UK Inflation Data Spurs Pound Rise As BOE Rate Cut Expectations Fade

Table of Contents

Lower-Than-Expected UK Inflation Data

The recently published UK inflation figures sent shockwaves through financial markets. The Consumer Price Index (CPI), a key measure of inflation, came in at [insert actual CPI figure]% for [insert month and year], significantly lower than the market consensus forecast of [insert market forecast]%. Similarly, the Retail Price Index (RPI), another important inflation gauge, also showed a lower-than-predicted figure of [insert actual RPI figure]%.

This data has significant implications for the Bank of England's inflation targets. The BOE aims to maintain CPI inflation at 2%, and the lower-than-expected figures suggest that the UK is making progress towards this target.

- CPI: [insert actual CPI figure]%, compared to the forecasted [insert market forecast]% and the previous month's [insert previous month's CPI figure]%.

- RPI: [insert actual RPI figure]%, compared to the forecasted [insert market forecast]% and the previous month's [insert previous month's RPI figure]%.

- Contributing factors to the lower inflation include a recent decline in energy prices and continued improvements in global supply chains, easing inflationary pressures.

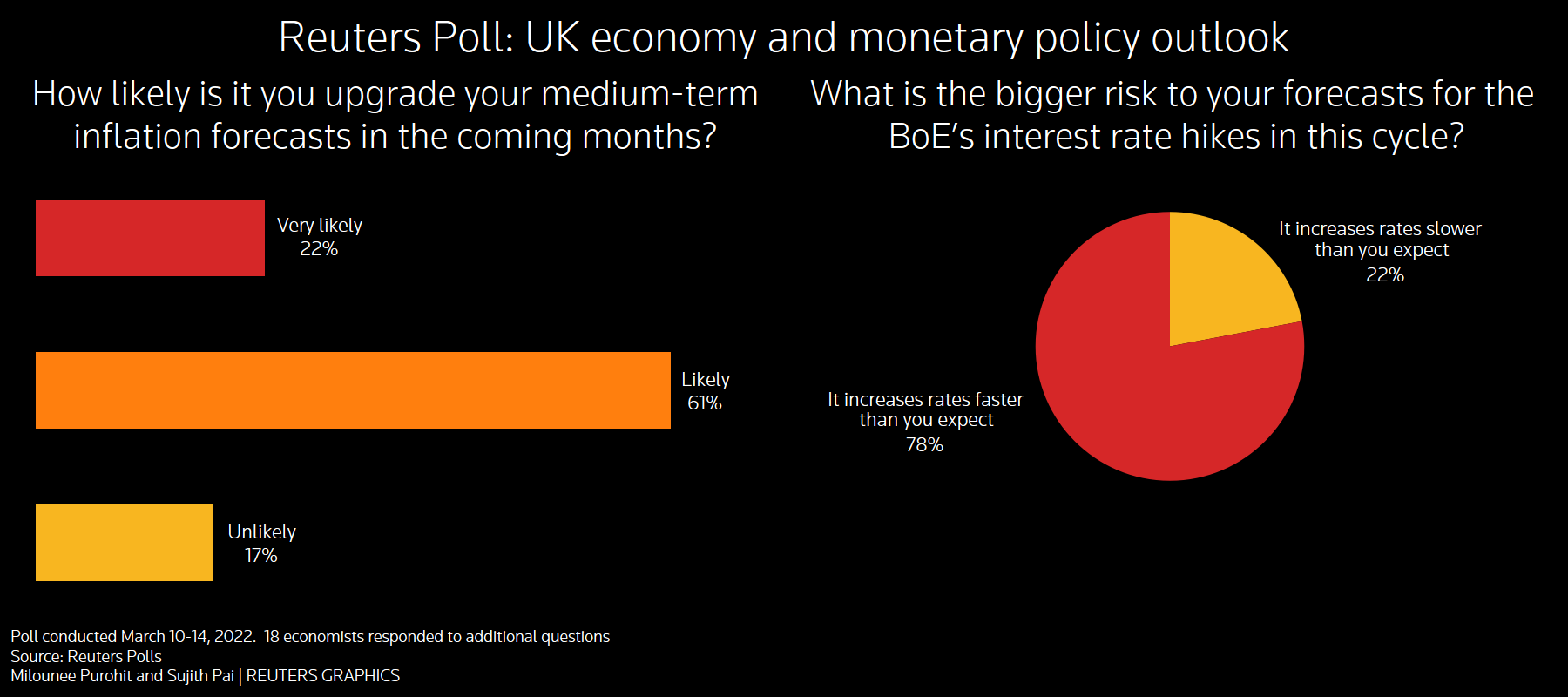

Impact on Bank of England (BOE) Monetary Policy

The unexpectedly positive UK inflation data has significantly altered the outlook for BOE monetary policy. The decreased likelihood of a near-term interest rate cut is now a dominant narrative. Lower inflation reduces the pressure on the BOE to stimulate economic growth through further rate reductions, a strategy previously considered more likely given previous economic forecasts.

- Previous BOE statements indicated a potential for further rate cuts to combat stubbornly high inflation. The recent data challenges this assessment.

- Market reaction to the inflation data was swift and positive, with traders quickly adjusting their expectations for future BOE actions, reflecting increased optimism.

- The reduced likelihood of a rate cut could lead to a more cautious approach from the BOE in the coming months, potentially impacting the overall trajectory of UK interest rates.

Pound Sterling's Appreciation

The positive UK inflation news resulted in a noticeable strengthening of the Pound against other major currencies. The GBP/USD exchange rate rose to [insert GBP/USD exchange rate], while the GBP/EUR rate climbed to [insert GBP/EUR exchange rate]. This appreciation reflects reduced risk aversion among investors and a renewed confidence in the UK economy.

- GBP/USD: Increased from [previous rate] to [current rate].

- GBP/EUR: Increased from [previous rate] to [current rate].

- [Include a chart or graph illustrating the Pound's movement against these currencies].

- This appreciation, however, has implications for UK exporters, making their goods more expensive for international buyers, while importers benefit from cheaper imports.

Market Reaction and Investor Sentiment

The market's response to the better-than-expected UK inflation data was overwhelmingly positive. Investor confidence in the UK economy received a significant boost, leading to increased investment and a generally improved market sentiment. Bond yields, reflecting investor expectations for future interest rates, also experienced [describe change – e.g., a slight decrease].

- The FTSE 100, a key UK stock market index, saw [describe the movement – e.g., a modest increase] following the data release.

- Financial analysts have commented positively on the data, suggesting that it represents a positive step in the UK's fight against inflation. [Insert quotes from reputable sources].

Conclusion: Analyzing the UK Inflation Data and its Long-Term Effects

In summary, the lower-than-expected UK inflation data has had a profound impact on the Pound Sterling and expectations surrounding BOE monetary policy. The resulting stronger Pound and reduced likelihood of a rate cut reflect a more optimistic outlook for the UK economy. However, uncertainties remain, and continued monitoring of UK inflation data is crucial. While this positive data is encouraging, long-term effects depend on several interconnected factors including global economic conditions and the BOE's future strategies.

Stay informed about future releases of UK inflation data to understand its ongoing impact on the Pound and the UK economy. Subscribe to our newsletter for regular updates and in-depth analysis of key economic indicators.

Featured Posts

-

Rising Tennis Stars In China A Boost To The Nations Sporting Culture

May 25, 2025

Rising Tennis Stars In China A Boost To The Nations Sporting Culture

May 25, 2025 -

Discover Local Connect Globally The Ae Xplore Campaign At England Airpark And Alexandria International Airport

May 25, 2025

Discover Local Connect Globally The Ae Xplore Campaign At England Airpark And Alexandria International Airport

May 25, 2025 -

Zheng Qinwens Historic Win Upsets Sabalenka At Italian Open

May 25, 2025

Zheng Qinwens Historic Win Upsets Sabalenka At Italian Open

May 25, 2025 -

Monacos Royal Family A Financial Scandal Investigation

May 25, 2025

Monacos Royal Family A Financial Scandal Investigation

May 25, 2025 -

Frankfurt Stock Exchange Dax Ends Trading Below 24 000 Points

May 25, 2025

Frankfurt Stock Exchange Dax Ends Trading Below 24 000 Points

May 25, 2025

Latest Posts

-

Arda Gueler Ve Real Madrid E Uefa Dan Bueyuek Sok Sorusturma Basladi

May 25, 2025

Arda Gueler Ve Real Madrid E Uefa Dan Bueyuek Sok Sorusturma Basladi

May 25, 2025 -

Real Madrid De Sok Arda Gueler Ve Takim Arkadaslarina Uefa Sorusturmasi

May 25, 2025

Real Madrid De Sok Arda Gueler Ve Takim Arkadaslarina Uefa Sorusturmasi

May 25, 2025 -

Queen Wens Parisian Court An Analysis Of Her Influence

May 25, 2025

Queen Wens Parisian Court An Analysis Of Her Influence

May 25, 2025 -

Queen Wens Second Parisian Court Observations And Analysis

May 25, 2025

Queen Wens Second Parisian Court Observations And Analysis

May 25, 2025 -

Uefa Arda Gueler Ve Real Madrid E Sorusturma Acti Detaylar

May 25, 2025

Uefa Arda Gueler Ve Real Madrid E Sorusturma Acti Detaylar

May 25, 2025