Uber's Autonomous Vehicles: Are ETFs The Smart Play?

Table of Contents

The Promise and Peril of Autonomous Vehicle Technology

The autonomous vehicle industry is brimming with potential, but the road to widespread adoption is paved with significant challenges.

Technological Challenges and Development Costs

Developing truly reliable self-driving cars presents a formidable technological hurdle. The sheer complexity of autonomous driving technology requires a confluence of sophisticated software and hardware components working seamlessly together.

- Software glitches: Autonomous driving relies heavily on AI and machine learning algorithms, which are prone to unforeseen errors and require constant refinement.

- Sensor limitations: The sensors used for perception (LiDAR, radar, cameras) can be affected by weather conditions, obscuring objects and leading to inaccurate readings.

- Mapping accuracy: Precise, up-to-date maps are crucial for autonomous navigation, demanding extensive and ongoing map creation and maintenance.

- Liability issues: Determining liability in accidents involving autonomous vehicles is a complex legal challenge that still requires clarification.

- Regulatory delays: The regulatory landscape for autonomous vehicles is still evolving, with varying rules and approvals needed across different jurisdictions, potentially slowing down deployment.

These challenges, coupled with the massive capital expenditure required for research, development, testing, and infrastructure, create considerable uncertainty for investors interested in robotaxis and autonomous trucking. The development of truly autonomous driving technology is a marathon, not a sprint.

Market Potential and Adoption Rate

Despite the hurdles, the potential market for autonomous vehicles is enormous. The global robotaxi market alone is projected to experience substantial growth in the coming years.

- Growth forecasts: Various market research firms offer differing forecasts, but all point to significant expansion in the autonomous vehicle market across various sectors.

- Potential applications: Beyond ride-sharing (robotaxis), autonomous vehicles hold immense promise for autonomous trucking, last-mile delivery services, and other logistics applications.

- Consumer acceptance: Public acceptance and trust are crucial for widespread adoption. Overcoming consumer concerns about safety and reliability is paramount.

- Infrastructure requirements: The infrastructure supporting autonomous vehicles needs to be adapted, including smart city initiatives and advancements in communication networks (5G).

Predicting the exact timeline for mass adoption remains difficult, given the interplay of technological advancements, regulatory approvals, and consumer behavior. The market penetration rate will significantly impact the investment landscape.

Investing in Autonomous Vehicles Through ETFs

ETFs provide a diversified way to gain exposure to the autonomous vehicle sector, mitigating some of the inherent risks associated with individual company investments.

Identifying Relevant ETFs

Several ETFs offer exposure to companies involved in various aspects of the autonomous vehicle industry. These can be categorized into:

- Technology ETFs: Many broad technology ETFs hold shares of companies developing autonomous driving technology, AI, and related software.

- Transportation ETFs: These ETFs focus on companies in the transportation sector, including those involved in autonomous vehicle development and deployment.

- Specific company ETFs: Some ETFs might focus on specific companies heavily invested in autonomous vehicles (though this carries higher risk than diversified ETFs).

Remember to check the ETF's holdings to understand the specific companies and their weightings within the portfolio. The diversification offered by ETFs provides a buffer against the failure of a single company.

Understanding ETF Risks and Returns

While ETFs offer diversification, investing in emerging technologies like autonomous driving always carries inherent risks.

- Market volatility: The autonomous vehicle sector is susceptible to significant market fluctuations, especially given the early stage of development and high levels of uncertainty.

- Technological disruption: Rapid technological advancements can render existing technologies obsolete, impacting the value of companies and their associated ETFs.

- Regulatory changes: Changes in regulations can significantly impact the viability and profitability of autonomous vehicle businesses.

- Competition: The autonomous vehicle market is highly competitive, with numerous companies vying for market share.

Despite these risks, the potential return on investment in the autonomous vehicle sector is substantial, particularly for investors with a long-term horizon and a higher risk tolerance. Understanding the volatility and potential for both high gains and significant losses is critical before investing.

Uber's Position in the Autonomous Vehicle Market

Uber's Advanced Technologies Group (ATG) plays a significant role in the autonomous vehicle race.

Uber's ATG (Advanced Technologies Group)

Uber has invested heavily in developing its own autonomous driving technology through its ATG division.

- Uber's ATG initiatives: Uber has conducted extensive testing programs, developed its own self-driving software and hardware, and forged partnerships with various technology providers.

- Partnerships: Collaborations with other companies in the sector can accelerate development and reduce costs.

- Testing programs: Rigorous testing is crucial to refine autonomous driving technology and demonstrate its safety and reliability.

- Deployment strategies: The strategy for deploying autonomous vehicles, including initial launch locations and service offerings, will influence market penetration.

Uber's market share and competitive position relative to other players like Waymo and Cruise will significantly impact the success of its autonomous vehicle endeavors.

Uber's Financial Performance and its Impact on ETF Value

Uber's financial performance in its autonomous vehicle segment directly influences the value of ETFs holding its stock.

- Financial projections: The success or failure of Uber's autonomous driving initiative will impact its overall financial health and valuation.

- Revenue streams from autonomous services: Generating revenue from autonomous ride-sharing and delivery services is crucial for long-term profitability.

- Impact on overall company valuation: Positive progress in autonomous driving will likely boost Uber's overall stock valuation, positively affecting relevant ETFs.

- Potential mergers or acquisitions: Uber may seek strategic mergers or acquisitions to strengthen its position in the autonomous vehicle market.

Analyzing Uber's financial reports and tracking its progress in the autonomous vehicle sector is crucial for investors using ETFs to gain exposure to this space.

Conclusion

Investing in autonomous vehicle technology through ETFs presents a unique opportunity with both significant potential and substantial risk. We've examined the technological hurdles and market potential, the advantages and risks of ETF investing, and Uber's vital role in this rapidly evolving landscape. Remember that even diversified investments carry risks. The key takeaway is the need for thorough research, a clear understanding of your risk tolerance, and a long-term investment perspective. Start your research on autonomous vehicle ETFs today and navigate the exciting world of self-driving car investments!

Featured Posts

-

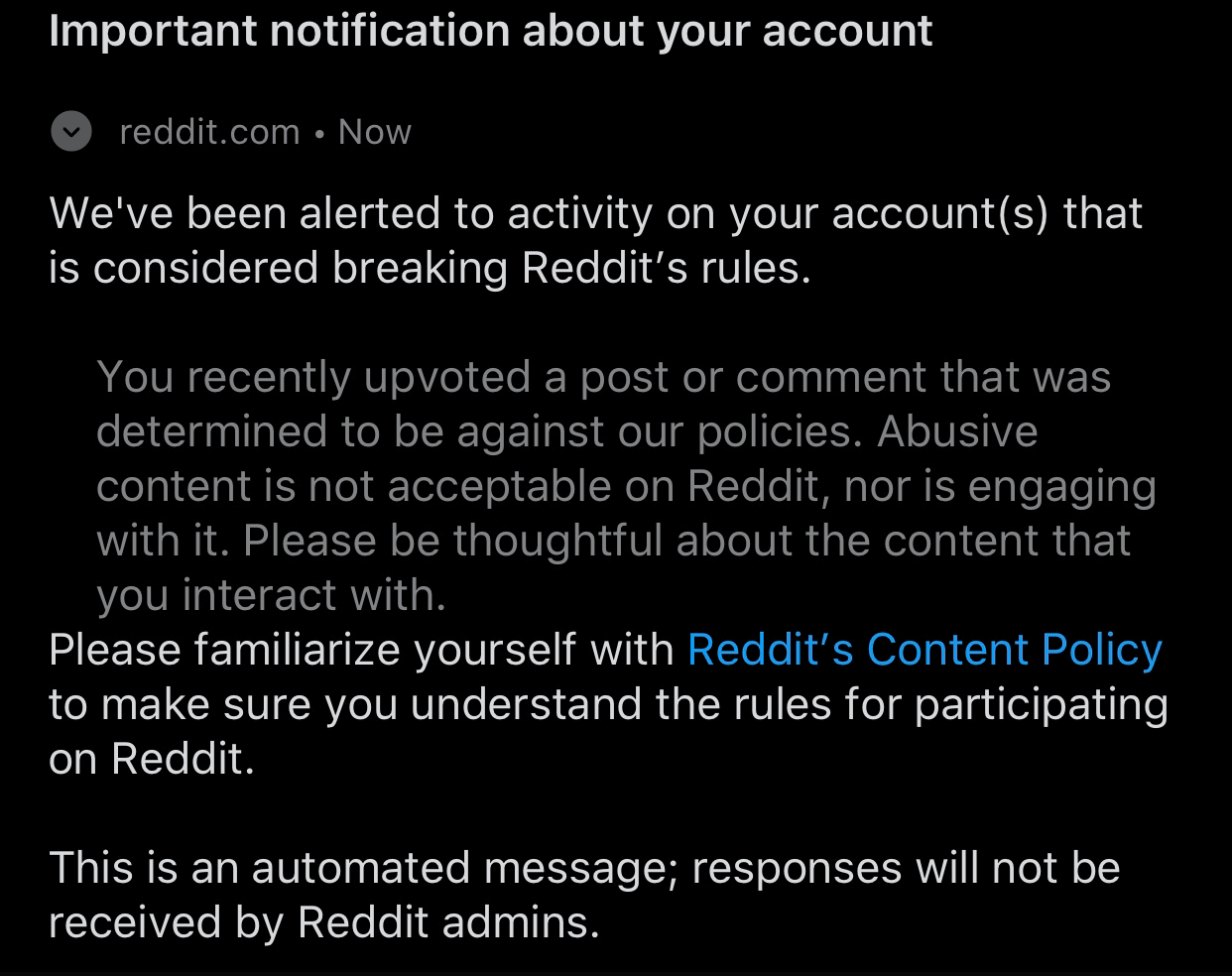

Reddits New Policy Cracking Down On Violent Content Upvotes

May 18, 2025

Reddits New Policy Cracking Down On Violent Content Upvotes

May 18, 2025 -

Play At The Best Virginia Online Casinos In 2025 A Players Guide

May 18, 2025

Play At The Best Virginia Online Casinos In 2025 A Players Guide

May 18, 2025 -

Bowen Yang Addresses Shane Gillis Snl Firing Rumors

May 18, 2025

Bowen Yang Addresses Shane Gillis Snl Firing Rumors

May 18, 2025 -

Disturbing Brooklyn Assault Woman Groped Sex Act Simulated

May 18, 2025

Disturbing Brooklyn Assault Woman Groped Sex Act Simulated

May 18, 2025 -

15 April 2025 Daily Lotto Results Winning Numbers

May 18, 2025

15 April 2025 Daily Lotto Results Winning Numbers

May 18, 2025

Latest Posts

-

Robotaxi Revolution Uber And Waymo Launch Autonomous Ride Hailing In Austin

May 19, 2025

Robotaxi Revolution Uber And Waymo Launch Autonomous Ride Hailing In Austin

May 19, 2025 -

Uber Technologies Uber Investment Potential And Risks

May 19, 2025

Uber Technologies Uber Investment Potential And Risks

May 19, 2025 -

Competition Heats Up Uber And Waymo Roll Out Robotaxi Services In Austin

May 19, 2025

Competition Heats Up Uber And Waymo Roll Out Robotaxi Services In Austin

May 19, 2025 -

Waymo And Uber Expand Autonomous Vehicle Services In Austin Texas

May 19, 2025

Waymo And Uber Expand Autonomous Vehicle Services In Austin Texas

May 19, 2025 -

Uber And Waymos Robotaxi Launch In Austin A New Era Of Autonomous Rides

May 19, 2025

Uber And Waymos Robotaxi Launch In Austin A New Era Of Autonomous Rides

May 19, 2025