Understanding Front-Loading And Its Impact On Malaysian Ringgit (MYR) Exports

Table of Contents

What is Front-Loading in the Context of MYR Exports?

Front-loading, in the context of MYR exports, refers to the practice of increasing export volumes ahead of anticipated negative changes in the economic environment. For Malaysian exporters, this often means accelerating shipments of goods priced in MYR before a predicted depreciation of the currency. This proactive strategy aims to secure higher returns and mitigate potential losses from unfavorable exchange rate fluctuations.

Motivations for Front-Loading:

Malaysian exporters might engage in front-loading due to several factors:

- Anticipating MYR Depreciation: If exporters foresee a weakening MYR against major trading partners' currencies (like the USD or EUR), they might front-load exports to lock in better prices before the currency depreciates further. This helps protect profit margins.

- Avoiding Future Tariffs or Trade Restrictions: The imposition of new tariffs or trade restrictions by importing countries can significantly impact export profitability. Front-loading allows exporters to beat potential trade barriers.

- Meeting Sales Targets: Sometimes, front-loading is employed to meet ambitious sales targets or fulfill contractual obligations before anticipated economic slowdowns.

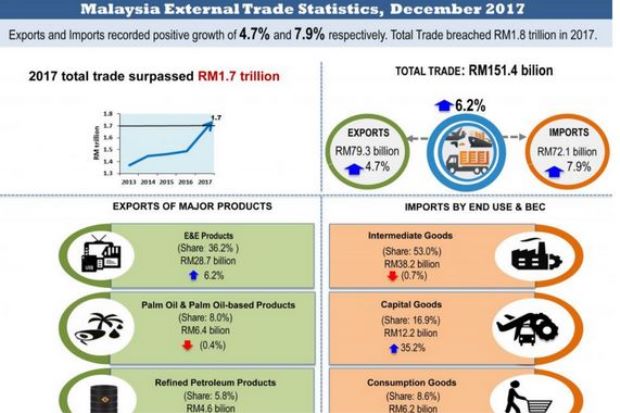

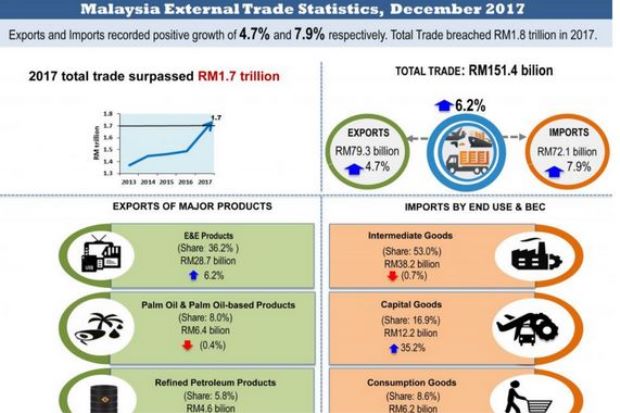

Examples of Front-Loading in Malaysian Export Sectors:

-

Palm Oil: Fluctuations in global palm oil prices and the MYR's exchange rate can prompt Malaysian palm oil exporters to front-load shipments to maximize revenue.

-

Electronics: The Malaysian electronics industry, a significant exporter, might front-load shipments in anticipation of changes in global demand or component prices.

-

Increased export volume before anticipated currency devaluation.

-

Preemptive measures to mitigate potential losses from unfavorable exchange rates.

-

Strategic stockpiling of goods by importers anticipating price hikes.

Impact of Front-Loading on Malaysian Ringgit (MYR) Exchange Rates

Front-loading's impact on the MYR exchange rate is complex and multifaceted.

Short-Term Effects: A surge in MYR export volume due to front-loading can temporarily strengthen the Ringgit. Increased demand for MYR to settle export transactions leads to appreciation.

Long-Term Effects: However, this effect is often temporary. Once the front-loading period ends, and export volumes normalize, the MYR might experience depreciation, potentially even exceeding the initial anticipated level. This is because the initial surge in demand is followed by a subsequent decrease, creating an imbalance.

External Factors: Global economic conditions significantly influence the impact of front-loading. For example, a global recession might negate the short-term strengthening effect, even with increased export volumes. The performance of other major currencies also plays a role.

- Temporary strengthening of MYR due to increased demand.

- Potential for future weakening as export volumes normalize.

- Influence of global market sentiment and investor confidence.

The Role of Government Policies and Regulations

Government policies and regulations play a vital role in mitigating the negative impacts of front-loading on the MYR and the Malaysian economy.

Government Intervention: Bank Negara Malaysia (BNM), the central bank, can utilize monetary policy tools, such as interest rate adjustments, to influence the MYR exchange rate and manage the effects of front-loading. Intervention might also involve managing foreign exchange reserves.

Regulatory Frameworks: Clear and consistent trade regulations can encourage long-term export strategies, reducing the reliance on short-term tactics like front-loading. This can promote stability in the export sector.

Impact on Businesses: Government policies, such as export incentives or subsidies, can influence businesses' decisions. Incentives that reward long-term planning may reduce the appeal of front-loading.

- Exchange rate management strategies employed by Bank Negara Malaysia.

- Impact of trade agreements on export competitiveness.

- Government incentives promoting long-term export strategies.

Analyzing the Future of MYR Exports and Front-Loading

Predicting the future of MYR exports and front-loading requires sophisticated economic modeling. These models can incorporate various factors, including global economic growth forecasts, commodity price predictions, and potential policy changes.

Risk Management Strategies: Malaysian businesses can adopt several strategies to manage risks associated with front-loading:

- Hedging: Employing hedging strategies, such as forward contracts or options, can help mitigate currency risk.

- Diversification: Diversifying export markets reduces reliance on any single market and mitigates risks associated with specific regional economic downturns.

Sustainable Export Practices: Adopting sustainable export practices, emphasizing long-term relationships with buyers and focusing on value-added products, is crucial for reducing reliance on short-term strategies like front-loading.

- Importance of diversification of export markets.

- Utilizing hedging strategies to manage currency risk.

- Adopting long-term export strategies for sustainable growth.

Conclusion

Front-loading significantly impacts Malaysian Ringgit (MYR) exports, creating both short-term gains and potential long-term risks. Understanding this strategic practice is crucial for businesses, policymakers, and economists. By carefully considering the effects of front-loading on the MYR exchange rate and implementing appropriate risk mitigation strategies, Malaysia can foster a more stable and sustainable export sector. To enhance your understanding of front-loading and its influence on the Malaysian Ringgit, explore further resources and consult with financial experts specializing in international trade and currency markets. Learn more about managing the impact of front-loading on your Malaysian Ringgit (MYR) exports today!

Featured Posts

-

Papal Conclave Explained A Step By Step Guide

May 07, 2025

Papal Conclave Explained A Step By Step Guide

May 07, 2025 -

Podcast Onetu I Newsweeka Stan Wyjatkowy Dwa Raz W Tygodniu

May 07, 2025

Podcast Onetu I Newsweeka Stan Wyjatkowy Dwa Raz W Tygodniu

May 07, 2025 -

The Impact Of Chris Finchs Leadership On The Minnesota Timberwolves

May 07, 2025

The Impact Of Chris Finchs Leadership On The Minnesota Timberwolves

May 07, 2025 -

Cobra Kai Exploring The Shows Karate Kid Continuity

May 07, 2025

Cobra Kai Exploring The Shows Karate Kid Continuity

May 07, 2025 -

Svetovy Pohar 2028 Rusko Vs Slovensko Nhl A Boj O Miesto

May 07, 2025

Svetovy Pohar 2028 Rusko Vs Slovensko Nhl A Boj O Miesto

May 07, 2025

Latest Posts

-

Where To Watch Cavaliers Vs Heat Game 2 Live Stream Tv Channel And Game Time

May 07, 2025

Where To Watch Cavaliers Vs Heat Game 2 Live Stream Tv Channel And Game Time

May 07, 2025 -

Nba Playoffs Game 1 Heat Vs Cavaliers Winning Picks And Predictions

May 07, 2025

Nba Playoffs Game 1 Heat Vs Cavaliers Winning Picks And Predictions

May 07, 2025 -

Nba Playoffs Heat Vs Cavaliers Game 1 Predictions Best Bets And Analysis

May 07, 2025

Nba Playoffs Heat Vs Cavaliers Game 1 Predictions Best Bets And Analysis

May 07, 2025 -

Heat Vs Cavaliers Game 1 Expert Predictions And Betting Picks For Nba Playoffs

May 07, 2025

Heat Vs Cavaliers Game 1 Expert Predictions And Betting Picks For Nba Playoffs

May 07, 2025 -

Heat Vs Cavaliers Prediction Game 1 Playoffs Best Bets And Picks

May 07, 2025

Heat Vs Cavaliers Prediction Game 1 Playoffs Best Bets And Picks

May 07, 2025