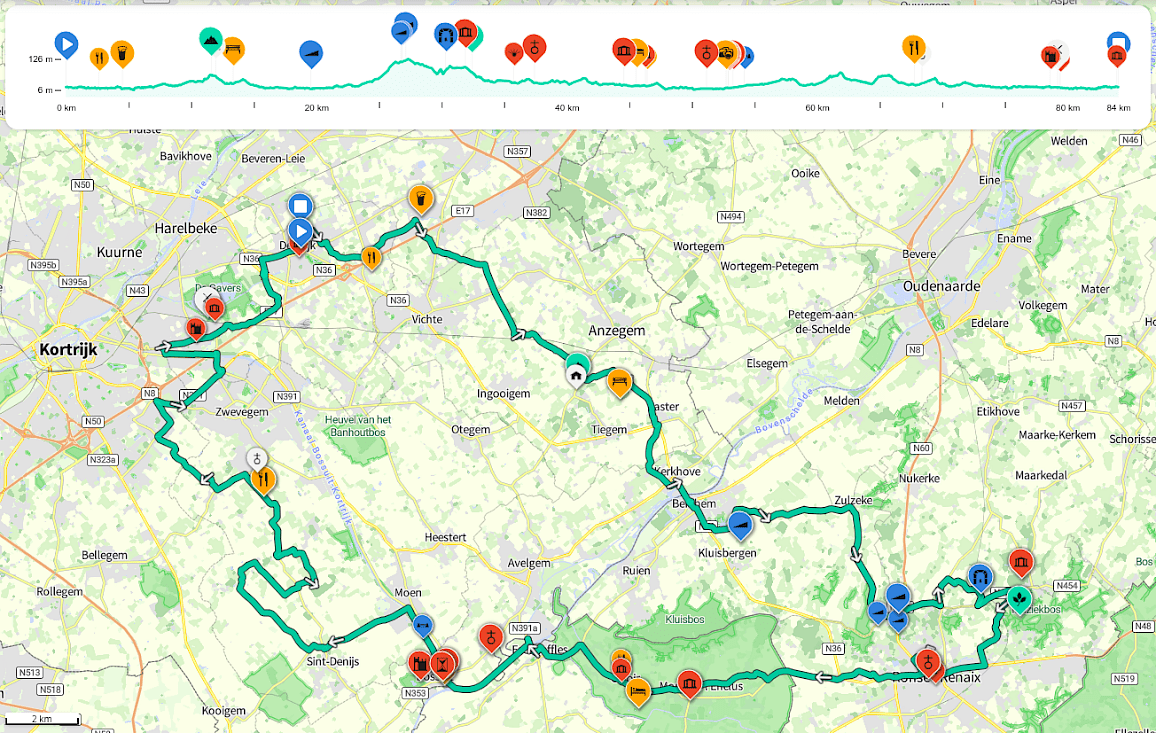

2024 Mlk Day Survey Reveals Divided Public Sentiment

May 18, 2025

2024 Mlk Day Survey Reveals Divided Public Sentiment

May 18, 2025 -

The Gops Medicaid Fight Internal Conflict And Consequences

May 18, 2025

The Gops Medicaid Fight Internal Conflict And Consequences

May 18, 2025 -

The Trump Administration And Stephen Millers Possible Nsa Role

May 18, 2025

The Trump Administration And Stephen Millers Possible Nsa Role

May 18, 2025 -

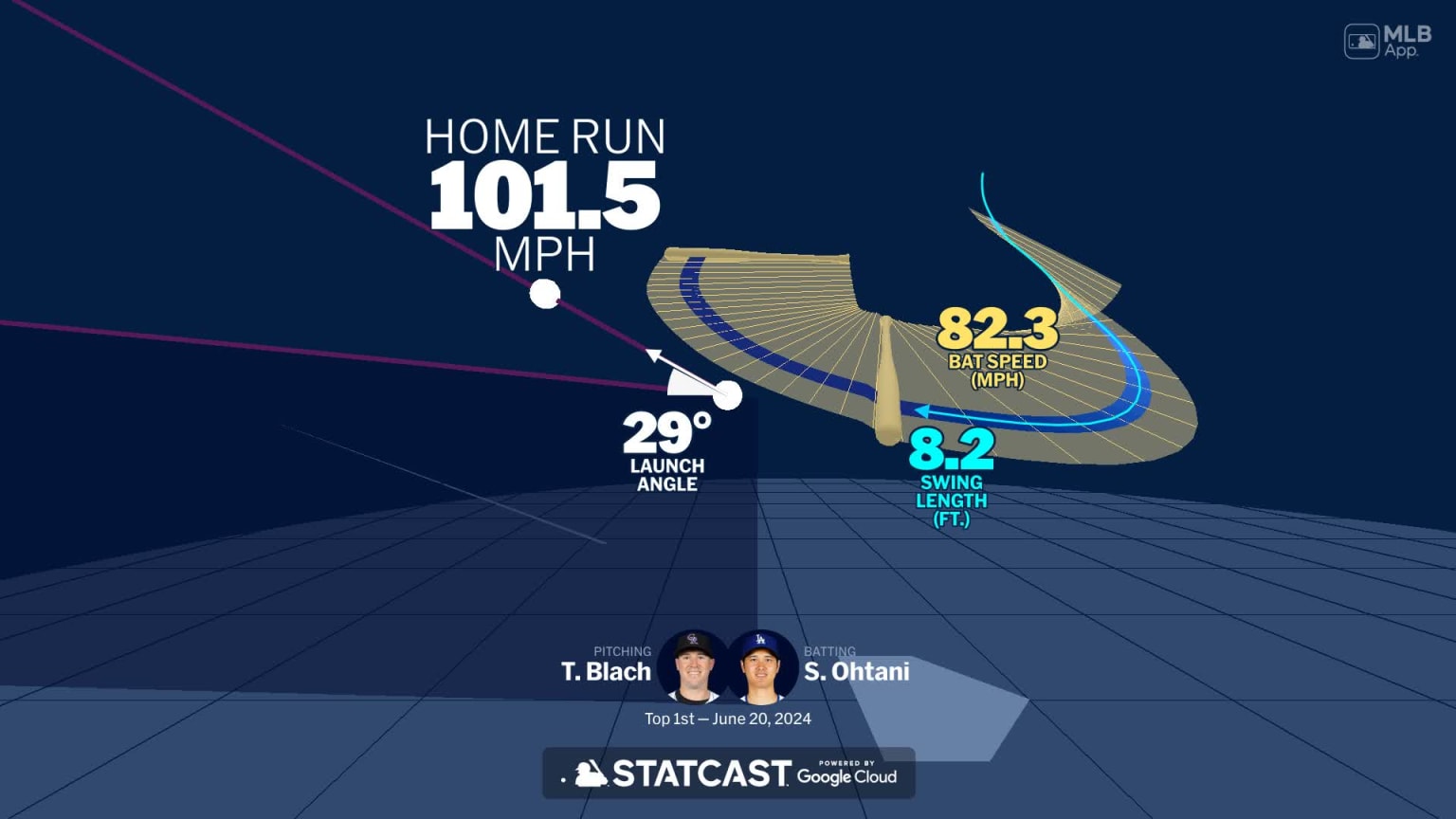

Ohtanis 2 Run Homer Highlights Return To Japan Game

May 18, 2025

Ohtanis 2 Run Homer Highlights Return To Japan Game

May 18, 2025

Latest Posts

-

Get Cashback With Uber Kenya Good News For Riders Drivers And Couriers

May 19, 2025

Get Cashback With Uber Kenya Good News For Riders Drivers And Couriers

May 19, 2025 -

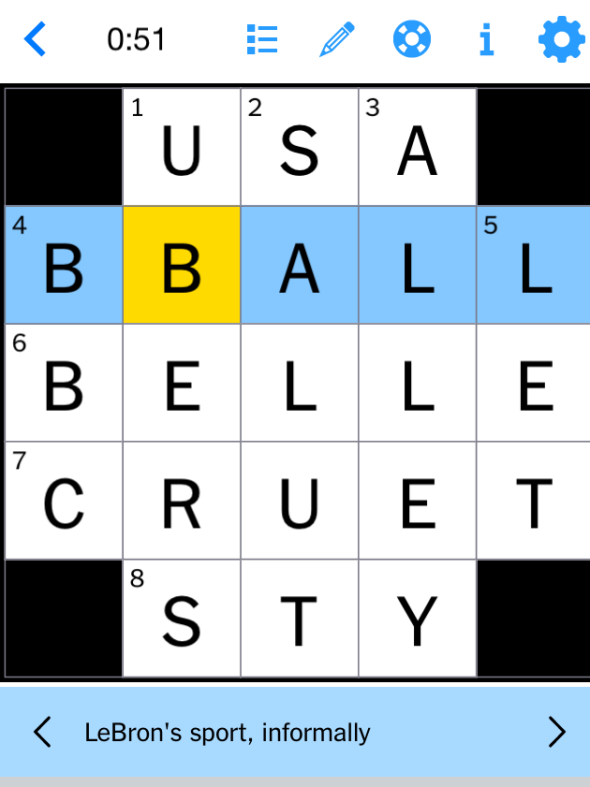

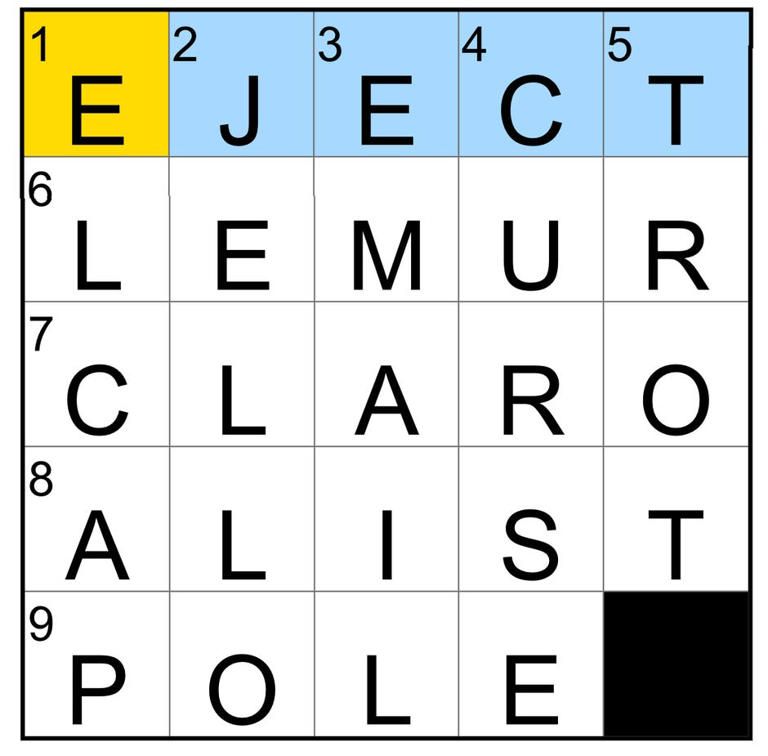

Find The Answers Nyt Mini Crossword March 12 2025

May 19, 2025

Find The Answers Nyt Mini Crossword March 12 2025

May 19, 2025 -

Uber Kenya Announces Cashback Program And Increased Order Volume For Partners

May 19, 2025

Uber Kenya Announces Cashback Program And Increased Order Volume For Partners

May 19, 2025 -

Nyt Mini Crossword Solution March 13 2025

May 19, 2025

Nyt Mini Crossword Solution March 13 2025

May 19, 2025 -

Nyt Mini Crossword Answers March 6 2025

May 19, 2025

Nyt Mini Crossword Answers March 6 2025

May 19, 2025