Understanding High Stock Market Valuations: Insights From BofA

Table of Contents

BofA's Current Outlook on Stock Market Valuations

BofA generally maintains a cautious, yet not overly pessimistic, stance on current high stock market valuations. While acknowledging the strong performance and robust corporate earnings driving the market, they emphasize the inherent risks associated with such elevated levels. Their assessments are often detailed in their regularly published research reports and market commentaries, such as [insert link to relevant BofA report here if available]. These reports offer a comprehensive overview of economic indicators and market trends.

- Key factors cited by BofA contributing to high valuations: BofA points to historically low interest rates, sustained strong corporate earnings, and positive investor sentiment fueled by technological advancements and anticipated economic growth as primary drivers of these high stock market valuations.

- BofA's assessment of potential risks: BofA highlights several potential risks, including the possibility of a market correction, increased inflation eroding corporate profits, and escalating geopolitical uncertainty as factors that could negatively impact the market. The firm acknowledges that these high valuations leave the market susceptible to greater volatility.

- Specific sectors: BofA's analyses often pinpoint specific sectors as either overvalued or undervalued. For example, they may suggest that certain technology stocks are overvalued relative to their fundamentals, while certain value sectors may represent better investment opportunities given the current market conditions. (Note: Specific sector calls would require referencing a current BofA report.)

Key Metrics Used by BofA to Assess Stock Market Valuations

BofA, like other financial analysts, utilizes several key metrics to gauge stock market valuations. Understanding these metrics is crucial for interpreting their assessments.

-

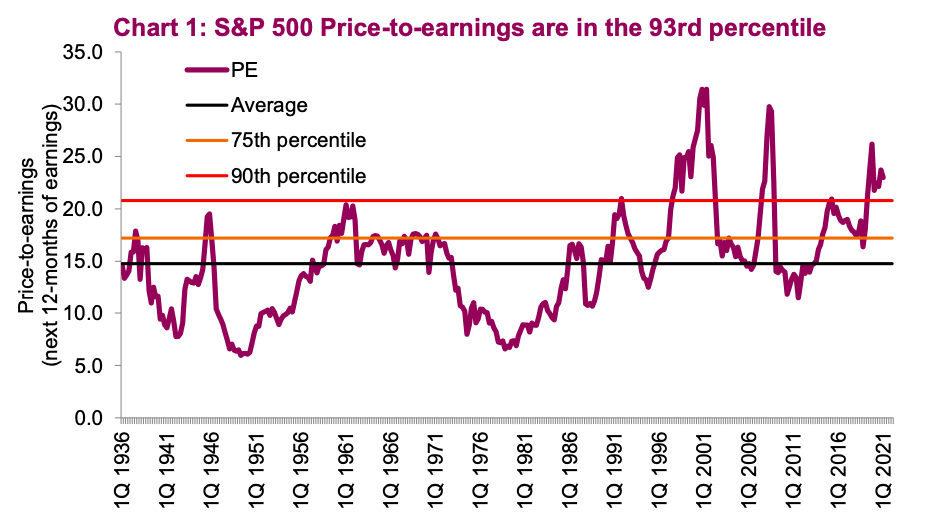

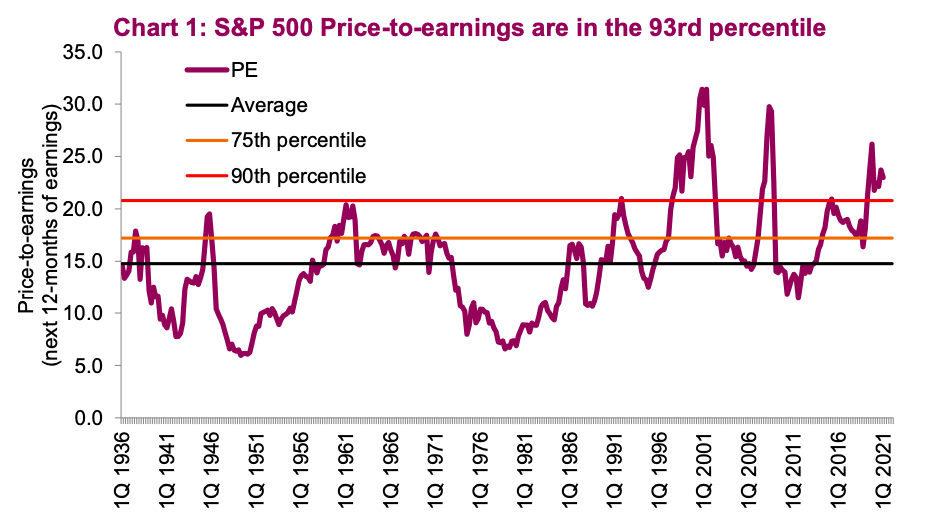

Price-to-Earnings ratio (P/E): This compares a company's stock price to its earnings per share. A high P/E ratio generally suggests that investors are willing to pay a premium for each dollar of earnings, potentially indicating overvaluation.

-

Price-to-Sales ratio (P/S): This compares a company's stock price to its revenue per share. It's useful for valuing companies with negative earnings. A high P/S ratio can suggest overvaluation.

-

Shiller P/E (Cyclically Adjusted Price-to-Earnings ratio): This metric smooths out earnings fluctuations over a longer period (typically 10 years), providing a more stable measure of valuation. A high Shiller P/E can suggest the market is overvalued relative to its historical average.

-

How these metrics help determine over/undervaluation: BofA analyzes these ratios across various sectors and compares them to historical averages and peer companies to determine if individual stocks or the overall market is overvalued or undervalued. For example, a significantly higher-than-average P/E ratio across the broad market might signal overvaluation.

-

BofA's interpretation: BofA's analysts use these metrics in conjunction with other qualitative factors (economic forecasts, industry trends, etc.) to reach their overall valuation assessments. Their interpretations of these metrics are crucial for understanding their outlook on the stock market.

Implications of High Stock Market Valuations for Investors

BofA's cautious perspective on high stock market valuations holds significant implications for investors, particularly regarding their investment strategies and risk management.

-

Long-term investors: Long-term investors may consider maintaining a diversified portfolio, potentially reducing exposure to sectors deemed overvalued by BofA and increasing exposure to undervalued sectors or defensive assets.

-

Short-term investors: Short-term investors might adopt a more cautious approach, potentially reducing their equity exposure or focusing on less volatile investments.

-

Strategies for investors concerned about high valuations: Diversification across asset classes (stocks, bonds, real estate), value investing focusing on undervalued companies, and investing in defensive stocks (those less susceptible to economic downturns) are often suggested strategies.

-

Opportunities despite high valuations: Even with high valuations, there may be opportunities within specific undervalued sectors or individual companies with strong fundamentals. Thorough research and due diligence are vital.

-

Importance of risk management: In a potentially volatile market, risk management is paramount. Investors should carefully assess their risk tolerance and adjust their portfolios accordingly.

Comparing BofA's Analysis to Other Market Experts

While BofA offers valuable insights, it's essential to consider other perspectives. Some analysts might hold more optimistic views on current valuations, citing potential future growth opportunities or arguing that current valuations are justified by strong underlying economic fundamentals. Others may share BofA's cautious outlook, perhaps emphasizing different risks or employing alternative valuation metrics.

- Differing viewpoints: [Mention specific analysts or firms with differing viewpoints and their rationale, if possible. Include links to their reports.]

- Reasons for contrasting opinions: Disagreements often stem from varying interpretations of economic data, different weighting of risk factors, or the utilization of distinct valuation models.

Conclusion: Understanding and Navigating High Stock Market Valuations

BofA's analysis highlights the inherent risks associated with currently high stock market valuations. Understanding key valuation metrics like the P/E ratio, P/S ratio, and Shiller P/E is crucial for interpreting market conditions and making informed investment decisions. BofA's cautious outlook underscores the importance of diversification, risk management, and a well-defined investment strategy. Understanding high stock market valuations is crucial for informed investment decisions. Dive deeper into BofA's research and consider seeking professional financial advice to develop a robust investment strategy to navigate this dynamic market landscape.

Featured Posts

-

Ftc To Appeal Activision Blizzard Acquisition Decision

Apr 22, 2025

Ftc To Appeal Activision Blizzard Acquisition Decision

Apr 22, 2025 -

Googles Search Monopoly Doj Files Renewed Legal Challenge

Apr 22, 2025

Googles Search Monopoly Doj Files Renewed Legal Challenge

Apr 22, 2025 -

Live Stock Market Updates Dow Futures Drop Dollar Slides On Trade Worries

Apr 22, 2025

Live Stock Market Updates Dow Futures Drop Dollar Slides On Trade Worries

Apr 22, 2025 -

Top Chinese Indonesian Officials Strengthen Security Ties

Apr 22, 2025

Top Chinese Indonesian Officials Strengthen Security Ties

Apr 22, 2025 -

Swedens Tanks Finlands Troops A Pan Nordic Defense Force

Apr 22, 2025

Swedens Tanks Finlands Troops A Pan Nordic Defense Force

Apr 22, 2025