Understanding High Stock Market Valuations: BofA's Insights

Table of Contents

BofA's Current Market Outlook and Valuation Metrics

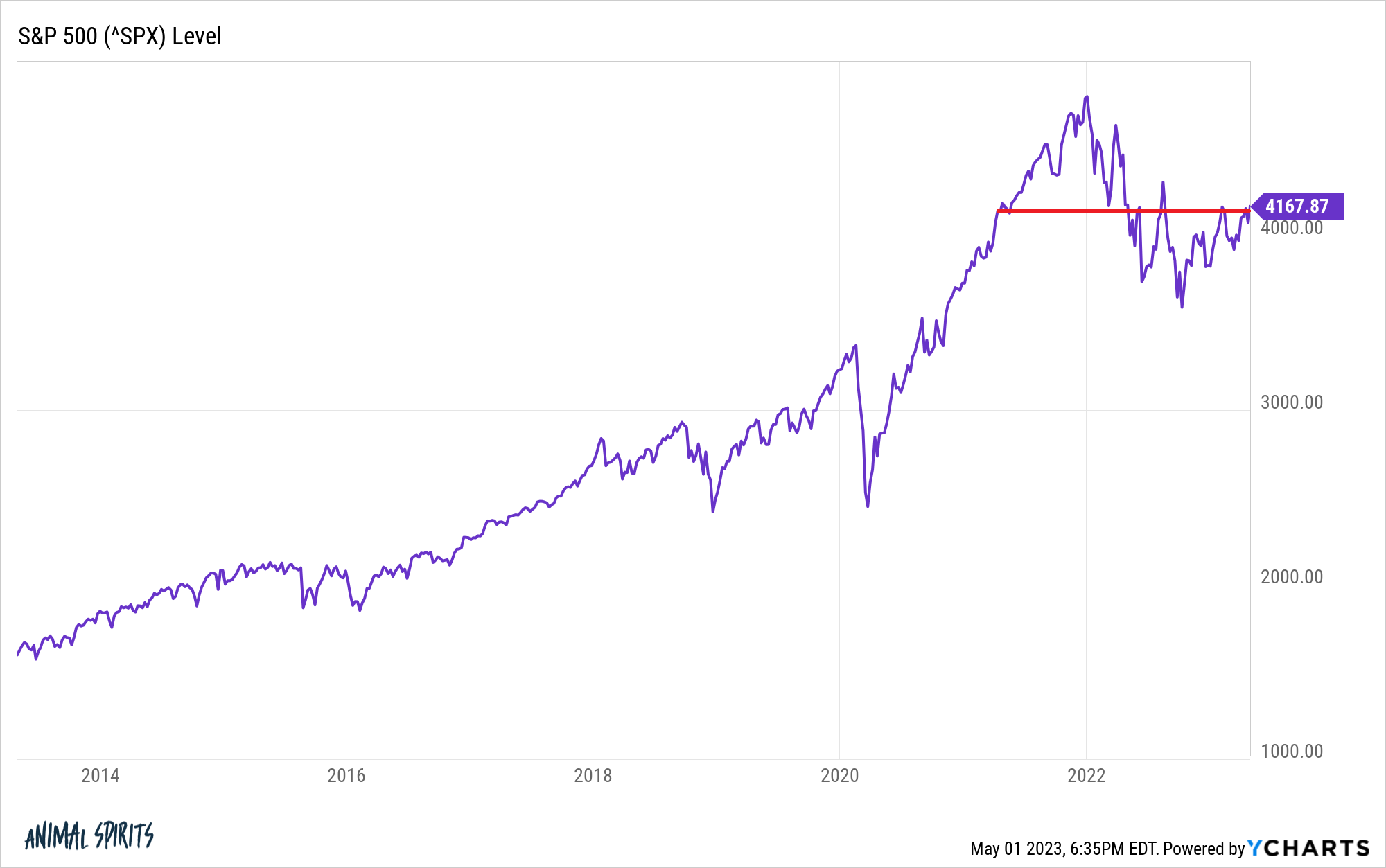

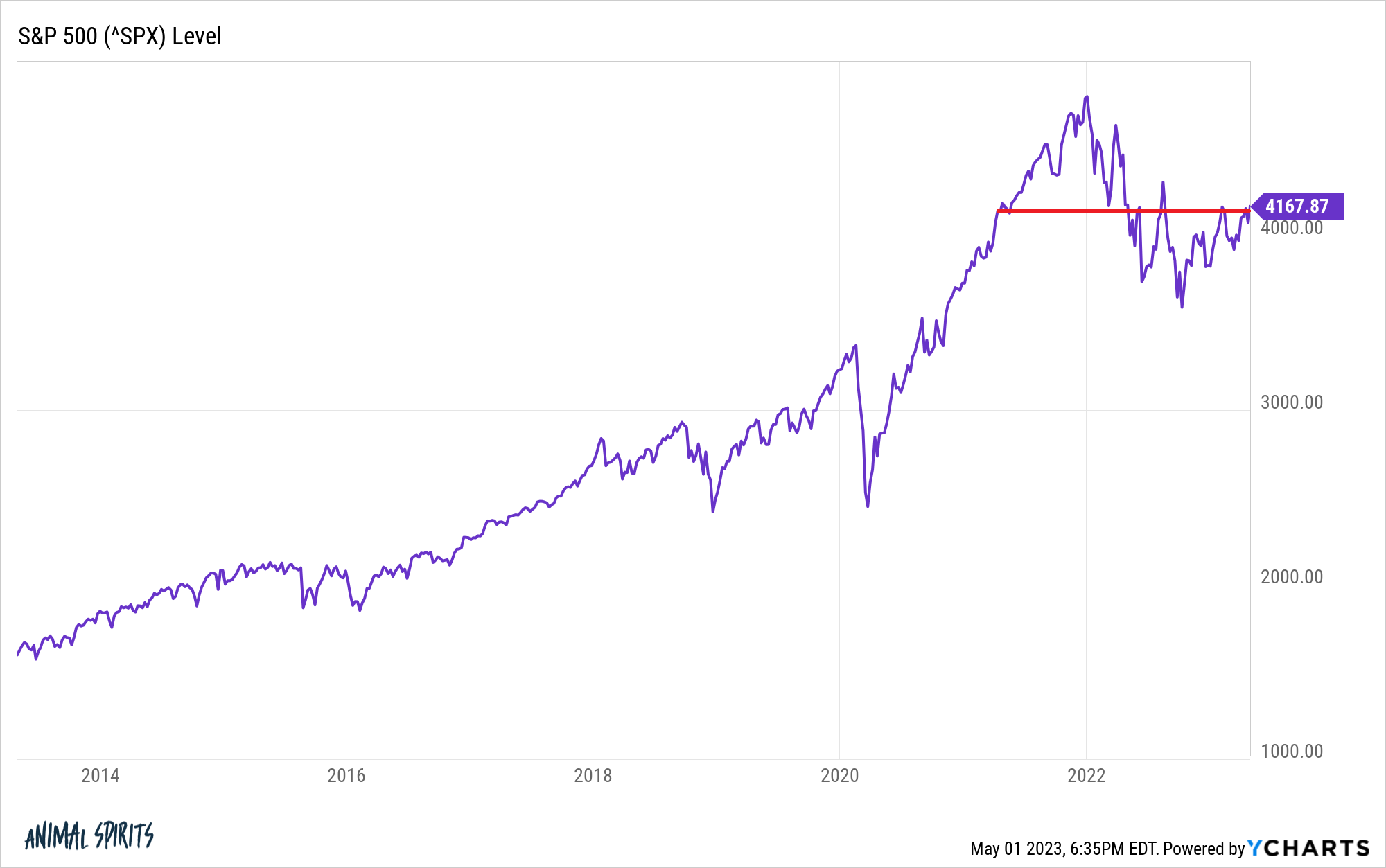

BofA's current market outlook often reflects a cautious optimism, acknowledging the robust performance but also highlighting the elevated valuation levels. They employ a range of valuation metrics to assess the market's health. These include the widely used Price-to-Earnings ratio (P/E), the Price-to-Sales ratio (P/S), and the cyclically adjusted price-to-earnings ratio (Shiller P/E), which smooths out short-term earnings fluctuations.

- BofA's target P/E ratio for the market: While specific target P/E ratios fluctuate based on economic forecasts, BofA typically uses historical averages and projected earnings growth to determine a reasonable range. Their targets often serve as a benchmark against which current valuations are compared.

- Comparison of current valuations to historical averages: BofA's analysis often reveals that current P/E ratios are significantly above historical averages, suggesting that the market may be overvalued. This comparison provides a crucial context for understanding the current market environment.

- Key indicators BofA uses to assess market valuation: Beyond traditional ratios, BofA incorporates a wide range of indicators, including interest rates, inflation, economic growth projections, and investor sentiment, to build a holistic view of market valuations. This multi-faceted approach allows for a more nuanced understanding of market dynamics.

Factors Contributing to High Stock Market Valuations

Several factors have contributed to the current high stock market valuations. These include:

-

Macroeconomic factors: Persistently low interest rates, fueled by quantitative easing policies from central banks globally, have significantly lowered the cost of borrowing for companies and investors. This has fueled increased investment and higher stock prices. Strong corporate earnings, driven by robust economic growth in certain sectors, also contribute to higher valuations.

-

Investor sentiment and market psychology: Positive investor sentiment, driven by factors like technological innovation and expectations of future growth, can lead to higher valuations as investors bid up prices. This positive feedback loop can push valuations beyond what fundamentals alone would justify.

-

Technological advancements and disruptive innovation: The rapid pace of technological change and the emergence of disruptive innovations have fueled growth in specific sectors, leading to significantly higher valuations for companies at the forefront of these advancements.

- Impact of low interest rates on discounted cash flow models: Lower interest rates reduce the discount rate used in discounted cash flow models, leading to higher valuations for companies with future growth potential.

- Influence of investor confidence and risk appetite: High investor confidence and a strong risk appetite can drive investors to pay higher prices for stocks, pushing valuations higher.

- Specific examples of sectors driving high valuations: Technology, healthcare, and consumer discretionary sectors have often been highlighted as key drivers of high stock market valuations in recent years.

Risks Associated with High Stock Market Valuations

Investing in a market with high stock market valuations carries inherent risks:

-

Increased vulnerability to corrections: Highly valued markets are inherently more susceptible to sharp corrections or crashes when investor sentiment shifts or unexpected economic events occur. A small negative trigger can lead to a significant sell-off.

-

Reduced potential for future returns: Historically, high valuations have often been followed by periods of lower returns, as the market reverts to more sustainable levels. Investors should anticipate reduced future returns compared to investing in undervalued markets.

-

Risks associated with specific sectors or asset classes: Certain sectors or asset classes may be disproportionately affected by shifts in investor sentiment or macroeconomic conditions. Careful analysis and diversification are crucial to mitigating these sector-specific risks.

- Historical examples of market corrections following periods of high valuations: The dot-com bubble burst and the 2008 financial crisis serve as stark reminders of the risks associated with investing in overvalued markets.

- Potential impact of rising interest rates on stock prices: Rising interest rates can negatively impact stock prices, particularly for growth stocks that rely heavily on future earnings, making understanding high stock market valuations even more crucial.

- Strategies for mitigating risks in a high-valuation environment: Diversification across different asset classes, employing defensive investment strategies, and focusing on undervalued companies can help mitigate the risks.

BofA's Recommendations for Investors

BofA's recommendations for investors navigating high stock market valuations often emphasize a cautious approach, balancing potential growth with risk mitigation. They may suggest diversifying portfolios across asset classes, focusing on quality companies with strong fundamentals, and employing value investing strategies. Specific sectors or asset classes that BofA highlights as potentially less vulnerable to market corrections vary depending on their current market outlook.

- BofA's recommended asset allocation strategies: Their recommendations often involve a balanced approach, adjusting the allocation based on risk tolerance and market outlook.

- Specific investment opportunities highlighted by BofA: This will often include undervalued companies with strong fundamentals, or companies in sectors with strong long-term growth prospects.

- Advice on managing portfolio risk in a high-valuation market: This typically involves diversifying across different assets, sectors, and geographies to reduce portfolio volatility.

Understanding High Stock Market Valuations – Key Takeaways and Call to Action

BofA's analysis reveals that current high stock market valuations present both opportunities and risks. Several macroeconomic factors, including low interest rates and strong corporate earnings, have contributed to these high valuations. However, this environment also carries increased vulnerability to market corrections and potentially lower future returns. Understanding these valuations is crucial for making informed investment decisions. To effectively analyze high stock market valuations and manage the associated risks, learn more about BofA's comprehensive research and analysis. [Link to BofA's relevant research]. By actively understanding and managing high stock market valuations, investors can make more informed decisions to navigate this complex market environment.

Featured Posts

-

Brewers Yankees Injury Concerns Ahead Of March 27 30 Series

May 11, 2025

Brewers Yankees Injury Concerns Ahead Of March 27 30 Series

May 11, 2025 -

Crazy Rich Asians Series What To Expect

May 11, 2025

Crazy Rich Asians Series What To Expect

May 11, 2025 -

Daily Comic Book News Superman Headlines Daredevil Vs Bullseye Showdown And More

May 11, 2025

Daily Comic Book News Superman Headlines Daredevil Vs Bullseye Showdown And More

May 11, 2025 -

Anunoby Lidera A Knicks En Victoria Sobre 76ers 27 Puntos

May 11, 2025

Anunoby Lidera A Knicks En Victoria Sobre 76ers 27 Puntos

May 11, 2025 -

Tam Krwz Awr Mdah Ayk Ghyr Mtwqe Waqeh

May 11, 2025

Tam Krwz Awr Mdah Ayk Ghyr Mtwqe Waqeh

May 11, 2025