Understanding Jim Cramer's Assessment Of Foot Locker (FL) As A Winner

Table of Contents

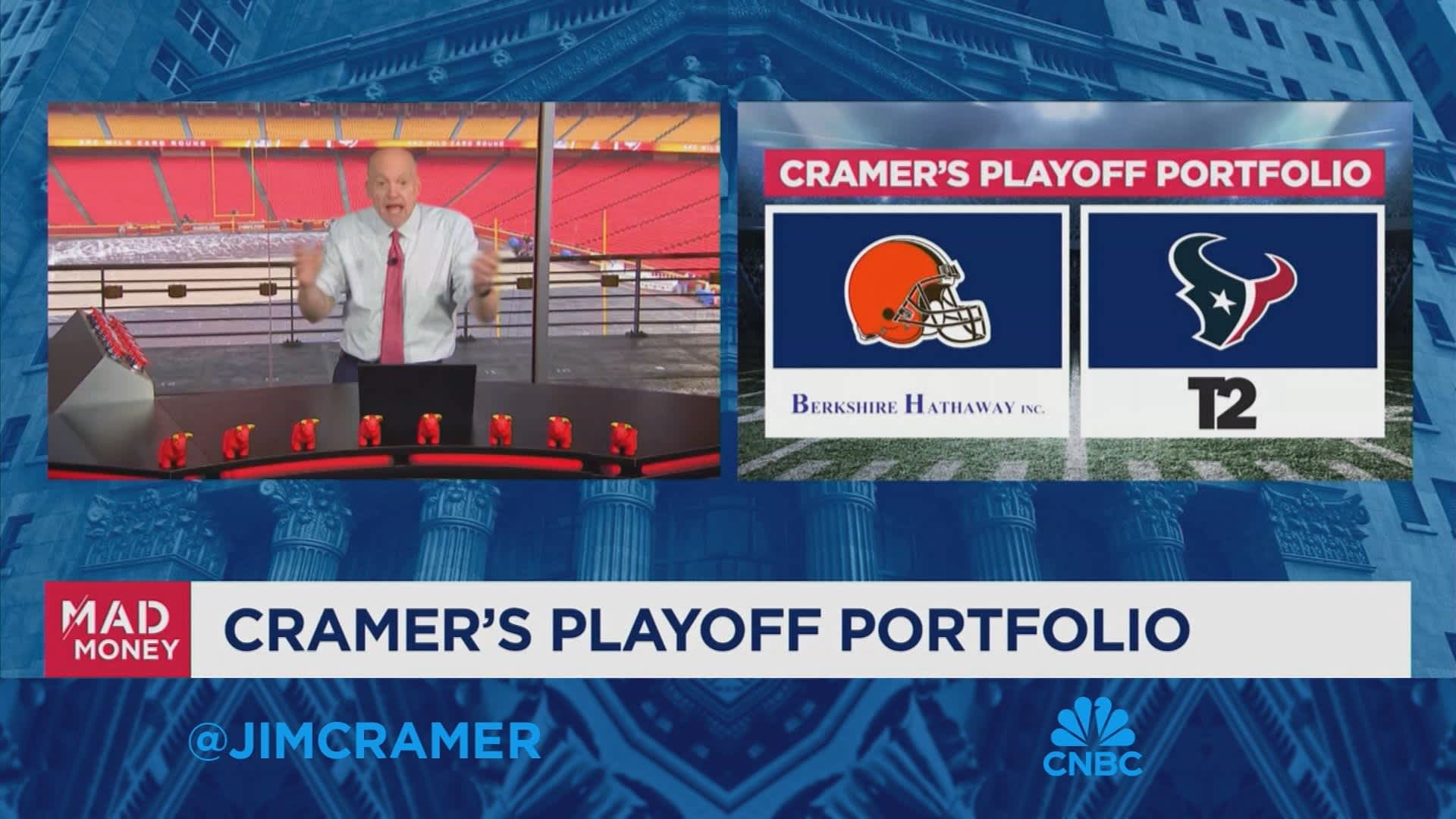

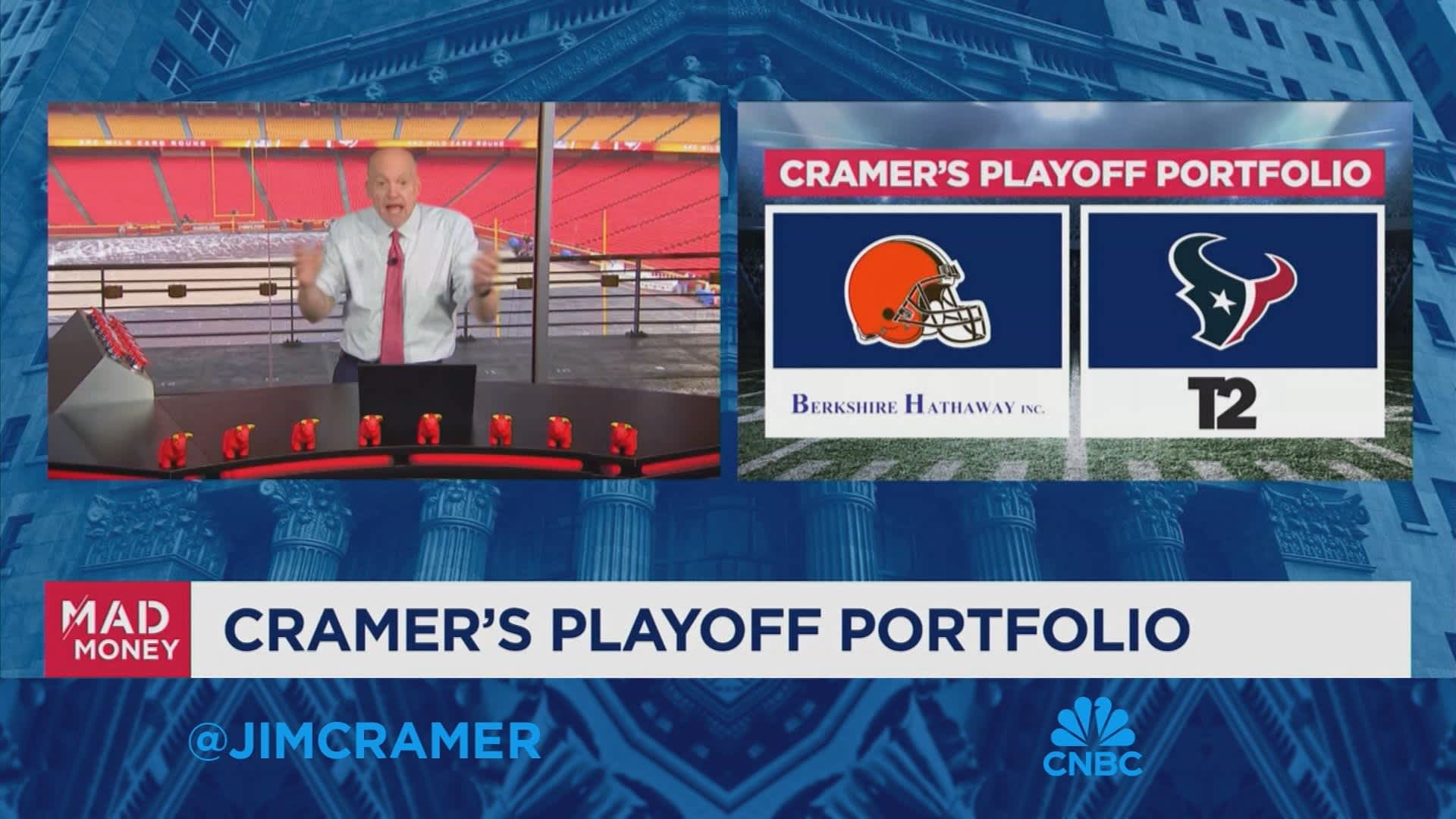

Cramer's Bullish Stance on Foot Locker

Analyzing Cramer's Rationale

Jim Cramer's optimism regarding Foot Locker often stems from several key factors. He frequently highlights the company's strong brand recognition, a crucial asset in the competitive athletic footwear and apparel market. Cramer's bullishness is also often tied to Foot Locker's strategic initiatives, such as its focus on exclusive collaborations and its efforts to enhance its omni-channel presence.

-

Specific examples of Cramer's statements: Cramer has often praised Foot Locker's ability to adapt to changing consumer preferences and its success in attracting younger demographics. He has also pointed to the company's strategic partnerships with major sneaker brands as a key driver of growth.

-

Influential news and events: Positive earnings reports, successful product launches (like exclusive sneaker drops), and announcements of new store openings or renovations have often coincided with Cramer's favorable commentary on Foot Locker. For instance, strong holiday sales figures often trigger positive comments from the financial commentator.

-

Supporting evidence from financial news sources: [Insert links to reputable financial news sources that quote Cramer's positive statements on Foot Locker. Examples might include CNBC transcripts, articles from reputable financial publications like the Wall Street Journal or Bloomberg].

Foot Locker's Fundamental Performance

Financial Performance Metrics

To understand the validity of Cramer's bullish stance, we must examine Foot Locker's fundamental performance. Analyzing key financial indicators provides valuable insights.

-

Key data points: We need to look at Foot Locker's revenue growth, profit margins (gross and operating), earnings per share (EPS), and its debt-to-equity ratio. [Insert data points with sources, preferably using a visually appealing chart or graph]. Positive trends in these metrics would support Cramer's optimism.

-

Industry comparison: Comparing Foot Locker's financial performance to its competitors (such as Nike, Adidas, and other athletic retailers) offers a crucial benchmark for assessing its relative strength and competitiveness within the market. [Insert comparative data and analysis].

-

Visual representation: A chart depicting Foot Locker's revenue, EPS, and profit margins over several quarters or years would provide a clear visual representation of its financial health. [Insert chart/graph].

Competitive Landscape and Market Trends

Foot Locker operates in a dynamic market characterized by intense competition and evolving consumer preferences.

-

Market position: Foot Locker's market share, its brand positioning (premium vs. value), and its customer base are critical to understanding its long-term viability.

-

Market trends: The growth of e-commerce, the increasing popularity of athleisure wear, and the rise of direct-to-consumer (DTC) brands from major manufacturers pose both challenges and opportunities. Foot Locker’s ability to navigate these trends is vital.

-

Competitive advantages and disadvantages: Analyzing Foot Locker's strengths (strong brand recognition, established retail network, strategic partnerships) alongside its weaknesses (dependence on specific brands, vulnerability to economic downturns) paints a more comprehensive picture.

Counterarguments and Potential Risks

Challenges Faced by Foot Locker

While Cramer's perspective is positive, acknowledging potential challenges and risks is crucial for a balanced assessment.

-

Significant risks: Supply chain disruptions, macroeconomic factors (like inflation and recessionary pressures), changing consumer tastes, and intense competition from DTC brands are all factors that could negatively impact Foot Locker's performance.

-

Differing expert opinions: It's essential to consider perspectives from analysts who hold a more cautious outlook on Foot Locker's stock. [Include quotes or summaries of these dissenting opinions with proper citations].

-

Mitigating factors: Foot Locker’s ability to innovate, improve its online presence, and effectively manage its inventory and supply chain could help mitigate some of these risks.

Conclusion

Jim Cramer's assessment of Foot Locker (FL) as a winner is a nuanced issue that requires careful consideration of many factors. While his bullishness highlights potential, a comprehensive analysis of Foot Locker's financial performance, competitive position within the market, and the inherent risks involved is essential before investing. Combining Cramer's perspective with independent research and a thorough due diligence process empowers investors to make informed decisions about Foot Locker stock. Are you ready to conduct your own thorough research and form your opinion on Jim Cramer's assessment of Foot Locker (FL)?

Featured Posts

-

Did The White House Suppress Information On Bidens Health A Former Cnn Journalist Investigates

May 15, 2025

Did The White House Suppress Information On Bidens Health A Former Cnn Journalist Investigates

May 15, 2025 -

De Hamer Zaak Discussie Tussen Bruins Npo En Toezichthouder

May 15, 2025

De Hamer Zaak Discussie Tussen Bruins Npo En Toezichthouder

May 15, 2025 -

Andor Season 2 Trailer Release Date And Plot Details A Comprehensive Guide

May 15, 2025

Andor Season 2 Trailer Release Date And Plot Details A Comprehensive Guide

May 15, 2025 -

Unexpected Baseball Moment Former Nfl Qb Intercepts Max Muncys Fly Ball In Japan

May 15, 2025

Unexpected Baseball Moment Former Nfl Qb Intercepts Max Muncys Fly Ball In Japan

May 15, 2025 -

98 Year Old Veteran Crushes Tesla With Historic Sherman Tank

May 15, 2025

98 Year Old Veteran Crushes Tesla With Historic Sherman Tank

May 15, 2025