Understanding High Stock Market Valuations: BofA's Investor Reassurance

Table of Contents

Factors Contributing to High Stock Market Valuations

Several key factors have contributed to the current high stock market valuations. Understanding these factors is crucial for making informed investment decisions.

Low Interest Rates and Quantitative Easing

Historically low interest rates and quantitative easing (QE) policies implemented by central banks globally have significantly impacted stock valuations. These policies have:

- Increased investor demand for higher-yielding assets: With low returns on traditional savings accounts and bonds, investors have sought higher returns in the stock market, driving up demand and prices.

- Reduced borrowing costs for companies: Lower interest rates enable companies to borrow money more cheaply, leading to increased investment in growth initiatives and stock buybacks, further boosting stock prices.

- Increased the present value of future earnings: Low discount rates, a consequence of low interest rates, increase the present value of future corporate earnings, making stocks appear more attractive. This is a key driver of higher Price-to-Earnings (P/E) ratios, a common valuation metric.

Strong Corporate Earnings and Growth Prospects

Robust corporate earnings and positive growth prospects are another significant factor supporting high valuations. Many sectors have shown impressive performance, leading to increased investor confidence.

- Technology and Healthcare: These sectors, among others, have been significant drivers of market growth, showcasing strong earnings and promising future prospects. Their innovative products and services continue to attract significant investment.

- Analysis of earnings reports: Consistent positive surprises in earnings reports have further fueled investor optimism and pushed stock prices higher. Analyzing these reports critically is vital for assessing the true value of individual companies.

- Long-term growth forecasts: Analysts' long-term growth forecasts often paint a positive picture, further supporting the belief that current high valuations are justified, at least in part, by expectations of future earnings.

Increased Liquidity and Investor Sentiment

High market liquidity, coupled with positive investor sentiment, has further contributed to elevated valuations.

- Retail and institutional investor participation: Increased participation from both retail and institutional investors has increased demand for stocks, driving up prices.

- Impact of news and media: Positive news coverage and generally optimistic media narratives can significantly influence investor sentiment, leading to a "fear of missing out" (FOMO) effect and further price increases.

- Market sentiment indicators: While not always perfectly reliable, market sentiment indicators such as the VIX (volatility index) can offer insights into investor confidence levels. A low VIX generally suggests lower fear and higher confidence.

BofA's Perspective on High Stock Market Valuations

BofA, a leading global financial institution, offers valuable insights into the current market dynamics. Their analysis helps investors understand the context of these high valuations.

BofA's Analysis and Rationale

BofA's analysis generally acknowledges the high valuations but often emphasizes long-term growth prospects as a key justification. Their reports frequently highlight:

- Long-term growth prospects: BofA analysts usually focus on long-term economic growth and corporate earnings potential as reasons to justify – at least partially – current high valuations.

- Sustainability of valuations: While acknowledging potential risks, BofA often suggests that current valuations are partly sustainable due to underlying economic factors and corporate performance.

- Specific sectors and companies: BofA regularly identifies specific sectors and companies they believe are particularly well-positioned for future growth, even in a high-valuation environment. These are often companies with strong balance sheets and competitive advantages.

BofA's Recommendations for Investors

BofA typically advises investors to adopt a cautious yet balanced approach, emphasizing strategic portfolio management:

- Risk mitigation strategies: They generally suggest diversification across various asset classes (stocks, bonds, real estate, etc.) to mitigate risks associated with high valuations.

- Portfolio diversification: BofA often recommends constructing well-diversified portfolios to reduce exposure to any single sector or company, reducing overall portfolio volatility.

- Outlook for different asset classes: Their recommendations often consider the outlook for different asset classes, suggesting adjustments based on their risk-reward assessments.

Strategies for Navigating High Stock Market Valuations

Navigating a market with high valuations requires a proactive and strategic approach.

Risk Management Techniques

Effective risk management is crucial in a high-valuation market. Key strategies include:

- Diversification: Spread investments across different asset classes and sectors to reduce the impact of any single investment underperforming.

- Stop-loss orders: Use stop-loss orders to automatically sell a security if it falls below a certain price, limiting potential losses.

- Due diligence: Thoroughly research any investment before committing capital, ensuring you understand its risks and potential rewards.

Long-Term Investment Strategies

Focusing on a long-term investment horizon is crucial for weathering short-term market fluctuations:

- Fundamental analysis: Prioritize fundamental analysis over short-term market trends to identify undervalued companies with strong long-term prospects.

- Dollar-cost averaging: Invest regularly regardless of market conditions, averaging your purchase price over time.

- Avoid market timing: Trying to time the market is extremely difficult and often unsuccessful. A consistent, long-term investment strategy is generally more effective.

Conclusion

Understanding high stock market valuations requires a comprehensive understanding of various contributing factors. BofA's analysis provides valuable insight and helps investors approach this complex environment with greater clarity. By employing sound risk management techniques and adopting a long-term investment strategy, investors can navigate the challenges and opportunities presented by high stock market valuations. Remember to conduct your own thorough research and consider seeking professional financial advice before making any investment decisions related to high stock market valuations.

Featured Posts

-

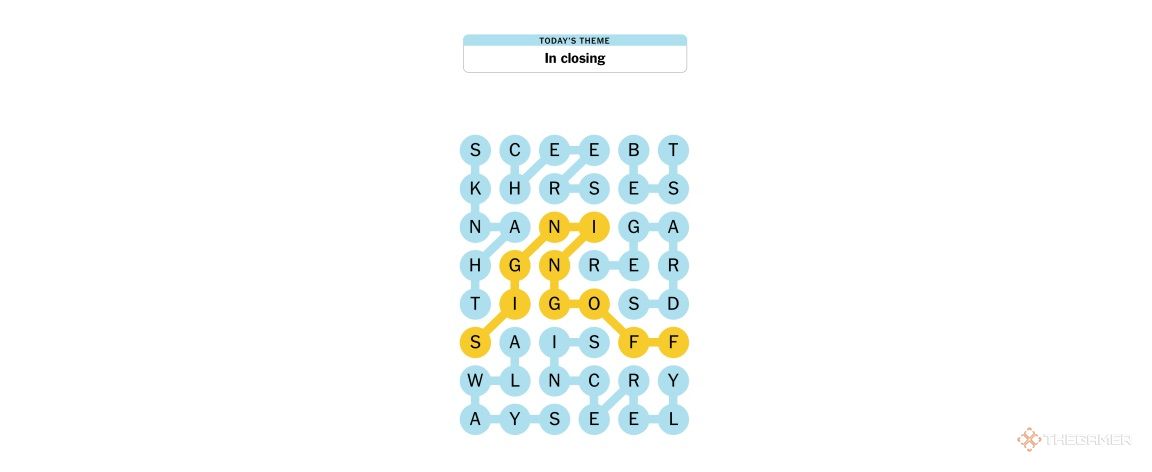

Solving The Nyt Strands A Comprehensive Look At The April 12 2025 Puzzle

May 10, 2025

Solving The Nyt Strands A Comprehensive Look At The April 12 2025 Puzzle

May 10, 2025 -

Investigating Pam Bondis Assertion About The Epstein Client List

May 10, 2025

Investigating Pam Bondis Assertion About The Epstein Client List

May 10, 2025 -

Uk Government Announces Stricter Visa Policies For Nigerians And Pakistanis

May 10, 2025

Uk Government Announces Stricter Visa Policies For Nigerians And Pakistanis

May 10, 2025 -

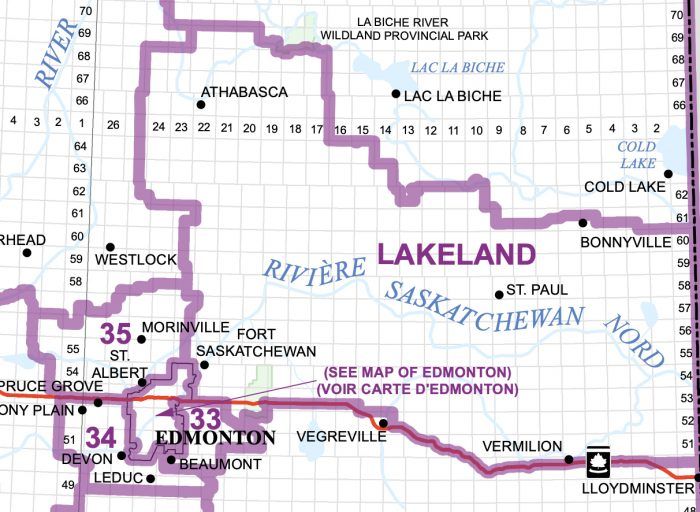

Analyzing The Effects Of Federal Riding Changes On Edmonton Area Voters

May 10, 2025

Analyzing The Effects Of Federal Riding Changes On Edmonton Area Voters

May 10, 2025 -

Leon Draisaitls 100 Point Milestone Oilers Defeat Islanders In Overtime

May 10, 2025

Leon Draisaitls 100 Point Milestone Oilers Defeat Islanders In Overtime

May 10, 2025