Understand Money Differently: A Podcast On Financial Education

Table of Contents

Why Podcasts Are the Perfect Medium for Financial Education

Podcasts offer a unique and effective way to improve your financial literacy and understand money differently. Their accessibility, engaging content, and ongoing learning opportunities make them a powerful tool for anyone looking to take control of their finances.

Convenience and Accessibility

- Listen anytime, anywhere: Podcasts seamlessly integrate into your life. Listen during your commute, while exercising, doing chores, or even relaxing at home. No need to schedule dedicated study time.

- Flexible learning: Unlike traditional courses or seminars, podcasts are incredibly flexible. You can listen at your own pace, rewind sections you find particularly helpful, and easily pause and resume listening.

- Free or affordable access: Many excellent financial education podcasts are completely free, providing valuable information without any financial barrier. Others offer premium content at a reasonable cost.

Engaging and Diverse Content

Podcasts offer diverse formats that cater to different learning styles:

- Varied formats: You'll find interviews with financial experts, solo shows offering insightful analysis, and even case studies illustrating real-world financial scenarios.

- Expert insights: Learn from financial advisors, economists, successful investors, and other professionals who share their expertise and experience.

- Relatable stories: Many podcasts share personal stories and anecdotes, making complex financial concepts more relatable and easier to understand. This helps you connect with the material on a more human level.

- Multiple perspectives: Exposure to different financial strategies and viewpoints broadens your understanding and helps you find approaches that align with your personal values and goals.

Ongoing Learning and Skill Development

Regularly listening to a financial education podcast fosters continuous learning:

- Reinforced learning: Consistent exposure to financial concepts reinforces learning and helps you retain key information more effectively.

- Cultivating a financial mindset: Podcasts help develop a positive and proactive approach to personal finance, shifting your perspective from fear and confusion to confidence and control.

- Staying up-to-date: Financial landscapes are constantly evolving. Podcasts keep you informed about the latest trends, updates, and best practices in managing your money.

- Building confidence: As you learn and apply new strategies, your confidence in handling your finances will steadily increase.

Finding the Right "Understand Money Differently" Podcast

Choosing the right podcast is crucial to maximizing your learning experience. Consider these factors when searching for the perfect fit:

Consider Your Financial Goals

Before selecting a podcast, identify your primary financial objectives:

- Savings goals: Are you focused on building an emergency fund, saving for a down payment, or accumulating wealth?

- Investment strategies: Are you interested in learning about stocks, bonds, real estate, or other investment vehicles?

- Debt reduction: Are you looking for strategies to pay down credit card debt, student loans, or other forms of debt?

- Retirement planning: Are you seeking guidance on retirement savings, investment options, and retirement income strategies?

Choose podcasts that directly address your specific goals.

Evaluate the Host's Expertise and Credibility

Assessing the credibility of the podcast host is essential:

- Background and qualifications: Research the host's background, experience, and credentials in personal finance.

- Proven track record: Look for evidence of their success in managing their own finances or helping others achieve their financial goals.

- Transparency and integrity: Choose hosts who are transparent about their affiliations and any potential conflicts of interest.

Look for Engaging Content and Practical Advice

Avoid podcasts that are overly theoretical or complex:

- Actionable steps: Look for podcasts that offer clear, practical advice and actionable steps you can implement immediately.

- Real-world examples: Podcasts that illustrate concepts with real-world examples are more engaging and easier to understand.

- Avoid hype and get-rich-quick schemes: Be wary of podcasts that promise unrealistic returns or rely on hype instead of sound financial principles.

Maximizing the Benefits of a Financial Education Podcast

To truly benefit from a financial education podcast, adopt these strategies:

Active Listening and Note-Taking

Passive listening won't yield significant results:

- Engage actively: Pay close attention to the content and actively engage with the information.

- Take notes: Jot down key concepts, strategies, and actionable steps you can implement.

- Identify takeaways: Clearly define the most important insights and how you can apply them to your own financial situation.

Implement What You Learn

Knowledge without action is useless:

- Apply the advice: Don't just passively listen; actively apply the advice and strategies you learn to your own finances.

- Track your progress: Monitor your progress and make adjustments as needed. Celebrate your successes and learn from any setbacks.

- Seek professional advice: If you have complex financial questions, seek personalized advice from a qualified financial advisor.

Join the Community (if applicable)

Many podcasts have online communities:

- Connect with others: Connect with other listeners to share experiences, ask questions, and receive support.

- Learn from others: Learn from the experiences and insights of other individuals on their financial journeys.

- Boost motivation: Community engagement can significantly boost your motivation and commitment to improving your financial situation.

Conclusion

This article has highlighted the power of podcasts in helping you understand money differently. By choosing the right podcast and actively engaging with the content, you can gain valuable insights, develop essential financial skills, and take control of your financial future. Don't just passively drift through your financial life; actively seek out a financial education podcast that resonates with you and start your journey towards financial freedom today. Begin to understand money differently – your future self will thank you! Start listening today and begin your journey to better financial understanding!

Featured Posts

-

The Annoying Welcome In Phenomenon Why Its So Frustrating

May 31, 2025

The Annoying Welcome In Phenomenon Why Its So Frustrating

May 31, 2025 -

Who Are Bernard Keriks Wife Hala Matli And Children A Family Overview

May 31, 2025

Who Are Bernard Keriks Wife Hala Matli And Children A Family Overview

May 31, 2025 -

Bernard Keriks Family Wife Hala Matli And Children

May 31, 2025

Bernard Keriks Family Wife Hala Matli And Children

May 31, 2025 -

Support Stop Cancer 2025 Love Moto Online Auction Live

May 31, 2025

Support Stop Cancer 2025 Love Moto Online Auction Live

May 31, 2025 -

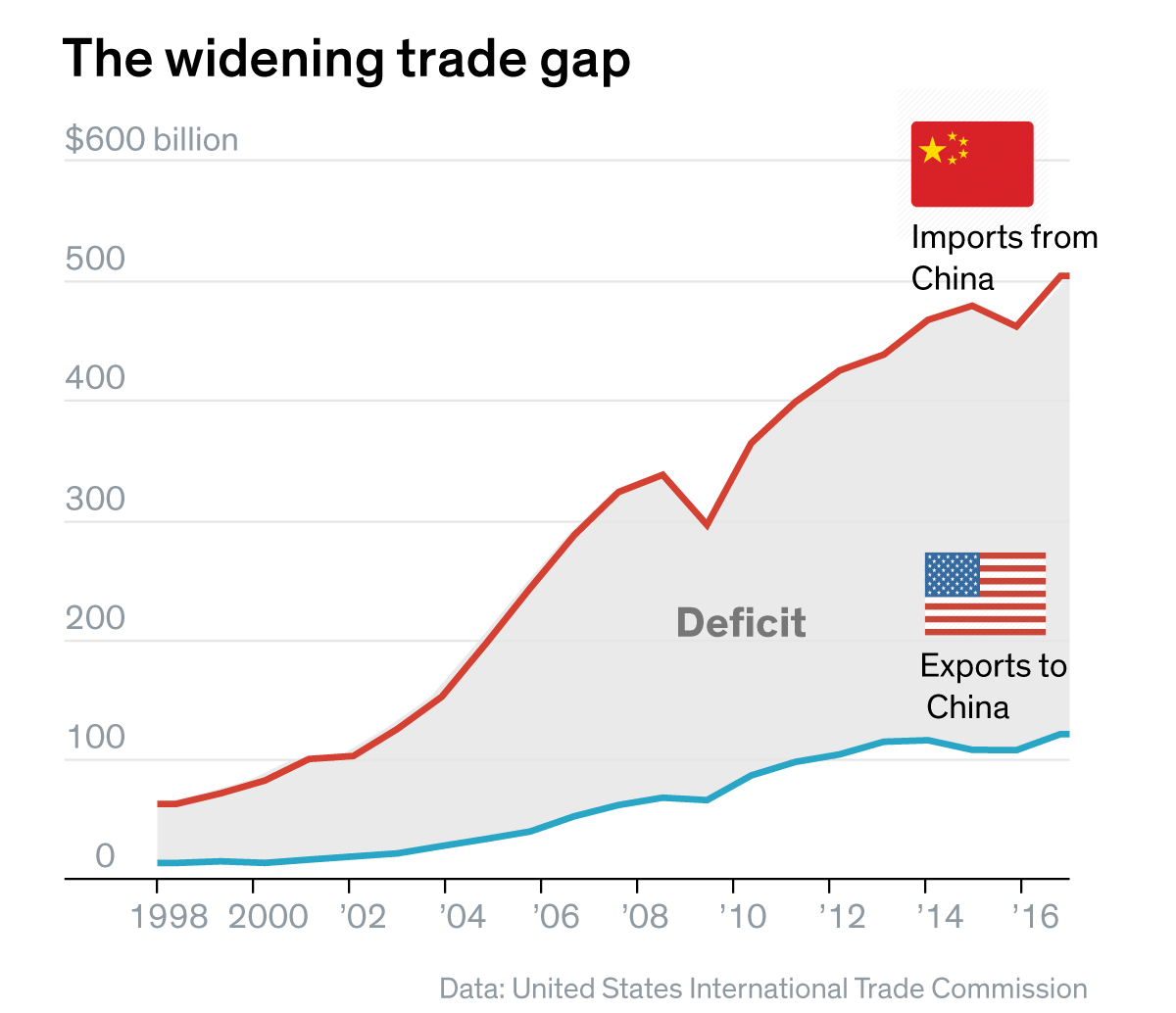

Tariff Truce A Delicate Balance In China Us Trade Relations

May 31, 2025

Tariff Truce A Delicate Balance In China Us Trade Relations

May 31, 2025