Understanding Bitcoin's Golden Cross: Historical Data And Market Outlook

Table of Contents

What is a Bitcoin Golden Cross?

Moving averages (MAs) are widely used technical indicators that smooth out price fluctuations, making it easier to identify trends. The 50-day MA represents the average closing price of Bitcoin over the past 50 days, while the 200-day MA represents the average closing price over the past 200 days.

A Bitcoin Golden Cross forms when the shorter-term 50-day MA crosses above the longer-term 200-day MA. This crossover is often interpreted as a bullish signal, suggesting a potential shift from a bearish to a bullish trend. Conversely, a Death Cross occurs when the 50-day MA crosses below the 200-day MA, signaling a potential bearish trend.

[Insert a chart here showing a clear example of a Bitcoin Golden Cross and a Death Cross]

- Key Characteristics of a Bitcoin Golden Cross:

- Bullish signal, suggesting potential upward price movement.

- Formed when the 50-day MA crosses above the 200-day MA.

- Often, but not always, precedes periods of increased Bitcoin price.

- Should be considered alongside other technical indicators and fundamental analysis.

Historical Analysis of Bitcoin Golden Crosses

Analyzing past Bitcoin Golden Cross events reveals varying outcomes. While some Golden Crosses have indeed been followed by significant price increases, others have resulted in less impressive or even negative short-term price movements.

[Insert a chart here showing Bitcoin price performance after past Golden Cross events.]

Several factors can influence the price movement following a Golden Cross:

- Market Sentiment: High investor confidence often amplifies the bullish effect of a Golden Cross. Conversely, negative sentiment can dampen the impact.

- Regulatory Changes: Government regulations and policies significantly impact cryptocurrency markets. A positive regulatory development can boost prices, while negative news can lead to sell-offs.

- Broader Economic Conditions: Global economic factors, such as inflation, recessionary fears, or geopolitical events, can affect Bitcoin's price regardless of technical indicators.

Statistical analysis of historical Bitcoin Golden Crosses shows a mixed success rate in predicting sustained bullish trends. While a Golden Cross often suggests a potential upward trend, it's not a guarantee of substantial price increases.

Factors Influencing the Effectiveness of the Bitcoin Golden Cross

The effectiveness of the Bitcoin Golden Cross as a predictive indicator isn't solely reliant on the crossover itself. Several other factors play a crucial role:

- Market Sentiment: Positive investor sentiment increases the likelihood of a sustained price increase after a Golden Cross. Negative sentiment can negate its positive effect. Monitoring social media sentiment and news headlines is crucial.

- Regulatory Landscape: Favorable regulations can bolster Bitcoin's price, while stricter regulations can cause volatility or declines.

- Adoption Rate: Widespread adoption of Bitcoin by businesses and individuals strengthens its value proposition, making a Golden Cross more likely to result in a sustained price increase.

- Macroeconomic Factors: Global economic conditions heavily influence Bitcoin's price. During economic uncertainty, investors may flock to Bitcoin as a safe haven asset, amplifying the effect of a Golden Cross.

- Technical Indicators: Relying solely on the Golden Cross is risky. Combining it with other technical indicators (e.g., RSI, MACD, Bollinger Bands) provides a more comprehensive analysis.

Market Outlook and Predictions Post-Golden Cross

[Discuss current market conditions and recent Bitcoin price movements here. Include relevant charts and data.]

Expert opinions on the potential impact of a Bitcoin Golden Cross vary. While some analysts see it as a bullish signal, others emphasize the importance of considering other market factors. It's crucial to remember that the Golden Cross is not a crystal ball.

- Alternative Scenarios: Even after a Golden Cross, prices could consolidate or even temporarily decline due to profit-taking or unforeseen market events.

- Risk Assessment: Investing in Bitcoin always carries risk. A Golden Cross should not be the sole basis for investment decisions. Diversification and risk management strategies are essential.

Conclusion

Historical data shows that the Bitcoin Golden Cross is a valuable technical indicator, but it's not a foolproof predictor of future price movements. Its effectiveness is influenced by various factors, including market sentiment, regulatory changes, adoption rates, and macroeconomic conditions. Combining the Golden Cross with other technical indicators and fundamental analysis is essential for making informed investment decisions. Understanding the Bitcoin Golden Cross is crucial for informed decision-making in the volatile crypto market. Continue learning about technical analysis and other indicators to make sound investment choices regarding Bitcoin and other cryptocurrencies.

Featured Posts

-

Where To Watch Los Angeles Angels Games Without Cable In 2025

May 08, 2025

Where To Watch Los Angeles Angels Games Without Cable In 2025

May 08, 2025 -

Presenca De Mick Jagger No Oscar Gera Preocupacao No Brasil

May 08, 2025

Presenca De Mick Jagger No Oscar Gera Preocupacao No Brasil

May 08, 2025 -

Best Streaming Services To Watch La Angels Baseball In 2025 No Cable

May 08, 2025

Best Streaming Services To Watch La Angels Baseball In 2025 No Cable

May 08, 2025 -

Jayson Tatum And Ella Mai Sons Birth Confirmed In New Commercial

May 08, 2025

Jayson Tatum And Ella Mai Sons Birth Confirmed In New Commercial

May 08, 2025 -

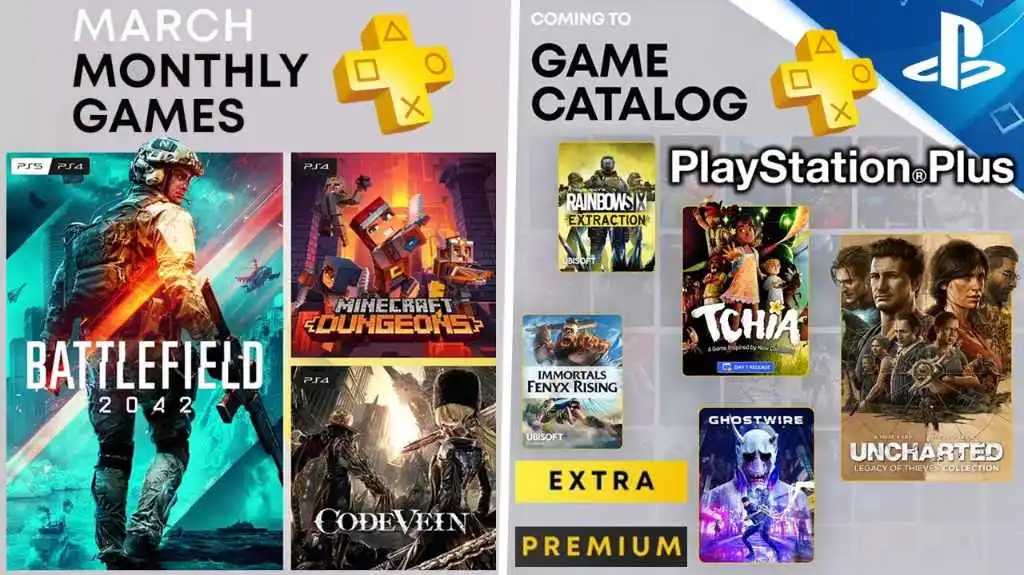

Analysis Ps 5 And Ps 4 Games At The March 2025 Nintendo Direct

May 08, 2025

Analysis Ps 5 And Ps 4 Games At The March 2025 Nintendo Direct

May 08, 2025