Understanding High Stock Market Valuations: Insights From BofA For Investors

Table of Contents

Key Factors Contributing to High Stock Market Valuations

Several interconnected factors contribute to the current high stock market valuations. Understanding these factors is the first step in developing a robust investment strategy.

Low Interest Rates

The inverse relationship between interest rates and stock valuations is well-established. Low interest rates, a hallmark of recent economic policy, make bonds less attractive, pushing investors towards higher-yielding assets like equities.

- Impact of Quantitative Easing: Central banks' quantitative easing (QE) programs, injecting liquidity into the market, have significantly lowered interest rates, fueling stock market growth.

- Low Bond Yields Driving Investors to Equities: With low bond yields offering minimal returns, investors seek higher potential returns from the stock market, increasing demand and driving up valuations.

Strong Corporate Earnings

Robust corporate earnings provide a solid foundation for high stock market valuations. Strong profits signal confidence in the economy and the future growth prospects of companies.

- Examples of Sectors with Strong Earnings Growth: Technology, healthcare, and consumer staples have shown particularly strong earnings growth, contributing significantly to overall market valuations.

- Impact of Technological Advancements: Technological innovation continues to drive efficiency and profitability for many companies, fueling their growth and boosting market sentiment.

Increased Investor Confidence

Positive investor sentiment plays a crucial role in driving up stock market valuations. Confidence in the economy and the future prospects of companies translates into higher demand for stocks.

- Role of Positive Economic News: Positive economic data, such as strong employment figures and consumer spending, bolsters investor confidence and pushes valuations higher.

- Impact of Government Stimulus Packages: Government stimulus efforts can significantly influence investor confidence and market valuations by injecting capital into the economy and supporting businesses.

Inflationary Pressures

While inflation can initially boost corporate earnings, persistent high inflation presents a challenge to stock market valuations. It erodes purchasing power and can impact future earnings growth.

- How Inflation Affects Earnings Growth: High inflation can increase input costs for businesses, squeezing profit margins and potentially slowing earnings growth.

- Discussion on Real vs. Nominal Returns: Investors need to consider the impact of inflation on real returns (returns adjusted for inflation) when assessing the attractiveness of stock market investments in a high-inflation environment.

BofA's Analysis and Forecasts on High Stock Market Valuations

BofA's research provides valuable insights into the current state of the market and potential future trends. Their analysis helps investors understand the risks and opportunities associated with high valuations.

BofA's Recent Reports and Analyses

BofA regularly publishes reports analyzing current market conditions and offering forecasts. These reports often highlight key economic indicators, sector performance, and potential risks.

- Key Findings from BofA Reports: BofA's reports frequently emphasize the impact of interest rates, inflation, and geopolitical events on market valuations. Specific findings vary based on the report and the prevailing economic environment.

- Their Predictions for Future Market Trends: BofA's predictions are typically cautious, acknowledging the risks associated with high valuations while also identifying potential opportunities in specific sectors.

BofA's Perspectives on Potential Risks

BofA acknowledges the inherent risks associated with high stock market valuations, including the potential for market corrections and asset bubbles.

- Potential for Market Corrections: High valuations often precede market corrections, as investors become concerned about overvaluation and potential declines in earnings growth.

- Risks of Asset Bubbles: In certain sectors or asset classes, valuations may become detached from fundamentals, creating the risk of an asset bubble that could burst unexpectedly.

BofA's Recommended Strategies

BofA's recommendations often emphasize the importance of diversification and risk management in a high-valuation environment.

- Diversification Strategies: Diversifying investments across different asset classes, sectors, and geographies helps mitigate risk and reduces exposure to market downturns.

- Sector-Specific Investment Recommendations: BofA may highlight specific sectors or companies that they believe offer attractive investment opportunities even in a high-valuation market. These recommendations typically consider factors such as growth potential, valuation, and risk tolerance.

Strategies for Investors in a High Valuation Market

Navigating a high-valuation market requires a thoughtful approach. Several strategies can help investors manage risk and potentially generate returns.

Value Investing

Value investing focuses on identifying undervalued companies whose stock prices are below their intrinsic value. This strategy can be particularly effective in high-valuation markets.

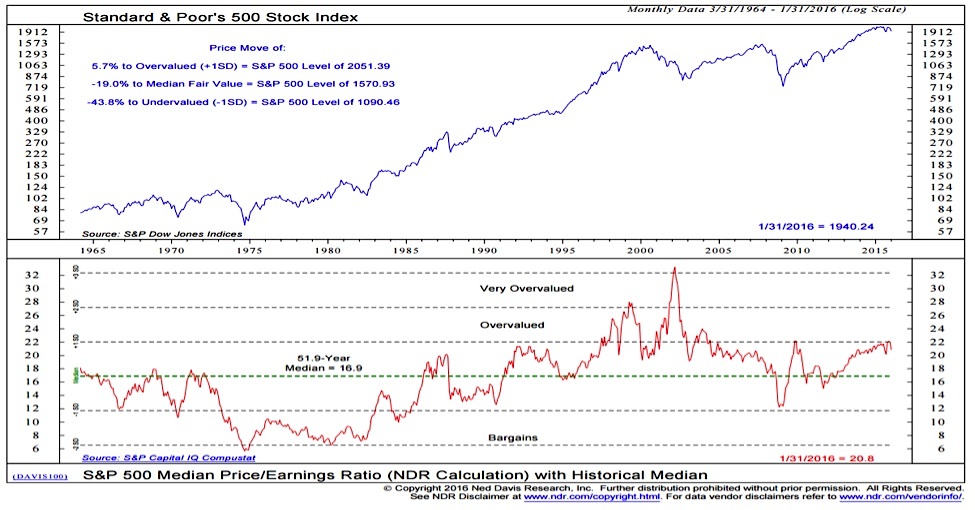

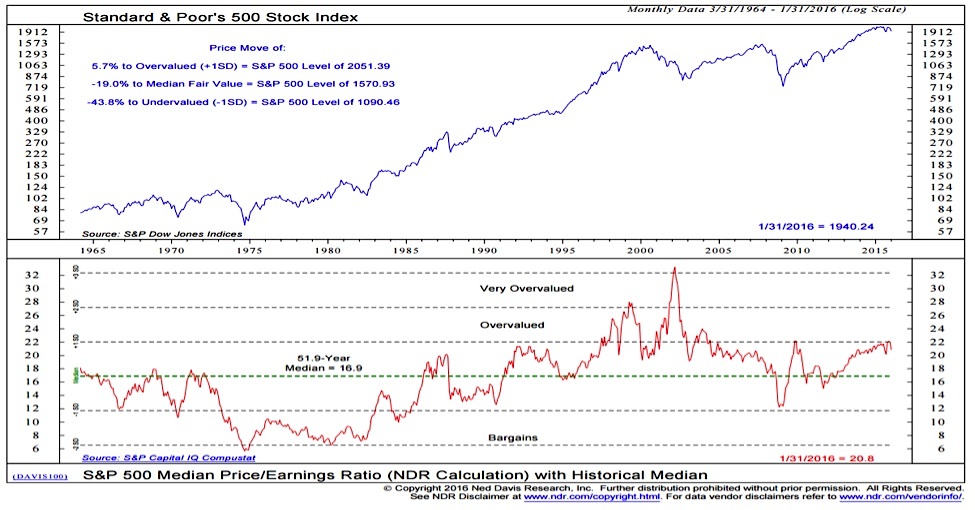

- Identifying Undervalued Stocks: Value investors utilize fundamental analysis to identify companies trading at discounts to their true worth. Metrics such as price-to-earnings ratios and price-to-book ratios play a crucial role in this process.

- Focusing on Fundamentals: Value investors prioritize companies with strong fundamentals, such as consistent earnings growth, strong balance sheets, and efficient management.

Growth Investing

Growth investing targets companies with high growth potential, even if their current valuations are high. This strategy can yield significant returns but carries higher risk.

- Selection Criteria for Growth Stocks: Growth investors look for companies with innovative products or services, strong market positions, and a history of rapid revenue and earnings growth.

- Managing Risk in a Growth Portfolio: Growth investing requires careful risk management, including diversification and position sizing to limit potential losses.

Defensive Investing

Defensive investing prioritizes capital preservation over high returns. In high-valuation markets, a defensive approach can help limit losses during market corrections.

- Strategies for Preserving Capital: Defensive investors often favor high-quality, dividend-paying stocks, bonds, and other low-risk assets.

- Diversifying Investments Across Asset Classes: Diversification across different asset classes reduces overall portfolio volatility and helps cushion against market declines.

Dollar-Cost Averaging

Dollar-cost averaging (DCA) involves investing a fixed amount of money at regular intervals, regardless of market price. This strategy helps mitigate the risk of investing a lump sum at a market peak.

- Benefits of DCA: DCA reduces the impact of market volatility on the average purchase price of investments.

- How to Implement it Effectively: Determine a consistent investment schedule and stick to it, regardless of short-term market fluctuations.

Conclusion: Navigating High Stock Market Valuations with BofA's Guidance

High stock market valuations are influenced by various factors, including low interest rates, strong corporate earnings, investor sentiment, and inflationary pressures. BofA's analysis provides valuable insights into these factors and the potential risks and opportunities they present. By understanding these factors and employing strategies such as value investing, growth investing, defensive investing, and dollar-cost averaging, investors can navigate this market environment more effectively. Leverage BofA's analysis for informed investment decisions and master the art of investing in high valuation markets. Understand the nuances of high stock market valuations to build a robust and resilient investment portfolio.

Featured Posts

-

Ufc 315 Expert Predictions For Shevchenko Vs Fiorot

May 12, 2025

Ufc 315 Expert Predictions For Shevchenko Vs Fiorot

May 12, 2025 -

Better Organization Of Asylum Shelters A E1 Billion Savings Potential

May 12, 2025

Better Organization Of Asylum Shelters A E1 Billion Savings Potential

May 12, 2025 -

Valentina Shevchenko Vs Manon Fiorot Ufc 315 Fight Preview

May 12, 2025

Valentina Shevchenko Vs Manon Fiorot Ufc 315 Fight Preview

May 12, 2025 -

India Pakistan Border Tensions 5 Indian Soldiers Killed Despite Truce

May 12, 2025

India Pakistan Border Tensions 5 Indian Soldiers Killed Despite Truce

May 12, 2025 -

Analyzing Rahal Letterman Lanigan Racings 2025 Indy Car Season

May 12, 2025

Analyzing Rahal Letterman Lanigan Racings 2025 Indy Car Season

May 12, 2025

Latest Posts

-

Search Continues For Missing 79 Year Old Woman In Portola Valley Preserve

May 13, 2025

Search Continues For Missing 79 Year Old Woman In Portola Valley Preserve

May 13, 2025 -

Sue Crane 92 Dedicated Portola Valley Public Servant Dies

May 13, 2025

Sue Crane 92 Dedicated Portola Valley Public Servant Dies

May 13, 2025 -

Cubs Fans React To Kyle Tucker Report A Detailed Analysis

May 13, 2025

Cubs Fans React To Kyle Tucker Report A Detailed Analysis

May 13, 2025 -

Remembering Sue Crane A Legacy Of Service In Portola Valley

May 13, 2025

Remembering Sue Crane A Legacy Of Service In Portola Valley

May 13, 2025 -

Longtime Portola Valley Public Servant Sue Crane Dies At 92

May 13, 2025

Longtime Portola Valley Public Servant Sue Crane Dies At 92

May 13, 2025