Understanding Ontario's $14.6 Billion Deficit: Tariffs And Economic Challenges

Table of Contents

The Role of Tariffs in Ontario's Deficit

Tariffs, essentially taxes on imported and exported goods, have played a significant role in exacerbating Ontario's $14.6 billion deficit. The impact is multifaceted, affecting both businesses and the overall trade balance.

Impact on Businesses and Exports

Tariffs imposed by other countries, most notably the US, have negatively affected Ontario's export-oriented industries. This has created a ripple effect throughout the Ontario export economy.

- Decreased demand for Ontario goods: Tariffs make Ontario products more expensive in foreign markets, leading to reduced demand and lost sales.

- Increased production costs: Businesses face higher costs for exporting goods due to tariffs, reducing profitability and competitiveness.

- Loss of jobs in export sectors: As demand falls and businesses struggle, job losses in export-focused sectors like automotive and agriculture are inevitable.

For example, the automotive industry, a cornerstone of Ontario's economy, has experienced significant losses due to tariffs imposed on Canadian-made vehicles. Estimates suggest that these tariffs have cost the sector billions of dollars and thousands of jobs, directly contributing to the province's fiscal woes. This highlights the critical link between tariffs impact on Ontario and the overall deficit. The resulting trade war effects have severely impacted the province’s economic stability.

Increased Import Costs

The impact of tariffs extends beyond exports. Tariffs on imported goods increase the cost of production for many Ontario businesses, impacting profitability and leading to higher consumer prices.

- Higher input costs: Businesses reliant on imported raw materials or components face significantly increased expenses, squeezing profit margins.

- Reduced competitiveness: Higher production costs make Ontario businesses less competitive both domestically and internationally.

- Inflation: Increased import costs contribute to inflation, eroding consumer purchasing power and further impacting economic activity.

For instance, the construction industry relies heavily on imported steel and lumber. Tariffs on these materials have driven up construction costs, impacting both residential and commercial projects and contributing to the overall inflation in Ontario. The resulting impact on import costs in Ontario has been significant.

Beyond Tariffs: Other Economic Headwinds Contributing to the Deficit

While tariffs have played a significant role, the $14.6 billion deficit is not solely attributable to trade issues. Several other economic headwinds have contributed to the province's fiscal challenges.

Economic Slowdown and Reduced Revenue

A general economic slowdown has resulted in decreased tax revenue for the Ontario government. This reduction in revenue further exacerbates the deficit.

- Lower tax revenues: Slower economic growth leads to lower corporate and personal income tax collections.

- Increased social program spending: Economic downturns often lead to increased demand for social programs like unemployment benefits, further straining government finances.

Key economic indicators like GDP growth and the unemployment rate directly reflect this slowdown. A shrinking GDP indicates reduced economic activity and consequently, lower tax revenues. The rising unemployment rate necessitates increased spending on social assistance programs, thus impacting the government spending in Ontario.

Increased Government Spending

Increased government spending on crucial social programs and infrastructure has also contributed significantly to the deficit. This spending, while necessary, has outpaced revenue generation.

- Aging population driving healthcare costs: Ontario's aging population is placing increasing demands on the healthcare system, resulting in escalating costs.

- Demands for increased education funding: There are ongoing pressures for increased funding for education, impacting the education spending in Ontario.

- Infrastructure needs: Significant investment in infrastructure is necessary but adds to the overall government spending.

These increased expenditures, while vital for the well-being of Ontarians, have further widened the gap between government revenue and expenditure, contributing to the Ontario's $14.6 Billion Deficit.

Potential Solutions and Future Outlook for Ontario's Finances

Addressing Ontario's $14.6 billion deficit requires a comprehensive and multi-pronged approach. Short-term fiscal responsibility measures combined with long-term strategies for economic diversification are crucial.

Fiscal Responsibility Measures

Several measures can be implemented to address the deficit in the short term. These include a combination of spending cuts and revenue generation strategies.

- Spending cuts: Identifying areas for efficient spending cuts without compromising essential services is crucial.

- Potential tax increases: This is a politically sensitive but potentially necessary measure to generate additional revenue.

- Revenue diversification strategies: Exploring new revenue streams and improving tax collection efficiency can also contribute to fiscal health.

The political feasibility of these measures varies, requiring careful consideration and public debate. The implementation of these measures will directly impact the Ontario budget cuts and Ontario tax reform landscape.

Diversification of the Ontario Economy

Reducing reliance on sectors vulnerable to external shocks like tariffs is essential for long-term fiscal stability. Economic diversification is key to a resilient and prosperous Ontario.

- Investing in new technologies: Fostering innovation and supporting emerging technologies can create new high-paying jobs and reduce dependence on traditional industries.

- Supporting small and medium-sized enterprises (SMEs): SMEs are the backbone of the economy; their growth and success are critical for overall economic health. This includes SME support in Ontario.

- Promoting innovation: Investing in research and development is crucial for fostering innovation and creating a more dynamic and resilient economy. This includes innovation in Ontario.

Long-term economic diversification strategies are paramount for creating a sustainable and robust economy, reducing vulnerability to external factors and ultimately contributing to fiscal responsibility in Ontario.

Conclusion

Ontario's $14.6 billion deficit is a complex issue stemming from a confluence of factors, including tariffs impacting key industries and broader economic headwinds. Addressing this challenge requires a multifaceted approach involving both fiscal responsibility measures and long-term strategies for economic diversification. Understanding the intricacies of Ontario's $14.6 billion deficit is critical for informed decision-making and ensuring the province's long-term financial stability. We need to actively engage in the discussion surrounding Ontario’s financial challenges and advocate for policies that promote sustainable economic growth and fiscal responsibility. Let's work together to overcome this challenge and secure a brighter financial future for Ontario.

Featured Posts

-

Tom Cruise Still Owes Tom Hanks 1 The Story Behind The Unpaid Acting Debt

May 17, 2025

Tom Cruise Still Owes Tom Hanks 1 The Story Behind The Unpaid Acting Debt

May 17, 2025 -

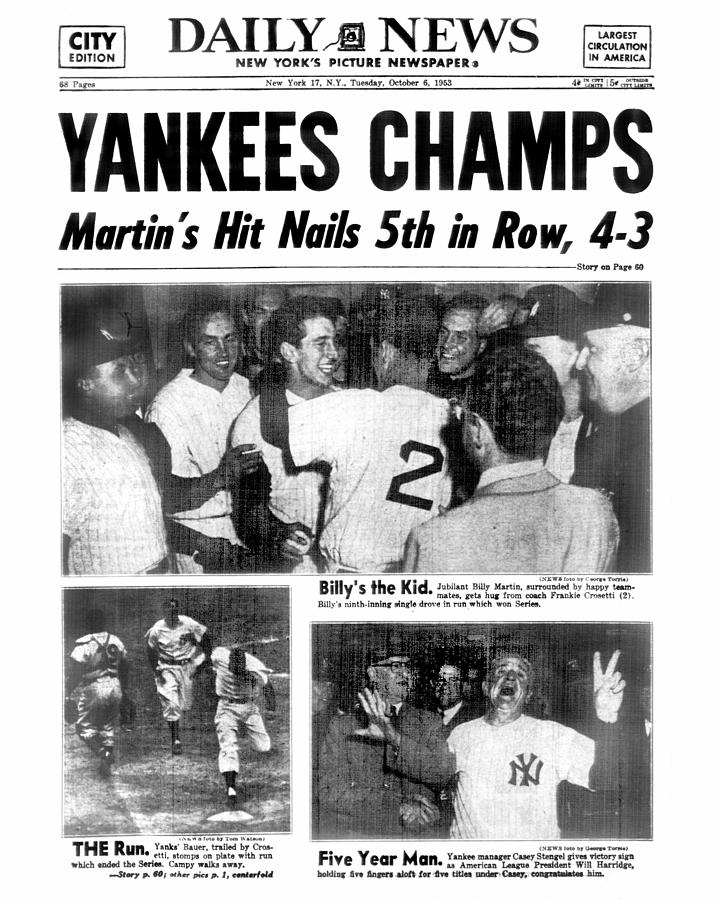

Researching The New York Daily News May 2025 Back Pages

May 17, 2025

Researching The New York Daily News May 2025 Back Pages

May 17, 2025 -

Knicks Vs Celtics Feb 23 Josh Hart Injury Report And Game Time Decision

May 17, 2025

Knicks Vs Celtics Feb 23 Josh Hart Injury Report And Game Time Decision

May 17, 2025 -

Trump Tariffs And The Price Of Replacing Your Smartphone Battery

May 17, 2025

Trump Tariffs And The Price Of Replacing Your Smartphone Battery

May 17, 2025 -

Increased Opposition From Car Dealers To Electric Vehicle Regulations

May 17, 2025

Increased Opposition From Car Dealers To Electric Vehicle Regulations

May 17, 2025

Latest Posts

-

Finding The New York Daily News Back Pages For May 2025

May 17, 2025

Finding The New York Daily News Back Pages For May 2025

May 17, 2025 -

Josh Cavallo Challenging Norms And Fostering Acceptance In Football

May 17, 2025

Josh Cavallo Challenging Norms And Fostering Acceptance In Football

May 17, 2025 -

From The Pitch To The Podium Josh Cavallos Post Coming Out Activism

May 17, 2025

From The Pitch To The Podium Josh Cavallos Post Coming Out Activism

May 17, 2025 -

The Josh Cavallo Effect A New Era For Lgbtq Athletes

May 17, 2025

The Josh Cavallo Effect A New Era For Lgbtq Athletes

May 17, 2025 -

Josh Cavallo Inspiration And Advocacy After Publicly Coming Out

May 17, 2025

Josh Cavallo Inspiration And Advocacy After Publicly Coming Out

May 17, 2025