Understanding Greg Abel: The Canadian Leading Berkshire Hathaway

Table of Contents

Greg Abel's Early Life and Career Before Berkshire Hathaway

Canadian Roots and Education

Greg Abel's journey began in Canada, where he laid the foundation for his future success. His Canadian upbringing likely instilled in him a strong work ethic and a pragmatic approach to business, traits clearly evident in his career. Understanding his background helps us appreciate the unique perspective he brings to Berkshire Hathaway.

- Education: While specific details about his early education are not widely publicized, his academic achievements clearly provided a solid base for his future career. A focus on business or finance would have been instrumental in his eventual success.

- Early Jobs: Before joining Berkshire Hathaway, Abel likely gained valuable experience in various roles, honing essential skills in areas such as finance, operations, or management. These early experiences undoubtedly shaped his leadership style and approach to problem-solving.

- Notable Achievements (Pre-Berkshire Hathaway): Information regarding achievements prior to joining Berkshire Hathaway is limited publicly, but these formative years likely played a crucial role in shaping his future trajectory.

The Path to Berkshire Hathaway

Abel's journey to Berkshire Hathaway is a testament to his talent, dedication, and strategic thinking. The specifics of his recruitment and early roles within the company remain relatively private, highlighting the importance of discretion within this prominent investment firm.

- Key Roles: His progression within Berkshire Hathaway has been marked by a series of increasingly senior positions, each showcasing his abilities and contributing to his eventual rise to a leadership role.

- Significant Contributions: Throughout his tenure, Abel has demonstrably contributed to the success of Berkshire Hathaway's diverse portfolio of companies. Specific contributions are often kept private for business reasons.

- Awards and Recognitions: While public accolades may be sparse, his internal promotions and increased responsibilities within the company clearly indicate significant recognition of his contributions.

Abel's Leadership Style and Management Philosophy

Operational Excellence

Abel's leadership philosophy centers around operational excellence. His focus on efficiency and streamlining processes has been instrumental in improving the performance of Berkshire Hathaway's subsidiaries. This emphasis on practical results is a hallmark of his management style.

- Examples of Successful Operational Changes: While specifics are generally undisclosed, anecdotal evidence points to a focus on improving efficiency and profitability across various Berkshire Hathaway businesses.

- Data-Driven Decision Making: Abel likely employs a data-driven approach to decision-making, relying on metrics and performance data to guide his strategies and ensure optimal operational outcomes.

Decentralized Management Approach

Despite overseeing a vast and diverse empire, Abel adopts a decentralized management approach. This hands-off but engaged style empowers subsidiary leaders to make critical decisions and encourages a high degree of autonomy.

- Evidence of Delegation: His leadership style strongly suggests a trust in and empowerment of the leaders within Berkshire Hathaway's subsidiaries.

- Collaborative Partnerships: Abel likely fosters collaborative relationships between the various subsidiary companies, allowing for information exchange and synergistic opportunities.

Long-Term Vision and Investment Strategy

Abel's investment strategy aligns with Berkshire Hathaway's long-term focus on value creation. While comparisons to Warren Buffett's style are inevitable, Abel's unique approach is slowly becoming clear.

- Examples of Investment Decisions: Specific details about Abel's personal investment decisions are largely unavailable publicly. His role within Berkshire Hathaway, however, allows for observation of the company's overall investment strategy.

- Value Investing Principles: Abel's investment philosophy undoubtedly adheres to the principles of value investing, focusing on identifying undervalued assets with long-term growth potential.

The Succession Plan and Abel's Potential Impact on Berkshire Hathaway

Warren Buffett's Legacy and Abel's Role

The succession plan at Berkshire Hathaway is a significant event in the business world. Abel's position as the likely successor to Warren Buffett carries immense responsibility and expectation.

- Challenges He Might Face: The challenge of leading a company of Berkshire Hathaway's size and complexity is immense, demanding strong leadership, strategic thinking and adaptability in the face of constant change.

- Opportunities for Innovation: Abel's leadership also presents exciting opportunities for innovation within the company, the potential for adapting Berkshire Hathaway's approach to the changing economic landscape.

Potential Changes Under Abel's Leadership

Speculation regarding potential changes under Abel's leadership is rife. His Canadian background might influence his approach in subtle but potentially significant ways.

- Possible Shifts in Investment Focus: While the core principles of value investing will likely remain, there might be a shift in specific sectors or industries favored for investment.

- Potential New Acquisitions: Abel's leadership could lead to a new set of acquisitions, reflecting his vision for the future of the company.

Maintaining Berkshire Hathaway's Success

Maintaining Berkshire Hathaway's remarkable success requires a delicate balance of preserving its core values and adapting to a changing world.

- Key Factors Influencing His Success: Abel's success will depend on several key factors, including his ability to maintain strong relationships with subsidiary leaders, navigate economic uncertainties and adapt to evolving market conditions.

- Potential Risks and Challenges: The global economic landscape poses significant risks and challenges for any company, and Berkshire Hathaway is no exception.

Conclusion: Understanding Greg Abel's Leadership of Berkshire Hathaway

Greg Abel's rise within Berkshire Hathaway is a compelling story of leadership and strategic vision. His Canadian background, coupled with his extensive experience at Berkshire Hathaway, uniquely positions him to lead the company into the future. Understanding his leadership style, his operational excellence, and his long-term vision is crucial for anyone interested in the future of this investment giant. He represents a significant shift in the leadership of this powerful institution, while still staying true to the principles upon which it was built.

Call to Action: Stay informed about the future of Berkshire Hathaway under Greg Abel's leadership. Learn more about the Canadian executive shaping the future of investment by exploring reputable financial news sources and business publications. Dive deeper into the world of Greg Abel and his influence on Berkshire Hathaway. [Link to relevant resource 1] [Link to relevant resource 2]

Featured Posts

-

The Rihanna A Ap Rocky Romance Fact Or Fiction

May 07, 2025

The Rihanna A Ap Rocky Romance Fact Or Fiction

May 07, 2025 -

Building A Resilient Future The Third Ldc Future Forums Action Plan

May 07, 2025

Building A Resilient Future The Third Ldc Future Forums Action Plan

May 07, 2025 -

Laram Wimbratwr Yteawnan Lajtdhab Almzyd Mn Alsyah Ila Albrazyl

May 07, 2025

Laram Wimbratwr Yteawnan Lajtdhab Almzyd Mn Alsyah Ila Albrazyl

May 07, 2025 -

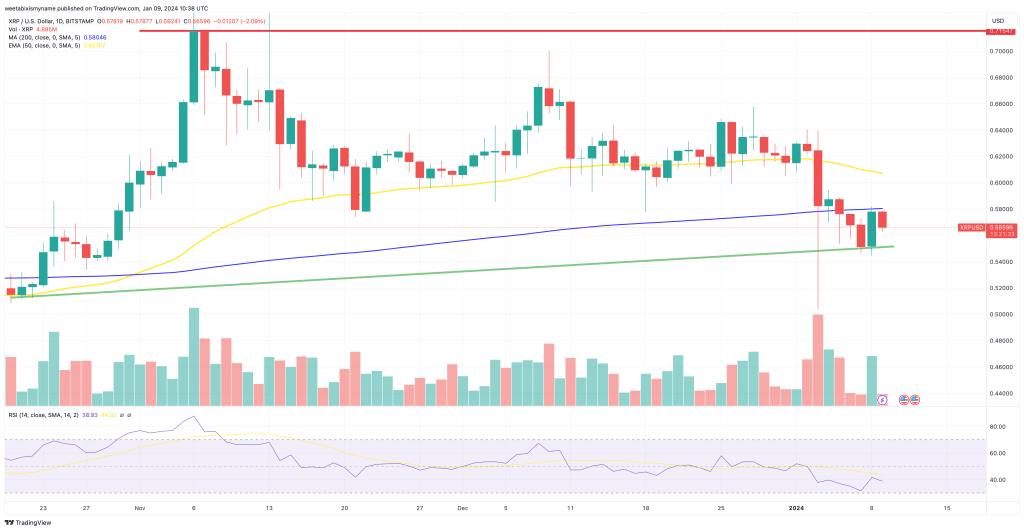

Xrp Rival Emerges Altcoin Projected For A 5880 Rally

May 07, 2025

Xrp Rival Emerges Altcoin Projected For A 5880 Rally

May 07, 2025 -

Why Jenna Ortega Is Poised To Become Horrors Next Scream Queen

May 07, 2025

Why Jenna Ortega Is Poised To Become Horrors Next Scream Queen

May 07, 2025

Latest Posts

-

Xrp Investment Understanding The Factors Driving Potential Xrp Growth

May 08, 2025

Xrp Investment Understanding The Factors Driving Potential Xrp Growth

May 08, 2025 -

Ripple And Xrp Analyzing Recent Developments And The Remittix Ico

May 08, 2025

Ripple And Xrp Analyzing Recent Developments And The Remittix Ico

May 08, 2025 -

Xrp Price Prediction 3 Reasons For Potential Xrp Surge And Remittix Ico Success

May 08, 2025

Xrp Price Prediction 3 Reasons For Potential Xrp Surge And Remittix Ico Success

May 08, 2025 -

Xrp News Is A Parabolic Xrp Price Move Imminent

May 08, 2025

Xrp News Is A Parabolic Xrp Price Move Imminent

May 08, 2025 -

Xrp On The Rise Three Reasons Why Xrp Could Experience A Parabolic Move

May 08, 2025

Xrp On The Rise Three Reasons Why Xrp Could Experience A Parabolic Move

May 08, 2025