UK Households: Don't Ignore New HMRC Nudge Letters

Table of Contents

Identifying Genuine HMRC Nudge Letters

Before you even consider the content, it's vital to verify the legitimacy of the letter itself. Many fraudulent letters mimic official HMRC correspondence, attempting to steal personal and financial information. Identifying genuine HMRC nudge letters is the first step to protecting yourself.

- Official Letterhead and Contact Details: Genuine HMRC letters will always feature the official HMRC letterhead, complete with the correct logo and address. Check for inconsistencies or poor quality printing. The contact details should be readily verifiable on the official HMRC website.

- Unique Reference Numbers: Every HMRC communication, including nudge letters, will contain a unique reference number. This number allows HMRC to quickly identify your specific case. If the number is missing or seems suspicious, be cautious.

- Suspicious Requests: Legitimate HMRC letters will never ask for sensitive information via email or request unusual payment methods. Beware of letters demanding immediate payment through untraceable means like wire transfers to overseas accounts.

Common features of fraudulent letters include:

- Poor grammar and spelling

- Threats of immediate legal action without prior warnings

- Requests for bank details or passwords via email

- Unofficial contact information

Always verify:

- Check the HMRC website for details of current campaigns and communication methods: [Insert Link to HMRC Website]

- Verify the sender's address and contact information independently.

- Never respond to emails requesting sensitive data. Contact HMRC directly using official channels if you have concerns.

- Report suspicious communications to Action Fraud immediately.

Understanding the Content of Your HMRC Nudge Letter

Once you've confirmed the letter's authenticity, carefully review its contents. HMRC nudge letters typically contain information regarding:

- Outstanding Tax: The letter will specify the amount of tax owed and the reason for the outstanding payment.

- Payment Deadlines: Clear deadlines for payment or submission of required information will be highlighted. Missing these deadlines can lead to significant penalties.

- Required Actions: The letter will outline the specific steps you need to take, such as filing a tax return, making a payment, or providing additional documentation.

Common reasons for receiving an HMRC nudge letter include:

- Missed tax return deadlines

- Incomplete tax returns

- Discrepancies between reported income and HMRC records

Key actions after reading your letter:

- Note the reference number and deadline immediately.

- Identify the specific issue highlighted in the letter.

- Check your tax records for accuracy and any potential errors.

- Contact HMRC directly via their official channels if clarification is needed.

Responding to Your HMRC Nudge Letter: A Step-by-Step Guide

Responding promptly and correctly to your HMRC nudge letter is crucial. The required actions will depend on the letter's content, but generally involve:

- Filing a Tax Return: If the letter relates to a missing or incomplete tax return, you must file the return as soon as possible using the HMRC online portal.

- Making a Payment: If you owe tax, make the payment before the deadline using the preferred HMRC payment methods.

- Providing Additional Information: If the letter requests further information, gather the necessary documents and submit them through the specified channels.

Step-by-step response:

- Access your online HMRC account: [Insert Link to HMRC Online Portal]

- Use the provided reference number for quicker processing.

- Keep records of all communication with HMRC, including emails, letters, and phone call notes.

- Follow the instructions carefully and respond promptly to avoid penalties.

Avoiding HMRC Nudge Letters in the Future

The best way to avoid HMRC nudge letters is through proactive tax planning and management. This includes:

- Timely Tax Filing: File your tax return before the deadline to avoid any late filing penalties.

- Accurate Record Keeping: Maintain meticulous records of your income and expenses throughout the tax year. This will help you accurately complete your tax return and avoid discrepancies.

- Utilize Tax Software: Consider using tax software to assist with calculations and ensure accuracy.

- Professional Tax Advice: If you find tax matters complex, seeking advice from a qualified tax professional can prevent errors and reduce the risk of receiving nudge letters.

Proactive strategies:

- File your tax return on time. Set reminders well in advance of the deadline.

- Keep accurate records of income and expenses using digital tools or spreadsheets.

- Use tax software to help with calculations and ensure compliance.

- Consider seeking professional tax advice, especially if your financial situation is complex.

Conclusion: Taking Action on Your HMRC Nudge Letter

Ignoring HMRC nudge letters can result in escalating penalties and potential legal action. Responding promptly is essential to avoid unnecessary stress and financial burden. This guide has highlighted the importance of verifying the authenticity of HMRC communication, understanding the content of nudge letters, and taking appropriate action. Remember to always refer to the official HMRC website for the most up-to-date information and guidance. Don't delay – check your mail for HMRC nudge letters today and take the necessary steps to avoid penalties. Visit the official HMRC website for further assistance: [Insert Link to HMRC Website]

Featured Posts

-

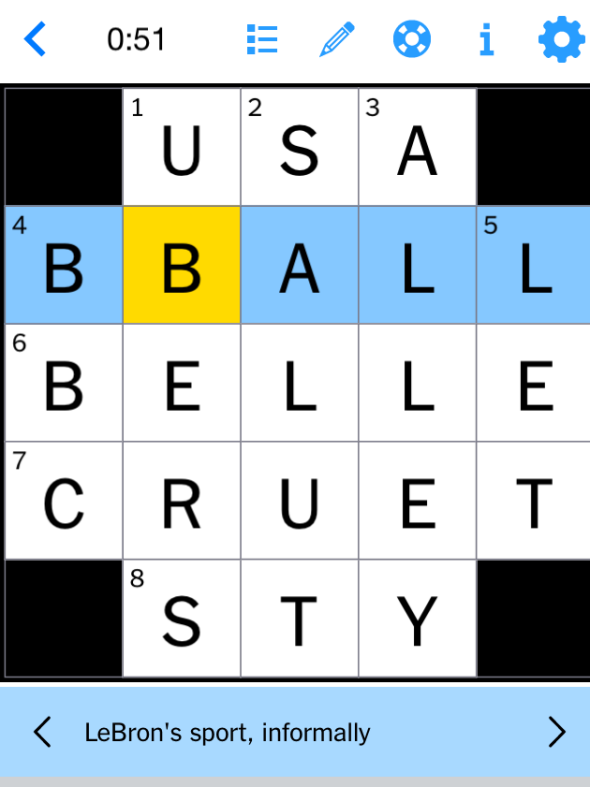

Nyt Mini Crossword Answer Marvels Avengers Clue May 1st

May 20, 2025

Nyt Mini Crossword Answer Marvels Avengers Clue May 1st

May 20, 2025 -

Charles Leclerc Ferraris Pre Imola Gp Statement

May 20, 2025

Charles Leclerc Ferraris Pre Imola Gp Statement

May 20, 2025 -

Transfer News Manchester Uniteds 62 5m Pursuit Of Top Target

May 20, 2025

Transfer News Manchester Uniteds 62 5m Pursuit Of Top Target

May 20, 2025 -

Sabalenka Starts Strong At Madrid Open

May 20, 2025

Sabalenka Starts Strong At Madrid Open

May 20, 2025 -

Exploring The Enduring Legacy Of Agatha Christies Poirot

May 20, 2025

Exploring The Enduring Legacy Of Agatha Christies Poirot

May 20, 2025