UK Inflation Surprise: Pound Rises As BOE Rate Cut Expectations Fade

Table of Contents

Unexpected Inflation Figures Spark Pound Rally

The recent release of UK inflation data revealed a figure significantly higher than analysts had predicted. This unexpected surge in inflation immediately impacted the value of the Pound Sterling (GBP).

- Specific Inflation Numbers: The Consumer Price Index (CPI) rose by X%, exceeding the predicted Y% increase. This represents a Z% increase from the previous month's figure.

- Market Reaction: The pound strengthened considerably against major currencies like the US dollar (USD) and the Euro (EUR) following the announcement. GBP/USD experienced a sharp increase of A%, while GBP/EUR saw a B% rise. [Insert chart or graph depicting pound's movement].

- Analyst Predictions vs. Reality: Economists had widely anticipated a more moderate increase in inflation, leading to widespread surprise and a recalibration of market forecasts. The discrepancy between predicted and actual UK CPI figures highlights the inherent volatility and uncertainty within the current UK economic climate.

BOE Rate Cut Expectations Diminish

The higher-than-expected inflation figures significantly reduce the likelihood of an imminent Bank of England interest rate cut. The BOE's primary mandate is to maintain price stability, typically targeting an inflation rate of around 2%. The recent data clearly indicates that this target is far from being met.

- BOE Mandate and Inflation Targets: The significant divergence from the target inflation rate puts immense pressure on the BOE to act. Rate cuts, previously considered a strong possibility, are now significantly less likely.

- Expert Opinion: Leading economists and financial analysts are now predicting a less dovish approach from the BOE, with some even suggesting the possibility of further interest rate hikes to combat persistent inflation.

- Implications for Borrowing Costs: The reduced likelihood of rate cuts means that borrowing costs are likely to remain elevated, impacting consumers and businesses alike. This could further stifle economic growth.

Impact on UK Economy and Consumers

The surprise inflation data and the subsequent market reaction have broad implications across various sectors of the UK economy.

- Consumer Spending: Higher inflation directly erodes consumer purchasing power, potentially leading to a slowdown in consumer spending and a decrease in consumer confidence.

- Business Investment: Businesses may also be hesitant to invest heavily in expansion plans due to the uncertainty surrounding inflation and interest rates. This could hinder UK economic growth in the short-to-medium term.

- Government Policy: The government might be forced to re-evaluate its economic policies and potentially implement measures to address the elevated inflation and its impact on the UK population. Fiscal policies may need to be adjusted to manage the economic fallout.

- Long-Term Economic Outlook: The unexpected surge in UK inflation introduces considerable uncertainty into the long-term economic outlook. The persistence of high inflation poses a significant challenge to sustainable economic growth.

Potential for Future Volatility

The current situation underscores the inherent volatility within the UK economy. Future inflation figures remain uncertain, creating the potential for further market fluctuations.

- Influencing Factors: Several factors could influence future inflation, including global energy prices, ongoing supply chain disruptions, and geopolitical events.

- Investment Risks and Opportunities: The current environment presents both risks and opportunities for investors. Careful analysis and a diversified investment strategy are crucial for navigating this period of uncertainty.

- Future BOE Actions: The BOE's future actions will depend heavily on upcoming economic data releases. Monitoring these releases is crucial for understanding the potential direction of interest rates and the pound's value.

Conclusion

The unexpected surge in UK inflation has sent ripples through the UK economy, leading to a strengthening pound and diminished expectations of BOE rate cuts. The implications are far-reaching, affecting consumer spending, business investment, and government policy. The potential for future volatility remains high, emphasizing the need for careful monitoring of economic data and BOE announcements. Stay informed about the evolving UK inflation landscape and its impact on the pound. Monitor future economic data releases and BOE announcements to make informed decisions related to UK investments and financial planning. Continue reading our analysis on UK inflation and related economic indicators for up-to-date insights into the UK's financial future and the evolving implications of UK Inflation.

Featured Posts

-

Roger Daltrey And Pete Townshend A Public Rift Revealed

May 23, 2025

Roger Daltrey And Pete Townshend A Public Rift Revealed

May 23, 2025 -

Wardrobe Malfunction Cat Deeleys This Morning Dress Blunder

May 23, 2025

Wardrobe Malfunction Cat Deeleys This Morning Dress Blunder

May 23, 2025 -

Exploring Pete Townshends Legacy Live Performances And Key Collaborations

May 23, 2025

Exploring Pete Townshends Legacy Live Performances And Key Collaborations

May 23, 2025 -

Parasal Bereket Nisan Ayinda Sansli Burclar

May 23, 2025

Parasal Bereket Nisan Ayinda Sansli Burclar

May 23, 2025 -

12 Mz

May 23, 2025

12 Mz

May 23, 2025

Latest Posts

-

Wwe Wrestle Mania 41 Golden Belts Memorial Day Weekend Ticket Sale

May 23, 2025

Wwe Wrestle Mania 41 Golden Belts Memorial Day Weekend Ticket Sale

May 23, 2025 -

The Last Rodeo A Critical Review Of The Film

May 23, 2025

The Last Rodeo A Critical Review Of The Film

May 23, 2025 -

Review The Last Rodeo A Heartfelt Bull Riding Tale

May 23, 2025

Review The Last Rodeo A Heartfelt Bull Riding Tale

May 23, 2025 -

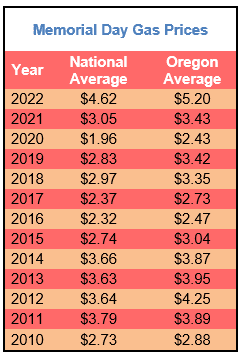

Low Gas Prices Forecast For Memorial Day Weekend

May 23, 2025

Low Gas Prices Forecast For Memorial Day Weekend

May 23, 2025 -

Memorial Day Gas Prices A Decade Low Prediction

May 23, 2025

Memorial Day Gas Prices A Decade Low Prediction

May 23, 2025