Understanding Palantir's High Price-to-Sales Ratio: History And Future Outlook

Table of Contents

Historical Context of Palantir's P/S Ratio

Palantir's Initial Public Offering (IPO) in 2020 generated considerable buzz, resulting in a high initial market capitalization that reflected substantial investor optimism. This optimism translated directly into a high P/S ratio, significantly above many of its competitors in the enterprise software and big data analytics sectors. Several factors contributed to this elevated valuation:

-

High Growth Expectations: Palantir's innovative technology and expanding client base fueled expectations of rapid revenue growth, justifying a premium valuation. Investors anticipated substantial market penetration across both government and commercial sectors.

-

Focus on Government and Enterprise Clients: Palantir's concentration on high-value, long-term contracts with government agencies and large enterprises contributed to its premium valuation. These clients often require specialized, high-margin solutions, justifying a higher P/S ratio compared to companies serving a broader, more price-sensitive market.

-

First-Mover Advantage: Palantir established itself as a pioneer in specific data analytics niches, particularly within the intelligence and defense sectors. This first-mover advantage translated into strong client relationships and a significant technological lead over competitors.

-

High Barriers to Entry: The complexity of Palantir's technology and the depth of its expertise create substantial barriers to entry for new competitors. This competitive moat supports the argument for a higher P/S ratio, reflecting its unique position in the market.

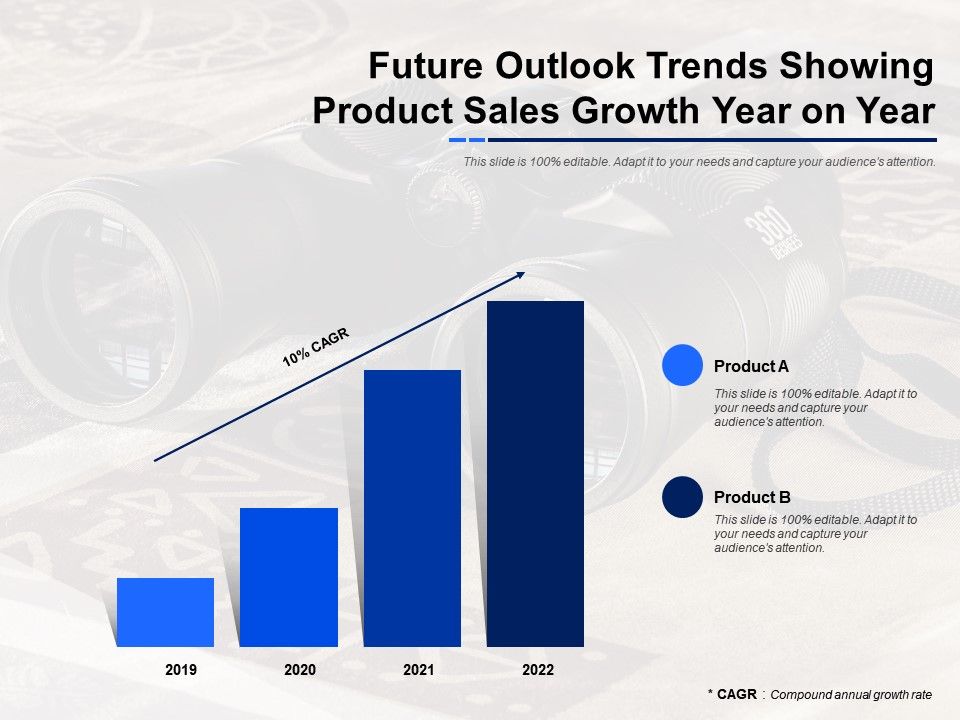

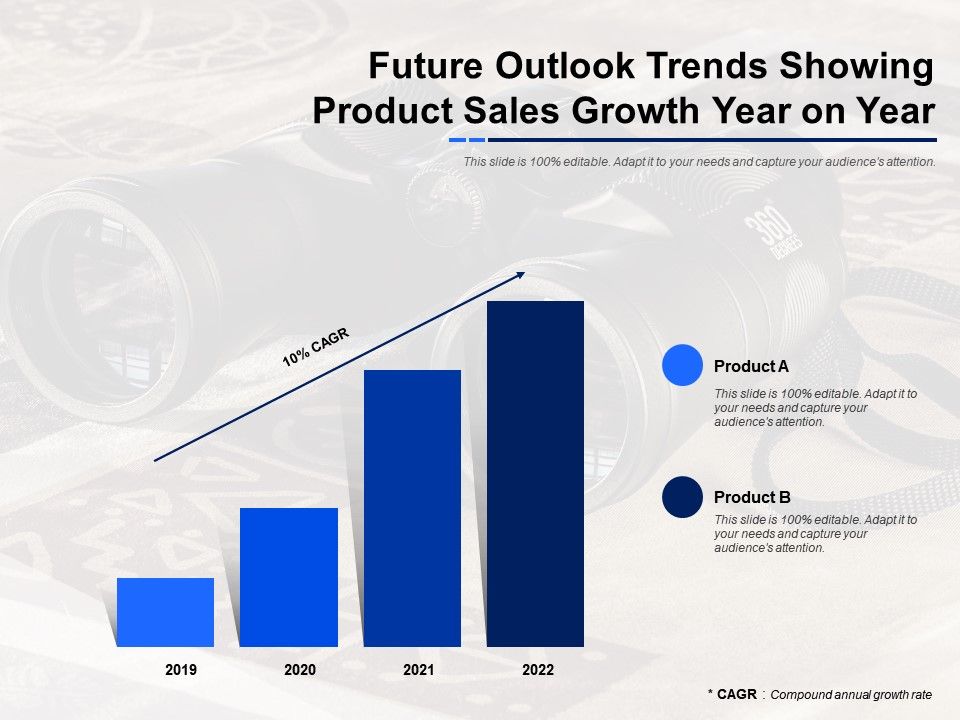

The following chart (replace with actual chart illustrating P/S ratio over time) visually demonstrates the evolution of Palantir's P/S ratio since its IPO, highlighting its historical highs and fluctuations relative to comparable companies in the big data analytics space. This provides valuable context for understanding its current valuation.

Analyzing Palantir's Revenue Streams and Profitability

Understanding Palantir's revenue streams is crucial for interpreting its P/S ratio. The company's revenue is primarily derived from two sources:

-

Government Contracts: This segment historically contributed a larger portion of Palantir's revenue, characterized by large, long-term contracts with government agencies for national security and intelligence applications. These contracts often command premium pricing but might demonstrate less rapid growth than the commercial sector.

-

Commercial Clients: Palantir's commercial business is increasingly significant, encompassing various sectors like finance, healthcare, and energy. This segment offers potential for faster growth but might have lower average contract values compared to government contracts.

While Palantir's revenue has been growing, its profitability has been a point of discussion. The company has focused on substantial investment in research and development and sales & marketing, impacting its operating margin and net income. This lower profitability relative to revenue contributes to the high P/S ratio. However, the long-term growth potential of both revenue streams is a key consideration for investors. Sustained revenue growth, coupled with improved operating margins, could significantly alter Palantir's P/S ratio over time.

Competitive Landscape and Market Share

Palantir operates within a competitive landscape dominated by other players in big data analytics, including established tech giants and specialized startups. Key competitors include companies like Databricks, Snowflake, and AWS. Despite this competition, Palantir retains several competitive advantages:

-

Proprietary Technology: Palantir's Gotham and Foundry platforms provide unique capabilities, particularly in data integration and analysis across disparate sources. This proprietary technology forms a significant part of its competitive moat.

-

Strong Client Relationships: Palantir has cultivated strong relationships with its clients, particularly in the government sector, which provides an element of stickiness and reduces the likelihood of customer churn.

Palantir's market share, though not precisely quantifiable across all relevant market segments, is a vital factor impacting its valuation. Increased market penetration and a demonstrated ability to outcompete rivals would likely contribute to a reduction in its P/S ratio, as increased revenue would proportionally impact the ratio.

Future Outlook and Predictions for Palantir's P/S Ratio

Predicting Palantir's future P/S ratio involves considering several scenarios. Continued robust growth in both government and commercial sectors, coupled with improved operational efficiency and higher profitability, could lead to a gradual decrease in its P/S ratio as revenue growth outpaces the market's valuation expectations. Conversely, slower-than-expected revenue growth or persistent losses could result in an even higher P/S ratio.

Expert opinions and market forecasts vary significantly regarding Palantir’s future. Some analysts remain bullish, citing the company's technological advantages and significant market opportunity. Others express concerns regarding its profitability and competitive pressures, particularly from larger cloud providers. Ultimately, the trajectory of Palantir's P/S ratio will depend on the interplay of these factors. Cautious predictions should incorporate a range of possibilities, acknowledging the inherent uncertainties in the market.

Conclusion: Investing in Palantir: Understanding the P/S Ratio's Implications

Palantir's high P/S ratio reflects a complex interplay of factors including high growth expectations, a unique business model focused on high-value clients, and a competitive landscape characterized by substantial barriers to entry. Understanding this ratio is critical for evaluating the company's stock. While Palantir presents potential for significant returns based on its market position and growth potential, investors must carefully assess the associated risks, including the impact of competition, the pace of revenue growth, and its path to sustained profitability. Conducting thorough due diligence, including reviewing financial statements and seeking advice from financial professionals, is crucial before making any investment decisions related to Palantir stock. Remember, a deep understanding of Palantir's price-to-sales ratio and future prospects is essential for informed investment choices. [Link to relevant financial resources].

Featured Posts

-

From Zero To Spider Man Zendayas Sudden Audition

May 07, 2025

From Zero To Spider Man Zendayas Sudden Audition

May 07, 2025 -

Las Vegas Aces Waive Forward During Training Camp

May 07, 2025

Las Vegas Aces Waive Forward During Training Camp

May 07, 2025 -

Stephen Curry Injury Update Coach Kerr Offers Hopeful Timeline

May 07, 2025

Stephen Curry Injury Update Coach Kerr Offers Hopeful Timeline

May 07, 2025 -

Tom Holland And Zendaya Unexpected Baby News

May 07, 2025

Tom Holland And Zendaya Unexpected Baby News

May 07, 2025 -

Could Buying Xrp Ripple Today Set You Up For Life A Realistic Look

May 07, 2025

Could Buying Xrp Ripple Today Set You Up For Life A Realistic Look

May 07, 2025

Latest Posts

-

2025 Release Date Announced For Stephen King Adaptation Directed By The Hunger Games Director

May 08, 2025

2025 Release Date Announced For Stephen King Adaptation Directed By The Hunger Games Director

May 08, 2025 -

Nba Kenrich Williams Reveals Key Thunder Leader

May 08, 2025

Nba Kenrich Williams Reveals Key Thunder Leader

May 08, 2025 -

Okc Thunder Vs Portland Trail Blazers March 7th Game Information Time Tv And Streaming

May 08, 2025

Okc Thunder Vs Portland Trail Blazers March 7th Game Information Time Tv And Streaming

May 08, 2025 -

Okc Thunder Kenrich Williams Names The Ultimate Leader

May 08, 2025

Okc Thunder Kenrich Williams Names The Ultimate Leader

May 08, 2025 -

The Hunger Games Directors New Stephen King Horror Movie 2025 Release Date

May 08, 2025

The Hunger Games Directors New Stephen King Horror Movie 2025 Release Date

May 08, 2025