Understanding High Stock Market Valuations: BofA's Investor Guidance

Table of Contents

BofA's Key Indicators of High Valuations

BofA likely uses several key metrics to assess market valuations. These include widely-used indicators such as the Price-to-Earnings ratio (P/E), the Shiller P/E (CAPE – Cyclically Adjusted Price-to-Earnings Ratio), and the Price-to-Sales ratio (P/S).

- Price-to-Earnings Ratio (P/E): This compares a company's stock price to its earnings per share. A high P/E ratio suggests investors are paying a premium for each dollar of earnings, potentially indicating overvaluation. BofA might consider a P/E significantly above the historical average as a sign of high valuations.

- Shiller P/E (CAPE): This adjusts the P/E ratio for inflation and uses a 10-year average of earnings, smoothing out short-term fluctuations. A high CAPE ratio suggests long-term overvaluation.

- Price-to-Sales Ratio (P/S): This compares a company's stock price to its revenue per share. It's useful for evaluating companies with negative earnings. A high P/S ratio might point to overvaluation.

Numerical Thresholds: While specific thresholds vary based on industry and economic context, BofA might consider the following as indicative of high valuations:

- P/E ratio consistently above 25-30 for the broad market index.

- CAPE ratio substantially exceeding its historical average (around 17).

- High P/S ratios across various sectors, significantly above historical norms.

Limitations of Valuation Metrics: It's crucial to remember that these metrics are not perfect. They can be influenced by factors like accounting practices, economic cycles, and industry-specific characteristics. Furthermore, these ratios only tell part of the story; qualitative factors such as management quality and competitive landscape should also be considered.

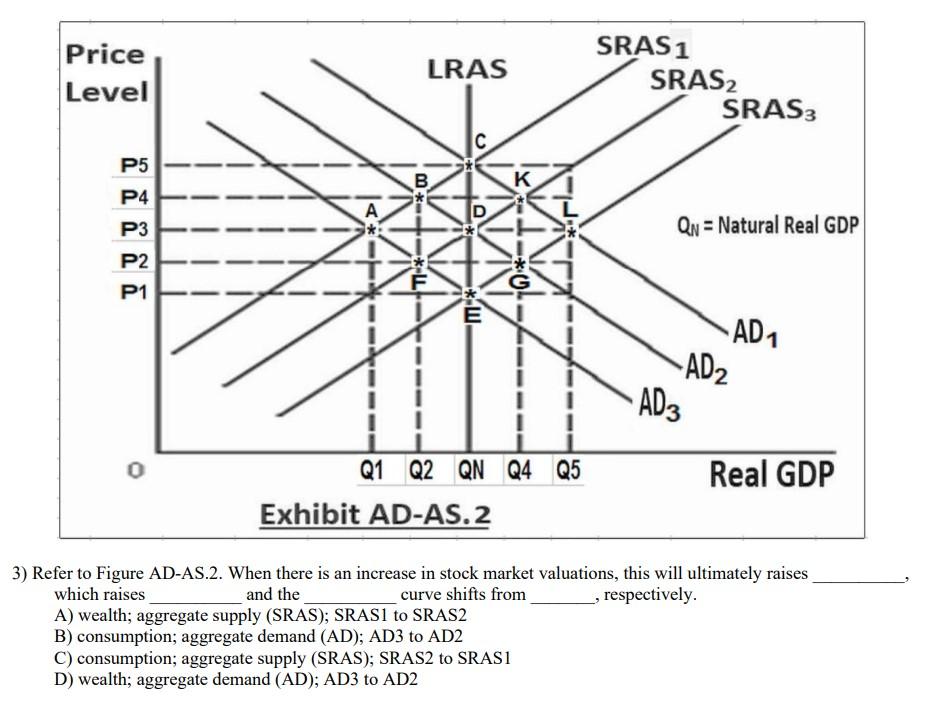

(Insert chart or graph here if available from BofA reports showing current state of these indicators)

Understanding the Underlying Economic Factors

High stock market valuations are often driven by several underlying economic factors. BofA's analysis likely considers these key contributors:

- Low Interest Rates: Low interest rates reduce the cost of borrowing, encouraging companies to invest and increasing demand for stocks as an alternative to low-yielding bonds.

- Quantitative Easing (QE): Central bank policies like QE inject liquidity into the market, driving up asset prices, including stocks.

- Strong Corporate Earnings: Robust corporate earnings growth can justify higher stock prices, particularly if earnings exceed expectations.

- Technological Advancements: Rapid technological progress can fuel investor optimism and drive significant growth in certain sectors, leading to elevated valuations.

These factors can significantly impact stock prices, but their sustainability is uncertain. A change in any of these factors could lead to a reassessment of market valuations and potentially a market correction. For example, rising interest rates could reduce the attractiveness of equities and lead to lower valuations. Similarly, slowing corporate earnings growth could dampen investor enthusiasm. Increased inflation, eroding purchasing power, poses another substantial risk.

BofA's Recommended Investment Strategies

In a high-valuation market, BofA likely recommends a diversified approach incorporating the following strategies:

- Diversification: Spreading investments across different asset classes (stocks, bonds, real estate) and sectors reduces overall portfolio risk.

- Value Investing: Focusing on undervalued companies with strong fundamentals can offer better risk-adjusted returns in the long term.

- Defensive Stocks: Investing in companies considered less sensitive to economic downturns (e.g., consumer staples, utilities) can provide stability during market corrections.

- Sector Rotation: Shifting investments between different sectors based on economic outlook and relative valuations.

Advantages and Disadvantages: Each strategy has advantages and disadvantages. Value investing, for instance, requires thorough research and patience; defensive stocks may offer lower growth potential. Sector rotation demands ongoing market analysis and can be time-consuming.

Risk Management Techniques: BofA likely advises investors to employ risk management techniques such as:

- Stop-loss orders: Automatically selling a security when it reaches a predetermined price to limit potential losses.

- Portfolio rebalancing: Regularly adjusting portfolio allocations to maintain desired asset allocations and risk levels.

Navigating Market Volatility and Risk

High valuations inherently increase market risk. Investors should be aware of the potential for:

- Market Corrections: Sharp declines in market prices.

- Significant Losses: The potential for substantial portfolio losses during market downturns.

- Inflation: Eroding the purchasing power of returns.

Managing Market Risks: BofA likely emphasizes the importance of a long-term investment horizon, diversification, and risk management techniques outlined above to mitigate these risks. Regularly reviewing your investment strategy and adjusting it based on market conditions is crucial.

Alternative Investment Options

BofA might suggest diversifying into alternative asset classes like bonds (to provide stability), real estate (for potential long-term appreciation), or precious metals (as an inflation hedge) to further mitigate risks associated with high stock market valuations.

Conclusion: Making Informed Decisions on High Stock Market Valuations

Understanding high stock market valuations is crucial for successful investing. BofA's guidance highlights the importance of analyzing key valuation metrics (P/E, CAPE, P/S), understanding underlying economic factors (interest rates, QE, corporate earnings), and employing diversified investment strategies (value investing, defensive stocks, sector rotation) along with robust risk management techniques (stop-loss orders, portfolio rebalancing). By carefully considering BofA's insights and conducting your own thorough research, you can make informed decisions and build a robust investment portfolio that can weather market volatility and achieve your long-term financial goals. Remember to consult with a qualified financial advisor before making any investment decisions.

Featured Posts

-

Promising Dodgers Prospects Phillips Linan And Quinteros Development

May 15, 2025

Promising Dodgers Prospects Phillips Linan And Quinteros Development

May 15, 2025 -

Is Creatine Right For Me A Guide To Creatine Supplementation

May 15, 2025

Is Creatine Right For Me A Guide To Creatine Supplementation

May 15, 2025 -

Rekord Ovechkina 12 Ya Pozitsiya V Spiske Luchshikh Snayperov Pley Off N Kh L

May 15, 2025

Rekord Ovechkina 12 Ya Pozitsiya V Spiske Luchshikh Snayperov Pley Off N Kh L

May 15, 2025 -

Cybercriminal Made Millions Targeting Office365 Executive Inboxes

May 15, 2025

Cybercriminal Made Millions Targeting Office365 Executive Inboxes

May 15, 2025 -

Panthers Vs Maple Leafs Game 5 Prediction Picks And Odds For Tonights Nhl Playoffs

May 15, 2025

Panthers Vs Maple Leafs Game 5 Prediction Picks And Odds For Tonights Nhl Playoffs

May 15, 2025