UK Wind Energy Auction Reforms: Vestas Flags Investment Uncertainty

Table of Contents

The New UK Wind Energy Auction System: A Detailed Overview

The UK government's reformed auction system, primarily utilizing the Contract for Difference (CfD) mechanism, aims to secure renewable energy projects at competitive prices. However, several key changes have introduced a level of uncertainty. These new rules and regulations affect the entire renewable energy support scheme and impact the bidding process considerably.

-

Changes in Contract Length: The duration of CfD contracts has been altered, impacting the long-term financial planning of developers. Shorter contracts might discourage investment in larger, more complex projects.

-

New Criteria for Selecting Winning Bids: The selection criteria have become more stringent, potentially favoring larger, established players and disadvantaging smaller developers and innovative technologies. This could stifle competition and limit the diversity of projects.

-

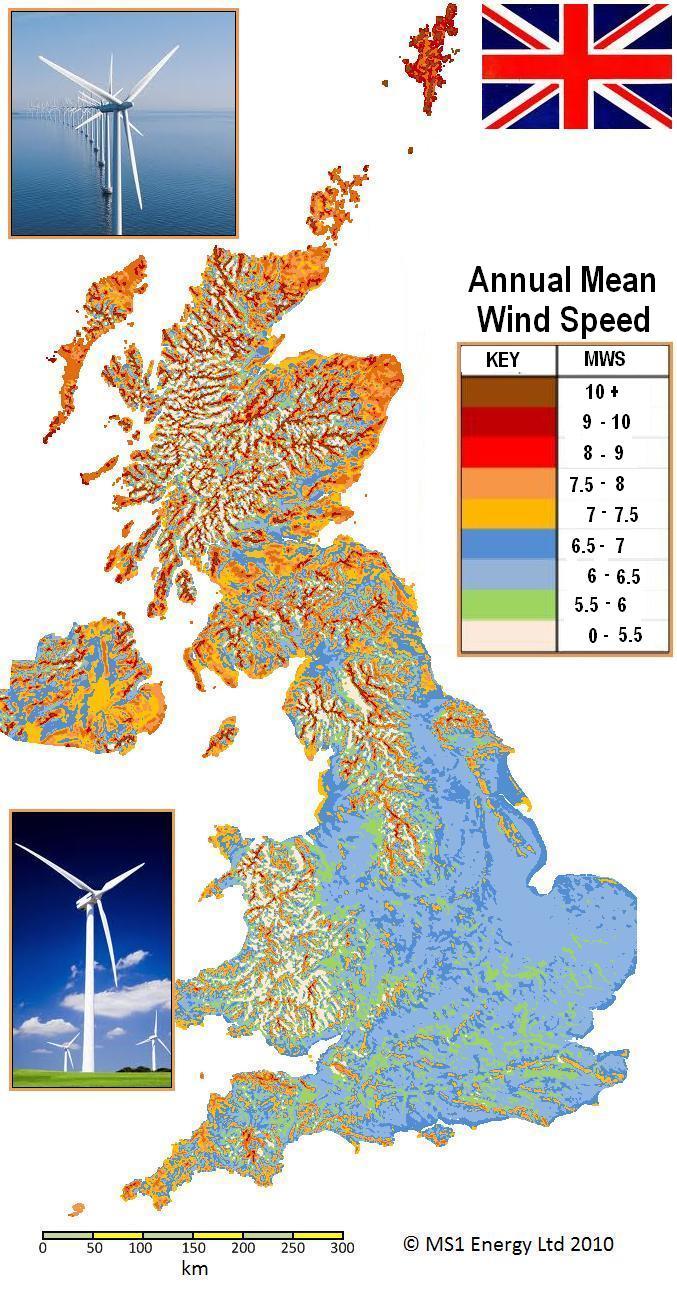

Impact on Different Types of Wind Energy Projects: The changes impact onshore and offshore wind energy projects differently. While offshore wind continues to be a priority, the reforms may inadvertently hinder the growth of onshore wind projects, which can offer faster deployment timelines and potentially lower costs.

-

Potential Implications for Smaller Developers: The increased complexity and risk associated with the new auction system pose significant challenges for smaller developers, who may lack the resources to navigate the more stringent requirements and bidding processes. This aspect impacts the UK's renewable energy landscape significantly. Access to financing for smaller projects is becoming increasingly difficult.

Vestas' Concerns and the Impact on Investment

Vestas, a global leader in wind turbine manufacturing, has voiced serious concerns about the reforms, citing uncertainty regarding the long-term viability of projects under the new system. Their hesitation to fully commit to new investment highlights the broader challenges facing the sector.

-

Uncertainty about the Long-Term Viability of Projects: The revised rules create uncertainty regarding the future regulatory environment, making it difficult for investors to accurately assess the long-term profitability and risk associated with new projects. This directly influences investment decisions and potentially delays project developments.

-

Potential Impact on Project Financing: The increased uncertainty makes securing project financing more challenging. Financial institutions are hesitant to invest in projects where the long-term revenue streams are less predictable. This is critical for the future of renewable energy investment.

-

Concerns about Regulatory Stability and Predictability: The frequent changes in government policy and regulations create a volatile environment, making it difficult for companies to plan long-term investments. A lack of regulatory stability and predictable frameworks make the UK less attractive compared to other countries with more consistent renewable energy policies.

-

Impact on Job Creation and Economic Growth: Reduced investment in wind energy projects could have significant negative consequences for job creation, particularly in manufacturing and construction, and overall economic growth. This could lead to lost opportunities for the UK's burgeoning green energy sector.

Analysis of Potential Consequences for the UK's Renewable Energy Targets

The UK has set ambitious targets for renewable energy generation to achieve its net-zero carbon emission goals by 2050. The reforms to the UK wind energy auction system could significantly hinder progress towards these targets.

-

Potential Delays in Project Development: Uncertainty surrounding the auction process can lead to delays in project development, pushing back the timeline for achieving renewable energy targets.

-

Reduced Investment in Wind Energy Projects: The concerns raised by Vestas and other industry players highlight the risk of significantly reduced investment in new wind energy projects. This directly impacts the country's ability to meet its renewable energy obligations.

-

Impact on the UK's Net-Zero Carbon Emission Goals: Slowed progress in wind energy deployment could jeopardize the UK's ability to meet its net-zero commitments. This will have serious consequences for efforts to mitigate climate change.

-

Comparison to Renewable Energy Policies in Other Countries: The UK's reformed auction system, when compared to more stable and predictable policy environments in other countries, may make the UK a less attractive destination for renewable energy investment. This affects international competitiveness and economic growth in the green sector.

The Role of Government Policy and Stakeholder Engagement

Mitigating investment uncertainty requires a concerted effort from the government and active stakeholder engagement.

-

Need for Clear and Consistent Policy Signals: The government needs to provide clear, consistent, and long-term policy signals to encourage investment confidence. This is critical for attracting investment in renewable energy.

-

Importance of Transparent and Predictable Regulatory Frameworks: Transparent and predictable regulatory frameworks are essential for reducing risk and encouraging private sector investment. These regulations must be stable and should not change drastically every few years.

-

Role of Stakeholder Consultations and Discussions with Industry Players: Regular consultations and open dialogue with industry players, including developers and manufacturers like Vestas, are crucial for developing policies that are both effective and supportive of industry needs.

Conclusion: Addressing Investment Uncertainty in UK Wind Energy Auctions

The reforms to the UK wind energy auction system, while aiming to improve efficiency, have introduced significant uncertainty, impacting investor confidence, as highlighted by Vestas' concerns. The potential consequences are considerable, ranging from project delays to jeopardizing the UK's net-zero targets. Addressing this investment uncertainty is paramount to achieving a successful energy transition and meeting the nation's ambitious renewable energy goals. To ensure the continued growth of the UK wind energy sector and attract substantial investment in UK wind energy auctions, the government must prioritize clear, consistent, and predictable policies, fostering a stable regulatory environment through transparent engagement with stakeholders. We urge readers to contact their elected officials and relevant industry associations to voice their concerns and advocate for policies that promote a stable and thriving UK wind energy sector, encouraging vital renewable energy investment in the UK. The future of UK wind energy policy relies on creating a conducive environment for investment in UK wind energy auctions.

Featured Posts

-

140 20 2025 3 17

Apr 26, 2025

140 20 2025 3 17

Apr 26, 2025 -

Kings Early Birthday Celebration Plans Revealed

Apr 26, 2025

Kings Early Birthday Celebration Plans Revealed

Apr 26, 2025 -

Portnoy Vs Newsom A Heated Exchange Explained

Apr 26, 2025

Portnoy Vs Newsom A Heated Exchange Explained

Apr 26, 2025 -

Help With Nyt Spelling Bee Hints And Answers For Puzzle 360 February 26th

Apr 26, 2025

Help With Nyt Spelling Bee Hints And Answers For Puzzle 360 February 26th

Apr 26, 2025 -

Feeling The Scope How Sinners Cinematography Showcases The Mississippi Delta

Apr 26, 2025

Feeling The Scope How Sinners Cinematography Showcases The Mississippi Delta

Apr 26, 2025