Understanding Elevated Stock Market Valuations: BofA's Analysis

Table of Contents

BofA's Key Findings on Current Stock Market Valuations

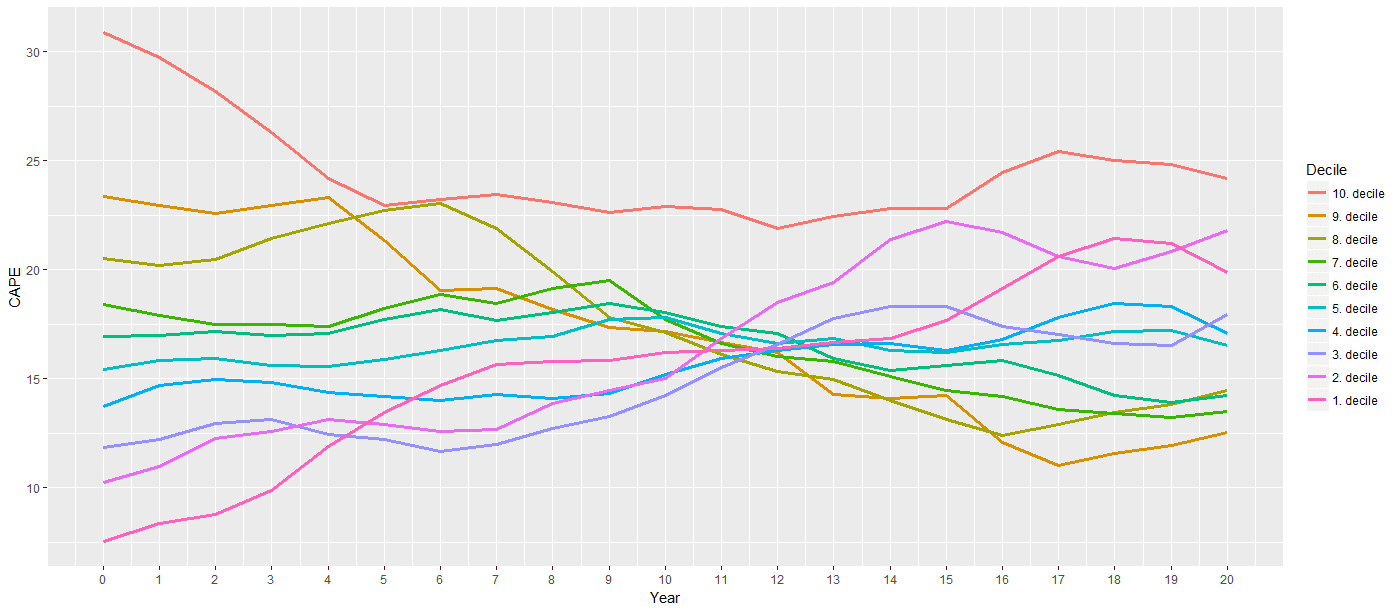

BofA's recent reports generally indicate that current stock market valuations are high, though the degree of overvaluation varies across sectors. While precise figures fluctuate based on the specific report and date, BofA often uses metrics like the Price-to-Earnings (P/E) ratio and market capitalization to assess valuation levels. For example, a particular report might show the S&P 500 trading at a P/E ratio significantly above its historical average.

-

BofA's Rationale: BofA's assessment is typically based on a combination of quantitative and qualitative factors. Their rationale often points to the influence of low interest rates, significant government stimulus, and strong investor sentiment driving asset prices higher than what might be justified by fundamental analysis alone.

-

Overvalued and Undervalued Sectors: BofA's analysis often highlights specific sectors showing signs of overvaluation (e.g., technology, certain consumer discretionary stocks during periods of high growth) and others that appear comparatively undervalued (e.g., certain value stocks, cyclical sectors during economic downturns). These assessments change depending on the market conditions and economic outlook.

-

Warnings and Cautions: BofA consistently issues warnings about the risks associated with elevated stock market valuations, emphasizing the potential for market corrections or even a significant downturn if certain underlying economic conditions change. They often stress the importance of diversification and risk management in light of these elevated valuations.

Factors Contributing to Elevated Stock Market Valuations

Several macroeconomic factors contribute to the current elevated stock market valuations. These factors interact in complex ways, making accurate prediction challenging.

-

Low Interest Rates: Extremely low interest rates, a common monetary policy response to economic slowdowns, significantly impact discounted cash flow (DCF) models. Lower discount rates inflate the present value of future earnings, leading to higher stock valuations.

-

Inflationary Pressures: Inflation erodes the purchasing power of money and can impact earnings expectations. While some inflation can be positive for growth, high or unpredictable inflation introduces uncertainty and can affect stock valuations, leading to increased volatility.

-

Government Stimulus and Quantitative Easing: Government stimulus packages and quantitative easing (QE) programs inject liquidity into the market, increasing the money supply and potentially inflating asset prices, including stocks.

-

Geopolitical Risks: Geopolitical events, such as trade wars or international conflicts, create uncertainty and can influence investor sentiment. This uncertainty can drive investors towards safer assets, impacting stock valuations.

-

Technological Advancements: Rapid technological advancements can drive significant growth in certain sectors, leading to higher valuations for companies poised to benefit from these innovations. This effect can disproportionately impact specific sectors and create valuation discrepancies.

Analyzing BofA's Valuation Metrics and Models

BofA employs a range of valuation metrics and models to assess stock market valuations. Understanding these tools is crucial to interpreting their analysis.

-

Price-to-Earnings (P/E) Ratio: This classic metric compares a company's stock price to its earnings per share. A high P/E ratio suggests investors are paying a premium for each dollar of earnings.

-

Price-to-Sales (P/S) Ratio: This ratio compares a company's stock price to its revenue per share. It's often used for companies with little or no earnings, such as many young technology companies.

-

Discounted Cash Flow (DCF) Analysis: This more complex model projects a company's future cash flows and discounts them back to their present value to estimate the intrinsic value of the stock.

-

Limitations of Metrics: It's crucial to remember that these metrics have limitations. For instance, P/E ratios can be distorted by accounting practices and don't account for future growth potential. DCF models are highly sensitive to assumptions about future growth rates and discount rates.

-

Discrepancies and Qualitative Factors: BofA likely uses multiple models and accounts for qualitative factors, such as management quality, competitive landscape, and regulatory changes, to refine their valuation assessments.

The Role of Investor Sentiment and Behavioral Economics

Investor sentiment and behavioral economics play a crucial role in shaping stock market valuations, often overriding purely fundamental analysis.

-

Herd Behavior and Market Bubbles: Herd behavior, where investors mimic the actions of others, can lead to market bubbles—periods of excessive speculation where asset prices rise far beyond their fundamental value.

-

Social Media and News Coverage: Social media and news coverage significantly influence investor sentiment, creating rapid shifts in market psychology. Positive news can quickly inflate valuations, while negative news can trigger sell-offs.

-

Fear and Greed: Fear and greed are powerful emotions driving market fluctuations. Fear can lead to panic selling, while greed can fuel speculative bubbles.

Implications for Investors: Navigating Elevated Stock Market Valuations

BofA's analysis has significant implications for investors. Navigating elevated valuations requires a cautious and strategic approach.

-

Diversification: Diversification across asset classes (stocks, bonds, real estate, etc.) is crucial to mitigate risk in a potentially overvalued market.

-

Value Investing: Consider sectors or asset classes that appear undervalued relative to their fundamental value, based on BofA's analysis and your own research.

-

Long-Term Investing: Focus on long-term investment strategies rather than short-term speculation, as short-term market volatility is amplified during periods of elevated valuations.

-

Alternative Investments: If the stock market appears significantly overvalued, consider exploring alternative investment options, such as precious metals or real estate, to diversify your portfolio.

Conclusion

BofA's analysis consistently indicates that current stock market valuations are elevated, driven by factors including low interest rates, government stimulus, and strong investor sentiment. While the exact level of overvaluation remains debated and subject to constant change, BofA emphasizes the importance of considering these factors and maintaining a cautious approach. Investors must consider BofA's analysis as one piece of the puzzle, conducting thorough due diligence and assessing their own risk tolerance before making investment decisions. Understanding elevated stock market valuations is crucial for making informed investment decisions. By carefully considering BofA's analysis and conducting your own thorough research, you can develop a robust investment strategy tailored to your risk tolerance and financial goals. Stay informed about the latest developments in stock market valuations to navigate this dynamic market effectively.

Featured Posts

-

Sevilla 0 2 Real Madrid Analisis Del Partido Y Reacciones Inmediatas

May 29, 2025

Sevilla 0 2 Real Madrid Analisis Del Partido Y Reacciones Inmediatas

May 29, 2025 -

Valverde Kroos Un Modelo A Seguir En El Real Madrid

May 29, 2025

Valverde Kroos Un Modelo A Seguir En El Real Madrid

May 29, 2025 -

The Pocket Breakneck Expansion A Pokemon Tcg Collectors Stress Test

May 29, 2025

The Pocket Breakneck Expansion A Pokemon Tcg Collectors Stress Test

May 29, 2025 -

Netherlands Eurovision 2025 Getting To Know Claude

May 29, 2025

Netherlands Eurovision 2025 Getting To Know Claude

May 29, 2025 -

Investigation Underway After Beacon Hill Shooting Injures Man

May 29, 2025

Investigation Underway After Beacon Hill Shooting Injures Man

May 29, 2025

Latest Posts

-

Legal Battle Erupts Dragon Den Alum Accuses Rival Of Copying Innovative Product

May 31, 2025

Legal Battle Erupts Dragon Den Alum Accuses Rival Of Copying Innovative Product

May 31, 2025 -

Puppy Toilet Patent Dispute Dragon Den Star Takes Legal Action

May 31, 2025

Puppy Toilet Patent Dispute Dragon Den Star Takes Legal Action

May 31, 2025 -

Dragon Den Entrepreneur Sues Competitor Over Stolen Puppy Toilet Design

May 31, 2025

Dragon Den Entrepreneur Sues Competitor Over Stolen Puppy Toilet Design

May 31, 2025 -

Dragon Den Winners Lawsuit Puppy Toilet Idea Theft Allegations

May 31, 2025

Dragon Den Winners Lawsuit Puppy Toilet Idea Theft Allegations

May 31, 2025 -

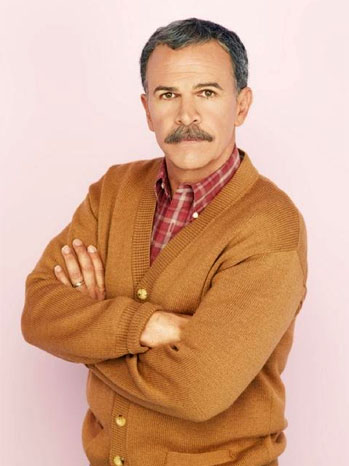

Complete Street Sweeping Schedule For Estevan Sk

May 31, 2025

Complete Street Sweeping Schedule For Estevan Sk

May 31, 2025